Global Aircraft ACMI Leasing Market Size, Share, and COVID-19 Impact Analysis, By Application (Private, Commercial, Others), By Type (Wet, Lease), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Aircraft ACMI Leasing Market Insights Forecasts to 2033

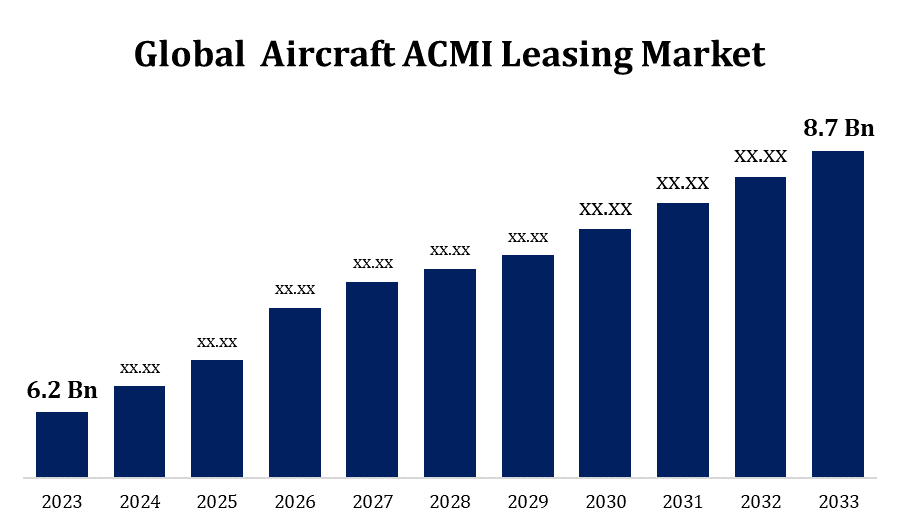

- The Aircraft ACMI Leasing Market was valued at USD 6.2 Billion in 2023.

- The Market Size is Growing at a CAGR of 3.45% from 2023 to 2033.

- The global Aircraft ACMI Leasing Market is expected to reach USD 8.7 Billion by 2033.

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The global Aircraft ACMI Leasing Market is expected to reach USD 8.7 billion by 2033, at a CAGR of 3.45% during the forecast period 2023 to 2033.

The Aircraft ACMI (Aircraft, Crew, Maintenance, and Insurance) leasing market has experienced significant growth in recent years, driven by rising demand for flexible and cost-effective aviation solutions. Airlines increasingly seek ACMI arrangements to manage capacity fluctuations without the long-term commitment of purchasing aircraft. This leasing model allows carriers to optimize operational efficiency and reduce capital expenditure while ensuring high-quality service delivery. Additionally, the post-pandemic recovery in air travel has further accelerated demand for ACMI services, as airlines look to expand routes quickly. Key players in the market include established leasing companies and airlines that offer ACMI solutions, fostering competitive pricing and innovative service offerings. As the aviation industry continues to evolve, the ACMI leasing segment is expected to remain a crucial element in airline operations.

Aircraft ACMI Leasing Market Value Chain Analysis

The Aircraft ACMI (Aircraft, Crew, Maintenance, and Insurance) leasing market value chain comprises several key components that contribute to its overall functionality and efficiency. It begins with aircraft manufacturers, who produce the planes that are subsequently leased. Next, leasing companies acquire these aircraft and offer them to airlines under ACMI agreements, including necessary maintenance and insurance. The operational phase involves crew management, where airlines ensure skilled personnel are available for flight operations. Maintenance providers play a crucial role, ensuring aircraft are in top condition, thus maintaining safety and compliance. Lastly, regulatory bodies oversee industry standards and operational guidelines, ensuring safety and reliability. Each link in this value chain is interconnected, emphasizing collaboration and strategic partnerships among stakeholders to enhance service delivery and operational effectiveness.

Aircraft ACMI Leasing Market Opportunity Analysis

The Aircraft ACMI (Aircraft, Crew, Maintenance, and Insurance) leasing market presents substantial opportunities for growth driven by several factors. The increasing demand for air travel, especially in emerging markets, necessitates flexible capacity solutions, making ACMI leasing an attractive option for airlines looking to expand quickly without significant capital investment. The rise of low-cost carriers also fuels demand for ACMI services, allowing them to scale operations efficiently. Additionally, the post-pandemic recovery phase has prompted airlines to rethink their operational strategies, further increasing reliance on ACMI arrangements. Technological advancements, such as improved fleet management systems, enhance efficiency and reliability, making ACMI leasing more appealing. Moreover, partnerships between leasing companies and airlines can foster innovation and tailor services, creating a competitive edge in this evolving market landscape.

Global Aircraft ACMI Leasing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 6.2 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 3.45% |

| 2033 Value Projection: | USD 8.7 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 243 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Application, By Type |

| Companies covered:: | GE Capital Aviation Service, AerCap, BBAM, SMBC Aviation Capital, Air Lease Corporation, ALAFCO Aviation Lease and Finance Company K.S.C.P, Boeing Capital, ICBC Leasing, Ansett Worldwide Aviation Services, CIT Commercial Air, and International Lease Finance Corporation |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Market Dynamics

Aircraft ACMI Leasing Market Dynamics

Increasing air travel demand to boost the market growth

The increasing demand for air travel is a significant catalyst for the growth of the Aircraft ACMI (Aircraft, Crew, Maintenance, and Insurance) leasing market. As global travel restrictions ease and passenger confidence returns, airlines are experiencing a surge in bookings, necessitating quick expansions in capacity. ACMI leasing offers a flexible solution, allowing airlines to quickly deploy aircraft without the high capital costs associated with purchasing. This is particularly beneficial for carriers looking to meet seasonal spikes or unpredictable demand patterns. Additionally, the rise of low-cost carriers further drives the need for ACMI arrangements, enabling these airlines to efficiently scale operations. As air travel continues to rebound, the ACMI leasing market is poised for substantial growth, catering to the evolving needs of airlines worldwide.

Restraints & Challenges

The Aircraft ACMI (Aircraft, Crew, Maintenance, and Insurance) leasing market faces several challenges that can impede growth. One significant issue is the rising cost of aircraft acquisition and maintenance, which can affect leasing rates and profitability for providers. Additionally, fluctuations in global fuel prices can impact operational costs, making it harder for airlines to predict expenses accurately. Regulatory compliance is another challenge, as airlines must adhere to stringent aviation standards, which can complicate leasing arrangements and increase operational burdens. Furthermore, the ongoing pilot and crew shortages exacerbate staffing issues for ACMI providers, hindering their ability to meet demand. Lastly, geopolitical uncertainties and economic downturns can adversely affect air travel demand, creating an unpredictable environment for ACMI leasing operations.

Regional Forecasts

North America Market Statistics

Get more details on this report -

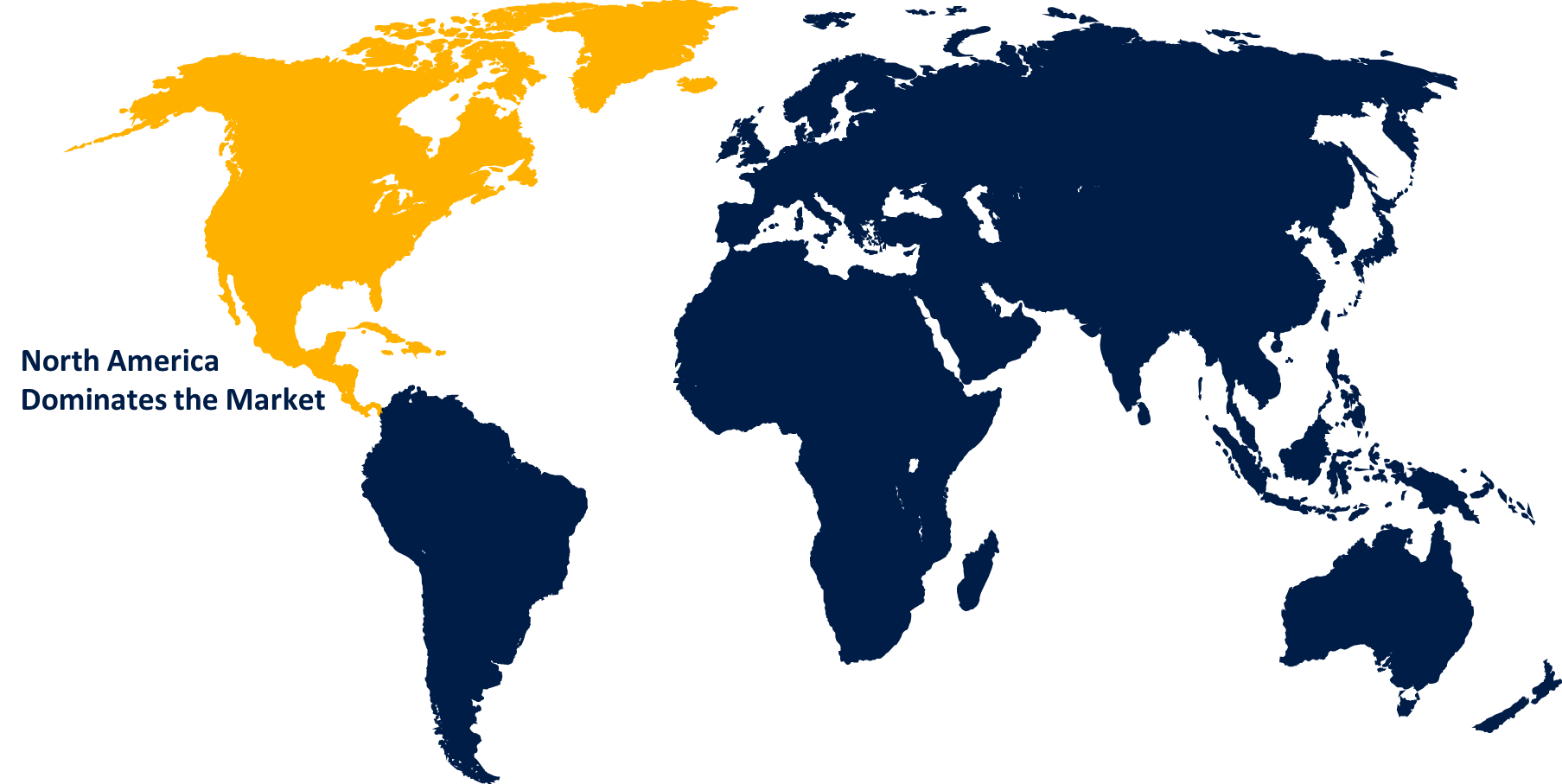

North America is anticipated to dominate the Aircraft ACMI Leasing Market from 2023 to 2033. Major airlines are increasingly adopting ACMI solutions to manage operational flexibility, enabling them to scale their fleets efficiently in response to fluctuating passenger volumes. Additionally, the presence of established leasing companies and a well-developed aviation infrastructure further bolster the market. The rise of low-cost carriers in North America is also contributing to increased demand for ACMI leasing, allowing these airlines to expand their reach without significant capital investment. However, challenges such as regulatory compliance, rising maintenance costs, and crew shortages remain critical considerations as the market evolves. Overall, North America stands as a key player in the global ACMI leasing landscape.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. As countries in this region expand their aviation infrastructure, airlines are seeking flexible solutions to scale their operations without incurring substantial capital costs. The rise of low-cost carriers is further propelling the demand for ACMI leasing, allowing these airlines to enter new markets quickly and efficiently. Additionally, the post-pandemic recovery of air travel is boosting capacity needs, with ACMI leasing providing a viable solution. However, challenges such as regulatory complexities, fluctuating fuel prices, and workforce shortages in the aviation sector may impact market dynamics. Overall, Asia Pacific is poised for robust growth in the ACMI leasing segment, supported by its dynamic aviation landscape.

Segmentation Analysis

Insights by Type

The wet lease segment accounted for the largest market share over the forecast period 2023 to 2033. Wet leasing allows airlines to quickly scale operations by acquiring fully equipped aircraft, including crew, without the long-term commitment of ownership. This is particularly advantageous for airlines facing fluctuating passenger demand or seasonal variations. The post-pandemic recovery of air travel has further accelerated this trend, as airlines look to optimize fleet capacity while minimizing financial risks. Additionally, wet leasing appeals to new and low-cost carriers seeking to expand their routes rapidly. As operational agility becomes increasingly crucial in a competitive market, the wet lease segment is expected to continue its upward trajectory, becoming a vital component of the ACMI leasing landscape.

Insights by Application

The private segment accounted for the largest market share over the forecast period 2023 to 2033. As high-net-worth individuals and corporate clients seek more flexible and efficient travel options, ACMI leasing provides an attractive solution, allowing them to operate private aircraft without the burdens of ownership. This segment benefits from the rise in business travel and the trend of fractional ownership, which encourages companies to lease aircraft on an as-needed basis. Additionally, the growing focus on safety, reliability, and tailored services enhances the appeal of private ACMI leasing. As the luxury travel market expands and more clients prioritize convenience and exclusivity, the private segment of the ACMI leasing market is set for continued growth, catering to evolving consumer preferences.

Recent Market Developments

- In Novembe 2021, AerCap Holdings N.V., the global leader in aircraft leasing, successfully acquired General Electric's GE Capital Aviation Services division (GECAS).

Competitive Landscape

Major players in the market

- GE Capital Aviation Service

- AerCap

- BBAM

- SMBC Aviation Capital

- Air Lease Corporation

- ALAFCO Aviation Lease and Finance Company K.S.C.P

- Boeing Capital

- ICBC Leasing

- Ansett Worldwide Aviation Services

- CIT Commercial Air

- International Lease Finance Corporation

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aircraft ACMI Leasing Market, Application Analysis

- Private

- Commercial

- Others

Aircraft ACMI Leasing Market, Type Analysis

- Wet

- Dry

Aircraft ACMI Leasing Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?