Global Agriculture Biologicals Testing Market Size, Share, and COVID-19 Impact Analysis, By Application (Analytical, Regulatory, and Field Support), By Product Type (Bio-Pesticides, Bio-Fertilizers, and Bio-Stimulants), By End User (Government Agencies, Biological Product Manufacturers, Outsourced Contracts, Plant Breeders, and Research Organizations), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: AgricultureGlobal Agriculture Biologicals Testing Market Insights Forecasts to 2033

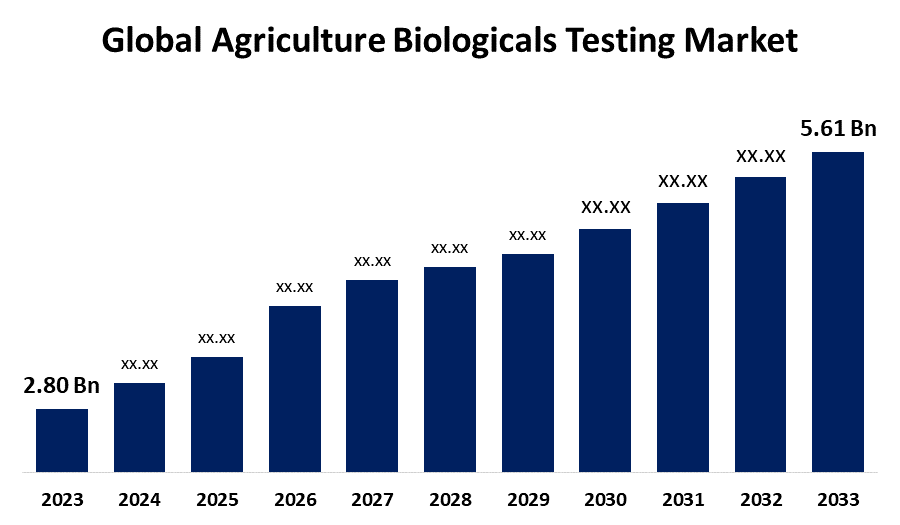

- The Global Agriculture Biologicals Testing Market Size was Valued at USD 2.80 Billion in 2023

- The Market Size is Growing at a CAGR of 7.20% from 2023 to 2033

- The Worldwide Agriculture Biologicals Testing Market Size is Expected to Reach USD 5.61 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Agriculture Biologicals Testing Market Size is Anticipated to Exceed USD 5.61 Billion by 2033, Growing at a CAGR of 7.20% from 2023 to 2033.

Market Overview

The evaluation and examination of biological products utilized in agriculture to boost production, protect crops from disease, and encourage environmentally friendly farming methods is known as agricultural biological testing. Various ingredients and organisms are included in these products including biopesticides, biofertilizers, biostimulants, and microbial inoculants. Agricultural biologicals are substances used to improve crop yield and health that come from natural sources like microorganisms, plants, or animals. Among these are biostimulants, biopesticides, and biofertilizers. The process of validating the effectiveness, safety, and quality of these products before they are sold or utilized in the field is referred to as agricultural biological testing. Agricultural biologicals must be tested and certified to meet customer expectations, legal requirements, and environmental sustainability.

Growing consumer demand for sustainable and organic food agricultural biologicals are becoming more and more popular as a result of customers' growing desire for sustainable and organic food products. Without the negative impacts of conventional fertilizers and pesticides, these natural products can improve crop yields, soil fertility, and pest resistance.

Report Coverage

This research report categorizes the market for the global agriculture biologicals testing market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global agriculture biological testing market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global agriculture biological testing market.

Global Agriculture Biologicals Testing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.80 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.20% |

| 2033 Value Projection: | USD 5.61 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 235 |

| Tables, Charts & Figures: | 118 |

| Segments covered: | By Application, By Product Type, By End User, and By Region |

| Companies covered:: | ALS Group, Anadiag Group, Bionema Group Limited, BioTecnologie BT, Eurofins APAL Pty Ltd, Eurofins Scientific SE, i2LResearch, Lallemand Inc., LAUS GmbH, R J Hill Laboratories Limited, SGS SA, Staphyt SA, SynTech Research Group, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Agronomic inputs generated from microbes, plants, or other living things are known as agricultural biologicals, and they are a quickly expanding class. A promising class of inputs designed to boost crop yield and health while lowering reliance on synthetic chemicals is called agricultural biologicals. Biologicals can be biopesticides, which suppress pests, or biostimulants, which promote a variety of advantageous activities. live microorganisms or natural products sourced from live organisms are examples of biologicals. Federal regulations govern biopesticides, but not biostimulants. The market for agricultural biological testing adopts a forward-thinking strategy for information collecting by utilizing cutting-edge technologies like artificial intelligence (AI), the Internet of Things (IoT), and big data analytics to swiftly and reliably analyze enormous amounts of data. These revelations offer important information about the efficacy and safety of agricultural biologicals, stimulating market strategy, regulatory compliance, and product development innovation. Businesses might make well-informed decisions to satisfy changing demands by having a thorough awareness of market trends and client preferences.

For illustration, in June 2024, leading producer and supplier of agricultural biologicals, DPH Biologicals, recently unveiled its new Prime platform, which accelerates the germination of bacterial spores to support overall plant development and give crops more consistent resistance to heat, drought, and alkaline and saline soil conditions. Bacillus spp. is a leading plant-growth rhizobacterium.

Restraining Factor

The absence of standardized testing procedures is the primary obstacle facing the agricultural biological testing industry. Agricultural products are currently not subject to generally recognized standards of testing, and many nations and areas have differing laws and policies. The conflict between farmers and customers might result from this, and businesses might find it challenging to grow within the global agriculture biological testing market projection.

Market Segmentation

The global agriculture biological testing market share is segmented into application, product type, and end-user.

- The analytical testing segment dominates the market with the largest market share through the forecast period.

Based on the application, the global agriculture biological testing market is segmented into analytical, regulatory, and field support. Among these, the analytical testing segment dominates the market with the largest market share through the forecast period. It helps in boosting agricultural output, encouraging sustainable farming methods, and protecting the environment, analytical testing has a substantial impact on agriculture. An analytical method called ICP-OES is frequently used in research and development centers as well as the agriculture sector. It is the perfect method for analyzing soils and plants to find main and minor elements, as well as to detect the presence of heavy metals.

For instance, in July 2024, the collaboration between trinamiX and renowned laboratory Eurofins Agro Testing Wageningen will allow for the optimization of forage assessments without requiring the transmission of samples to a laboratory. Through the partnership, trinamiX's technology and Eurofins Agro Testing's cutting-edge analytical expertise, extensive industry knowledge, and global network of laboratories will be combined to provide on-the-spot analytics in a fraction of the time it takes to analyze a traditional sample.

- The bio-pesticides segment is anticipated to grow at the fastest CAGR growth through the forecast period.

Based on the product type, the global agriculture biological testing market is segmented into bio-pesticides, bio-fertilizers, and bio-stimulants. Among these, the bio-pesticides segment is anticipated to grow at the fastest CAGR growth through the forecast period. This is due to the increased focus on lowering the use of chemical pesticides to reduce threats to the environment and human health. Due to they are made from living things, bio-pesticides provide efficient pest control without harming the environment. The need for bio-pesticide testing services has been further fueled by regulatory support for minimizing the usage of chemical pesticides. In addition, the development of new techniques and technologies is the main trend in the agricultural biological testing market for biopesticides. For instance, the use of proteomic and genomic techniques is growing in the evaluation of herbicides' impacts on bacteria.

- The biological product manufacturers segment accounted for the largest revenue share through the forecast period.

Based on the end-user, the global agriculture biological testing market is segmented into government agencies, biological product manufacturers, outsourced contracts, plant breeders, and research organizations. Among these, the biological product manufacturers segment accounted for the largest revenue share through the forecast period. Before their products are delivered to customers, biological products are directly in charge of ensuring the products' efficacy, safety, and quality. Testing services are vital to manufacturers to comply with regulations, substantiate product claims, and preserve customer confidence. Producers of biological products for use in agriculture, including biopesticides, biostimulants, and biofertilizers, which are meant to promote plant development and protect crops from pests and diseases.

Regional Segment Analysis of the Global Agriculture Biologicals Testing Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global agriculture biological testing market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global agriculture biological testing market over the predicted timeframe. Driven by the necessity to maintain food security and the rising demand for sustainable agriculture. Furthermore, the proliferation of genetically modified organisms (GMOs) and the rise in agricultural diseases are driving this industry's expansion. Since disease testing might identify and prevent crop diseases, it is the most important test among those utilized in agricultural bio testing. elements like a firmly established industry for organic farming, strict legal restrictions, and large R&D expenditures. The largest market segment is represented by the United States, with its enormous agricultural area and varied climate.

For instance, in October 2022, To improve knowledge of soil and crop performance under management or input applications, SynTech Research Group, a global provider of agricultural contract research, product positioning, development, registration, and market support services, has committed to leveraging Biome Makers’ BeCrop technology and its taxonomic database of over 10M microorganisms. SynTech Research will use BeCrop to run BeCrop Trials and assist all of SynTech's clients with their product development and research procedures.

Asia Pacific is expected to grow at the fastest CAGR growth of the global agriculture biological testing market during the forecast period. A tremendous increase in the use of agricultural biologicals and testing services is occurring in the Asia Pacific region. This is a result of the necessity to minimize farming's negative environmental effects while simultaneously raising agricultural productivity. The need for sustainable and ecologically friendly farming methods is rising in a growing number of Asia-Pacific nations. Food security is becoming a concern as the Asia-Pacific region's population is growing rapidly. Thus, there is a growing awareness and various initiatives are done by the government.

For instance, in December 2023, during the third edition of Global Bio-India, a massive international Program on biotechnology, the Department of Biotechnology (DBT) and the Biotechnology Industry Research Assistance Council (BIRAC) announced the launch of 14 new biotech-based products developed by startups and entrepreneurs across verticals including healthcare, diagnostics, medical devices, agriculture, and industrial biotechnology.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global agriculture biological testing market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ALS Group

- Anadiag Group

- Bionema Group Limited

- BioTecnologie BT

- Eurofins APAL Pty Ltd

- Eurofins Scientific SE

- i2LResearch

- Lallemand Inc.

- LAUS GmbH

- R J Hill Laboratories Limited

- SGS SA

- Staphyt SA

- SynTech Research Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2024, A new partnership to accelerate the release of a novel biological solution was announced by Ginkgo Bioworks (NYSE: DNA), a company that is developing the most advanced platform for cell programming and biosecurity, and Syngenta Crop Protection, a pioneer in agricultural innovation. The two businesses have already worked together on next-generation seed technology in the past.

- In June 2024, EnvelixTM Prime is a patented biological nutrient enhancer that is designed to evenly cover bulk dry fertilizer. It combines fertilizer with a robust biological consortium in a single application. DPH Biologicals is a prominent inventor and provider of agricultural biologicals.

- In March 2024, the Leading agricultural biologicals company Lavie Bio Ltd., a division of Evogene Ltd., is creating novel bio-stimulants and bio-pesticides based on microbiomes and computationally driven. Following a successful year of laboratory and greenhouse testing, the company announced that it is expanding the joint validation trials for its bio fungicides, which are being carried out by Bayer AG, a major player in the global agriculture industry.

- In February 2023, A new strategic alliance between Bayer and Kimitec aims to speed up the creation and marketing of biological crop protection products and biostimulants. Both businesses play a major role in advancing and establishing biological solutions generated from natural sources as part of a global agreement. These solutions include biostimulants, which encourage plant development, and crop protection products, which deal with pests, diseases, and weeds.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global agriculture biologicals testing market based on the below-mentioned segments:

Global Agriculture Biologicals Testing Market, By Application

- Analytical

- Regulatory

- Field Support

Global Agriculture Biologicals Testing Market, By Product Type

- Bio-Pesticides

- Bio-Fertilizers

- Bio-Stimulants

Global Agriculture Biologicals Testing Market, By End-User

- Government Agencies

- Biological Product Manufacturers

- Outsourced Contracts

- Plant Breeders

- Research Organizations

Global Agriculture Biologicals Testing Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which are the key companies that are currently operating within the market?ALS Group, Anadiag Group, Bionema Group Limited, BioTecnologie BT, Eurofins APAL Pty Ltd, Eurofins Scientific SE, i2LResearch, Lallemand Inc., LAUS GmbH, R J Hill Laboratories Limited, SGS SA (Société Générale de Surveillance SA), Staphyt SA, SynTech Research Group, and Others

-

2. What is the size of the global agriculture biological testing market?The global agriculture biological testing market Size is Expected to Grow from USD 2.80 Billion in 2023 to USD 5.61 Billion by 2033, at a CAGR of 7.20% during the forecast period 2023-2033.

-

3. Which region is holding the largest share of the market?North America is anticipated to hold the largest share of the global agriculture biological testing market over the predicted timeframe.

Need help to buy this report?