Global Air Refueling Market Size By Aircraft Type (Combat & Tanker, Turboprop & Helicopter, UAV), By System Type (Hose & Drogue, Boom & Receptacle), By Component (Hose, Drogue, Probe, Boom, Refueling Pods, Others), By End User (OE, Aftermarket), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033

Industry: Aerospace & DefenseGlobal Air Refueling Market Insights Forecasts to 2033

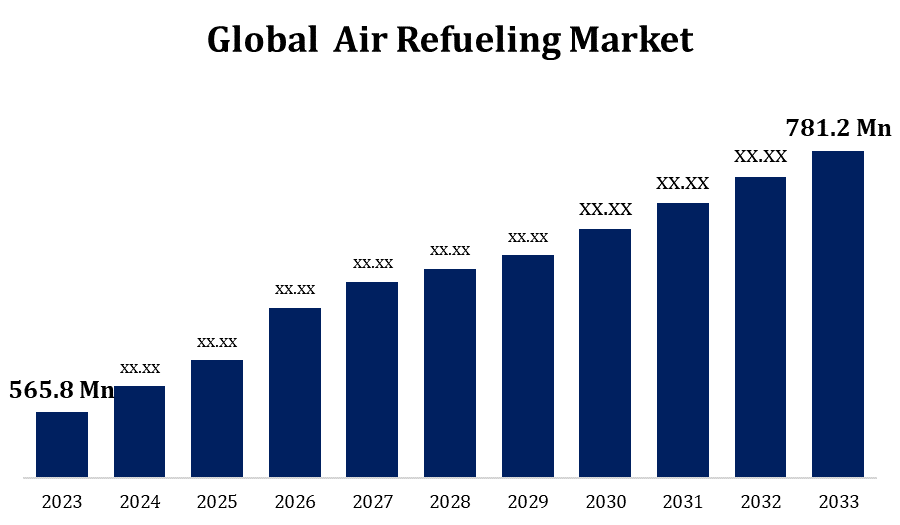

- The Global Air Refueling Market Size Was valued at USD 565.8 Million in 2023.

- The Market Size is Growing at a CAGR of 3.28% from 2023 to 2033.

- The Worldwide Air Refueling Market Size is expected to reach USD 781.2 Million by 2033.

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Air Refueling Market size is expected to reach USD 781.2 Million by 2033, at a CAGR of 3.28% during the forecast period 2023 to 2033.

As part of larger efforts to modernise their militaries, many nations are updating their air refuelling capabilities. This include expenditures in cutting-edge refuelling technologies, fleet modifications, and the purchase of new tanker aircraft. The requirement to support long-range missions and expeditionary operations, as well as the ageing tanker fleets in many nations, are some of the causes contributing to the continued strong demand for tanker aircraft. In the air refuelling sector, partnerships and international cooperation are important. Countries frequently work together on tanker development and procurement projects in order to split expenses, take advantage of technological know-how, and improve interoperability amongst coalition forces. The market for air refuelling is dominated by military uses, but interest in commercial uses is growing, especially for long-haul commercial aircraft.

Air Refueling Market Value Chain Analysis

Companies that manufacture tanker aircraft include Boeing, Airbus, Lockheed Martin, and Embraer. These businesses create, produce, and transport specialised tanker aeroplanes with aerial refuelling equipment installed. Additionally, they offer tanker operators support and aftermarket services. For tanker aircraft, component providers offer a range of parts and systems, such as engines, avionics, refuelling pods, hoses, booms, and receptacle systems. This market may include companies that make engines, such as General Electric and Rolls-Royce, as well as those that specialise in providing refuelling equipment, such Eaton Corporation and Cobham plc. Certain firms focus on upgrading tanker planes with new refuelling technology or integrating refuelling systems onto already-existing aircraft platforms. For the smooth integration of refuelling systems, these integrators collaborate closely with component vendors and aircraft manufacturers. End users of air refuelling capabilities include the armed forces, the government, and maybe private companies.

Air Refueling Market Opportunity Analysis

Globally, there is an increasing requirement for air refuelling capabilities due to the need for longer operational ranges, quicker force deployment, and more mission flexibility. Manufacturers, service providers, and tech developers now have the chance to adapt to the changing needs of both military and commercial operations. Many nations are working on modernising their air refuelling infrastructure in order to replace their outdated fleets of tankers with new, more efficient models. This offers potential for advanced refuelling systems and technologies to be supplied by component suppliers and integrators, as well as for aircraft manufacturers to gain contracts for the development and delivery of tanker aircraft. The market for air refuelling is dominated by military uses, but interest in commercial uses is growing, especially for long-haul commercial aircraft.

Global Air Refueling Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 565.8 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.28% |

| 2033 Value Projection: | USD 781.2 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Aircraft Type, By System Type, By Component, By End User, By Region, By Geographic Scope |

| Companies covered:: | Airbus SE, Cobham plc, Draken Internationnal, Eaton Corporation, GE Aviation, Marshall Aerospace & Defence Group, Parker Hannifin Corporation, Safran, Zodiac Aerospace, and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact,Challenges,Growth, Analysis. |

Get more details on this report -

Market Dynamics

Air Refueling Market Dynamics

Increasing investment in defence to propel the market growth

A lot of nations are spending money updating their defence capabilities, which includes buying new tanker planes with cutting-edge aerial refuelling technology. The goal of these modernization initiatives is to swap out the outdated tanker fleets for more competent and effective platforms, which will increase demand for aerial refuelling systems. Military aircraft can increase their operational reach by refuelling in-flight, which increases their endurance and range, thanks to aerial refuelling systems. The need for aerial refuelling systems is anticipated to rise as defence forces look to improve their capacity to project power over greater distances and conduct operations in isolated or contested areas. Growing investments in defence capabilities, such as aerial refuelling systems, are being driven by the changing global security scene, which is marked by new threats, geopolitical tensions, and regional instability.

Restraints & Challenges

It can be unaffordable to develop, acquire, and run aerial refuelling systems, including tanker aircraft and related equipment. Defence budgets have difficulties due to the large upfront expenses of purchase and the continuous operations costs, especially during times of financial restriction. Even though automated refuelling systems and sophisticated communication/navigation systems are examples of the major technological developments in aerial refuelling, technological constraints and dependability issues still need to be solved. It is still difficult to create and apply new technologies that will improve the effectiveness, dependability, and security of aerial refuelling operations. There is fierce competition among manufacturers, service providers, and technology innovators in the air refuelling business. To sustain market share and profitability, businesses need to manage shifting client demands, market dynamics, and competitive pressures.

Regional Forecasts

North America Market Statistics

North America is anticipated to dominate the Air Refueling Market from 2023 to 2033. To preserve strategic capabilities and counter new threats, the US, Canada, and other North American nations keep funding defence modernization initiatives. By increasing operational flexibility, facilitating quick force deployment, and extending the range and endurance of military aircraft, aerial refuelling capabilities are essential to the success of modernization initiatives. In North America, demand for commercial aerial refuelling services is rising in addition to military uses. Particularly in the logistics and cargo industries, businesses are investigating the viability of utilising aerial refuelling to increase the range of commercial aircraft for long-haul flights. The maintenance, repair, and overhaul (MRO) services, as well as the upgrades and modernization plans for the current tanker fleets, are included in the aftermarket part of the air refuelling market in North America.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. A number of Asia-Pacific nations are funding defence modernization initiatives in an effort to improve their armed forces and respond to changing security concerns. Power projection, quick reaction times, and increased operational range are all deemed dependent on aerial refuelling capabilities, especially in the region's large maritime and territorial domains. China's attempts to modernise its military, particularly the creation and application of sophisticated aerial refuelling capabilities, have alarmed regional allies and neighbours. Commercial operators are investigating the viability of employing aerial refuelling to increase the range and endurance of their aircraft for long-haul flights across the huge expanses of the Asia-Pacific region. These operators are primarily in the freight and logistics sectors.

Segmentation Analysis

Insights by Aircraft Type

The combat and tanker segment accounted for the largest market share over the forecast period 2023 to 2033. In order to preserve air superiority and counter changing threats, many nations are updating their fleets of combat aircraft. Combat aircraft need to be able to refuel from the air in order to increase their operational flexibility, endurance, and range. This will allow them to carry out missions over greater distances and remain visible in regions that are under attack. Tanker aircraft facilitate long-range strike missions, strategic airlift operations, and expeditionary deployments, hence playing a crucial role in enhancing global reach and force projection. There is anticipated to be an increase in demand for tanker aircraft equipped with aerial refuelling systems as nations look to improve their expeditionary capabilities and address concerns related to regional security.

Insights by System Type

The hose & drogue segment accounted for the largest market share over the forecast period 2023 to 2033. When comparing acquisition and operating costs, hose and drogue systems are frequently less expensive than boom systems. This makes them a desirable choice for nations looking to save costs or get the most out of their investments in aerial refuelling. The commercial sector is witnessing expansion in the hose and drogue segment due to the growing demand for aerial refuelling services for long-haul commercial flights. Commercial operators are investigating the viability of utilising hose and drogue systems to increase the range and endurance of their aircraft for ultra-long-haul operations, especially in the freight and logistics sectors.

Insights by Component

The boom segment accounted for the largest market share over the forecast period 2023 to 2033. Boom systems are very useful for refuelling big aircraft, such aerial tankers, heavy bombers, and transport planes. Boom systems are becoming more and more necessary to assist the refuelling of these platforms as nations update their tanker fleets and acquire larger aircraft for strategic airlift and aerial refuelling operations. Many nations are starting tanker modernization projects to swap out their outdated fleets of tankers with new, more capable vessels fitted with cutting-edge boom refuelling technologies. Through these modernization initiatives, boom system providers and manufacturers can increase their market share and win contracts.

Insights by End User

The OE segment accounted for the largest market share over the forecast period 2023 to 2033. As part of their efforts to modernise their defences, many nations are investing in the purchase of new tanker aircraft outfitted with cutting-edge aerial refuelling technologies. Through these initiatives, outdated tanker fleets are to be replaced with cutting-edge platforms that can refill at any time. Although the OEM market mostly caters to military clients, OEMs may also sell aerial refuelling systems for commercial use, especially in the logistics and cargo industries. For commercial tanker aircraft, OEMs may create customised aerial refuelling systems to facilitate long-haul flights and boost operational effectiveness.

Recent Market Developments

- In Decembe 2018, in order to jointly investigate the possibilities to satisfy the industry's demand for aerial refuelling for American defence customers, Lockheed Martin and Airbus struck an agreement.

Competitive Landscape

Major players in the market

- Airbus SE

- Cobham plc

- Draken Internationnal

- Eaton Corporation

- GE Aviation

- Marshall Aerospace & Defence Group

- Parker Hannifin Corporation

- Safran

- Zodiac Aerospace

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Air Refueling Market, Aircraft Type Analysis

- Combat & Tanker

- Turboprop & Helicopter

- UAV

Air Refueling Market, System Type Analysis

- Hose & Drogue

- Boom

- Receptacle

Air Refueling Market, Component Analysis

- Hose

- Drogue

- Probe

- Boom

- Refueling Pods

- Other

Air Refueling Market, End User Analysis

- OE

- Aftermarket

Air Refueling Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Air Refueling Market?The global Air Refueling Market is expected to grow from USD 565.8 million in 2023 to USD 781.2 million by 2033, at a CAGR of 3.28% during the forecast period 2023-2033.

-

2. Who are the key market players of the Air Refueling Market?Some of the key market players of the market are Airbus SE, Cobham plc, Draken Internationnal, Eaton Corporation, GE Aviation, Marshall Aerospace & Defence Group, Parker Hannifin Corporation, Safran, and Zodiac Aerospace.

-

3. Which segment holds the largest market share?The boom segment holds the largest market share and is going to continue its dominance.

-

4. Which region is dominating the Air Refueling Market?North America is dominating the Air Refueling Market with the highest market share.

Need help to buy this report?