Global Agrochemical Packaging Market Size, Share, and COVID-19 Impact Analysis, By Type (Plastic, Paper, Metal, and Others), By Product Type (Pesticides, Herbicides, Fertilizers, Insecticides, and Others), By Material (Pouches, Bags & Sacks, Bottles, Containers, Boxes, Drums, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: AgricultureGlobal Agrochemical Packaging Market Insights Forecasts to 2033

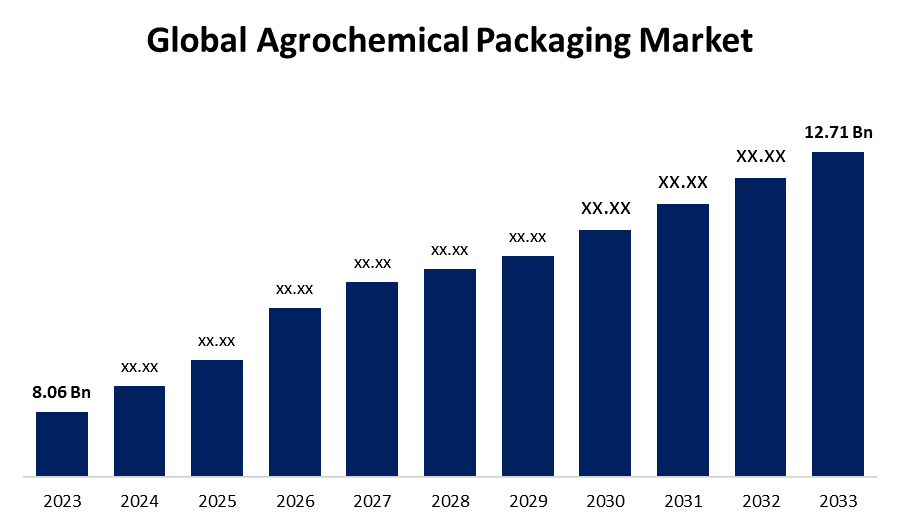

- The Global Agrochemical Packaging Market Size was Valued at USD 8.06 Billion in 2023

- The Market Size is Growing at a CAGR of 4.6% from 2023 to 2033

- The Worldwide Agrochemical Packaging Market Size is Expected to Reach USD 12.71 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Agrochemical Packaging Market Size is Anticipated to Exceed USD 12.71 Billion by 2033, Growing at a CAGR of 4.6% from 2023 to 2033.

Market Overview

In the highly complicated agriculture sector, where crop performance directly impacts global food production, the importance of agrochemical product Packaging cannot be overstated. This crucial element keeps the compounds safe for anyone handling them during the agricultural process while also maintaining their efficacy. Products using agrochemicals boost crop yields while protecting plants from pests and diseases. These products consist of insecticides and fertilizers. Since maintaining these products' chemical makeup is necessary for their efficacy, proper Packaging is crucial to the agricultural supply chain.

In the agricultural sector, packaging is essential since agrochemical chemicals like pesticides and fertilizers are hazardous. Therefore, they require cutting-edge packaging options that can lower the risk of handling, storing, and moving these hazardous items. To reduce the chance of loss during transit, these products' packaging is made with improved closing.

For Instance, for biostimulants and organic fertilizers, single-layer HDPE packaging offers sufficient resistance against moisture and weather conditions, but even with high weights, it is not resistant enough against gases produced by the most aggressive pesticide and insecticide formulations. However, because it contains highly dangerous materials, PET is considered a second-tier material when it comes to packaging used in this industry. This is due to there being insufficient guarantees that the container will remain intact during its entire life cycle. It is necessary to create a special design whose mechanical properties sustain the polymer.

Report Coverage

This research report categorizes the market for the agrochemical packaging market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the agrochemical packaging market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the agrochemical packaging market.

Global Agrochemical Packaging Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 8.06 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 4.6% |

| 2033 Value Projection: | USD 12.71 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 265 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Product Type, By Material |

| Companies covered:: | FMC Corporation, Biostadt India Limited, Aries Agro Ltd., Nippon Soda Co. Ltd., Syngenta AG, Adama Agricultural Solutions Ltd., BASF SE, American Vanguard Corporation, Nufarm Limited, PI Industries, Sumitomo Chemical, GREENCHEM BIOTECH, Dow AgroSciences LLC, Bayer CropScience AG, and Others |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

The need for packaging solutions that safely store and administer pesticides, herbicides, and chemicals to protect crops from diseases, weeds, and pests is fueled by the growing demand for crop protection products on a global scale. The market is expanding as a result of the increased demand for agrochemicals around the world and the development of biodegradable packaging options. Furthermore, the market is expanding due to the increased use of flexible packaging options including pouches and bag-in-box, which limit exposure to dangerous chemicals. Throughout the projection period, the agricultural chemical packaging market will witness more growth and potential due to an increase in equipment modernization and improvement.

Market Segmentation

The agrochemical packaging market share is classified into type, product type, and material.

- The plastic segment is estimated to hold the highest market revenue share through the projected period.

Based on the type, the agrochemical packaging market is classified into plastic, paper, metal, and others. Among these, the plastic segment is estimated to hold the highest market revenue share through the projected period. Due to agricultural plastics being used in every aspect of agriculture, there has been an increase in interest in these materials in recent years. Plastics are frequently less expensive, safer to use, and have increased production efficiency, they are replacing more durable materials like concrete, glass, ceramic, metal, etc. The market for agrochemical products is being driven by plastic material's capacity to shield them from moisture, physical harm, and pests. Plastic also provides flexibility about the sizes, forms, and formats of packaging.

- The pesticides segment is anticipated to hold the largest market share through the forecast period.

Based on the product type, the agrochemical packaging market is divided into pesticides, herbicides, fertilizers, insecticides, and others. Among these, the pesticides segment is anticipated to hold the largest market share through the forecast period. The growing need for packaging that is safe. In the agriculture industry, pesticide packaging is essential since a large portion of agricultural products are lost during handling, transit, and storage. Pesticides are packed in bags, pouches, bottles, and containers. Plastic jars and bottles composed of HDPE and PET are primarily used to package various agricultural chemicals, including insecticides and fertilizers. Pesticide-treated packaging keeps products from going bad before they are purchased by customers. The packaging for pesticides is made to ensure better sealing, minimize operating problems, and prevent packing failure during transit. Due to pesticides are poisonous by nature, handling risks can be minimized by using innovative packaging. These packaging options extend product shelf life and minimize product loss while in transit. Anticipated to propel market expansion is pesticide packing, which prevents agricultural products from rotting before they reach end consumers.

- The pouches segment dominates the market with the largest market share through the forecast period.

Based on the material, the agrochemical packaging market is categorized into pouches, bags & sacks, bottles, containers, boxes, drums, and others. Among these, the pouches segment dominates the market with the largest market share through the forecast period. The ease of handling and transportation of pouches is another factor contributing to their rising demand. Pouches protect against moisture and physical harm. Pouches are robust, stackable, and capable of shielding the products from harm while in transit. Crop protection products are kept fresh and flavorful with the usage of agrochemical packaging pouches. To prevent food spoilage, these pouches are maintained at a temperature below freezing. Various chemical firms use this bag for packing. The packaging pouch is highly useful and designed to be stored. The pouches' special polypropylene construction keeps the contents inside intact.

Regional Segment Analysis of the Agrochemical Packaging Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the agrochemical packaging market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the agrochemical packaging market over the predicted timeframe. Top of Form In this region, market demand increases by the demand for agricultural output. Rising crop quality demands and greater knowledge of the use of agrochemical packaging and biorational fungicides to avoid bacterial infections in crop yields are the main drivers of market expansion in the region. A sizable number of national and international participants. There will likely be fierce competition between them due to their ability to offer cutting-edge products and market penetration. Furthermore, the business is pushed toward greater competition when major investment is involved since it raises the departure barriers for current companies. For instance, in February 2022, ProAmpac, a prominent figure in the fields of material science and flexible packaging, revealed that it had procured Belle-Pak Packaging, a distinguished producer of products for flexible packaging. ProAmpac gains further traction in Canada and broadens its reach into rapidly expanding e-commerce, healthcare, and logistics end sectors with the acquisition of Belle-Pak.

Asia Pacific is expected to grow at the fastest CAGR growth of the agrochemical packaging market during the forecast period. Owing to fertilizer and pesticide sales on e-commerce are increasing. Market expansion is being aided by investments and technical developments, such as artificial intelligence-based agricultural technologies. For instance, up to October 2023–24, India's fertilizer and agriculture sectors saw remarkable success. The production, import, and sales of important fertilizers like urea, DAP, and NPKs have all increased significantly. In other words, production of urea, DAP, and NPK increased by 11%, 14%, and 5%, respectively, over the same period last year. By October 2023, the total amount of fertilizer produced had reached an astounding 26.5 million tons. Of that amount, 18.1 million tons were produced from urea, followed by 5.6 million tons from NPKs and 2.7 million tons from DAP. Furthermore, India's growing population and rising scale of consumption have increased the country's need for food, which will boost agricultural operations and raise the need for agrochemical packaging solutions for the safe transportation of fertilizers and pesticides.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the agrochemical packaging market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- FMC Corporation

- Biostadt India Limited

- Aries Agro Ltd.

- Nippon Soda Co. Ltd.

- Syngenta AG

- Adama Agricultural Solutions Ltd.

- BASF SE

- American Vanguard Corporation

- Nufarm Limited

- PI Industries

- Sumitomo Chemical

- GREENCHEM BIOTECH

- Dow AgroSciences LLC

- Bayer CropScience AG

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2024, Leading crop protection business ADAMA Ltd. announced that it would be using its newly designed one-liter containers more widely, a move that demonstrates its dedication to increased sustainability. These containers were created with a focus on lessening their impact on the environment and enhancing farmer utility. They have already been introduced with success in India.

- In June 2022, In Brazil, Greif, a global leader in industrial packaging goods and services, introduced a high-performance, lightweight jerrycan that works well with flavors, beverages, scents, and agrochemicals.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the agrochemical packaging market based on the below-mentioned segments:

Global Agrochemical Packaging Market, By Type

- Plastic

- Paper

- Metal

- Others

Global Agrochemical Packaging Market, By Product Type

- Pesticides

- Herbicides

- Fertilizers

- Insecticides

- Others

Global Agrochemical Packaging Market, By Material

- Pouches

- Bags & Sacks

- Bottles

- Containers

- Boxes

- Drums

- Others

Global Agrochemical Packaging Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the agrochemical packaging market over the forecast period?The agrochemical packaging market is projected to expand at a CAGR of 4.6% during the forecast period.

-

2. What is the market size of the agrochemical packaging market?The Global Agrochemical Packaging Market Size is Expected to Grow from USD 8.06 Billion in 2023 to USD 12.71 Billion by 2033, at a CAGR of 4.6% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the agrochemical packaging market?North America is anticipated to hold the largest share of the agrochemical packaging market over the predicted timeframe.

Need help to buy this report?