Global Air Starter Market Size, Share, and COVID-19 Impact Analysis, By Type (Turbine Starter, Vane Starter), By End-Use (Oil and Gas, Aviation), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Machinery & EquipmentGlobal Air Starter Market Insights Forecasts to 2033

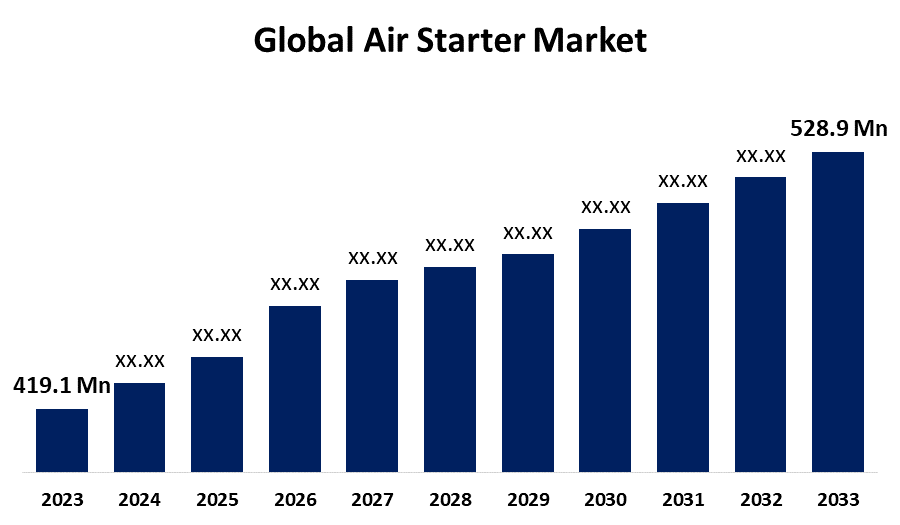

- The Air Starter Market was valued at USD 419.1 million in 2023.

- The Market Size is growing at a CAGR of 2.35% from 2023 to 2033.

- The global Air Starter Market is expected to reach USD 528.9 million by 2033.

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Air Starter Market Size is expected to reach USD 528.9 million by 2033, at a CAGR of 2.35% during the forecast period 2023 to 2033.

The air starter market is experiencing significant growth, driven by increasing demand for efficient and reliable starting solutions in various industries, including aerospace, marine, and oil and gas. Air starters are preferred for their ability to operate in hazardous environments where electrical starters pose risks, offering enhanced safety and performance. The market is characterized by technological advancements, such as the development of lightweight and compact starter designs that improve portability and ease of use. Additionally, rising investments in renewable energy projects and the need for backup power solutions in critical applications are further propelling market expansion. Key players are focusing on innovation and strategic partnerships to strengthen their market position, catering to the evolving needs of customers in diverse sectors.

Air Starter Market Value Chain Analysis

The air starter market value chain encompasses several key stages, beginning with raw material sourcing, where manufacturers procure components like valves, cylinders, and air motors. Next, the production phase involves designing and assembling air starters, focusing on quality and efficiency to meet industry standards. After manufacturing, distribution channels play a crucial role, with products being delivered to various sectors such as aerospace, marine, and industrial applications. The market also includes aftermarket services, such as maintenance and repair, which are vital for ensuring product longevity and performance. Lastly, end-users contribute valuable feedback that informs future product innovations. Overall, collaboration among suppliers, manufacturers, distributors, and end-users is essential for optimizing the value chain and enhancing customer satisfaction in the air starter market.

Air Starter Market Opportunity Analysis

The growing demand for efficient and safe starting solutions in industries such as aerospace, marine, and oil and gas is a significant catalyst. Additionally, the increasing focus on renewable energy projects, particularly in wind and solar, requires reliable starting mechanisms for auxiliary equipment. Advancements in technology, such as the development of lightweight and compact air starters, enhance their appeal, particularly in applications with space constraints. Furthermore, expanding infrastructure projects and the need for backup power solutions in critical operations offer additional growth avenues. Companies can capitalize on these opportunities by innovating their product offerings, exploring strategic partnerships, and enhancing service capabilities to meet the evolving needs of diverse industries effectively.

Air Starter Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 419.1 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 2.35% |

| 2033 Value Projection: | USD 528.9 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By End-Use, and By Region |

| Companies covered:: | Maradyne Corporation, Power Force Technologies Pte Ltd, Fokker, RS Group, Energotech AG., KH Equipment Pty Ltd., Hilliard Corporation, Universal Starter, Inc., Tech Development Inc. (TDI), and GaliInternacional SA |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Air Starter Market Dynamics

Rising Demand in the Aviation and Oil & Gas Industries

The air starter market is witnessing rising demand in the aviation and oil and gas industries, driven by the need for reliable and efficient starting solutions. In aviation, air starters are favored for their safety and performance in high-stakes environments, ensuring aircraft engines start smoothly and quickly, even in extreme conditions. Similarly, the oil and gas sector relies on air starters for their ability to function in hazardous environments where electrical systems pose risks. The growing exploration and production activities in these sectors further contribute to the demand for air starters, as they are essential for powering drilling equipment and compressors. As both industries expand, the need for advanced, durable, and efficient air starters will continue to rise, presenting significant growth opportunities for market players.

Restraints & Challenges

The air starter market faces several challenges that could impact its growth. One significant hurdle is the high initial cost of air starter systems compared to traditional electrical starters, which may deter potential customers, particularly small and medium enterprises. Additionally, the availability of skilled labor for installation and maintenance poses a challenge, as specialized knowledge is required to ensure optimal performance. Regulatory compliance and safety standards in various industries can complicate market entry, requiring manufacturers to invest time and resources in meeting these requirements. Moreover, competition from alternative starting technologies, such as electric starters, could limit market share. Lastly, fluctuations in raw material prices can affect production costs, necessitating strategic management to maintain profitability while meeting customer demands for quality and efficiency.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Air Starter Market from 2023 to 2033. The aviation sector's demand for efficient and reliable starting solutions has increased, particularly with the rise in air travel and aircraft maintenance needs. Additionally, the oil and gas industry continues to expand, with ongoing exploration and production activities requiring robust starting systems for drilling and extraction equipment. North American manufacturers are investing in technological advancements, focusing on lightweight and compact air starters that meet stringent safety regulations. Furthermore, the push for sustainable energy solutions is fostering innovation in air starter designs, enhancing their appeal. Overall, the North American air starter market is well-positioned to capitalize on these trends, offering significant growth opportunities.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Developing nations are witnessing significant expansion in their aviation and oil and gas sectors, which rely heavily on efficient and reliable starting solutions. The rising number of aircraft and ongoing investments in airport infrastructure are boosting the demand for air starters in aviation. Simultaneously, the oil and gas industry is expanding due to exploration and production activities in offshore and onshore fields. Furthermore, technological advancements and the development of compact, lightweight air starters are enhancing their appeal in various applications. As the region continues to evolve, the air starter market is expected to benefit from these trends, presenting substantial opportunities for manufacturers and suppliers.

Segmentation Analysis

Insights by Type

The turbine starters segment accounted for the largest market share over the forecast period 2023 to 2033. Turbine engines require robust starting systems that can operate effectively in extreme conditions, making air starters an ideal choice. The growth of the aviation sector, characterized by a rising number of commercial and military aircraft, is a key factor boosting this segment. Additionally, the expanding renewable energy sector, particularly wind energy, necessitates reliable starting mechanisms for turbine operation. Technological advancements in turbine starter designs, such as enhanced efficiency and reduced weight, further contribute to their growing adoption. As industries seek improved performance and safety, the turbine starters segment is expected to capture a larger share of the air starter market.

Insights by End Use

The oil and gas segment accounted for the largest market share over the forecast period 2023 to 2033. As the demand for energy rises, operators in this sector require reliable and efficient starting solutions for drilling rigs, compressors, and other critical equipment. Air starters are preferred in hazardous environments where electrical systems pose risks, ensuring safe and effective engine starts in challenging conditions. The ongoing advancements in technology, including the development of compact and lightweight air starters, enhance their performance and reliability, further fueling their adoption. Additionally, rising investments in offshore and onshore oil and gas projects contribute to market expansion. As safety and efficiency remain paramount, the oil and gas segment is expected to see significant growth in the air starter market in the coming years.

Recent Market Developments

- On March 2023, Ingersoll Rand has launched its ST2000 Air Starter, featuring an inline turbine design that promotes efficient air consumption. The ST2000 enhances productivity for engines ranging from 15 to 150 liters, delivering an impressive 70 horsepower while weighing only 40 pounds.

Competitive Landscape

Major players in the market

- Maradyne Corporation

- Power Force Technologies Pte Ltd

- Fokker

- RS Group

- Energotech AG.

- KH Equipment Pty Ltd.

- Hilliard Corporation

- Universal Starter, Inc.

- Tech Development Inc. (TDI)

- GaliInternacional SA

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Air Starter Market, Type Analysis

- Turbine Starter

- Vane Starter

Air Starter Market, End Use Analysis

- Oil and Gas

- Aviation

Air Starter Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Air Starter Market?The global Air Starter Market is expected to grow from USD 419.1 million in 2023 to USD 528.9 million by 2033, at a CAGR of 2.35% during the forecast period 2023-2033.

-

2. Who are the key market players of the Air Starter Market?Some of the key market players of the market are Maradyne Corporation, Power Force Technologies Pte Ltd, Fokker, RS Group, Energotech AG., KH Equipment Pty Ltd., Hilliard Corporation, Universal Starter, Inc., Tech Development Inc. (TDI), GaliInternacional SA.

-

3. Which segment holds the largest market share?The oil and gas segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Air Starter Market?North America dominates the Air Starter Market and has the highest market share..

Need help to buy this report?