Global Air Freight Software Market Size By Deployment (On-Premise and Cloud Based), By Air Freight Service (Expedited Service, Standard Service, and Deferred Service), By Application (Freight Handling, Freight Tracking and Monitoring, Warehouse Management, Price and Revenue Management, Freight Routing and Scheduling, and Delivery Tracking), By End User (Cargo Airlines, Commercial Airlines, E-Commerce Companies, Third Party Freight Service Providers, and Others), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033

Industry: Information & TechnologyGlobal Air Freight Software Market Insights Forecasts to 2033

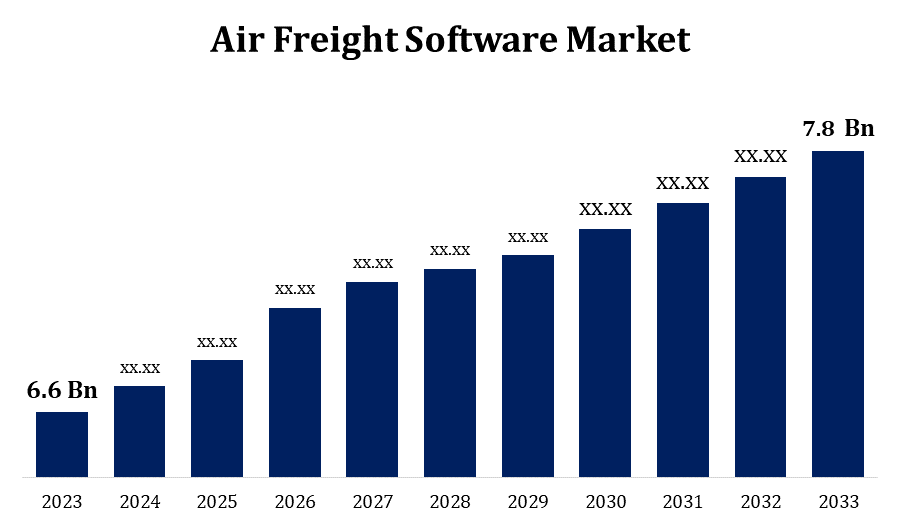

- The Global Air Freight Software Market Size was valued at USD 6.6 Billion in 2023.

- The Market is Growing at a CAGR of 1.68% from 2023 to 2033

- The Worldwide Air Freight Software Market Size is Expected to reach USD 7.8 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Air Freight Software Market Size is Expected to reach USD 7.8 billion by 2033, at a CAGR of 1.68% during the forecast period 2023 to 2033.

The air freight software market is a dynamic and continuously growing industry that offers crucial solutions for managing and optimising air cargo and logistics operations. This market includes software systems for managing many aspects of air freight, such as cargo tracking, route optimisation, inventory management, paperwork automation, customs compliance, and analytics. The exponential expansion of e-commerce has resulted in a considerable increase in air cargo shipments. Retailers and logistics organisations are using air freight software to manage the difficulties of moving items promptly and efficiently in order to satisfy customer expectations. As global trade expands, supply chains become more complex. Air freight software helps to manage these complications by providing solutions for real-time tracking, efficient route planning, and worldwide regulatory compliance.

Air Freight Software Market Value Chain Analysis

The air freight software market value chain involves multiple stages, including research and development (R&D), software development, cloud infrastructure and hosting, sales and marketing, implementation and integration, training and support, usage and operations, and feedback and continuous improvement. Key stakeholders in this chain include software providers, cloud service providers, logistics companies, freight forwarders, airlines, cargo handlers, end customers, and regulatory bodies. Each stage is critical for ensuring the software meets industry needs, integrates advanced technologies like AI and IoT, and complies with regulations. This comprehensive process enables efficient and effective air freight operations, optimizing routes, improving real-time tracking, automating documentation, and ultimately enhancing the overall logistics and supply chain management.

Air Freight Software Market Opportunity Analysis

Artificial intelligence (AI), machine learning (ML), the Internet of Things (IoT), and blockchain technology are all advancing the capabilities of air freight software. These technologies can help with predictive analytics, real-time tracking, route optimisation, and secure transactions. Businesses are increasingly focused on optimising their supply chains in order to cut costs and increase efficiency. Air freight software that provides integrated inventory management, real-time visibility, and automated documentation is in great demand. The change to cloud-based software solutions enables air freight software companies to provide scalable, adaptable, and cost-effective solutions. Cloud-based technologies allow for easy updates, remote access, and increased collaboration across worldwide teams.

Global Air Freight Software Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 6.6 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 1.68% |

| 2033 Value Projection: | USD 7.8 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 221 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Air Freight Service, By Application, By End User, By Region |

| Companies covered:: | AirBridgeCargo Airlines, All Nippon Airways Co. Ltd (ANA), American Airlines, Azul Airlines, Cargojet Inc., Cargolux Airlines International SA, Cathay Pacific Airways Limited, China Airlines Ltd, Copa Airlines, Delta Airlines, Deutsche Lufthansa AG, Deutsche Post DHL, FedEx (Federal Express) Corporation, Gol Airlines, International Consolidated Airlines Group SA, Japan Airlines Co. Ltd, Kuehne + Nagel International AG, LATAM Airlines, Magma Aviation Limited, Qatar Airways Company QCSC, The Emirates Group, United Airlines, and United Parcel Service Inc. |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Market Dynamics

Air Freight Software Market Dynamics

Increasing Demand for Air Freight Services by E-Commerce Companies will Boost the Market.

E-commerce businesses frequently deal with large volumes of orders and demand speedy delivery times to meet client expectations. Air freight provides the speed and efficiency required for timely deliveries, particularly cross-border products. Air freight software enables these organisations to efficiently manage and optimise their air cargo operations, resulting in smooth and timely delivery of goods. E-commerce businesses need real-time access into their shipments to track the status and location of goods throughout the transportation process. Air freight software provides comprehensive tracking and monitoring features, allowing businesses to trace shipments in real time, forecast delays, and proactively handle exceptions. This visibility allows for better decision-making and increases consumer happiness.

Restraints & Challenges

Implementing air freight software frequently necessitates a considerable initial investment in the form of software licencing fees, implementation charges, and training expenses. This initial expenditure can be too expensive for smaller logistics organisations or those on a tight budget. Air freight software manages and saves sensitive shipping data, such as customer information, inventory details, and financial transactions. It is critical to have comprehensive data security procedures in place to protect against cyber attacks, data breaches, and unauthorised access. Compliance with data protection rules such as GDPR and CCPA increases the complexity. To guarantee proper utilisation, air freight software must be implemented successfully, with user buy-in and appropriate training programmes. Resistance to change, a lack of user engagement, and insufficient training can all impede adoption and reduce the software's efficacy.

Regional Forecasts

North America Market Statistics

North America is anticipated to dominate the Air Freight Software Market from 2023 to 2033. The thriving e-commerce sector in North America is driving up demand for air freight services and related technological solutions. With consumers increasingly expecting speedy and dependable delivery of goods, e-commerce enterprises rely significantly on air freight to achieve these expectations, resulting in the widespread adoption of air freight software. North America is home to several important players in the air freight software business, including established software vendors, logistics firms, and e-commerce behemoths. These organisations encourage market innovation and competitiveness by providing a diversified set of software solutions to fulfil the needs of their customers. Air freight software in North America must integrate with other systems such as ERP, TMS, and WMS. Companies require seamless compatibility between several software platforms in order to optimise operations and increase efficiency.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Some of the world's greatest e-commerce markets are in Asia Pacific, including China, India, and Southeast Asian countries. The thriving e-commerce sector has resulted in an increase in demand for air freight services to ensure speedy and efficient delivery of goods, boosting the development of air freight software solutions. Governments and commercial entities around Asia Pacific are making significant investments in modernising and developing logistical infrastructure, such as airports, seaports, and transportation networks. This infrastructure expansion improves the effectiveness of air cargo operations and opens up potential for the implementation of innovative air freight software solutions. The Asia Pacific region is a major hub for worldwide trade, with a large volume of commodities transported by air. As trade volumes increase, there is a greater demand for air freight software systems that can optimise cargo handling.

Segmentation Analysis

Insights by Deployment

The cloud based segment accounted for the largest market share over the forecast period 2023 to 2033. Cloud-based air freight software provides scalability and flexibility, allowing businesses to effortlessly scale their operations up or down in response to changing business demands. This scalability is especially useful for businesses with varying shipping volumes or seasonal peaks in demand. Cloud-based solutions are often subscription-based, which eliminates the need for major upfront hardware and infrastructure investments. This cost-effective price model makes cloud-based air freight software available to companies of all sizes, including small and medium-sized organisations (SMEs).

Insights by Air Freight Service

The deferred service segment is dominating the market with the largest market share over the forecast period 2023 to 2033. The growing demand for deferred air freight services has resulted in increased rivalry between air freight airlines and logistics providers. This rivalry has spurred innovation in service offerings, pricing methods, and technology solutions, accelerating the expansion of the deferred service segment in the air freight software market. Advances in air freight software and logistics technology have improved the efficiency and dependability of postponed air cargo services. Automated route optimisation, real-time tracking, and reduced documentation processes facilitate smoother operations, making postponed services more appealing to firms looking for cost-effective shipping solutions.

Insights by Application

The freight tracking segment accounted for the largest market share over the forecast period 2023 to 2033. Globalisation of trade has resulted in increasingly complicated and geographically distributed supply networks. As a result, organisations are challenged to manage logistics across numerous geographies and modes of transportation. Freight tracking solutions improve supply chain visibility by integrating data from multiple sources, such as carriers, warehouses, and customs agencies, onto a single platform, allowing for effective shipment monitoring and management. The increasing expansion of e-commerce has fueled demand for freight tracking technologies, notably in the air freight industry. Real-time tracking capabilities are required for e-commerce enterprises to give customers with precise delivery predictions and assure order fulfilment on time. Freight monitoring software allows e-commerce enterprises to follow shipments from the warehouse to the customer's doorstep, increasing transparency and trust in the delivery process.

Insights by End User

The cargo airlines segment accounted for the largest market share over the forecast period 2023 to 2033. Global trade volumes continue to expand, increasing demand for air cargo services offered by cargo carriers. As businesses seek speedier and more dependable transportation for their goods, cargo aircraft play an important role in facilitating freight movement across domestic and international markets. Cargo airlines face pressure to optimise their operations and increase efficiency in order to remain competitive in the market. Air freight software solutions provide enhanced capabilities for route optimisation, load planning, and resource allocation, allowing cargo carriers to improve operations, reduce costs, and increase revenue.

Recent Market Developments

- In May 2023, Speedcargo collaborated with Güdel to create the world's first autonomous robotic cargo handling solution for air cargo. The robotic system can handle freight of all sizes and weights, including irregularly shaped cargo.

Competitive Landscape

Major players in the market

- AirBridgeCargo Airlines

- All Nippon Airways Co. Ltd (ANA)

- American Airlines

- Azul Airlines

- Cargojet Inc.

- Cargolux Airlines International SA

- Cathay Pacific Airways Limited

- China Airlines Ltd

- Copa Airlines

- Delta Airlines

- Deutsche Lufthansa AG

- Deutsche Post DHL

- FedEx (Federal Express) Corporation

- Gol Airlines

- International Consolidated Airlines Group SA

- Japan Airlines Co. Ltd

- Kuehne + Nagel International AG

- LATAM Airlines

- Magma Aviation Limited

- Qatar Airways Company QCSC

- The Emirates Group

- United Airlines

- United Parcel Service Inc.

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Air Freight Software Market, Deployment Analysis

- On-Premise

- Cloud Based

Air Freight Software Market, Air Freight Service Analysis

- Expedited Service

- Standard Service

- Deferred Service

Air Freight Software Market, Application Analysis

- Freight Handling

- Freight Tracking and Monitoring

- Warehouse Management

- Price and Revenue Management

- Freight Routing and Scheduling

- Delivery Tracking

Air Freight Software Market, End User Analysis

- Cargo Airlines

- Commercial Airlines

- E-Commerce Companies

- Third Party Freight Service Providers

- Others

Air Freight Software Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Air Freight Software Market?The global Air Freight Software Market is expected to grow from USD 6.6 billion in 2023 to USD 7.8 billion by 2033, at a CAGR of 1.68% during the forecast period 2023-2033.

-

2. Who are the key market players of the Air Freight Software Market?Some of the key market players of the market are AirBridgeCargo Airlines, All Nippon Airways Co. Ltd (ANA), American Airlines , Azul Airlines, Cargojet Inc., Cargolux Airlines International SA, Cathay Pacific Airways Limited , China Airlines Ltd, Copa Airlines, Delta Airlines, Deutsche Lufthansa AG, Deutsche Post DHL, FedEx (Federal Express) Corporation, Gol Airlines, International Consolidated Airlines Group SA , Japan Airlines Co. Ltd, Kuehne + Nagel International AG, LATAM Airlines, Magma Aviation Limited, Qatar Airways Company QCSC, The Emirates Group, United Airlines and United Parcel Service Inc.

-

3. Which segment holds the largest market share?The cargo airlines segment holds the largest market share and is going to continue its dominance.

-

4. Which region is dominating the Air Freight Software Market?North America is dominating the Air Freight Software Market with the highest market share.

Need help to buy this report?