Global Aircraft Actuator Market Size By Product (Mechanical, Pneumatic, Hydraulic), By Application (Flight Control System, Health Monitoring System), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033

Industry: Aerospace & DefenseGlobal Aircraft Actuator Market Size Insights Forecasts to 2033

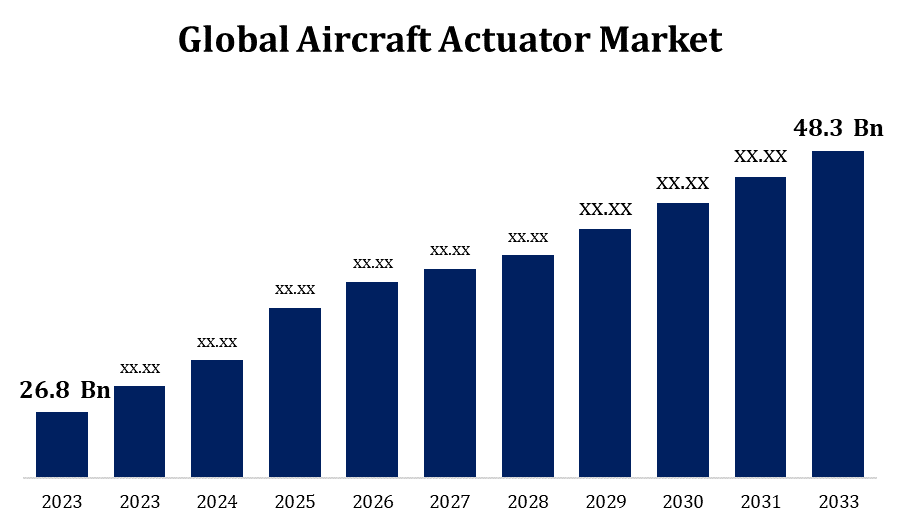

- The Global Aircraft Actuator Market Size was valued at USD 26.8 Billion in 2023

- The Market Size is growing at a CAGR of 6.07% from 2023 to 2033

- The Worldwide Aircraft Actuator Market Size is Expected to reach USD 48.3 Billion by 2033

- Asia Pacific Market is Expected to Grow the fastest during the Forecast period

Get more details on this report -

The Global Aircraft Actuator Market is expected to reach USD 48.3 billion by 2033, at a CAGR of 6.07% during the Forecast period 2023 to 2033.

Aircraft actuators are critical in the aviation industry because they regulate a variety of systems and movements in an aircraft, including flight control surfaces, landing gear, and other key components. The general growth and expansion of the aviation industry increases the demand for innovative and efficient aircraft components, such as actuators. The quantity of orders for new aircraft, both commercial and military, influences the demand for various aircraft components, such as actuators. This market is driven primarily by aircraft manufacturers and aerospace suppliers. With a growing emphasis on fuel efficiency and environmental sustainability, there is a trend towards designing aeroplanes with more efficient systems, such as actuators that contribute to lower fuel use.

Aircraft Actuator Market Value Chain Analysis

Companies that supply the basic materials required for aircraft actuator manufacture, such as metals, alloys, and electronic components, are part of the raw material supplier stage. Component Specialised firms create the different components that comprise the aeroplane actuators. These parts include gears, bearings, motors, sensors, and electronic control units. The components are subsequently combined to form full aeroplane actuators. To ensure perfect construction, this technique may require sophisticated assembly lines and expert labourers. Actuators are thoroughly tested before being introduced to the market. This can involve functional testing to guarantee proper functioning, stress tests to assess durability, and compliance tests to assure conformity with industry norms and laws. Actuators are subsequently delivered to a variety of clients, including aircraft manufacturers, maintenance facilities, and other end users. Airlines and other end users use aircraft equipped with integrated actuators. Depending on the aircraft type, these end users could be commercial airlines or military organisations.

Aircraft Actuator Market Opportunity Analysis

The rise of electrification in aircraft opens up potential for electric actuators. As aircraft manufacturers shift their focus to electric and hybrid propulsion systems, there is a growing demand for improved electric actuators to handle numerous aircraft functions. The aviation industry's emphasis on fuel efficiency and environmental sustainability presents potential for actuators that help to reduce fuel usage. Actuators with energy-efficient designs may be in great demand. The continued growth of global air travel creates a greater demand for new aircraft. As a result, aviation actuator producers will have more opportunity to offer components for these new aircraft. The increase in defence budgets in many countries opens considerable prospects for firms who supply actuators for military aircraft.

Global Aircraft Actuator Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 26.8 billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.07% |

| 2033 Value Projection: | USD 48.3 billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product, By Application, By Region, By Geographic Scope |

| Companies covered:: | Infineon, UTC Aerospace Systems, Honeywell, Microsemi, Vishay Intertechnology, Inc., Safran, Rockwell, Woodward, Inc, and |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Aircraft Actuator Market Dynamics

Increasing demand for commercial aircraft

The global increase in air travel, fueled by factors such as rising disposable income, urbanisation, and better connectivity, raises demand for commercial aircraft. Many airlines are expanding their fleets to accommodate rising passenger demand. As a result, aircraft manufacturers receive more orders, driving up demand for various aircraft components, including actuators. Ageing aircraft in existing fleets are frequently replaced with newer, more fuel-efficient types. This replacement cycle adds to the ongoing demand for sophisticated aviation technologies, especially new actuators. Airlines are increasingly focused on lowering operational costs, and fuel efficiency is a major factor. Newer aircraft types, which contain sophisticated technologies, such as efficient actuators, have higher fuel efficiency than previous models.

Restraints & Challenges

The aviation industry is experiencing fast technical improvements. Actuator makers must keep up with these developments to remain competitive, which can be difficult in terms of R&D and expenditure. Intense competition in the aerospace sector frequently results in cost concerns. Actuator makers must strike a balance between innovation and cost-effectiveness in order to meet market needs. The aviation sector depends on a complicated worldwide supply network. Disruptions such as geopolitical conflicts, natural disasters, or pandemics can have an impact on component delivery times, influencing overall aircraft production and, as a result, actuator demand. The certification process for new aircraft and components, including actuators, is extensive and stringent. Delays in acquiring essential certifications may impede the market entrance of innovative items.

Regional Forecasts

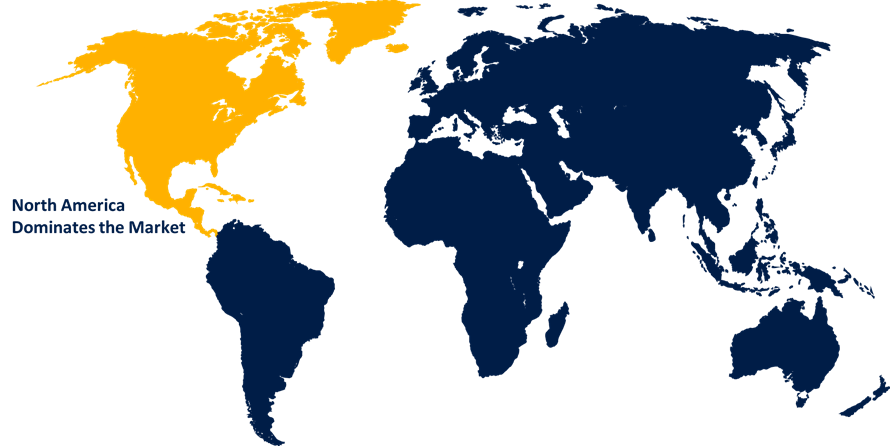

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Aircraft Actuator Market from 2023 to 2033. The United States is a major aircraft manufacturing base, with Boeing and other defence contractors making important contributions. The demand for aeroplane actuators is closely related to the production and orders of commercial and military aircraft. North America has a thriving commercial aviation industry, with major airlines constantly modernising their fleets. The demand for new, fuel-efficient aircraft directly affects the requirement for improved actuators. The region has a well-established MRO business, which is critical for aircraft maintenance and repair, especially actuators. MRO services help to support the aftermarket part of the actuator market.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The Asia-Pacific area is witnessing tremendous economic growth, which is driving up demand for air travel. This rise has increased demand for new commercial aircraft, which has contributed to the demand for aircraft actuators. The region makes a significant contribution to the global expansion of commercial aviation. Airlines in China and India are growing their fleets, providing possibilities for aviation component makers, particularly actuator providers. Several Asia-Pacific countries are investing in modernising their defence forces. This involves the procurement of modern military aircraft and associated components, which will provide opportunities for actuator producers.

Segmentation Analysis

Insights by Product

The hydraulic actuator type segment accounted for the largest market share over the forecast period 2023 to 2033. Hydraulic systems are known for their dependability and endurance in harsh aircraft conditions. These actuators can survive extreme conditions such as temperature fluctuations and high pressure settings, which contributes to their popularity in important aircraft systems. Hydraulic actuation technology has been used in aircraft for decades and has shown to be reliable. This dependability has resulted in its continued use in many aircraft, particularly bigger commercial and military types. Larger commercial and military aircraft frequently rely on hydraulic actuators to provide power and control. As demand for these aircraft grows, so does the need for hydraulic actuation systems.

Insights by Application

The health monitoring system segment accounted for the largest market share over the forecast period 2023 to 2033. Health monitoring systems make predictive maintenance possible by constantly monitoring the status of aircraft components. This enables the early diagnosis of possible faults, decreasing the need for unscheduled maintenance and minimising downtime. The use of health monitoring systems increases safety by giving real-time information on the health and performance of crucial components. This proactive strategy reduces breakdowns and increases overall system reliability. Health monitoring systems reduce the chance of unexpected failures and enable predictive maintenance, resulting in cost savings associated with maintenance, repair, and operational disruptions.

Recent Market Developments

- In January 2020, Honeywell announced the ongoing development of a new range of electromechanical actuators primarily intended for urban air mobility.

Competitive Landscape

Major players in the market

- Infineon

- UTC Aerospace Systems

- Honeywell

- Microsemi

- Vishay Intertechnology, Inc.

- Safran

- Rockwell

- Woodward, Inc

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aircraft Actuator Market, Product Analysis

- Mechanical

- Pneumatic

- Hydraulic

Aircraft Actuator Market, Application Analysis

- Flight Control System

- Health Monitoring System

Aircraft Actuator Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Need help to buy this report?