Global Agrochemical Intermediates Market Size, Share, and COVID-19 Impact Analysis, By Type (Bio-Based and Synthetic), By Product (Aldehydes, Alkylamines, Amines, and Acids), By Application (Insecticides, Herbicides, and Fungicides), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: AgricultureGlobal Agrochemical Intermediates Market Insights Forecasts to 2033

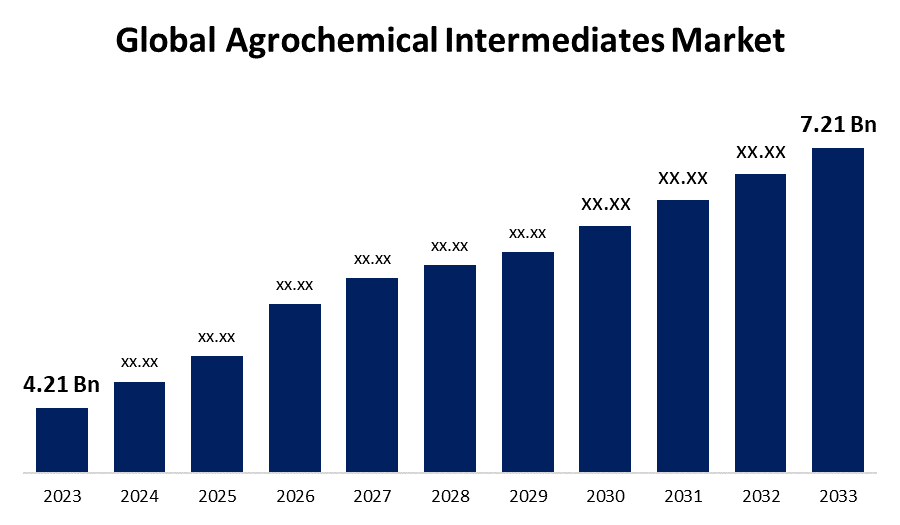

- The Global Agrochemical Intermediates Market Size was Valued at USD 4.21 Billion in 2023

- The Market Size is Growing at a CAGR of 5.5% from 2023 to 2033

- The Worldwide Agrochemical Intermediates Market Size is Expected to Reach USD 7.21 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Agrochemical Intermediates Market Size is Anticipated to Exceed USD 7.21 Billion by 2033, Growing at a CAGR of 5.5% from 2023 to 2033.

Market Overview

Pesticides, such as herbicides, fungicides, and insecticides, are frequently made using agrochemical intermediates. Agrochemical intermediates are frequently found in substances like 2-chloro-6-(Trichloromethyl) Pyridine, 2-chloro-5-chloro Methyl Pyridine, 2-fluoro toluene Diethyl Phosphorochloridothionate, and 2-Chloropropionic Acid. Applications' most commonly used agrochemical intermediates include acids, alkylamines, amines, and aldehydes.

For Instance, In December 2023, at its manufacturing facility in Bharuch, Gujarat, Jubilant Ingrevia Limited announced the commissioning of its state-of-the-art multipurpose agro intermediate plant to generate derivatives with value addition. The factory intends to meet the increasing global demand for agro intermediates.

The global increase in agriculture activities due to the growing population and food demand, as well as favorable government policies, technological advancements, rising demand for organic compost, and emerging environmental concerns are the main factors driving the growth of the agrochemical intermediates market.

Report Coverage

This research report categorizes the market for agrochemical Intermediates market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the agrochemical Intermediates market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the agrochemical Intermediates market.

Global Agrochemical Intermediates Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 4.21 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.5% |

| 2033 Value Projection: | USD 7.21 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Product, By Application, By Region |

| Companies covered:: | RohnerChem, Eastman Chemical Company, Arkema, AGC, Lonza, Sugai Chemical Industry Co., Kuraray Co., BASF SE, Evonik Industries, Air Water Inc., Astec LifeSciences Ltd., WeylChem Group, DPx Fine Chemicals, Mitsubishi Corporation, and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The growing global population necessitates a commensurate increase in food production, and agrochemical intermediates are essential in helping farmers and agricultural producers meet this growing demand by making it easier to manufacture agrochemicals like pesticides and fertilizers. By helping to maximize agricultural output, these intermediary molecules provide a steady and plentiful supply of food. Furthermore, there is a close relationship between the market for agrochemical intermediates and the requirement for food production. The continuous expansion in the global population has led to a consistent need for agricultural products. According to the UN's most recent estimate, there are 7.3 billion people on the planet. A consistent and plentiful food supply and maximum agricultural productivity depend on agrochemicals. They significantly contribute to global food security by giving crops essential nutrients and protecting them from diseases and pests. Therefore, the market is growing as a result of the growing population.

Restraining Factors

Environmental issues are one of the many obstacles and problems that the agrochemical intermediates industry encounters and could have an impact on its expansion and development. Modern agriculture places a high priority on ecological impact and environmental sustainability, and the use of agrochemicals, particularly intermediates, can have unforeseen environmental effects. Potential problems include exposure to non-target organisms and soil, water, and air contamination.

Market Segmentation

The agrochemical intermediates market share is classified into type, product, and Application.

- The synthetic segment is estimated to hold the highest market revenue share through the projected period.

Based on the type, the agrochemical Intermediates market is divided into bio-based and synthetic. Among these, the synthetic segment is estimated to hold the highest market revenue share through the projected period. Chemical compounds known as synthetic agrochemical intermediates are produced artificially through chemical reactions. Due to their established presence, availability, and broad use in agriculture, these compounds have dominated the market for a long time.

The industry with the fastest growth is bio-based. Agrochemical intermediates derived from natural and renewable resources that are biobased are gaining popularity. This is due to consumers are becoming more conscious of the benefits that sustainable and eco-friendly products provide for the environment and are drawn to them. This industry is therefore expected to have rapid growth soon. Nonetheless, a significant increase in demand for bio-based intermediates is anticipated as a result of growing customer demand for sustainable products and increased awareness of the advantages to the environment.

- The aldehydes segment is anticipated to hold the largest market share through the forecast period.

Based on the product, the agrochemical Intermediates market is divided into aldehydes, alkylamines, amines, and acids. Among these, the aldehydes segment is anticipated to hold the largest market share through the forecast period. Aldehydes are essential to the growth of the global market for agrochemical intermediates. They serve as essential raw materials for the production of various fungicides, herbicides, and insecticides. In light of the growing global population and shifting climate, this aids in enhancing agricultural productivity and addressing issues related to food security.

The herbicides segment dominates the market with the largest market share through the forecast period.

Based on the Application, the agrochemical intermediates market is categorized into insecticides, herbicides, and fungicides. Among these, the herbicides segment dominates the market with the largest market share through the forecast period. Herbicides successfully manage weed populations, providing improved agricultural yields and quality and contributing considerably to the growth of the global agrochemical intermediate industry. The need for efficient farming practices to meet the growing global population's food demands is what is driving their broad adoption. Herbicide formulations have become more useful due to technological developments in both selective and non-selective variations as well as the creation of herbicide-resistant crops. Market trends are influenced by regulations centered on integrated weed management techniques and environmental sustainability. Herbicides are therefore essential to contemporary agriculture, driving the growth of the agrochemical intermediate business.

For instance, in May 2024, Brazil has approved registration for the use of FMC Corporation, a well-known worldwide agricultural sciences company, for its herbicides Azugro and Ezanya, which are meant to be applied to wheat, cotton, and tobacco crops. The herbicides Azugro and Ezanya are powered by Isoflex Active, a brand name for bixlozone owned by FMC.

Regional Segment Analysis of the Agrochemical Intermediates Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the agrochemical intermediates market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the agrochemical Intermediates market over the predicted timeframe. owing to its substantial agricultural industry, great agricultural production, and sizeable population India and China, with their sizable populations and significant agricultural sectors, have sizable marketplaces. The market is growing as a result of farmers' preferences for effective crop protection products and Asia-Pacific's quickly growing population. The region's growing population, expanding food demand, and sizable agricultural industry are its market drivers.

North America is expected to grow at the fastest CAGR growth of the agrochemical Intermediates market during the forecast period. The agrochemical intermediates market in North America is well-established and mature, with advanced agricultural methods, high per capita consumption of agrochemical intermediates, and a robust regulatory framework. The major market in this region, accounting for a sizeable portion of agricultural production, is the United States.

Advanced farming technologies and large-scale agriculture production define the European agrochemical intermediates market. Environmental restrictions are highly valued in this region and are a driving force behind the development of sustainable and environmentally friendly agrochemical products. European countries have strict regulations regarding the use of agricultural intermediates.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the agrochemical Intermediates market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- RohnerChem

- Eastman Chemical Company

- Arkema

- AGC

- Lonza

- Sugai Chemical Industry Co.

- Kuraray Co.

- BASF SE

- Evonik Industries

- Air Water Inc.

- Astec LifeSciences Ltd.

- WeylChem Group

- DPx Fine Chemicals

- Mitsubishi Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2024, leading agricultural technology provider Sipcam Oxon SpA has announced that, through its recently established subsidiary Sipcam France SA, it has acquired all of the distribution assets of French company Phyteurop SA.

- In June 2024, public comments were invited on the Environmental Impact Assessment (EIA) for the yearly 10,000-ton chlorantraniliprole intermediates project of Inner Mongolia Zhonggao Chemical, a Chinese agrochemical company. The project is located in the Alxa High-tech Industrial Development Zone, Bayin Aobao Industrial Park, and Zhonggao Chemical plant region in Inner Mongolia. Construction on the project, which will cost 250 million in total, will take place between June 2024 and May 2025.

- In May 2024, a local government website recently announced the completion approval of Gansu Binnong Technology Co., Ltd.'s 22,000-ton pesticide and intermediates project (Phase I) for public opinion. The Chinese agrochemical company Shandong Binnong Technology Co., Ltd. owns Gansu Binnong Technology entirely. The 22,000-ton pesticide and intermediates project, which cost 1 billion to build, is situated inside Gansu Binnong Technology Co., Ltd's grounds in Lanzhou New Area Chemical Industry Park, according to the completion acceptance report.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the Agrochemical Intermediates market based on the below-mentioned segments:

Global Agrochemical Intermediates Market, By Type

- Bio-Based

- Synthetic

Global Agrochemical Intermediates Market, By Product

- Aldehydes

- Alkylamines

- Amines

- Acids

Global Agrochemical Intermediates Market, By Application

- Insecticides

- Herbicides

- Fungicides

Global Agrochemical Intermediates Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the agrochemical Intermediates market over the forecast period?The agrochemical Intermediates market is projected to expand at a CAGR of 5.5% during the forecast period.

-

2. What is the market size of the agrochemical Intermediates market?The global agrochemical Intermediates market Size is Expected to Grow from USD 4.21 Billion in 2023 to USD 7.21 Billion by 2033, at a CAGR of 5.5% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the agrochemical Intermediates market?Asia Pacific is anticipated to hold the largest share of the agrochemical Intermediates market over the predicted timeframe.

Need help to buy this report?