Global Agrochemicals Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Pesticides and Fertilizers), By Crop Type (Food Grains, Cash Crops, Plantation Crops, and Horticulture Crops), By Pesticide Type (Fungicides, Herbicides, Insecticides, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: AgricultureGlobal Agrochemicals Market Insights Forecasts to 2033

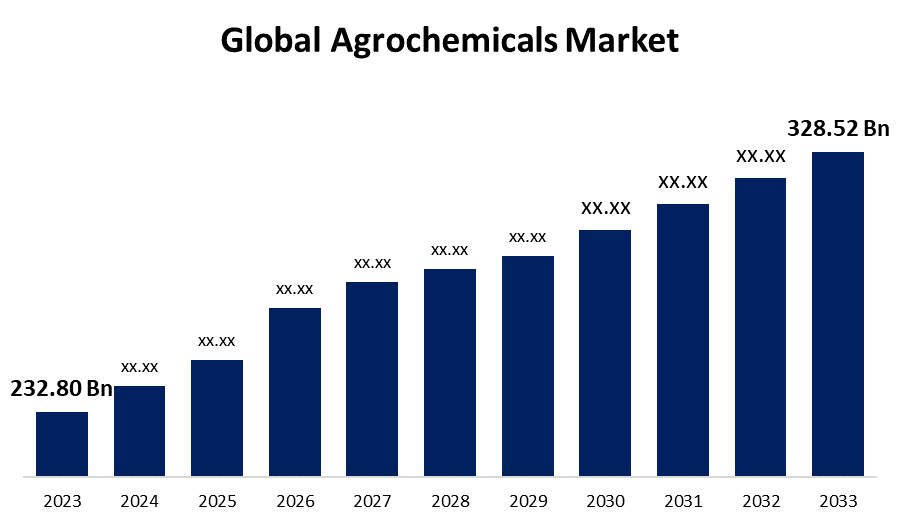

- The Global Agrochemicals Market Size was Valued at USD 232.80 Billion in 2023

- The Market Size is Growing at a CAGR of 3.5% from 2023 to 2033

- The Worldwide Agrochemicals Market Size is Expected to Reach USD 328.52 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Agrochemicals Market Size is Anticipated to Exceed USD 328.52 Billion by 2033, Growing at a CAGR of 3.5% from 2023 to 2033.

Market Overview

Agrochemicals are chemical products composed of fertilizers, plant-protection chemicals or pesticides, and plant-growth hormones used in agriculture. It's a material that keeps an agricultural ecosystem functioning. Herbicides, insecticides, soil conditioners, fungicides, liming, and acidifying agents (which adjust pH). Agrochemicals are designed chemical or biological formations that improve crop quality and productivity. Farmers can generate more crops per acre of land for longer periods with the use of agrochemicals. They promote an effective harvest by protecting crops from weeds, pests, and diseases. Considering the current increase in global population, it is essential to increase productivity in agriculture on cultivable land to feed the world's expanding population. Agrochemicals therefore play a vital function in agriculture, assisting farmers in raising the quality and volume of their yield. The global agrochemicals market is driven by factors such as soil deterioration, a lack of arable land, growing consumer awareness of the benefits of agrochemicals, and rising global population growth and food consumption. Additionally, governments particularly those in Asian nations are launching various programs to assist farmers which leads to expanding the agrochemicals market.

Report Coverage

This research report categorizes the market for the global agrochemicals market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global Agrochemicals market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global agrochemicals market.

Global Agrochemicals Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 232.80 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 3.5% |

| 023 – 2033 Value Projection: | USD 328.52 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Crop Type, By Pesticide Type, By Region |

| Companies covered:: | Clariant AG; BASF SE, Huntsman International LLC, Bayers, The DOW Chemical Company, Solvay, Nufarm, Evonik Industries AG, Croda International Plc, Helena Agri-Enterprises, LLC Ashland, Inc., Land O’ Lakes, ADAMA Ltd, Stepan Company, Syngenta, and Others Key Vendors |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

Driving Factors

In farming activities, agrochemicals are heavily utilized. It boosts the agricultural industry's productivity. Thus, agrochemicals are now considered to be essential to agriculture. The objective of the ongoing research and development efforts is to provide the market with high-quality agrochemicals. Food consumption is closely linked to agriculture. Furthermore, while pesticides protect crops by preventing, eliminating, and repelling harmful weeds and pests, fertilizers enhance crop quality by giving soil and crops vital nutrients. Increasing agricultural productivity on currently cultivated land is essential to feeding the world's population due to the current situation of the global population. Consequently, agrochemicals are essential to the agricultural industry as they assist farmers increase the amount and quality of their crops. These elements are assisting the agrochemicals market’s expansion.

Restraining Factors

Due to growing awareness of the significance of maintaining standards about health, food safety, and environmental protection, the market for organic food has been growing quickly in emerging nations. There is a growing trend in the growing acceptance of consuming organic food. Increased demand for low-risk and nutrient-dense foods, combined with increased per capita income, is expected to drive the organic food industry and increase the use of biofertilizers, both of which will affect the chemical fertilizer composition. Consequently, the growth of the organic fertilizer sector has hampered the worldwide agrochemical market's expansion.

Market Segmentation

The global agrochemicals market share is segmented into product type, crop type, and pesticide type.

- The fertilizers segment dominates the market with the largest market share through the forecast period.

Based on the product type, the global agrochemicals market is segmented into pesticides and fertilizers.

Among these, the fertilizers segment dominates the market with the largest market share through the forecast period. Grain and cereal fertilization can be done in three main ways. These nutrients can be applied to seedlings by spraying, top-dressing separately, or combining them with other fertilizers. Fertilizers need to be applied correctly both in terms of rate and amount to raise grain and cereal yields. Due to the rising need for food, farmers are using more fertilizer to boost crop productivity and yield. This is because agricultural land is under more strain. Subsequently, the increasing use of fertilizers to increase crop yield is driving the market for agrochemicals.

- The food grains segment is anticipated to grow at the fastest CAGR growth through the forecast period.

Based on the crop type, the global agrochemicals market is segmented into food grains, cash crops, plantation crops, and horticulture crops. Among these, the food grains segment is anticipated to grow at the fastest CAGR growth through the forecast period. Since poor soil quality can result in lower yields and lower nutritional levels for crops like rice, these chemicals are most commonly utilized in grains. Minerals are added to fertilizers to increase the nutritional content and productivity of grains to solve this particular problem. Grains also have a lot of other advantages, such as minimizing the risk of diabetes, cancer, and obesity. Several grains are utilized as raw ingredients in the food and beverage industry to enhance the nutritional characteristics of a range of products.

- The herbicides segment accounted for the largest revenue share through the forecast period.

Based on the pesticide type, the global agrochemicals market is segmented into fungicides, herbicides, insecticides, and others. Among these, the herbicides segment accounted for the largest revenue share through the forecast period. Herbicides are insecticides intended for controlling weeds and other unwanted plants. Since weeds can compete with crops for resources like water, nutrients, and sunlight, they are crucial for weed management. They effectively restrict the growth of broad-spectrum weeds and some plant species, preventing them from hindering crop growth.

Regional Segment Analysis of the Global Agrochemicals Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the global agrochemicals market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the global agrochemicals market over the predicted timeframe. This is due to there being a large population living there and there being big companies in the market. Chemical businesses serving the farming community are entering the Asia-Pacific region through mergers and acquisitions to capture a substantial share of the market. Japan, China, and India are the largest suppliers to the regional market. China leads the globe in both crop production and crop protection product manufacturing. This region uses most of the portion of the global supply of fertilizers and insecticides. The area of arable land is shrinking as a result of the growing economy, population, and rate of urbanization. Due to this, the Chinese government is very concerned about ensuring food security, and as a result, more cereal and grain are produced to keep up with the country's growing food demand. Moreover, India is the 13th-largest exporter of pesticides and the fourth-largest manufacturer of crop protection products worldwide. worldwide. The primary driver of market expansion is the rising production of rice and wheat.

North America is expected to grow at the fastest CAGR growth of the global agrochemicals market during the forecast period. The largest producer of sorghum, corn, almonds, and blueberries is North America. It is also the nation that produces the most soybeans, second only to Brazil. These are the primary factors behind the country's market expansion. Agrochemicals are produced, consumed, and exported in large quantities by the region. Several variables, including improved weather patterns, rising grain commodity prices, and easing trade concerns with China, are contributing to the growth of the nation's agrochemical sector.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global agrochemicals market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Clariant AG;

- BASF SE

- Huntsman International LLC

- Bayers

- The DOW Chemical Company

- Solvay

- Nufarm

- Evonik Industries AG

- Croda International Plc

- Helena Agri-Enterprises

- LLC Ashland, Inc.

- Land O’ Lakes

- ADAMA Ltd

- Stepan Company

- Syngenta

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2023, Best Agrolife, an India based agrochemical manufacturer, launched six new formulations- Amito, Promos, Propique, Ghotu, Doddy, and Headshot along with their star products Citizen and Vistara.

- In January 2022, A commercial agreement was signed by Lantmannen and Yara International ASA to introduce fossil-free fertilizers to the market. A commercial agreement for green fertilizers was reached as a result of the collaboration; Yara will produce the fertilizers and Lantmannen will market them in Sweden.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global agrochemicals market based on the below-mentioned segments:

Global Agrochemicals Market, By Product Type

- Pesticides

- Fertilizers

Global Agrochemicals Market, By Crop Type

- Food Grains

- Cash Crops

- Plantation Crops

- Horticulture Crops

Global Agrochemicals Market, By Pesticide Type

- Fungicides

- Herbicides

- Insecticides

- Others

Global Agrochemicals Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which are the key companies that are currently operating within the market?Clariant AG, BASF SE, Huntsman International LLC, Bayers, The DOW Chemical Company, Solvay, Nufarm, Evonik Industries AG, Croda International Plc, Helena Agri-Enterprises, LLC Ashland, Inc., Land O’ Lakes, ADAMA Ltd, Stepan Company, Syngenta, and Others.

-

2. What is the size of the global Keyword market?The Global Agrochemicals Market Size is Expected to Grow from USD 232.80 Billion in 2023 to USD 328.52 Billion by 2033, at a CAGR of 3.5% during the forecast period 2023-2033.

-

3. Which region is holding the largest share of the market?Asia Pacific is anticipated to hold the largest share of the global agrochemicals market over the predicted timeframe.

Need help to buy this report?