Global Agritech Platform Market Size, Share, and COVID-19 Impact Analysis, By Component (Platform and Services), By Application (Livestock Monitoring, Smart Greenhouses, Precision Farming, and Supply Chain Management), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: AgricultureGlobal Agritech Platform Market Insights Forecasts to 2033

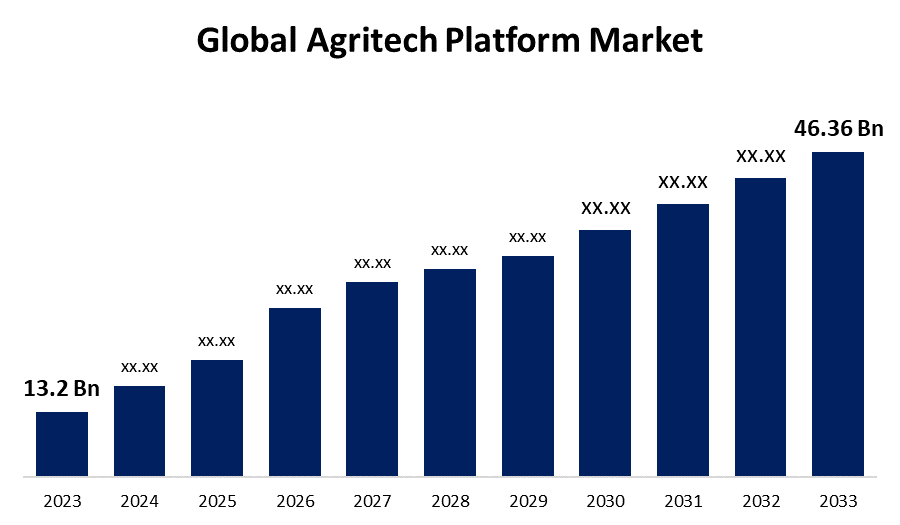

- The Global Agritech Platform Market Size was Valued at USD 13.2 Billion in 2023

- The Market Size is Growing at a CAGR of 13.3% from 2023 to 2033

- The Worldwide Agritech Platform Market Size is Expected to Reach USD 46.36 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Agritech Platform Market Size is Anticipated to Exceed USD 46.36 Billion by 2033, Growing at a CAGR of 13.3% from 2023 to 2033.

Market Overview

The utilization of science, technology, and innovation in agriculture is referred to as "agri-tech," or agricultural technology. A wide range of technologies, such as robotics, sensors, drones, AI, machine learning, big data analytics, and biotechnology, are applied to enhance farming methods, boost output, sustainability, and efficiency, and solve problems confronting the world's agricultural industry.

The proliferation of predictive analytics tools and data-driven farming solutions is one trend that is prevalent in the global agriTech platform market. To give farmers real-time insights on crop health, soil conditions, weather patterns, and insect infestations, agritech platforms collect and analyze data from a variety of sources, including sensors, drones, satellites, weather stations, and farm equipment. Farmers might enhance productivity, quality, and profitability by anticipating hazards, allocating resources optimally, and making well-informed decisions owing to predictive analytics algorithms.

For instance, in May 2024, with CropX farmers can easily create and save customized management zones and VRA/VRI maps using the satellite or machine data in CropX. Farmers can also export scripts to their controller in any format or send them wirelessly to John Deere Operations for direct import into machines

This agritech platforms market's growth is primarily driven by enabling farmers to make informed decisions by providing them with up-to-date information on crop performance, soil health, weather, and other relevant aspects.

Report Coverage

This research report categorizes the market for the global agritech platform market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global agritech platform market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global agritech platform market.

Global Agritech Platform Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 13.2 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 13.3% |

| 2033 Value Projection: | USD 46.36 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 225 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Component, By Application, and By Region |

| Companies covered:: | CropX, Arable, Gamaya, CropIn, Agro-star, Semios, Hortau, Waycool, CropSafe, Xocean, Ninja Cart, Machine Eye, FarmEye, Intello Labs, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The ongoing digital transformation of the agriculture industry drives market demand for AgriTech platforms that streamline operations, automate processes, and enable data-driven insights. As farmers and agribusinesses seek to optimize resource allocation, minimize input costs, and maximize yields, they turn to digital solutions for farm management, crop monitoring, precision agriculture, and supply chain optimization. AgriTech platforms offer real-time visibility into field conditions, weather patterns, crop health, and market dynamics, empowering stakeholders to make informed decisions and optimize agricultural operations.

Restraining Factors

High initial investment costs significantly limit the adoption of agritech platforms. The implementation of these platforms is expensive due to the necessity for infrastructure, software licenses, and technical equipment purchases. The requirement for specialized labor to ensure the effective usage of these platforms drives up the cost even more. Small-scale farmers and other agricultural businesses with limited funding may find these upfront costs prohibitive, which would hinder or delay their adoption of agritech solutions and restrict their ability to benefit from the efficiency and advantages these platforms offer.

Market Segmentation

The global agritech platform market share is segmented into component and application.

- The platforms segment dominates the market with the largest market share through the forecast period.

Based on the component, the global agritech platform market is segmented into platforms & services. Among these, the platforms segment dominates the market with the largest market share through the forecast period. The introduction of agritech platforms to increase smallholder farmers' profits is driving the platform segment's notable growth. By giving farmers access to essential resources, markets, and financial services, these platforms enable them to increase their output and profitability.

- The precision farming segment is anticipated to grow at the fastest CAGR growth through the forecast period.

Based on the application, the global agritech platform market is segmented into livestock monitoring, smart greenhouses, precision farming, and supply chain management. Among these, the precision farming segment is anticipated to grow at the fastest CAGR growth through the forecast period. Partnerships to advance precision farming are propelling the expansion of the agritech sector. Farmers can obtain cutting-edge technologies and knowledge for precision agriculture by utilizing alliances among agritech companies. These partnerships make it easier to develop and implement cutting-edge solutions like data analytics platforms, drones, and lot sensors, which help farmers maximize resource use, boost yields, and lessen their impact on the environment.

For instance, in March 2024, A Leading provider of digital farm management CropX Technologies recently announced an API interface with WiseConn, a world leader in precision drip irrigation technology, to enhance data collection and analytics for farmers globally. Users of WiseConn can easily integrate the CropX system into their network for precise irrigation. Irrigation systems made by WiseConn are used in Australia, Europe, South and North America.

Regional Segment Analysis of the Global Agritech Platform Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global agritech platform market over the predicted timeframe.

Get more details on this report -

North America is projected to hold the largest share of the global agritech platform market over the forecast period. The growing uptake of precision agriculture and technical improvements are driving market demand in North America. Modern agritech solutions are being developed in the region owing to ongoing innovation in IoT, Al, robotics, and data analytics. These innovations let farmers precisely monitor crop health and optimize input usage. The focus on precision agriculture methods, like remote sensing and GPS-guided equipment, improves farming practices' productivity and efficiency. Consequently, to optimize yields while limiting resource inputs, North American farmers are depending more and more on agritech solutions, which is driving the expansion of the North American industry. Syngenta and InstaDeep collaborate to accelerate crop seed trait research using AI, One of the top producers of agricultural technology worldwide. For illustration, Syngenta Seeds recently announced a partnership with InstaDeep, an AI startup. The partnership will combine Syngenta's in-house capabilities for trait research and development with InstaDeep's Large Language Model (LLM) platform to expedite the creation of crop traits that offer farmers solutions. The partnership's initial phase will concentrate on AI-mediated trait design for soybeans and maize.

Asia Pacific is expected to grow at the fastest CAGR growth of the global agritech platform market during the forecast period. The increasing use of digital technologies in agriculture, the need for more sophisticated farming methods, and government initiatives are some of the causes driving this expansion. With substantial investment and the potential to create jobs, government initiatives over the past ten years have accelerated the use of innovation and technology in the agriculture industry, despite obstacles such as limited penetration, geographic concentration, and environmental concerns. Asia-Pacific nations are substantially investing in agritech solutions to increase production due to their robust agricultural sectors and expanding populations.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global agritech platform market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- CropX

- Arable

- Gamaya

- CropIn

- Agro-star

- Semios

- Hortau

- Waycool

- CropSafe

- Xocean

- Ninja Cart

- Machine Eye

- FarmEye

- Intello Labs

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2024, Growero Technologies, an agritech company, released a pest forecast platform that leverages artificial intelligence (AI), historical meteorological data, data from remote sensing, and satellite data to deliver precise forecasts on pests or diseases.

- In July 2024. Cropin Introduces "Sage," an AI-powered agri-intelligence Platform Sage provides information on crops, irrigation, soil, climate, and cultivation techniques by converting agricultural landscapes into grid-based maps. According to a statement from the company, the platform is based on Google Cloud and makes use of Google's Gemini AI model.

- In May 2023, The fintech, investment, and ventures division of Standard Chartered, known as SC Ventures, introduced Tawi, a B2B agritech platform situated in Kenya that facilitates safe online transactions for smallholder farmers in the country. Tawi wants to give farmers access to a sustainable and reliable market, transparent pricing, and effective supply chain management.

- In September 2022, Cropin, an agritech startup, introduced its cloud platform to revolutionize the agriculture sector.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global agritech platform market based on the below-mentioned segments:

Global Agritech Platform Market, By Component

- Platform

- Services

- Anti-infective Dressing

Global Agritech Platform Market, By Application

- Livestock Monitoring

- Smart Greenhouses

- Precision Farming

- Supply Chain Management

Global Agritech Platform Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which are the key companies that are currently operating within the market?CropX, Arable, Gamaya, CropIn, Agro-star, Semios, Hortau, Waycool, CropSafe, Xocean, Ninja Cart, Machine Eye, FarmEye, Intello Labs, and Others.

-

2. What is the size of the global agritech platform market?The Global Agritech Platform Market Size is Expected to Grow from USD 13.2 Billion in 2023 to USD 46.36 Billion by 2033, at a CAGR of 13.3% during the forecast period 2023-2033.

-

3. Which region is holding the largest share of the market?North America is anticipated to hold the largest share of the global agritech platform platform market over the predicted timeframe.

Need help to buy this report?