Global Air Freight Market Size, Share, and COVID-19 Impact Analysis, By Type (Domestic Air Freight, International Air Freight), By End-User (Airport-To-Airport Service and Door-To-Door Service), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Aerospace & DefenseGlobal Air Freight Market Insights Forecasts to 2033

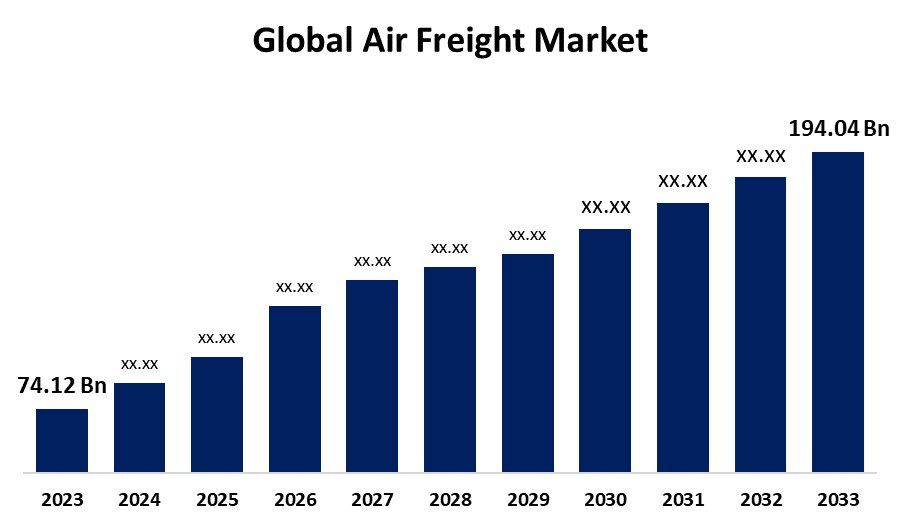

- The Global Air Freight Market Size was Valued at USD 74.12 Billion in 2023

- The Market Size is Growing at a CAGR of 10.10% from 2023 to 2033

- The Worldwide Air Freight Market Size is Expected to Reach USD 194.04 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Air Freight Market Size is Anticipated to Exceed USD 194.04 Billion by 2033, Growing at a CAGR of 10.10% from 2023 to 2033.

Market Overview

Air freight is the shipment of goods through an air carrier. Air transport services are the most valuable when it comes to moving fast shipments around the world. Air freight similar to commercial or passenger airlines, operates through the same gateways. Air freight is known for being faster and more efficient than other types of transportation such as sea or land. It is used for high-value or time-sensitive items, such as perishable commodities, medications, electronics, and important papers.

For Instance, in February 2024, AllMasters, a digital freight consolidation platform specializing in Less Than Container Load (LCL) exports, launched its latest solution designed to address the issues faced by freight forwarders in the industry.

In July 2024, Air France KLM Martinair Cargo announced that it would commence a new Boeing 747-400ERF or BCF freighter service operated by Martinair from Amsterdam Schiphol Airport (AMS) to Hong Kong (HKG) via Dubai (DWC).

Report Coverage

This research report categorizes the market for air freight based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the air freight market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the air freight market.

Global Air Freight Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 74.12 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 10.10% |

| 2033 Value Projection: | USD 194.04 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By End-User, By Region and COVID-19 Impact Analysis |

| Companies covered:: | Agility Logistics, Bolloré Logistics, C.H. Robinson, CEVA Logistics, DB Schenker, DHL, Dimerco, DSV Panalpina, Expeditors International, FedEx Corporation, Geodis, Hellmann Worldwide Logistics, Kerry Logistics, Kuehne + Nagel, Nippon Express, Panalpina, Sinotrans, UPS, XPO Logistics, Yusen Logistics, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The air freight market is growing due to increased global trade, booming e-commerce, and economic development. Advances in technology and investments in infrastructure also boost efficiency. Air freight is crucial for shipping high-value and time-sensitive goods quickly, and improved supply chain management further drives demand. One important driver of the global air freight business is the increasing rise of e-commerce. The initiation of online shopping and cross-border e-commerce led to an increased demand for speedy and dependable shipping of goods. Air freight provides faster delivery times, making it an excellent option for time-sensitive shipments.

Restraining Factors

The air freight market faces challenges due to high shipping costs, environmental regulations, and limited cargo capacity. Regulatory complexities and economic fluctuations also pose obstacles, potentially impacting the efficiency and affordability of air cargo services. Rising fuel prices can lead to higher transportation costs, discouraging some consumers from using air freight services and instead seeking more cost-effective options, limiting the industry's growth potential.

Market Segmentation

The air freight market share is classified into type and end-user.

- The international air freight segment is estimated to hold the highest market revenue share through the projected period.

Based on the type, the air freight market is classified into domestic air freight and international air freight. Among these, the international air freight segment is estimated to hold the highest market revenue share through the projected period. The airport-to-airport service segment leads the market due to its low cost and efficiency in long-distance freight transportation. This segment is selected by major organizations and corporations that require mass transportation of goods.

- The airport-to-airport service segment is anticipated to hold the largest market share through the forecast period.

Based on the end-user, the air freight market is divided into airport-to-airport service and door-to-door service. Among these, the airport-to-airport service segment is anticipated to hold the largest market share through the forecast period. Airport-to-airport services are preferred for their cost-effectiveness and efficient operations, since they need fewer logistical stages and take advantage of specialist infrastructure at major airports. This segment specializes in handling high-volume or bulk shipments with its extensive network of airlines and logistical suppliers. Additionally, door-to-door services are more convenient, airport-to-airport services are preferred due to better cost control and operational efficiency.

Regional Segment Analysis of the Air Freight Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the air freight market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the air freight market over the predicted timeframe. North America is expected to dominate the air freight market due to strong economic activity, advanced infrastructure, and significant growth in e-commerce. The region benefits from well-developed logistics networks, technological advancements, and extensive global trade relationships, which drive high demand for air cargo services. Major key players in the North American air freight market include UPS, FedEx, and DHL.

Bottom of Form

Asia Pacific is expected to grow at the fastest CAGR growth of the air freight market during the forecast period. Asia Pacific is expected to grow the fastest in the air freight market due to rapid economic growth, booming e-commerce, and significant infrastructure investments. China, India, and Japan are significant contributors to the APAC air freight sector. The region's role as a major manufacturing hub and rising consumer markets also drive high demand for air freight services.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the air freight market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Agility Logistics

- Bolloré Logistics

- C.H. Robinson

- CEVA Logistics

- DB Schenker

- DHL

- Dimerco

- DSV Panalpina

- Expeditors International

- FedEx Corporation

- Geodis

- Hellmann Worldwide Logistics

- Kerry Logistics

- Kuehne + Nagel

- Nippon Express

- Panalpina

- Sinotrans

- UPS

- XPO Logistics

- Yusen Logistics

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2024, CMA CGM Air Cargo is finally launching transpacific services to the US, after it ended its tie-up with Air France-KLM at the end of March, in part owing to regulatory issues that prevented the partnership from serving the US.

- In March 2024, The International Air Transport Association (IATA) launched the IATA Digitalization Leadership Charter during the IATA World Cargo Symposium in Hong Kong. The charter's inaugural signatories are Cathay Cargo, CHAMP Cargosystems, Global Logistics System (HK) Company Limited, IAG Cargo, IBS Software, LATAM Cargo, and Lufthansa Cargo.

- In February 2024, Maersk launched a fully digital solution for customers interested in purchasing air freight solutions. The new online solution available on Maersk.com provides customers with the option of booking their air cargo requirements through a simple online tool that will provide customers with instant prices for as many as 70,000 connections between virtually all relevant airports worldwide.

- In January 2024, Delta Cargo launched DeliverDirect, a door-to-door delivery service for the United States that was developed in conjunction with SmartKargo, an air cargo management software platform. The new service is intended for e-commerce merchants looking to improve their direct-to-consumer shipping solutions.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the air freight market based on the below-mentioned segments:

Global Air Freight Market, By Type

- Domestic Air Freight

- International Air Freight

Global Air Freight Market, By End-User

- Airport-To-Airport Service

- Door-To-Door Service

Global Air Freight Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the air freight market over the forecast period?The air freight market is projected to expand at a CAGR of 10.10% during the forecast period.

-

2. What is the market size of the air freight market?The Global Air Freight Market Size is Expected to Grow from USD 74.12 Billion in 2023 to USD 194.04 Billion by 2033, at a CAGR of 10.10% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the air freight market?North America is anticipated to hold the largest share of the air freight market over the predicted timeframe.

Need help to buy this report?