Global Air Purification Systems Market Size By Technology (HEPA, Electrostatic precipitator), By Product (Portable/Stand-Alone Purifiers, In-Duct purifiers), By Geographic Scope And Forecast, 2023 – 2032

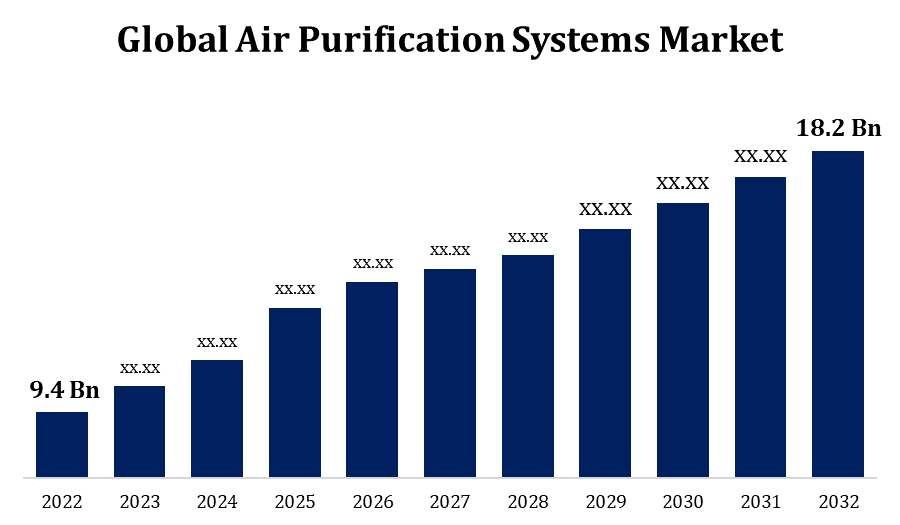

Industry: Semiconductors & ElectronicsGlobal Air Purification Systems Market Size to Grow from USD 9.4 Billion in 2022 to USD 18.2 Billion by 2032, at a CAGR of 8.4% during the forecast period.

By eliminating toxins, allergies, and pollutants from the air, air purification systems are tools or systems intended to improve indoor air quality. These systems are frequently utilised to produce a healthier and more comfortable living or working environment in homes, businesses, healthcare facilities, and other indoor spaces. There are various kinds of air purification systems, and they all use various technologies to filter or purify the air. By attaching to positively charged dust and allergy particles, these devices discharge negatively charged ions into the air, which then cause the particles to fall to the ground. Electrostatic plates are sometimes included in ionic purifiers to further gather these particles. These gadgets emit ozone into the air, which can kill some bacteria and mask odours. The need for air filtration systems was being driven by growing concerns about indoor air quality, particularly in metropolitan areas with high levels of pollution, allergies, and volatile organic compounds. Consumers were becoming more interested in strategies to design healthier living and working environments.

Get more details on this report -

Global Air Purification Systems Market Size to Grow from USD 9.4 Billion in 2022 to USD 18.2 Billion by 2032, at a Compound Annual Growth Rate (CAGR) of 8.4% during the forecast period.

Impact of COVID 19 On Global Air Purification Systems Market

Due to the pandemic, people are now more aware of the value of indoor air quality in halting the spread of respiratory infections. As a result, both in home and commercial settings, demand for air filtration systems increased. To lessen the possibility of the virus spreading through the air, many people and companies sought out these devices. Many educational institutions made investments in air filtration systems to enhance indoor air quality out of concern for the safety of employees and students. In the classrooms and social areas, HEPA filters and UV-C systems were installed. In order to reassure staff members and clients, businesses and commercial organisations were interested in air purification technologies. These programmes were thought to improve worker safety. During the pandemic, the supply chain was disrupted because to the increase in demand for air purification devices. Some manufacturers have difficulties locating components and satisfying rising manufacturing needs, which could have an impact on availability and cost.

Global Air Purification Systems Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 9.4 Billion |

| Forecast Period: | 2022 - 2032 |

| Forecast Period CAGR 2022 - 2032 : | 8.4% |

| 2032 Value Projection: | USD 18.2 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Technology, By Product, By Geographic Scope, By Geographic Scope and COVID 19 Impact |

| Companies covered:: | Honeywell International, Inc., IQAir North America, Inc., LG Electronics, Inc., Aerus LLC, Unilever PLC, Daikin Industries, Ltd., Panasonic Corporation, Koninklijke Philips N.V., Whirlpool Corporation, and Hamilton Beach Brands, Inc.. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Air Purification Systems Market Dynamics

Increasing prevalence of airborne diseases

The need for air purification devices often rises in direct proportion to the incidence of airborne diseases. There is a growing interest in air purification technologies as people become more aware of the need to shield themselves and their family from airborne infections like viruses and bacteria. When the threat of airborne infections is present, hospitals and healthcare facilities are among the first to implement cutting-edge air filtration equipment. To ensure a safe environment for patients, healthcare professionals, and visitors, these institutions make investments in cutting-edge air purification systems. To reduce the danger of disease transmission, businesses, educational institutions, and public areas may also give priority to air filtration equipment. This includes placing air purifiers in crowded places including offices, schools, airports, and shopping centres.

Launch of new air purifiers

Modern technology advancements are frequently incorporated into brand-new air purifiers. These developments may result in air filtration systems that are more effective and efficient, luring customers and companies looking for cutting-edge solutions. New models may be especially appealing if they have features like smart controls, real-time air quality monitoring, and automatic filter replacement notifications. Compact and portable air purifiers have become common options for bedrooms, offices, and other smaller spaces since they allow users to focus on particular spaces or rooms. The market's potential is increased by these goods' ability to provide flexible solutions.

Restraints & Challenges

Lack of dynamic monitoring system

Users may only have a limited understanding of the air quality in their indoor environments in real time without a dynamic monitoring system. As air quality might fluctuate during the day and in different parts of a building, this ignorance could be harmful. Lacking dynamic monitoring mechanisms, air purifiers frequently operate constantly at a constant pace or according to a set schedule. Even when the air quality is already acceptable, this might lead to wasteful energy use. This inefficiency over time might result in increased energy consumption and needless component wear and tear.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Air Purification Systems market from 2023 to 2032. In North America, there were varied degrees of concerns about the quality of the air, with metropolitan areas frequently encountering greater pollution-related difficulties. The demand for air filtration systems was impacted by this. Due to growing customer demand for eco-friendly products and environmental concerns, energy-efficient air purifiers are becoming more and more common. Models that used less energy also helped cut down on operating expenses. Manufacturers were releasing smart, networked air purifiers with sensors to continuously monitor the quality of the air. Through smartphone apps, these gadgets allowed consumers to remotely manage and monitor their air purifiers.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2032. Numerous Asian nations are experiencing rapid urbanisation, which has increased industrialization, transportation, and building activity and raised air pollution levels. In order to address indoor and outdoor air pollution, there has been an increase in the demand for air purification systems in homes, workplaces, and public spaces. Residential, commercial, hospital, and industrial settings are just a few of the many places where air purification systems are used. The market has grown as a result of the variety of applications.

Segmentation Analysis

Insights by Technology

The HEPA segment accounted for the largest market share over the forecast period 2023 to 2032. The demand for air purification systems with HEPA filters has increased as people are becoming more aware of the health hazards linked to poor indoor air quality. HEPA filtration is seen as an efficient remedy as consumers' concerns about allergens, pollutants, and toxins in the air they breathe grow. The HEPA market expanded in a variety of contexts, including industrial, commercial, residential, and healthcare applications. HEPA filtration is being used more frequently in businesses, hospitals, public buildings, and schools to ensure that the air is cleaner and safer. Due to their reputation for great filtration efficiency and dependability, HEPA filters are preferred by many users above alternative filtering technologies in air purification systems.

Insights by Product

The Portable purifiers segment accounted for the largest market share over the forecast period 2023 to 2032. The demand for portable air purifiers has increased as people are becoming more aware of how important indoor air quality is and how it affects health. Particularly in cities with high pollution levels, consumers are more concerned about allergens, pollutants, and toxins in the air they breathe. Portable air purifiers are made to be portable and simple to use in a variety of settings. They are desirable for both home and commercial use because of their mobility. They can be positioned by customers in living rooms, businesses, automobiles, and even beds. Nowadays, a lot of portable air purifiers have smart features like air quality monitoring, remote control, and mobile app integration. These options improve user comfort and control.

Recent Market Developments

- In January 2020, a car air purifier called Airlines Car Air Sanitizer was created by AIIMS and IIT in India. In less than two minutes, the car cleaner can clean the air inside a car.

Competitive Landscape

Major players in the market

- Honeywell International, Inc.

- IQAir North America, Inc.

- LG Electronics, Inc.

- Aerus LLC

- Unilever PLC

- Daikin Industries, Ltd.

- Panasonic Corporation

- Koninklijke Philips N.V.

- Whirlpool Corporation

- Hamilton Beach Brands, Inc.

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2032.

Air Purification Systems Market, Technology Analysis

- HEPA

- Electrostatic precipitator

Air Purification Systems Market, Product Analysis

- Portable/Stand-Alone Purifiers

- In-Duct purifiers

Air Purification Systems Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Questions (FAQ)

-

1.What is the market size of the Air Purification Systems Market?The global Air Purification Systems Market is expected to grow from USD 9.4 Billion in 2023 to USD 18.2 Billion by 2032, at a CAGR of 8.4% during the forecast period 2023-2032.

-

2. Who are the key market players of the Air Purification Systems Market?Some of the key market players of market are Honeywell International, Inc., IQAir North America, Inc., LG Electronics, Inc., Aerus LLC, Unilever PLC, Daikin Industries, Ltd., Panasonic Corporation, Koninklijke Philips N.V., Whirlpool Corporation, and Hamilton Beach Brands, Inc.

-

3.Which segment holds the largest market share?HEPA segment holds the largest market share are going to continue its dominance.

-

4.Which region is dominating the Air Purification Systems Market?North America is dominating the Air Purification Systems Market with the highest market share.

Need help to buy this report?