Global Agriculture Robot Market Size, Share, and COVID-19 Impact Analysis, By Type (Material Management, Unmanned Aerial Vehicles (UAVs), Dairy Robots, and Driverless Tractors), By Application (Planting & Seeding Management, Monitoring & Surveillance, Spraying Management, Milking, Livestock Monitoring, Harvest Management, and Others), By Offering (Hardware, Software, And Services), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: AgricultureGlobal Agriculture Robot Market Insights Forecasts to 2033

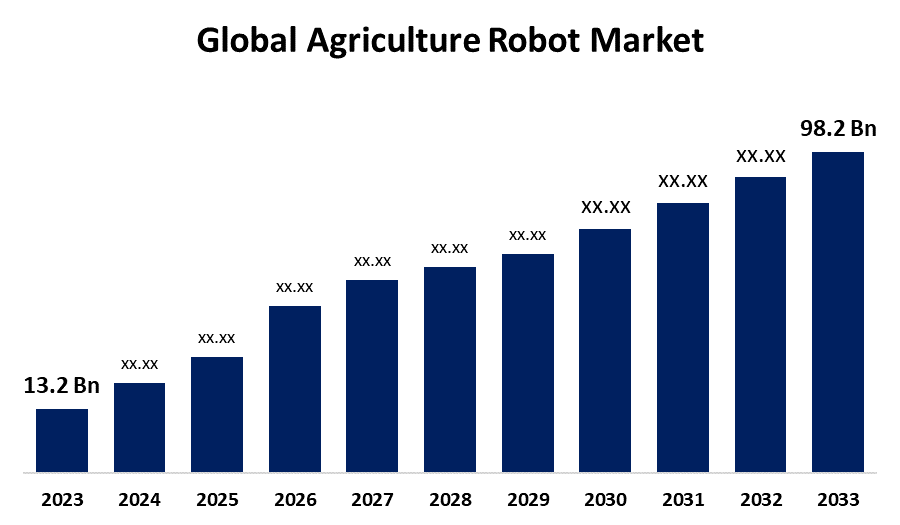

- The Global Agriculture Robot Market Size was Valued at USD 13.2 Billion in 2023

- The Market Size is Growing at a CAGR of 22.2% from 2023 to 2033

- The Worldwide Agriculture Robot Market Size is Expected to Reach USD 98.2 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Agriculture Robot Market Size is Anticipated to Exceed USD 98.2 Billion by 2033, Growing at a CAGR of 22.2% from 2023 to 2033.

Market Overview

Any robotic device that can make agricultural processes better by taking over labor-intensive or slow-moving tasks from farmers is considered an agricultural robot. Using robots in agriculture can simplify, speed up, and improve many tasks. Common uses of agricultural robots include driverless tractors, drones for data collection and crop monitoring, autonomous precision seeding, automated irrigation and harvesting systems, and dairy herd milking.

For Instance, In April 2024, the U.S. National Science Foundation and the U.S. Department of Agriculture's National Institute of Food and Agriculture (USDA NIFA) are collaborating in a historic way to advance foundational research in agricultural robotics. The agencies are issuing a new Dear Colleague Letter to solicit innovative research proposals to develop robots that could revolutionize farming practices. The collaboration is based on a shared understanding of the critical role that robotics can play in addressing challenges in agriculture and food production, such as the need for precision agriculture practices and the need for increased food demand. By leveraging resources from both agencies, NSF and USDA hope to foster interdisciplinary research that will address agricultural challenges and raise sustenance.

Due to the growing need for creative agricultural solutions, which prompted the most recent advancements in the agriculture robot industry, the market has been growing quickly. Choosing agricultural robots can increase competitiveness, sustainability, and profitability in the current agricultural environment.

Report Coverage

This research report categorizes the market for agriculture robot market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the agriculture robot market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the agriculture robot market.

Global Agriculture Robot Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | 13.2 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 22.2% |

| 2033 Value Projection: | USD 98.2 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 234 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type , By Application, By Offering, By Region |

| Companies covered:: | Agribotix.com, Autonomous Solutions Inc., Autonomous Tractor Corporation, Blue River Technology, Clearpath Robotics Inc., Deere & Company, DeLaval, GEA Group, Harvest Automation, IBM, Lely, Naio Technologies, Precision Hawk, Trimble Inc., and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

With the accuracy that machines and robots can provide, farming can become more consistent, uniform, predictable, and waste-free from planting to harvesting. The capacity to maximize plant development, cut waste, and provide a consistent product is what makes this valuable. While precise sowing and harvesting can greatly save labor costs, precision fertilizing can minimize expenses and negatively impact nearby ecosystems. In addition to working significantly faster than a human, machines can improve food safety by minimizing the number of human-to-food touchpoints that might lead to contamination. Robots' ability to make intelligent judgments based on data can help farmers maximize agricultural yields while using the least number of resources possible, especially in light of the changing environment.

For instance, in April 2024, to promote fundamental research in agricultural robotics, the National Science Foundation and the National Institute of Food and Agriculture (USDA NIFA) of the U.S. Department of Agriculture are collaborating. The collaboration is the result of a common understanding of the vital role that robotics can play in tackling issues in agriculture and food production, such as the need for precision agriculture techniques and the rise in food demand. NSF and USDA want to promote multidisciplinary research that will address agricultural issues and improve sustainability by using resources from both organizations.

Restraining Factors

The digitalization of the agricultural sector is facing considerable problems due to the high cost of agriculture robots. Due to their high prices, these robots are not widely used by farmers, particularly small and medium-sized ones, even though they have several advantages, such as improved efficiency, precision, and decreased labor requirements. Many farmers are unable to acquire modern technology due to the initial investment and ongoing maintenance costs associated with agricultural robots.

Market Segmentation

The agriculture robot market share is classified into type, application, and, offering.

- The dairy robot segment is estimated to hold the highest market revenue share through the projected period.

Based on the type, the agriculture robot market is classified into material management, unmanned aerial vehicles (UAVs), dairy robots, and driverless tractors. Among these, the dairy robot segment is estimated to hold the highest market revenue share through the projected period. The technological devices that enable voluntary milking, allow the cow to determine when to milk itself. Dairy producers can use the data that robotic milking systems can record on the milking frequency and quality to make informed choices about nutrition, health, and herd management.

For instance, in January 2024, DeLaval announced the release of its new VMSTM Batch Milking system, an innovative robotic milking technique that helps save labor costs and boost productivity. This system is intended for bigger dairy farms. The company claims that this approach, which has gained popularity across the world and is currently milking 10,000 cows at over 10 installations, entails splitting herds into groups and transporting them to the milking center in a manner akin to a traditional parlor or rotary.

- The planting & seeding segment is anticipated to hold the largest market share through the forecast period.

Based on the application, the agriculture robot market is divided into planting & seeding management, monitoring & surveillance, spraying management, milking, livestock monitoring, harvest management, and others. Among these, the planting & seeding segment is anticipated to hold the largest market share through the forecast period. The demand in the agriculture sector is enormous. Farmers can no longer afford to rely exclusively on traditional methods due to the rising expenses of labor, equipment, and materials, as well as the growing global demand for sustainability. Automation puts efficiency and creativity at the forefront of agricultural activities and provides a contemporary answer to various planting-related problems. It is becoming more and more important to comprehend the function and potential of planting robots as the agricultural industry looks to adopt more efficient and ecological techniques. Contemporary farmers can prosper in the current agricultural landscape by comprehending the varied uses of robotic planting for different crops, as well as the kinds of robots that are currently on the market. The increasing diversity of the agricultural landscape necessitates that planting and seeding robots be flexible and versatile to satisfy the diverse demands of contemporary farming. With the help of this technology, planting can be done more precisely, efficiently, and, in many cases, sustainably. It also fills in gaps and enhances the process.

- The hardware segment dominates the market with the largest market share through the forecast period.

Based on the offering, the agriculture robot market is categorized into hardware, software, and services. Among these, the hardware segment dominates the market with the largest market share through the forecast period. The hardware sector is essential to the agricultural robots industry since it provides the foundation for these cutting-edge farming solutions. It includes the hardware motors, batteries, and other mechanical parts that allow robots to carry out various activities in agricultural environments. The fact that agriculture robot components are capital-intensive is another element in the hardware segment's dominance. Research, development, and manufacturing costs associated with producing high-quality hardware are costly. Due to their complexity, hardware components frequently for sophisticated engineering knowledge, exacting production procedures, and stringent quality control procedures.

Regional Segment Analysis of the Agriculture Robot Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

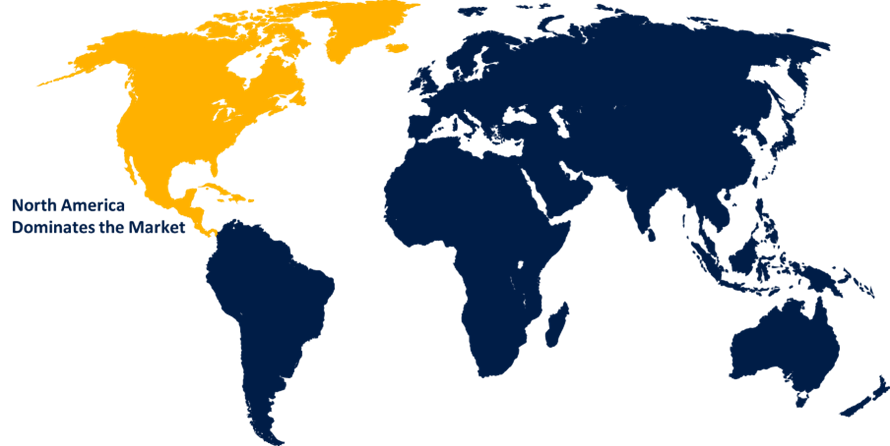

North America is anticipated to hold the largest share of the agriculture robot market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the agriculture robot market over the predicted timeframe. North America has a thriving ecosystem of tech firms, academic institutions, and agriculturally-focused innovation hubs. Innovative agricultural robotics solutions are developed and adopted more easily in this conducive setting. Furthermore, North America's strong dedication to precision and sustainable agricultural practices has increased demand for precision agriculture instruments such as robotic harvesters, drones, and autonomous tractors. Due to its large acreage and easy availability of modern technologies, North America is the global leader in terms of revenue. The region has seen significant expansion in this industry.

Asia Pacific is expected to grow at the fastest CAGR growth of the agriculture robot market during the forecast period. Innovation and technological progress in nations like China, India, and Japan have created sophisticated robotics solutions for the agricultural industry. The demand for efficient farming methods is critical given the expanding population and increasing concerns about food security. Robots for agriculture provide a solution by increasing crop yields and automating labor-intensive operations. Farmers find robots to be an appealing investment due to labor shortages and growing wages in the area. The region's potential for the rise of agriculture robots is further enhanced by strong government support and a diverse agricultural terrain.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the agriculture robot market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Agribotix.com

- Autonomous Solutions Inc.

- Autonomous Tractor Corporation

- Blue River Technology

- Clearpath Robotics Inc.

- Deere & Company

- DeLaval

- GEA Group

- Harvest Automation

- IBM

- Lely

- Naio Technologies

- Precision Hawk

- Trimble Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2024, the autonomous robot pre-series for vegetable and beet crops was commercially released by SIZA Robotics, a French business. A group of engineers spent more than three years developing the robot, which they called TOOGO, as a solution to the problems that arise in agriculture daily. The robot was co-designed by Bouton Net and the team collaborated with farmers throughout France.

- In February 2024, the e-X1, an electric small agricultural robot meant to set the standard for emission-free farming, is the latest innovation from Yanmar AG. By 2025, the corporation wants to start keeping an eye on the market.

- In November 2023, with $12 million, AgTech firm Aigen completed a series A investment round for its solar-powered, self-governing robots. ReGen Ventures, Cleveland Avenue, Incite, NEA, and Susquehanna Private Equity Investments LLLP led the round. With this most recent investment round, Aigen has collected a total of $19 million, which it says it will use to construct a 7,500-square-foot production and R&D center to produce its fleet of solar-powered robotic vehicles.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the agriculture robot market based on the below-mentioned segments:

Global Agriculture Robot Market, By Type

- Material Management

- Unmanned Aerial Vehicles (UAVs)

- Dairy Robots

- Driverless Tractors

Global Agriculture Robot Market, By Application

- Planting & Seeding Management

- Monitoring & Surveillance

- Spraying Management

- Milking

- Livestock Monitoring

- Harvest Management

- Others

Global Agriculture Robot Market, By Offering

- Hardware

- Software

- Services

Global Agriculture Robot Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the agriculture robot market over the forecast period?The agriculture robot market is projected to expand at a CAGR of 22.2% during the forecast period.

-

2. What is the market size of the agriculture robot market?The global agriculture robot market Size is Expected to Grow from USD 13.2 Billion in 2023 to USD 98.2 Billion by 2033, at a CAGR of 22.2% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the agriculture robot market?North America is anticipated to hold the largest share of the agriculture robot market over the predicted timeframe.

Need help to buy this report?