Global Agriculture Equipment Finance Market Size, Share, and COVID-19 Impact Analysis, By Type (Loans, Leases, and Line-of-Credit), By Product (Harvesters, Haying Equipment, Tractors, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: AgricultureGlobal Agriculture Equipment Finance Market Insights Forecasts to 2033

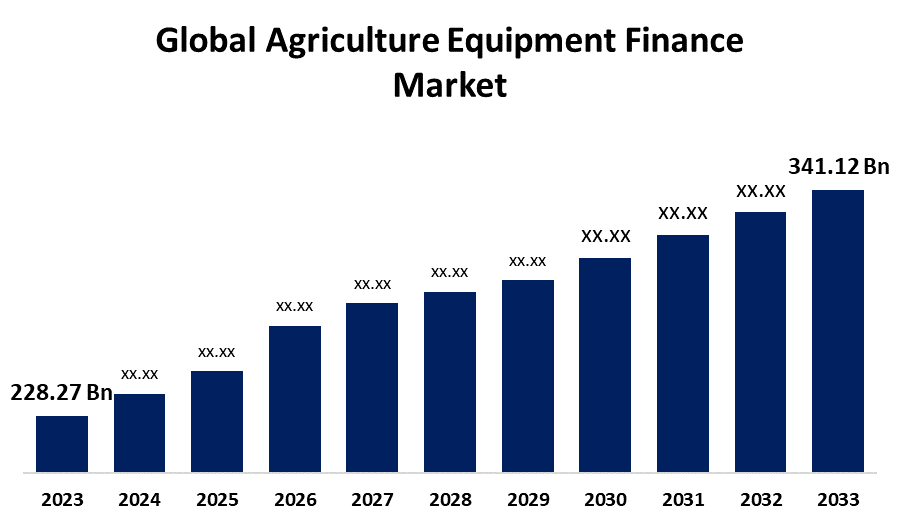

- The Global Agriculture Equipment Finance Market Size Was Valued at USD 228.27 Billion in 2023

- The Market Size is Growing at a CAGR of 4.10% from 2023 to 2033

- The Worldwide Agriculture Equipment Finance Market Size is Expected to Reach USD 341.12 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Agriculture Equipment Finance Market Size is Anticipated to Exceed USD 341.12 Billion by 2033, Growing at a CAGR of 4.10% from 2023 to 2033.

Market Overview

A loan intended exclusively for the acquisition of equipment for a farm or other comparable agricultural enterprise is known as a farm equipment loan. A farmer might be able to purchase new or old equipment, including utility vehicles, tractors, combines, harvesters, and planters, among other things, based on the terms of their loan. Farm equipment loans, like other forms of equipment finance, usually use the machinery that farmers buy as security for the loan.

Loans for farm equipment are often designed as business-term loans. Farmers take out a loan from a lender in full and pay it back over time with interest. Depending on the kind of equipment the farmer is buying, loan repayment durations for agricultural equipment might vary from one to ten years. Terms are usually determined by the equipment's anticipated useful life. Although some lenders provide variable payment schedules (e.g., annually, semi-annually, or quarterly), payments are often made every month. Rates for government, bank, and direct loans for farm equipment can vary from 5% to 15%. The interest rates of online lenders could be higher. However, the final rate that the farmer receives will be determined by your business's eligibility, the amount of your down payment, and the cost of the equipment that the farmer is purchasing.

For Instance, in October 2022, A new online tool was released by the U.S. Department of Agriculture (USDA) to assist farmers and ranchers in navigating the application process for farm loans. Regardless of their unique circumstances, all farm loan applicants will benefit from equal support and a consistent customer experience with USDA's Farm Service Agency (FSA) owing to this uniform application procedure.

The market is primarily driven by the global trend toward increasing farm mechanization. The growing need for quick and easy borrowing through online financial platforms is another factor propelling the industry. The development of blockchain technology, which guarantees real-time information transparency of a loan to all parties involved, is also propelling the business on a global scale. A further aspect fueling the market's expansion is the low import tariff on farm equipment.

Report Coverage

This research report categorizes the market for the agriculture equipment finance market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the agriculture equipment finance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the agriculture equipment finance market.

Global Agriculture Equipment Finance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 228.27 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 4.10% |

| 023 – 2033 Value Projection: | USD 341.12 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 212 |

| Tables, Charts & Figures: | 125 |

| Segments covered: | Analysis, By Type, By Product, By Region |

| Companies covered:: | Adani Group, AGCO Corp., Agricultural Bank of China Ltd., Argo Tractors SpA, Barclays PLC, BlackRock Inc., BNP Paribas SA, Citigroup Inc., Deere and Co., ICICI Bank Ltd., IDFC FIRST Bank Ltd., IndusInd Bank Ltd., JPMorgan Chase and Co., Key Corp., Larsen and Toubro Ltd., Mahindra and Mahindra Ltd.,, Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Due to the demand for greater productivity and efficiency as well as the agriculture industry's growing mechanization, the market for agricultural tractors is expanding steadily. The market for agricultural tractors has grown steadily due to several factors, including population expansion, urbanization, rising food consumption, and technical advancements in agricultural operations. One of the main factors propelling the market's expansion is quick and simple finance availability. It could take a few more weeks for the financial institution to approve and transfer the credit, even if the request is accepted. Guidelines from many banks also urge them to lend money to farmers with government assistance. Furthermore, alternative financing focuses on these companies by giving them rapid and simple access to funding.

For instance, direct farm operating loans from the FSA are an excellent tool for establishing, growing, and sustaining a farm or ranch. By covering the expenses of running a farm, FSA's direct farm operating loans offer young farmers a crucial first step into agricultural production. All FSA direct operating loans, which have a $400,000 maximum loan amount, are sponsored and managed by the agency through regional farm loan officers and farm loan managers. The money for the USDA comes from appropriations made by the government.

Restraining Factors

Higher bank loan rates are a problem that hinders the market's expansion. The supply and demand of financial products have changed as a result of overall economic globalization. For the last ten years, bank financing has been thought to be the most affordable source of funding. Furthermore, a few of the elements of loans and credit lines are documentation, processing, fees, and third-party procedures. As a result, financial institutions might force borrowers to return their credit line balances at higher interest rates, which reduces the investment portfolios of their clients. Farmers are now more likely to rent equipment than purchase it outright owing to these considerations. Consequently, the market's expansion would be hindered throughout the projected time.

Market Segmentation

The agriculture equipment finance market share is classified into type and product.

- The lease segment is estimated to hold the highest market revenue share through the projected period.

Based on the type, the agriculture equipment finance market is classified into loans, leases, and line-of-credit. Among these, the lease segment is estimated to hold the highest market revenue share through the projected period. With the ability to buy, exchange, renew, or return the equipment at a later time, leasing provides farmers with a special approach to financing the assets they need now. Farmers can also benefit from improved fuel efficiency, higher output, or innovations via leasing, which allows them to test out the newest equipment models without having to commit to purchasing. Leasing is a great approach for farmers to boost their cash flow and free up working capital from a financial standpoint. Leasing can be a more cost-effective option than loans for businesses that regularly exchange equipment every few years. This is due to leasing avoiding big capital outlays that could be utilized for renovations, expansion, or other business needs.

For Instance, the advent of several farm machinery leasing apps in India represents a noteworthy advancement in the modernization of agriculture and the empowerment of farmers. These cutting-edge platforms, supported by private businesses and agricultural agencies, seek to give farmers access to premium agricultural equipment without the burden of ownership. For example, Custom Hiring Centers (CHC) Farm Machinery App.

- The tractors segment is anticipated to hold the largest market share through the forecast period.

Based on the product, the agriculture equipment finance market is divided into harvesters, haying equipment, tractors, and others. Among these, the tractors segment is anticipated to hold the largest market share through the forecast period. The standard in the industry for agricultural machinery is tractor loans for farmers. Businesses and industries require tractor finance. Top banks therefore provide tractor loans. Tractor financing is most in demand in the rural and semi-urban sections of the nation. Farmer loans enable them to purchase new or used tractors. There are numerous uses for these tractors in both agriculture and industry. The farm can produce more if it has a tractor. Additionally, farmers will have more time to dedicate to each duty as a result of the enhanced productivity. A tractor with a rotavator, sprayer, thresher, and cultivator attached is also useful. Compared to using farm animals, it greatly increases farming efficiency. It expedites the procedure as well. The farmer can therefore maximize their time. Harvesting of crops is directly impacted by a farm's amount of automation. Purchasing a tractor might result in savings of 15% to 20% on fertilizer and seed. Its improved accuracy is the reason for this. This is due to tractors facilitating inter-row crop cultivation, tillage, seeding, and harvesting. When taken as a whole, these elements enable increased cropping intensity. which thus produces higher yields.

For instance, in 2022, the Government of India launched PM Kisan Tractor Yojana Indian farmers can apply for loans under the PM Kisan Tractor Yojana to purchase tractors. They will be able to use tractors for farming and other related purposes thanks to it. Overall, this plan can improve the farmer's quality of life. Correct tractor use can reduce operational risks while increasing crop productivity and product quality. The farmers will receive a subsidy from the system ranging from 20% to 50%, depending on their economic situation.

Regional Segment Analysis of the Agriculture Equipment Finance Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

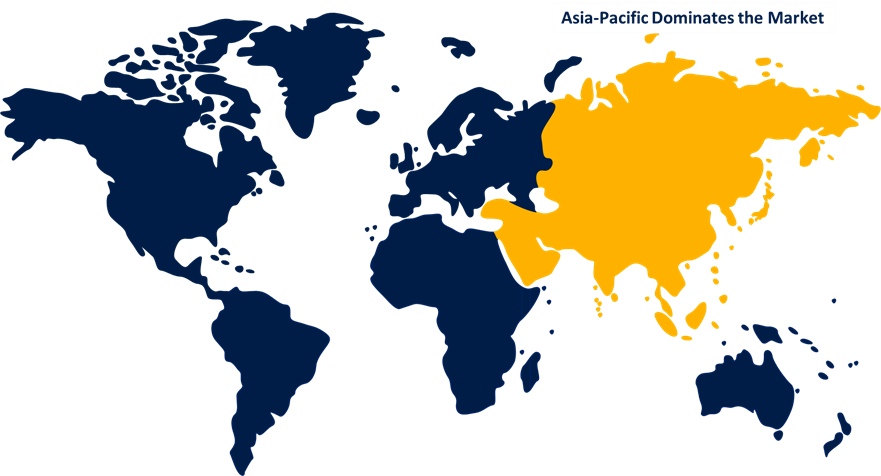

Asia Pacific is anticipated to hold the largest share of the agriculture equipment finance market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the agriculture equipment finance market over the predicted timeframe. The governments of emerging APAC nations like China, Japan, and India are concentrating on low-cost ways to achieve high agricultural output due to their economies' heavy reliance on agriculture, extensive populations, and growing disposable income. In Asia-Pacific, 60% of agriculture machinery is owned by China and India. In China and India, the need for farm mechanization has been rising steadily. The primary factors driving the market are the lack of manpower, contract farming, the desire to increase farm productivity, government subsidies, and high labor costs. For instance, the Indian government encourages farmers to mechanize their operations by providing incentives, cheap import tariffs on agricultural equipment, and simple financing options. Numerous institutions, including commercial banks, cooperative banks, regional rural banks, and microfinance institutions, offer agricultural financing in India. In India, crop loans, the Kisan Credit Card (KCC) scheme, agricultural term loans, and agricultural insurance are just a few of the additional credit support options available for agricultural financing in addition to traditional lending. These programs are designed to give farmers financial support for crop production, input purchases, and capital investments in agriculture.

North America is expected to grow at the fastest CAGR growth of the agriculture equipment finance market during the forecast period. Extensive areas of land are the main factor driving the rise, and this has increased the need for farm mechanization. In addition, the area is seeing a rise in the use of smart combine harvesters with monitoring devices to boost agricultural productivity. The profitability of the farms declines as labor costs rise annually and more workers are needed to manage a larger farm. Since labor payments account for a sizable amount of farm revenues, operating farms only through labor is time-consuming and unsatisfactory to farm owners. As a result, agricultural machinery is used by farm owners in their operations.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the agriculture equipment finance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Adani Group

- AGCO Corp.

- Agricultural Bank of China Ltd.

- Argo Tractors SpA

- Barclays PLC

- BlackRock Inc.

- BNP Paribas SA

- Citigroup Inc.

- Deere and Co.

- ICICI Bank Ltd.

- IDFC FIRST Bank Ltd.

- IndusInd Bank Ltd.

- JPMorgan Chase and Co.

- Key Corp.

- Larsen and Toubro Ltd.

- Mahindra and Mahindra Ltd.,

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

• In March 2024, Tesco and NatWest introduced a low-cost sustainable financing program for farmers. Through the provision of focused financing, the cooperative project seeks to assist 1,500 Tesco-affiliated farmers in implementing sustainable agricultural methods.

• In May 2024, With the introduction of a new Sustainable Equipment Finance Loan, Westpac NZ is helping Kiwi companies lessen their environmental effect. For corporate clients, the new loan offers a competitive five-year rate. It can be used to buy a variety of environmentally friendly assets, such as company vehicles that run on electricity or hydrogen, as well as machinery, tools, and equipment that will minimize the carbon footprint of an organization.

• In December 2023, Leading Indian tractor OEMs Tractors and Farm Equipment Limited (TAFE) and TAFE Motors and Tractors Limited (TMTL) collaborated with the Indian Bank to provide tractor financing to improve the customer experience. Through the partnership, farmers and other persons would be able to obtain tractor loans at reasonable interest rates, along with the added benefit of seamless loan processing.

• In August 2023, A Letter of Understanding (MOU) was signed between the Bank of Baroda (BOB) and Kubota Agricultural Machinery India Pvt. Ltd. (KAI) to finance farm equipment and Kubota brand tractors. One of the top public sector banks in India, Bank of Baroda has more than 8200 branches spread throughout the country. At a reasonable interest rate, the Bank of Baroda will finance Kubota's premium line of tractors and farm equipment.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the agriculture equipment finance market based on the below-mentioned segments:

Global Agriculture Equipment Finance Market, By Type

- Loans

- Leases

- Line-of-Credit

Global Agriculture Equipment Finance Market, By Product

- Harvesters

- Haying Equipment

- Tractors

- Others

Global Agriculture Equipment Finance Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the agriculture equipment finance market over the forecast period?The agriculture equipment finance market is projected to expand at a CAGR of 4.10% during the forecast period.

-

2.What is the market size of the agriculture equipment finance market?The Global Agriculture Equipment Finance Market Size is Expected to Grow from USD 228.27 Billion in 2023 to USD 341.12 Billion by 2033, at a CAGR of 4.10% during the forecast period 2023-2033.

-

3.Which region holds the largest share of the agriculture antibacterial market?Asia Pacific is anticipated to hold the largest share of the agriculture equipment finance market over the predicted timeframe.

Need help to buy this report?