Global Air Separation Plant Market Size By Process (Cryogenic, Non-cryogenic), By End-User (Iron & Steel, Oil & Gas, Chemical, Healthcare), By Region, And Segment Forecasts, By Geographic Scope And Forecast

Industry: Chemicals & MaterialsGlobal Air Separation Plant Market Size Insights Forecasts to 2032

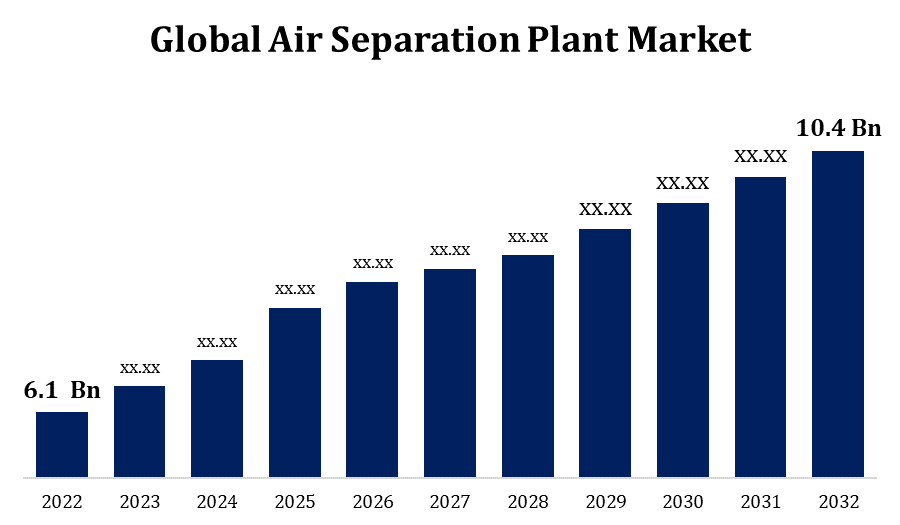

- The Air Separation Plant Market Size was valued at USD 6.1 Billion in 2022.

- The Market Size is Growing at a CAGR of 5.48 % from 2022 to 2032

- The Global Air Separation Plant Market Size is expected to reach USD 10.4 Billion by 2032

- Asia Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Air Separation Plant Market Size is expected to reach USD 10.4 Billion by 2032, at a CAGR of 5.48 % during the forecast period 2022 to 2032.

As the maestros of gas separation, air separation plants are. They take ordinary air and separate it into its constituent gases, which are commonly nitrogen, oxygen, and other gases. This capability is critical for a variety of businesses that rely on certain gases in their processes. The demand for industrial gases drives the ASP market. For diverse uses, industries such as healthcare, chemicals, metallurgy, and electronics rely on gases such as oxygen and nitrogen, and air separation plants are the go-to supplier. The reliance of the healthcare sector on medicinal oxygen adds significantly to the demand for air separation plants. These plants are critical in the production of medical-grade oxygen, which is required for respiratory therapy and other medical purposes. Ultra-pure gases are frequently required by industries involved in electronics and semiconductor fabrication. By creating gases like nitrogen and argon, air separation plants assist achieve these strict purity criteria.

Air Separation Plant Market Value Chain Analysis

Air separation technologies' efficiency and environmental sustainability are the focus of R&D centres. To stay ahead in a competitive market, they investigate innovative methods, materials, and process improvements. Once manufactured, industrial gases must be delivered to end consumers. Through large gas distribution networks, distribution and logistics businesses assure the safe and timely transportation of gases to numerous industries. The final link in the value chain is industry, which uses the industrial gases produced by air separation plants for a variety of applications. For the successful utilisation of industrial gases, industries frequently require specialised equipment. Manufacturers of application-specific equipment, such as medical oxygen concentrators or semiconductor gas control systems, contribute to the value chain.

Air Separation Plant Market Opportunity Analysis

The healthcare sector, particularly in developing countries, offers substantial opportunities. The rising demand for medical oxygen for respiratory therapy, surgeries, and medical treatments ensures that air separation plants will have a steady market. As emerging countries experience industrialization and economic expansion, demand for industrial gases in industries such as chemicals, metallurgy, and manufacturing is increasing. This opens the door for the construction of air separation plants to fulfil rising demand. Air separation plants integrated with the energy sector for oxy-fuel combustion provide environmental and efficiency benefits. The need for oxygen in environmental applications is expected to rise as industry strive for greener operations. The growing interest in hydrogen as a sustainable energy carrier opens up new possibilities for air separation plants.

Global Air Separation Plant Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 6.1 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 5.48 % |

| 2032 Value Projection: | USD 10.4 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Process, By End-User, By Region And Segment Forecasts, By Geographic Scope And Forecast |

| Companies covered:: | Air Liquide S.A., Linde AG, Messer Group GmbH, Air Products and Chemicals, Inc., E Taiyo Nippon Sanso Corporation, Praxair, Inc., Oxyplants, AMCS Corporation, Enerflex Ltd, Technex Ltd., and others key vendors. |

| Pitfalls & Challenges: | Covid-19 Empact,Challenges,Growth, Analysis. |

Get more details on this report -

Market Dynamics

Air Separation Plant Market Dynamics

Rising consumption of goods and services

As consumer demand for goods rises, industry respond by increasing output. For diverse processes, industrial manufacturing industries such as automotive, electronics, and chemicals require industrial gases produced by air separation plants. Steel demand is directly related to goods consumption, as it is generated by infrastructure development and construction projects. Air separation plants supply critical oxygen for the steel manufacturing process, contributing to the thriving metallurgical industry. Rising consumer electronics use drives growth in the electronics manufacturing sector. Air separation plants help by supplying ultra-pure gases required for semiconductor manufacture and other electronics manufacturing processes.

Restraints & Challenges

A large initial investment in infrastructure, equipment, and technology is required to establish an air separation facility. This high initial cost might be a deterrent to new entrants and smaller businesses. Separating air into its constituents requires a lot of energy, especially with cryogenic distillation procedures. Optimising plant operations requires balancing the need for effective separation with energy usage. Maintenance and operational expenditures can add up quickly. Keeping air separation plants reliable and efficient necessitates continuing investments in maintenance, monitoring, and specialised people. With multiple established businesses and technical breakthroughs, the ASP industry is competitive. New entrants must carve out a niche while competing with well-established enterprises. The handling of industrial gases entails inherent safety issues.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Air Separation Plant Market from 2023 to 2032. North America is a large industrial hub that includes a wide range of industries such as automotive, aerospace, chemicals, and electronics. The demand for industrial gases from these industries contributes significantly to the ASP market's growth. Industrial gases are used in the region's energy sector, which includes power generating and oil refining. Air separation plants are critical in producing oxygen for combustion processes, helping to meet the energy sector's demand for industrial gases. The healthcare industry in North America consumes a significant amount of medicinal oxygen. The increasing demand for healthcare services, as well as the necessity for medical-grade oxygen, provide prospects for the ASP industry.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2032. The Asia-Pacific area is a manufacturing behemoth, with thriving industries such as automobiles, electronics, chemicals, and steel. The rising demand for industrial gases from various industries propels the ASP market forward. The Asia-Pacific healthcare business is growing, which adds to the demand for medical oxygen. Air separation plants are critical in supplying hospitals and healthcare facilities with medical-grade oxygen. Asia-Pacific emerging economies, such as China and India, are rapidly industrialising. These emerging markets' demand for industrial gases creates substantial prospects for the ASP industry.

Segmentation Analysis

Insights by Process

The cryogenic segment accounted for the largest market share over the forecast period 2023 to 2032. Cryogenic technology is especially effective in producing nitrogen and argon, two key industrial gases utilised in a variety of applications. Cryogenic air separation is in high demand since industries such as chemicals, metallurgy, and electronics rely on these gases. As global industrialization continues, so does the demand for industrial gases. With their ability to create huge amounts of high-purity gases, cryogenic air separation systems meet the demands of expanding industrial activity. Cryogenic air separation assists the electronics and semiconductor industries, which demand ultra-pure gases. This section delivers the precise gas purity required for semiconductor fabrication procedures.

Insights by End User

The iron and steel segment accounted for the largest market share over the forecast period 2023 to 2032. The iron and steel industry heavily relies on oxygen in blast furnaces to burn coke and other fuels. Air separation plants are critical in supplying enormous amounts of oxygen required for this critical step in iron manufacturing. The iron and steel segment is influenced by the increase in steel demand, which is being driven by infrastructure development and construction projects. Air separation plants are critical for fulfilling the increasing demand for industrial gases in the steel industry. Air separation plants aid in the reduction of energy usage in the iron and steel sector. The utilisation of oxygen from air separation plants improves combustion process efficiency, which contributes to energy savings.

Recent Market Developments

- In March 2022, INOX Air Products Ltd announced that it had been granted a contract to build India's largest Greenfield Oxygen Plant at the Steel Authority of India's (SAIL) Bokaro plant in Jharkhand.

Competitive Landscape

Major players in the market

- Air Liquide S.A.

- Linde AG

- Messer Group GmbH

- Air Products and Chemicals, Inc.

- E Taiyo Nippon Sanso Corporation

- Praxair, Inc.

- Oxyplants

- AMCS Corporation

- Enerflex Ltd

- Technex Ltd

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2032.

Air Separation Plant Market, Process Analysis

- Cryogenic

- Non-cryogenic

Air Separation Plant Market, End User Analysis

- Iron & Steel

- Oil & Gas

- Chemical

- Healthcare

Air Separation Plant Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Air Separation Plant Market?The global Air Separation Plant Market is expected to grow from USD 6.1 Billion in 2023 to USD 10.4 Billion by 2032, at a CAGR of 6.1% during the forecast period 2023-2032.

-

2. Who are the key market players of the Air Separation Plant Market?Some of the key market players of market are Air Liquide S.A., Linde AG, Messer Group GmbH, Air Products and Chemicals, Inc., E Taiyo Nippon Sanso Corporation, Praxair, Inc., Oxyplants, AMCS Corporation, Enerflex Ltd, and Technex Ltd.

-

3. Which segment holds the largest market share?The iron and steel segment holds the largest market share and is going to continue its dominance.

-

4. Which region is dominating the Air Separation Plant Market?North America is dominating the Air Separation Plant Market with the highest market share.

Need help to buy this report?