Global Aircraft Antenna Market Size By Application (Communication, Navigation & Surveillance), By End User (Original Equipment Manufacturer (OEM), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033

Industry: Aerospace & DefenseGlobal Aircraft Antenna Market Insights Forecasts to 2033

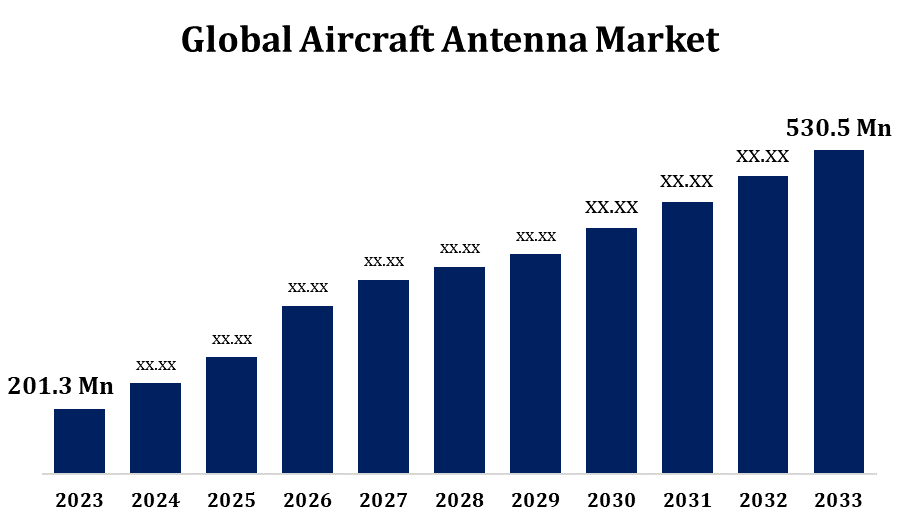

- The Global Aircraft Antenna Market Size was valued at USD 201.3 Million in 2023

- The Market Size is growing at a CAGR of 10.18% from 2023 to 2033

- The Global Aircraft Antenna Market Size is expected to reach USD 530.5 Million by 2033

- Asia Pacific Market is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Aircraft Antenna Market Size is expected to reach USD 530.5 Million by 2033, at a CAGR of 10.18% during the forecast period 2023 to 2033.

The market for aircraft antenna plays a crucial role in the aerospace sector by supporting the navigation, communication, and surveillance systems on a range of aircraft models. In order to maintain dependable and effective communication between aircraft and other aircraft as well as ground stations, antennas are essential. Global air traveller numbers are rising, which has increased demand for aeroplanes and, in turn, increased need for aircraft antennas. The need for cutting-edge antennas is a result of airlines and operators frequently investing in modernising and equipping their current fleets with communication and navigation technologies. There are commercial and military segments in the market. Specialised antennas are frequently installed on military aircraft for radar, communication, and other mission-specific functions.

Aircraft Antenna Market Value Chain Analysis

The first step in the value chain is research and development, where businesses spend money on cutting-edge antenna technologies. Research and development endeavours centre on augmenting functionality, diminishing mass, fortifying robustness, and integrating cutting-edge communication and navigation technology. The production of antenna components is the following step after the antenna design is complete. This involves the manufacturing of materials like radomes, conductive elements, and other essential parts. This step involves actually assembling the antennas. To make the finished antenna product, the produced components must be combined. Antennas are put through a thorough testing process to make sure they meet industry standards and regulatory criteria before being integrated into aircraft systems. After manufacturing and integration, the antennas are supplied to MRO (maintenance, repair, and overhaul) facilities, aircraft manufacturers, and other end users. Antennas are placed as part of the avionics suite during aeroplane building. The end users, which comprise both commercial airlines and military organisations, are involved in the last stage.

Aircraft Antenna Market Opportunity Analysis

The creation and incorporation of cutting-edge technology into antennas, such as phased array systems, multi-function antennas, and smart antenna systems, present opportunities. The market for sophisticated antennas will likely rise as a result of the potential for greater demand for new aircraft and the chance to upgrade existing fleets with modern communication and navigation systems. This demand will be driven by the ongoing development in air travel. The aviation sectors in emerging markets are growing, which presents potential for market expansion. Antennas supporting satellite connectivity are seeing potential due to the growing usage of satellite communication in aviation. Various nations' increased defence budgets may present prospects for the military aircraft antenna market.

Global Aircraft Antenna Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 201.3 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 10.18% |

| 2033 Value Projection: | USD 530.5 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Application, By End User, By Region, By Geographic Scope |

| Companies covered:: | The Boeing Company, Honeywell International Inc., Antcom Corporation, RAMI Aviation., Sensor Systems Inc., McMurdo Limited, Azimut Benetti Group, Harris Corporation, TECOM Group, Cobham plc, and Other Key Vendors. |

| Growth Drivers: | Growing trend of modernization of the aerospace sector |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Aircraft Antenna Market Dynamics

Growing trend of modernization of the aerospace sector

The upgrading of antennas is being driven by the need for more durable and dependable communication systems. Modern aeroplanes are becoming increasingly dependent on broadband connectivity, satellite communication, and high-speed data transfer, which calls for the use of sophisticated antenna technologies. Modernised antennas that can effectively receive and process signals for precise navigation are becoming more and more necessary as a result of advancements in navigation systems, including GPS and other satellite-based technologies. Antennas that can support these developments are necessary when integrating next-generation technologies, such machine learning, artificial intelligence, and the Internet of Things, into aircraft systems. The use of satellite communication systems is being driven by the increasing demand for in-flight connection services. In order to modernise the passenger experience, antennas that support broadband services and smooth connectivity are crucial.

Restraints and Challenges

Antenna design for aircraft must reduce aerodynamic drag and prevent adverse effects on the aircraft's overall performance and fuel efficiency. It is very difficult to achieve the best aerodynamic design while keeping the antenna functioning. In aircraft, weight is crucial, therefore antenna weight requirements are very rigorous. The difficulty is in creating designs and materials that are both strong and lightweight while still meeting these requirements without sacrificing functionality. Extreme temperatures, high altitudes, and exposure to a variety of meteorological variables are just a few of the challenging climatic circumstances in which aircraft operate. Antenna performance and dependability must not suffer under these circumstances. Antenna integration has difficulties in modern aeroplanes due to the usage of composite materials.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Aircraft Antenna Market from 2023 to 2033. The need for military aircraft antennas is mostly driven by the strength of the defence industry in North America. For defence applications, specialised antennas are essential for radar, electronic warfare, and communication systems. There is a sizable and established commercial aviation industry in the area. North American airlines are constantly investing in modernising their fleets with cutting-edge avionics equipment, which include sophisticated communication and navigational antennas. In North America, there is an increasing need for satellite communication services and in-flight connection. In order to improve the experience of passengers on commercial flights, this trend necessitates the development of antennas that can support broadband services. In North America, the aftermarket services industry is well-established and offers maintenance, repair, and antenna replacement services.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Commercial aviation has grown significantly in the Asia-Pacific area as a result of growing urbanisation, economic development, and demand for air travel. The market for aircraft antennas is growing as a result of this expansion. Asia's emerging economies, including China and India, are significant drivers of the aircraft antenna market's expansion. The need for communication and navigation systems, particularly antennas, is rising as a result of these nations' investments in growing their fleets. There are initiatives underway in the Asia-Pacific area to enhance aviation connectivity on a national and international level. This includes the construction of new airfields, flight paths, and other aviation-related infrastructure, all of which increase demand for aircraft antennas.

Segmentation Analysis

Insights by Application

The Navigation & Surveillance segment accounted for the largest market share over the forecast period 2023 to 2033. Sustainably increasing aviation traffic around the world requires reliable navigation and surveillance systems. These systems rely heavily on antennas to provide precise and dependable data for air traffic control. Antennas are necessary for efficient aeroplane communication in the global deployment of ADS-B, a surveillance device that broadcasts aircraft position and other information. The market for ADS-B-compatible antennas is driven by this development. Advanced surveillance systems are critical to military aircraft's situational awareness and threat identification. The expansion of this market is facilitated by antennas used in military applications to support radar and surveillance systems.

Insights by End User

The OEM segment accounted for the largest market share over the forecast period 2023 to 2033. As the aviation sector grows worldwide, airlines and operators are adding more aircraft to their fleets, which in turn causes a rise in aircraft deliveries. There is a comparable demand for antennas to be placed as original equipment when new aeroplanes are produced and delivered. The demand for cutting-edge avionics equipment, including antennas, is driven by the creation and introduction of new aircraft models, including next-generation military and commercial aircraft. When creating these new aeroplanes, OEMs concentrate on incorporating the newest technologies. Manufacturers place more orders for aeroplanes as a result of the growing demand for air travel around the globe. Therefore, in order to provide these aircraft with cutting-edge communication and navigation capabilities, OEMs must find sophisticated antennas.

Recent Market Developments

- In April 2020, Cobham Aerospace was given a contract by the UK MOD's Defence Equipment and Support (DE&S) to research enhanced anti-jam solutions for the defence of navigation signals received from the Global Navigation Satellite Systems (GNSS).

Competitive Landscape

Major players in the market

- The Boeing Company

- Honeywell International Inc.

- Antcom Corporation

- RAMI Aviation.

- Sensor Systems Inc.

- McMurdo Limited

- Azimut Benetti Group

- Harris Corporation

- TECOM Group

- Cobham plc

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aircraft Antenna Market, Application Analysis

- Communication

- Navigation & Surveillance

Aircraft Antenna Market, End User Analysis

- Original Equipment Manufacturer (OEM)

- Aftermarket

Aircraft Antenna Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Need help to buy this report?