Global Air Cargo Market Size, Share, and COVID-19 Impact Analysis, by Type (Air Freight and Air Mail), Service (Express and Regular), End User (Retail, Food & Beverages, Pharmaceutical and Healthcare, Consumer Electronics, Automotive and others) and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Air Cargo Market Insights Forecasts to 2033

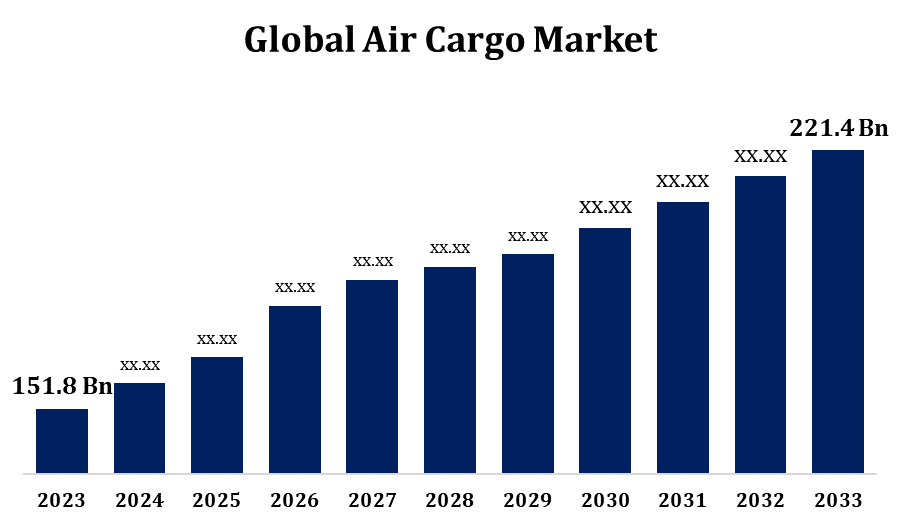

- The Global Air Cargo Market Size was valued at USD 151.8 Billion in 2023.

- The Market is Growing at a CAGR of 3.85% from 2023 to 2033

- The Worldwide Air Cargo Market Size is Expected to reach USD 221.4 Billion By 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Air Cargo Market Size is Expected to reach USD 221.4 Billion by 2033, at a CAGR of 3.85% during the forecast period 2023 to 2033.

The air cargo market, a critical component of global trade, has witnessed robust growth driven by e-commerce expansion and increased demand for timely deliveries. Advancements in technology, such as real-time tracking and automated warehouses, enhance operational efficiency. The market faces challenges, including fluctuating fuel prices and stringent regulatory standards. Major players are investing in fleet modernization and sustainable practices to mitigate environmental impact. Asia-Pacific remains a key region, bolstered by strong manufacturing bases and export activities. Despite economic uncertainties and geopolitical tensions, the air cargo sector is poised for sustained growth, supported by globalization and the continual evolution of supply chain dynamics. Innovations in air logistics and strategic partnerships are set to further propel market expansion.

Air Cargo Market Value Chain Analysis

The air cargo market value chain encompasses multiple interconnected stages, from production to final delivery. It begins with manufacturers and suppliers, who produce and provide goods for shipment. Freight forwarders then coordinate the logistics, including documentation and customs clearance. Ground handling agents manage cargo at airports, ensuring efficient loading and unloading. Airlines transport the cargo, utilizing specialized aircraft designed for freight. Upon arrival, ground handlers again take charge, facilitating transfer to local warehouses. Distribution networks, including trucking companies, ensure last-mile delivery to end customers. Throughout the process, technology plays a pivotal role, enabling real-time tracking and streamlined operations. Collaborative efforts among stakeholders, from suppliers to logistics providers, are essential for maintaining efficiency and meeting the growing demands of global trade.

Air Cargo Market Opportunity Analysis

The air cargo market presents significant opportunities, driven by the surge in e-commerce and the need for rapid, reliable delivery services. Emerging markets, particularly in Asia-Pacific and Africa, offer untapped potential due to increasing industrialization and trade activities. Technological advancements such as AI, IoT, and blockchain are set to revolutionize logistics, enhancing efficiency and transparency. Sustainable practices, including the adoption of eco-friendly aircraft and fuel alternatives, present avenues for growth as environmental concerns become paramount. Additionally, the rise of specialized cargo, such as pharmaceuticals and perishables, demands tailored solutions, providing niche market opportunities. Strategic partnerships and investments in infrastructure, especially in developing regions, can further bolster market expansion, positioning companies to capitalize on the evolving global supply chain landscape.

Global Air Cargo Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 151.8 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.85% |

| 2033 Value Projection: | USD 221.4 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 215 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Service, By End User, By Region. |

| Companies covered:: | Qatar Airways (Qatar), Etihad Airways (UAE), International Consolidated Airlines Group, SA (UK), All Nippon Airways Co., Ltd (Japan), Deutsche Lufthansa AG (Germany), Japan Airlines (Japan), The Emirates Group (UAE), Singapore Airlines (Singapore), Cargolux (Luxembourg), and other key vendors. |

| Growth Drivers: | Expansion in the e-commerce sector fuels the air cargo market |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Air Cargo Market Dynamics

Expansion in the e-commerce sector fuels the air cargo market

The rapid expansion of the e-commerce sector significantly fuels the air cargo market, driven by the increasing demand for fast and reliable delivery services. Online shopping platforms and consumer expectations for quick delivery times have heightened the need for efficient air freight solutions. This surge in e-commerce has led to greater volumes of parcels and goods being transported globally, necessitating advancements in logistics and supply chain management. Airlines and logistics providers are investing in dedicated cargo fleets, advanced tracking technologies, and automated handling systems to meet these demands. The trend towards cross-border e-commerce further amplifies this growth, making air cargo a crucial component in fulfilling international orders swiftly and efficiently.

Restraints & Challenges

Fluctuating fuel prices impose financial pressures on airlines, affecting profitability and operational costs. Regulatory constraints, including stringent customs procedures and security requirements, can lead to delays and increased compliance costs. The industry must also navigate the complexities of global trade tensions and economic uncertainties, which can disrupt supply chains. Additionally, environmental concerns are pushing for more sustainable practices, necessitating investments in greener technologies and fuel alternatives. Capacity constraints at airports and within aircraft, coupled with infrastructure limitations, further strain the market.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Air Cargo Market from 2023 to 2033. Driven by robust e-commerce growth, technological advancements, and strong economic activity, the market is experiencing steady expansion. Key hubs such as Memphis, Anchorage, and Louisville facilitate substantial cargo traffic, supported by major carriers like FedEx, UPS, and DHL. Innovations in automation and real-time tracking are enhancing operational efficiency. However, the market faces challenges such as regulatory complexities, fluctuating fuel prices, and environmental concerns. Investments in infrastructure, sustainable practices, and strategic partnerships are pivotal for continued growth. The North American air cargo sector remains poised to capitalize on increasing demand for expedited delivery services and the evolving needs of global trade.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The growth is driven by driven by robust manufacturing, booming e-commerce, and extensive trade networks. Major hubs like Hong Kong, Shanghai, and Singapore are pivotal in handling substantial cargo volumes, supported by leading airlines such as Cathay Pacific, Singapore Airlines, and China Airlines. Technological innovations, including automation and IoT, enhance efficiency and tracking capabilities. Despite facing challenges such as regulatory barriers, fluctuating fuel costs, and environmental concerns, the region remains a key growth area. Investments in modernizing infrastructure, expanding capacity, and adopting sustainable practices are critical.

Segmentation Analysis

Insights by Type

The air freight type segment accounted for the largest market share over the forecast period 2023 to 2033. E-commerce expansion drives the need for express and same-day delivery services, boosting demand for dedicated freighter aircraft. Specialized freight segments, including temperature-sensitive pharmaceuticals, perishables, and high-value electronics, require advanced, temperature-controlled cargo solutions. Technological innovations, such as real-time tracking and automation, enhance efficiency and reliability. Additionally, the rise of cross-border trade necessitates more comprehensive and efficient air freight solutions. Airlines are investing in fleet upgrades and expanding their cargo networks to meet these demands.

Insights by Service

The express service segment accounted for the largest market share over the forecast period 2023 to 2033. Consumers' expectations for quick shipping times have led to increased reliance on air freight for express services. Major logistics companies and airlines are expanding their dedicated express fleets and optimizing routes to meet this demand. Technological advancements, such as real-time tracking and automated sorting systems, enhance efficiency and ensure timely deliveries. The growth of cross-border e-commerce further boosts the need for express air services. Investments in infrastructure, strategic partnerships, and sustainability initiatives are pivotal for sustaining this growth.

Insights by End User

The pharmaceutical and healthcare segment accounted for the largest market share over the forecast period 2023 to 2033. The rise of biopharmaceuticals, including vaccines and biologics, necessitates specialized cargo solutions with stringent temperature control and real-time monitoring to ensure product integrity. The pandemic highlighted the critical need for efficient air freight in distributing vaccines globally, accelerating growth in this sector. Advances in packaging technology and regulatory compliance are driving improvements in service quality and reliability. Investments in specialized handling facilities and dedicated aircraft further support this growth. As healthcare demands continue to evolve, the pharmaceutical segment remains a vital and growing component of the air cargo industry.

Recent Market Developments

- In February 2022, Flexport has placed an advanced purchase order for Natilus' two large-scale freight UAV prototypes, including the 100t pitting cargo drone technology, which could compete with traditional aircraft.

Competitive Landscape

Major players in the market

- Qatar Airways (Qatar)

- Etihad Airways (UAE)

- International Consolidated Airlines Group

- SA (UK)

- All Nippon Airways Co., Ltd (Japan)

- Deutsche Lufthansa AG (Germany)

- Japan Airlines (Japan)

- The Emirates Group (UAE)

- Singapore Airlines (Singapore)

- Cargolux (Luxembourg)

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Air Cargo Market, Type Analysis

- Air Freight

- Air Mail

Air Cargo Market, Service Analysis

- Express

- Regular

Air Cargo Market, End User Analysis

- Retail

- Food & Beverages

- Pharmaceutical and Healthcare

- Consumer Electronics

- Automotive

- Others

Air Cargo Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Air Cargo?The global Air Cargo Market is expected to grow from USD 151.8 billion in 2023 to USD 221.4 billion by 2033, at a CAGR of 3.85% during the forecast period 2023-2033.

-

2. Who are the key market players of the Air Cargo Market?Some of the key market players of the market are Qatar Airways (Qatar), Etihad Airways (UAE), International Consolidated Airlines Group, SA (UK), All Nippon Airways Co., Ltd (Japan), Deutsche Lufthansa AG (Germany), Japan Airlines (Japan), The Emirates Group (UAE), Singapore Airlines (Singapore), Cargolux (Luxembourg) and other key vendors.

-

3. Which segment holds the largest market share?The express service segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Air Cargo market?North America dominates the Air Cargo market and has the highest market share.

Need help to buy this report?