Global Aircraft Arresting System Market Size, Share, and COVID-19 Impact Analysis, By Type (Mobile Aircraft Arresting System (MAAS), Net Barrier, Cable, Aircraft Carrier Arresting System, Engineered Material Arresting System {EMAS}), By Platform (Ship-based, Ground-based), By System (Portable System, Fixed System), By End-Users (Commercial Airport, Aircraft Carrier, Military Airbase), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Aircraft Arresting System Market Insights Forecasts to 2033

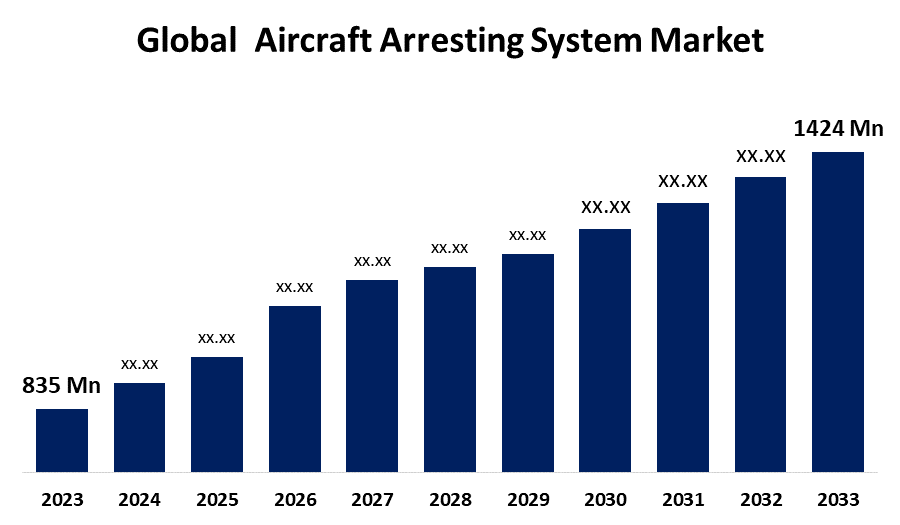

- The Aircraft Arresting System Market was valued at USD 835 Million in 2023.

- The market is growing at a CAGR of 5.48% from 2023 to 2033.

- The Global Aircraft Arresting System Market is expected to reach USD 1424 Million by 2033.

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Aircraft Arresting System Market is expected to reach USD 1424 million by 2033, at a CAGR of 5.48% during the forecast period 2023 to 2033.

The Aircraft Arresting System market is expanding due to growing air traffic, increased defense spending, and the modernization of military infrastructure. These systems are critical for ensuring safety during emergency landings and aborted takeoffs, particularly on short or limited-length runways. The market is driven by the demand for efficient aircraft recovery systems at both military and civil airports. Key technologies include cable-based arresting systems, engineered materials arresting systems (EMAS), and aircraft arrestor beds. North America dominates the market due to high military expenditure and a substantial number of airports, while Asia-Pacific is anticipated to grow rapidly due to increased defense investments.

Aircraft Arresting System Market Value Chain Analysis

The value chain of the Aircraft Arresting System market comprises several key stages, beginning with the raw material suppliers who provide essential components like cables, energy absorbers, and advanced composites. Manufacturers then design, develop, and assemble these components into complete arresting systems. Research and development play a crucial role, focusing on safety, performance, and compliance with aviation regulations. Distribution is handled by both direct sales to government bodies and defense contractors, and through partnerships with civil airport authorities. Service providers, including installation, maintenance, and training services, add further value by ensuring systems' operational readiness and longevity. End-users are military airbases and civil airports, which rely on these systems for emergency aircraft recovery and to enhance runway safety. The value chain is highly integrated, emphasizing quality and reliability.

Aircraft Arresting System Market Opportunity Analysis

The Aircraft Arresting System market presents significant opportunities driven by rising air traffic, increasing defense budgets, and a growing focus on safety across military and civil aviation sectors. The modernization of existing military infrastructure, particularly in Asia-Pacific and the Middle East, offers substantial growth prospects. Emerging economies are investing heavily in airport expansions and upgrades, creating demand for advanced aircraft arresting systems. Technological advancements, such as the development of lightweight, durable materials and innovative designs for arresting systems, are expected to further boost market growth. Additionally, the need for compliance with stringent safety regulations and the adoption of new technologies like engineered materials arresting systems (EMAS) provides new avenues for market players to innovate and expand their market footprint globally.

Global Aircraft Arresting System Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 835 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.48% |

| 2033 Value Projection: | USD 1424 Million |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By System, By End-User, and By Region |

| Companies covered:: | General Atomics (US), SCAMA AB (Sweden), Curtiss-Wright Corporation (US), A-laskuvarjo (Finland), Safran (France), ESCRIBANO Mechanical and Engineering (Spain), Bridon-Bekaert (UK), QinetiQ (UK), WireCoWorldGroup (Paris), and Runway Safe Sweden AB (Sweden) |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Aircraft Arresting System Market Dynamics

The necessity for military aircraft is growing along with the growth of commercial airports

The Aircraft Arresting System market is witnessing increased demand due to the rising necessity for military aircraft and the expansion of commercial airports. As global defense budgets grow, many countries are enhancing their military capabilities, necessitating reliable arresting systems for safe aircraft recovery during emergencies or aborted takeoffs. Additionally, the expansion of commercial airports, driven by escalating air traffic and infrastructure modernization, is boosting the demand for arresting systems to ensure operational safety on runways, particularly those with limited lengths. This dual need for military readiness and civil aviation safety is propelling investments in innovative arresting systems that combine advanced materials and technology. Both sectors are focusing on upgrading existing infrastructure, thereby presenting lucrative growth opportunities for key market players worldwide.

Restraints & Challenges

The Aircraft Arresting System market faces several challenges, including high installation and maintenance costs, which can deter potential buyers, especially smaller airports with limited budgets. Additionally, the need for strict compliance with international aviation safety regulations creates a complex and time-consuming certification process for new technologies, slowing market growth. The market also encounters technical challenges, such as ensuring reliability under diverse weather conditions and adapting systems to different aircraft types and runway configurations. Furthermore, the dependence on government defense budgets means that any cuts or reallocations can significantly impact demand. Geopolitical tensions and economic uncertainties can further delay decision-making and funding for these systems. As a result, market players must navigate cost constraints, regulatory hurdles, and fluctuating demand to maintain growth and competitiveness.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Aircraft Arresting System Market from 2023 to 2033. The United States, in particular, plays a significant role due to its large number of military airbases, aircraft carriers, and commercial airports that require efficient aircraft recovery systems. The region’s market growth is supported by ongoing modernization programs, including the replacement and upgrade of legacy arresting systems with advanced technologies such as cable-based arrestors and engineered materials arresting systems (EMAS). Additionally, the presence of key market players and a robust aerospace and defense industry fosters innovation and the development of next-generation solutions. Increased investments in airport infrastructure and stringent regulatory safety standards further bolster North America's market position and expansion opportunities.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The region is enhancing their military capabilities, driving demand for advanced arresting systems to ensure aircraft safety during emergency landings and aborted takeoffs. The region’s commercial aviation sector is also booming, with numerous airport expansions and new construction projects underway to accommodate rising air traffic. This growth necessitates robust safety systems, including aircraft arresting technologies. Additionally, geopolitical tensions in the region spur defense readiness and infrastructure development. As a result, market players are capitalizing on these opportunities by offering innovative and customized solutions to meet the diverse needs of both military and civil aviation sectors.

Segmentation Analysis

Insights by Type

The Engineered material arresting system (EMAS) segment accounted for the largest market share over the forecast period 2023 to 2033. EMAS technology, which uses engineered materials designed to deform and absorb energy during aircraft overruns, is becoming a preferred choice for runways with limited space. Regulatory mandates from aviation authorities like the FAA and ICAO, emphasizing runway safety and the need for overrun protection, are further propelling its adoption. Additionally, airport expansions and modernization projects worldwide are boosting the market, as EMAS offers a practical solution for upgrading safety without significant changes to existing infrastructure. The segment's growth is also fueled by technological advancements, improved materials, and innovations that enhance performance and reduce installation and maintenance costs, attracting more investments and installations globally.

Insights by Platform

The ship-based segment accounted for the largest market share over the forecast period 2023 to 2033. As navies enhance their operational readiness and modernize fleets, the demand for advanced arresting systems for aircraft carriers grows, ensuring safe and efficient recovery of military aircraft in challenging sea conditions. Rising geopolitical tensions and strategic military initiatives are driving investments in new aircraft carriers and retrofitting older vessels with cutting-edge arresting technologies, such as advanced cable-based systems. North America and Asia-Pacific, particularly the U.S., China, and India, are key contributors to this growth, given their significant naval modernization programs. Innovations in materials, automation, and energy absorption technologies further support this segment's expansion, making it a crucial area in the market.

Insights by System

The fixed system segment accounted for the largest market share over the forecast period 2023 to 2033. Fixed systems, which typically use cable-based arrestors and net barriers, are crucial for enhancing safety during emergency landings or aborted takeoffs. Growing defense budgets and the modernization of air force infrastructure, particularly in North America, Europe, and Asia-Pacific, are fueling demand for these systems. Additionally, heightened safety regulations and airport expansion projects require cost-effective and durable arresting solutions, positioning fixed systems as an ideal choice. Technological advancements, including improved energy absorption capabilities and reduced maintenance needs, further support this segment’s growth, offering a stable, long-term option for both military and commercial aviation sectors.

Insights by End Users

The commercial airport segment accounted for the largest market share over the forecast period 2023 to 2033. As airports seek to enhance safety measures and comply with stringent regulatory standards, the demand for advanced arresting systems is rising. The expansion of existing airports and the construction of new ones, especially in rapidly growing regions like Asia-Pacific and the Middle East, drive this growth. Engineered Material Arresting Systems (EMAS) and other innovative technologies offer effective solutions for handling emergency landings and preventing runway overruns. Additionally, the focus on improving operational efficiency and safety standards at commercial airports supports investment in high-quality arresting systems.

Recent Market Developments

- In May 2020, a contract has been signed by General Atomics and the US Navy to supply new arresting gear systems and an electromagnetic aircraft launch system for the Ford class. The company supplies the US Navy with cutting-edge AAG systems.

Competitive Landscape

Major players in the market

- General Atomics (US)

- SCAMA AB (Sweden)

- Curtiss-Wright Corporation (US)

- A-laskuvarjo (Finland)

- Safran (France)

- ESCRIBANO Mechanical and Engineering (Spain)

- Bridon-Bekaert (UK)

- QinetiQ (UK)

- WireCoWorldGroup (Paris)

- Runway Safe Sweden AB (Sweden)

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aircraft Arresting System Market, Type Analysis

- Mobile Aircraft Arresting System (MAAS)

- Net Barrier

- Cable

- Aircraft Carrier Arresting System

- Engineered Material Arresting System {EMAS}

Aircraft Arresting System Market, Platform Analysis

- Ship-based

- Ground-based

Aircraft Arresting System Market, System Analysis

- Portable System

- Fixed System

Aircraft Arresting System Market, End User Analysis

- Commercial Airport

- Aircraft Carrier

- Military Airbase

Aircraft Arresting System Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Aircraft Arresting System Market?The global Aircraft Arresting System Market is expected to grow from USD 835 million in 2023 to USD 1424 million by 2033, at a CAGR of 5.48% during the forecast period 2023-2033.

-

2. Who are the key market players of the Aircraft Arresting System Market?Some of the key market players of the market are General Atomics (US), SCAMA AB (Sweden), Curtiss-Wright Corporation (US), A-laskuvarjo (Finland), Safran (France), ESCRIBANO Mechanical and Engineering (Spain), Bridon-Bekaert (UK), QinetiQ (UK), WireCoWorldGroup (Paris), Runway Safe Sweden AB (Sweden).

-

3. Which segment holds the largest market share?The commercial airports segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Aircraft Arresting System Market?North America dominates the Aircraft Arresting System Market and has the highest market share.

Need help to buy this report?