Global AI In Banking Market Size, Share, and COVID-19 Impact Analysis, By Component (Service and Solution), By Application (Risk Management, Customer Service, Virtual Assistant, Financial Advisory, and Others), By Technology (Machine Learning, Natural Learning Processing, Generative AI, and Computer Vision), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Banking & FinancialGlobal AI In Banking Market Insights Forecasts to 2033

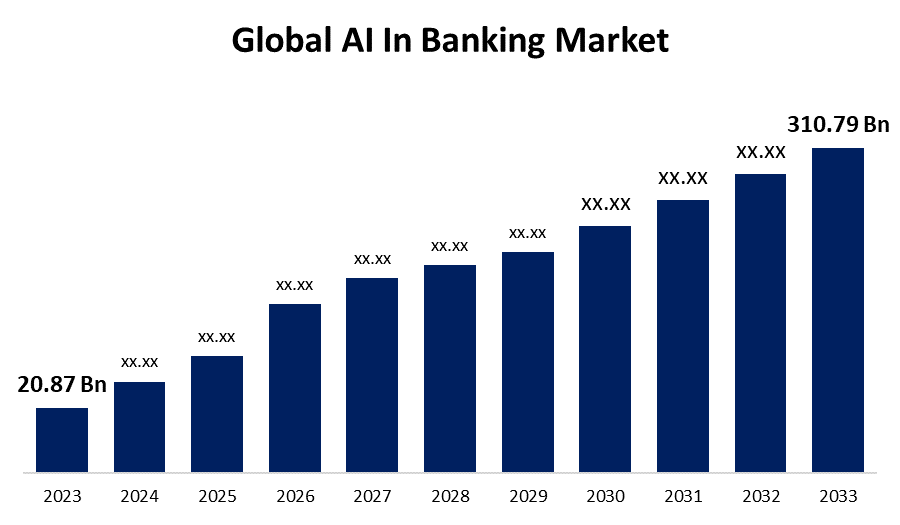

- The Global AI In Banking Market Size was Valued at USD 20.87 Billion in 2023

- The Market Size is Growing at a CAGR of 31.01% from 2023 to 2033

- The Worldwide AI In Banking Market Size is Expected to Reach USD 310.79 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global AI In Banking Market Size is Anticipated to Exceed USD 310.79 Billion by 2033, Growing at a CAGR of 31.01% from 2023 to 2033.

Market Overview

AI is utilized in banking to improve client experiences, security, and efficiency. Automating repetitive processes like fraud detection and data entry lowers operating expenses. AI-powered chatbots offer round-the-clock client service. To improve security and personalize services, machine learning algorithms examine client data and look for abnormal transactions. Credit scoring models use AI to provide a more accurate creditworthiness assessment. AI optimizes investment strategies and helps with portfolio management as well. Moreover, natural language processing (NLP) facilitates the analysis of user input to improve product development. All things considered, AI transforms banking by lowering risks, optimizing processes, and providing clients with specialized services. The most significant corporations prioritize goals like customer experience and regulatory compliance, and artificial intelligence (AI) is being utilized to boost banking and tech industries. The growing number of patents indicates the intense competition in the BFSI business sector and the critical role AI plays in transforming BFSI operations, including generating ideas for future development and investment prospects. The development of AI in the banking sector and the evolution of data-gathering technologies among banks and other financial institutions are propelling the market's expansion. In addition, the industry is expanding as a result of a rise in bank AI investments and a rise in customer demand for individualized financial services.

Report Coverage

This research report categorizes the market for the global AI in banking market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global AI in banking market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global AI in banking market.

Global AI In Banking Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 20.87 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 30.01% |

| 2033 Value Projection: | USD 310.79 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Component, By Application, By Technology, By Region |

| Companies covered:: | IBM, Microsoft, Google Cloud, AWS Inc., NVIDIA, H2O.ai, DataRobot, Kabbag, Upstart, Zest AI, Ayasdi, Darktrace, Feedzai, and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Driving Factors

Banks are investing more in artificial intelligence technology to improve user experience and transform the FinTech management process. Furthermore, there is a growing need for specialized solutions that are suited to the objectives of the banking business as it grows more competitive and advanced. Thus, many financial institutions and FinTech businesses are investing in AI solutions to suit client needs, which is driving the expansion of AI in the banking industry. Additionally, AI is essential to financial institutions' success in all phases of risk management, including impact assessment, measurement, quantification, and identification of risks. The expansion of the Artificial intelligence market in banking is being driven by rising investment from FinTech businesses and banks. These investments aim to improve automation processes and offer customers a more efficient and personalized experience.

Restraining Factors

Data integrity protection for deep learning and machine learning algorithms is a significant challenge. Banking professionals assert that privacy and security concerns are the primary barriers to the adoption of AI technologies. Financial institutions are more susceptible to cyber threats due to, they use AI platforms and solutions that analyze large amounts of customer data to extract valuable insights for informed decision-making and operational efficiency.

Market Segmentation

The global AI in banking market share is segmented into component, application, and technology.

- The solution segment dominates the market with the largest market share through the forecast period.

Based on the component, the global AI in banking market is segmented into service and solution. Among these, the solution segment dominates the market with the largest market share through the forecast period. Owing to the market's growing need for AI-powered tools. These technologies include fraud detection, personalized financial suggestions, and automated client care. As AI technology continues to progress, more accurate and efficient solutions that are customized to meet unique banking demands are being produced. Additionally, there is a growing trend of investment in AI-based solutions as banks seek to modernize their processes. The goal of this effort is to enhance decision-making skills, optimize workflows, and deliver better customer experiences.

- The customer service segment is anticipated to grow at the fastest CAGR growth through the forecast period.

Based on the application, the global AI in banking market is segmented into risk management, customer service, virtual assistant, financial advisory, and others. Among these, the customer service segment is anticipated to grow at the fastest CAGR growth through the forecast period. The AI customer services market is expanding as a result of consumers' growing need for a customized banking experience. Artificial Intelligence facilitates quick customer service, saving hours of work. The creation of AI chatbots and other customer service tools to enhance customer support. Artificial intelligence chatbots can automatically produce pertinent responses to consumer questions, summarize them, and offer customer assistance.

- The natural learning processing segment accounted for the largest revenue share through the forecast period.

Based on the technology, the global AI in banking market is segmented into machine learning, natural learning processing, generative AI, and computer vision. Among these, the natural learning processing segment accounted for the largest revenue share through the forecast period. To comprehend and extract insightful information from unstructured data, client inquiries, and social media interaction, the banking industry is increasingly using natural language processing. This helps meet customer wants and requirements. Various tasks in banking operations are facilitated by natural language processing, including sentiment analysis, task streamlining, error reduction, and performance prediction. Moreover, fraud detection, investment analysis, risk assessment, and intelligent document search are all assisted by natural language processing.

Regional Segment Analysis of the Global AI In Banking Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global AI in banking market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global AI in banking market over the predicted timeframe. The expansion of the banking industry in the region is propelled by a greater number of people with more stable and expanded sources of income, which in turn stimulates market growth in the region. The region's banking sector is experiencing increased digitization and technical review, along with early technology acceptance in all end-use industries, including banking. These factors are propelling the market's expansion. The region's artificial intelligence (AI) banking market is expanding due in part to the growing investments made in AI by the large-scale banking industry to improve operational efficiency, ongoing research and development efforts to expand technological capabilities, mergers, and acquisitions.

Asia Pacific is expected to grow at the fastest CAGR growth of the global AI in banking market during the forecast period. Due to the expansion of the fintech sector, the increasing speed of digital transformation, and the rising number of individuals with access to digital banking services, artificial intelligence (AI) in the banking sector is experiencing a rise in the Asia Pacific. Asia Pacific's expanding economies, including China and India, are being propelled by significant investments from the existing economy and the establishment of new fintech firms.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global AI in banking market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- IBM

- Microsoft

- Google Cloud

- AWS Inc.

- NVIDIA

- H2O.ai

- DataRobot

- Kabbag

- Upstart

- Zest AI

- Ayasdi

- Darktrace

- Feedzai

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2024, Pine Labs-owned Setu debuted "Sesame," a Large Language Model (LLM) created especially for the BFSI industry. With the help of India's digital infrastructure, Sesame can power services like better fraud detection, credit underwriting, loan monitoring, upselling and cross-selling, and personal finance advice.

- In April 2024, Salesforce launched new AI-powered capabilities, built on the Einstein 1 Platform, to help banks handle transaction disputes more quickly and efficiently. The company has also announced implementation and data governance bundles for safe and secure AI rollouts.

- In September 2023, Temenos First has first to Launched a Secure Generative AI Solution in Banking to Help Banks Offer Personalized Experiences.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global AI in banking market based on the below-mentioned segments:

Global AI In Banking Market, By Component

- Service

- Solution

Global AI In Banking Market, By Application

- Risk Management

- Customer Service

- Virtual Assistant

- Financial Advisory

- Others

Global AI In Banking Market, By Technology

- Machine Learning

- Natural Learning Processing

- Generative AI

- Computer Vision

Global AI In Banking Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?