Global Airborne Fire Control Radar Market Size By Platform (Fighter Jets, Combat Helicopter, Special Mission Aircraft and UAVs) By Frequency Band (L & S-band, X-band, and KU/K/KA band), By Application (Air to Sea, Air to Air, and Air to Ground), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033

Industry: Aerospace & DefenseGlobal Airborne Fire Control Radar Market Insights Forecasts to 2033

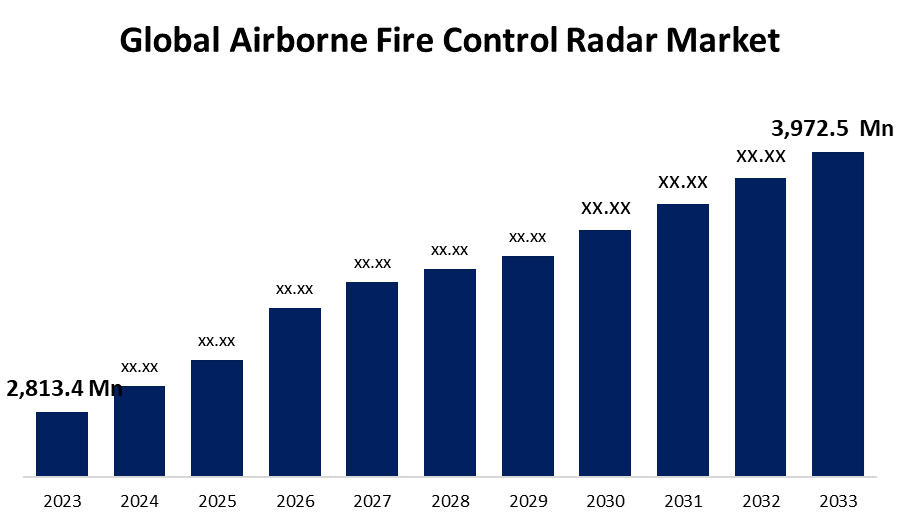

- The Global Airborne Fire Control Radar Market Size was valued at USD 2,813.4 Million in 2023.

- The Market Size is Growing at a CAGR of 3.51% from 2023 to 2033

- The Worldwide Airborne Fire Control Radar Market Size is Expected to reach USD 3,972.5 Million by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Airborne Fire Control Radar Market Size is Expected to reach USD 3,972.5 Million by 2033, at a CAGR of 3.51% during the forecast period 2023 to 2033.

The airborne fire control radar market is concerned with the development, manufacture, and sale of radar systems developed expressly for military aircraft to detect, track, and engage targets, primarily enemy aircraft and missiles. These radar systems are critical for improving situational awareness, enabling air-to-air and ground combat capabilities, and assuring the efficacy of aerial missions. The increased emphasis on network-centric warfare, as well as the development of multi-function radars capable of performing numerous functions at the same time, are defining the future of the airborne fire control radar industry. As militaries seek to improve their operational capabilities and maintain a competitive advantage, investing in next-generation radar systems remains a top priority.

Airborne Fire Control Radar Market Value Chain Analysis

The airborne fire control radar market's value chain is divided into several stages, beginning with research and development, which develops revolutionary radar technologies, and ending with component suppliers, who provide crucial radar components. Radar system manufacturers combine these components into full systems, which are subsequently installed in military aircraft by original equipment manufacturers (OEMs). Military procurement agencies purchase radar systems based on their performance and strategic needs, while military integrators and maintenance suppliers assure correct integration and support throughout the system's lifecycle. Military forces employ radar equipment for missions such as air superiority and reconnaissance. Training, support services, aftermarket upgrades, and innovations all contribute to the operational efficacy and durability of radar systems.

Airborne Fire Control Radar Market Opportunity Analysis

As countries modernise their military aircraft fleets, the need for improved fire control radar systems grows. Upgrading older systems with cutting-edge radar technology improves aircraft surveillance, target acquisition, and engagement. Evolving threats, like as stealth aircraft, drones, and hypersonic missiles, demand sophisticated radar systems that can detect and track these targets with accuracy and reliability. Airborne fire control radar is critical in addressing these threats because it provides early warning and allows for successful engagement. Many countries are raising defence budgets to handle rising security threats and maintain a strategic advantage. This funds the acquisition of modern radar equipment, particularly airborne fire control radars, to improve military capabilities and preparedness. Regional wars and geopolitical tensions increase demand for military aircraft outfitted with advanced fire control radar systems. Governments aim to improve their air superiority and defence capabilities in order to confront security challenges and sustain deterrence.

Airborne Fire Control Radar Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2,813.4 Million |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 3.51% |

| 2033 Value Projection: | USD 3,972.5 Million |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Platform, By Frequency Band, By Application, By Region |

| Companies covered:: | BAE Systems Plc, Bharat Electronics Limited, Hensoldt AG, Israel Aerospace Industries, Leonardo S.P.A., Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Technologies Corporation, SAAB AB, Thales Group, and |

| Growth Drivers: | Increasing Adoption of Active Electronically Scanning Array (AESA) Technology to Drive Market Growth |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Airborne Fire Control Radar Market Dynamics

Increasing Adoption of Active Electronically Scanning Array (AESA) Technology to Drive Market Growth

AESA radar systems outperform typical mechanically scanned array radars. They offer faster scanning, higher resolution, improved identification and tracking, and greater resilience to jamming and electronic countermeasures. These advantages make AESA-equipped fire control radars an excellent choice for current military aircraft. Compared to previous radar systems, AESA technology enables greater detection ranges and wider coverage areas. This increased range allows aircraft equipped with AESA fire control radars to detect and engage targets from a larger distance, improving situational awareness and operational effectiveness in both air-to-air and air-to-ground scenarios. While AESA radars often have higher initial costs than conventional systems, they have lower lifecycle costs due to their inherent reliability, decreased maintenance requirements, and extended operational duration. This cost-effectiveness makes AESA-equipped fire control radars appealing to military customers looking to maximise their long-term investment in radar technology.

Restraints & Challenges

The high cost of developing and acquiring modern fire control radar systems can be a barrier to market expansion, especially for budget-constrained defence organisations. While AESA technology saves money in the long run by lowering lifecycle costs, many potential customers find the initial acquisition cost prohibitively expensive. To remain competitive in the market, radar manufacturers must strike a compromise between performance and cost. The high cost of developing and acquiring modern fire control radar systems can be a barrier to market expansion, especially for budget-constrained defence organisations. While AESA technology saves money in the long run by lowering lifecycle costs, many potential customers find the initial acquisition cost prohibitively expensive. To remain competitive in the market, radar manufacturers must strike a compromise between performance and cost.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Airborne Fire Control Radar Market from 2023 to 2033. North American governments, particularly the United States and Canada, make major investments in military modernization programmes to maintain their technological advantage and ensure national security. These initiatives include the procurement of modern fighter planes and other military assets outfitted with cutting-edge fire control radar systems. North American countries, particularly the United States, have some of the world's biggest defence budgets. This large financing allows defence organisations to invest in the development, procurement, and maintenance of airborne fire control radar systems to meet a variety of military objectives and operational needs. North American defence companies use their technological skills and global networks to sell airborne fire control radar systems to ally countries and foreign consumers.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The Asia-Pacific region is marked by geopolitical tensions and security issues, such as territory conflicts, military buildups, and the spread of modern weapon systems. As a result, governments in the region are aggressively investing in defence capabilities, such as modern airborne fire control radar systems, to strengthen their deterrence posture and confront new security concerns. Many Asian-Pacific countries are undergoing considerable military modernization programmes to improve defence capabilities and handle new security threats. This involves the acquisition of sophisticated fighter aircraft, unmanned aerial vehicles (UAVs), and other military platforms outfitted with cutting-edge fire control radar systems to assure air superiority and operational effectiveness across the region's diverse operational conditions.

Segmentation Analysis

Insights by Platform

The fighter jets segment accounted for the largest market share over the forecast period 2023 to 2033. Several nations throughout the world are investing in modernising their fighter aircraft fleets in order to preserve air superiority and confront emerging threats. Upgrading existing fighter aircraft with improved fire control radar systems is a vital component of these modernization programmes, since it improves combat capability, situational awareness, and battlefield survival. Fighter jets are increasingly outfitted with multi-function AESA radar systems capable of carrying out a variety of missions, such as air-to-air and air-to-ground operations, electronic warfare, and maritime surveillance. These adaptable radar systems improve situational awareness, target recognition, and tracking, allowing fighter pilots to successfully engage multiple threats in difficult operational scenarios.

Insights by Frequency Band

The X-band segment is dominating the market with the largest market share over the forecast period 2023 to 2033. X-band radar systems have great resolution and precision, making them ideal for target detection, tracking, and identification in both air-to-air and air-to-ground environments. Their capacity to accurately distinguish between closely spaced targets and give extensive situational awareness improves the performance of airborne fire control systems in difficult operational scenarios. X-band radar systems can identify targets at long ranges, providing early warning and increasing the standoff distance between aircraft and possible threats. This increased detection range allows fighter aircraft equipped with X-band fire control radars to engage targets beyond optical range, hence improving mission effectiveness and battlefield survival. X-band radar systems contribute to network-centric warfare concepts by enabling the exchange of real-time sensor data with other friendly platforms and command centres.

Insights by Application

The Air to Ground segment accounted for the largest market share over the forecast period 2023 to 2033. The increased emphasis on counter-insurgency and counter-terrorism operations has resulted in a greater demand for airborne fire control radar systems capable of enabling precision attack capabilities against ground targets. Air-to-ground radar systems allow military aircraft to effectively detect, track, and engage ground-based threats, such as enemy vehicles, structures, and soldiers, with minimal collateral damage. Air-to-ground radar systems enable military aircraft to deliver guided missiles and munition systems precisely to designated ground targets. These radar systems offer precise target acquisition, identification, and engagement, increasing the effectiveness of air-to-ground missions while reducing risk to friendly forces and civilians.

Recent Market Developments

- In February 2021, Hindustan Aeronautics Limited (HAL) installed ELTA-sourced Active Electronically Scanning Radar on Jaguar Darin III fighter planes.

Competitive Landscape

Major players in the market

- BAE Systems Plc

- Bharat Electronics Limited

- Hensoldt AG

- Israel Aerospace Industries

- Leonardo S.P.A.

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Raytheon Technologies Corporation

- SAAB AB

- Thales Group

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Airborne Fire Control Radar Market, Platform Analysis

- Fighter Jets

- Combat Helicopter

- Special Mission Aircraft

- UAVs

Airborne Fire Control Radar Market, Frequency Band Analysis

- L & S-band

- X-band

- KU/K/KA band

Airborne Fire Control Radar Market, Application Analysis

- Air to Sea

- Air to Air

- Air to Ground

Airborne Fire Control Radar Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the market size of the Airborne Fire Control Radar Market?The global Airborne Fire Control Radar Market is expected to grow from USD 2,813.4 million in 2023 to USD 3,972.5 million by 2033, at a CAGR of 3.51% during the forecast period 2023-2033.

-

2.Who are the key market players of the Airborne Fire Control Radar Market?Some of the key market players of the market are BAE Systems Plc, Bharat Electronics Limited, Hensoldt AG, Israel Aerospace Industries, Leonardo S.P.A., Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Technologies Corporation, SAAB AB, and Thales Group.

-

3.Which segment holds the largest market share?The fighter jets segment holds the largest market share and is going to continue its dominance.

-

4.Which region is dominating the Airborne Fire Control Radar Market?North America is dominating the Airborne Fire Control Radar Market with the highest market share.

Need help to buy this report?