Global Aircraft Battery Market Size, Share, and COVID-19 Impact Analysis, By Battery Type (Lead Acid Battery, Lithium Ion Battery, Nickel-Cadmium Battery, and Others), By Technology (Traditional Aircraft, More Electric Aircraft, Hybrid Aircraft, and Electric Aircraft), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Aircraft Battery Market Insights Forecasts to 2033

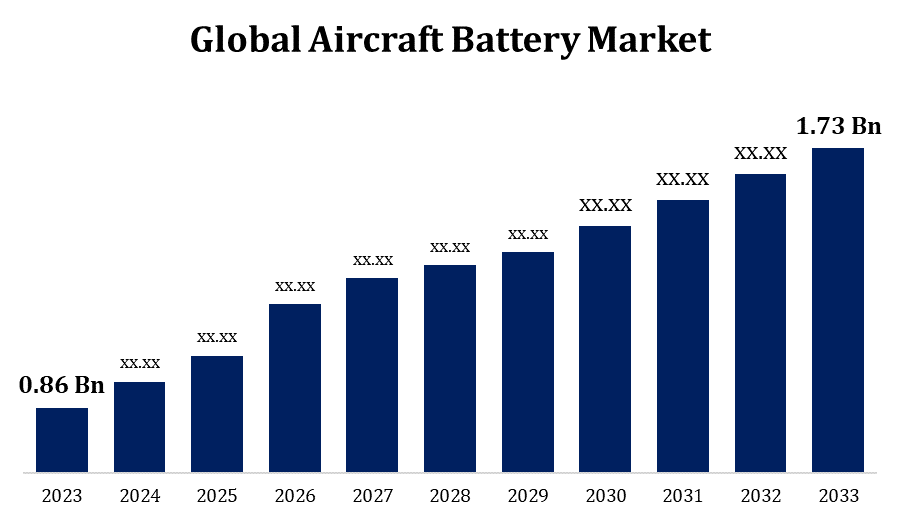

- The Global Aircraft Battery Market Size was valued at USD 0.86 Billion in 2023.

- The market is growing at a CAGR of 7.24% from 2023 to 2033

- The Worldwide Aircraft Battery Market Size is Expected to reach USD 1.73 Billion by 2033

- Asia Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Aircraft Battery Market Size is Expected to reach USD 1.73 Billion by 2033, at a CAGR of 7.24% during the forecast period 2023 to 2033.

The aircraft battery market is experiencing substantial growth due to increasing demand for advanced aviation systems and the rising adoption of electric and hybrid-electric aircraft. These batteries are crucial for powering various aircraft systems, including emergency systems, backup power, and auxiliary power units. Technological advancements in battery chemistry, such as lithium-ion and solid-state batteries, are enhancing energy density, safety, and lifecycle, driving market expansion. Key players are focusing on R&D and strategic collaborations to innovate and meet stringent regulatory standards. The market is also influenced by the growing emphasis on reducing carbon emissions and improving fuel efficiency. North America and Europe are leading markets due to robust aerospace industries and significant investments in sustainable aviation technologies.

Aircraft Battery Market Value Chain Analysis

The aircraft battery market value chain encompasses several critical stages, starting with raw material suppliers who provide essential components like lithium, cobalt, and nickel. Manufacturers then process these materials to produce battery cells, which are assembled into modules and packs. These battery systems are integrated into aircraft by original equipment manufacturers (OEMs) and maintenance, repair, and overhaul (MRO) service providers. Distribution channels, including specialized suppliers and distributors, play a pivotal role in delivering batteries to end-users such as airlines and defense sectors. Additionally, regulatory bodies ensure compliance with safety and performance standards throughout the value chain. Continuous innovation and collaboration among stakeholders are vital for advancing battery technology, improving efficiency, and meeting the growing demands of the aerospace industry.

Aircraft Battery Market Opportunity Analysis

The aircraft battery market presents significant opportunities driven by the shift towards more electric and hybrid-electric aircraft, aimed at enhancing fuel efficiency and reducing emissions. Technological advancements, such as the development of high-energy-density lithium-ion and solid-state batteries, offer potential for longer flight durations and improved safety. The increasing demand for unmanned aerial vehicles (UAVs) and urban air mobility (UAM) solutions further expands market prospects. Additionally, the rise in air passenger traffic and the subsequent need for reliable backup power systems in commercial and military aircraft boost market growth. Strategic investments in R&D, along with collaborations between battery manufacturers and aerospace companies, are crucial to capitalizing on these opportunities, ensuring compliance with stringent safety regulations, and meeting evolving industry requirements.

Global Aircraft Battery Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 0.86 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.24% |

| 2033 Value Projection: | USD 1.73 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Battery Type, By Technology, By Region |

| Companies covered:: | Concorde Battery Corporation (US), Eaglepicher (US), Cella Engery (US), Enersys (US), Kokam (South Korea), Marvel Aero International (US), Mid-Continent Instruments and Avionics (US), GS Yuasa (Japan), Teledyne Battery Products (US), Saft Groupe SA (France), and other key companies. |

| Growth Drivers: | Growing usage of electric propulsion in the aviation sector |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Market Dynamics

Aircraft Battery Market Dynamics

Growing usage of electric propulsion in the aviation sector

The growing usage of electric propulsion in the aviation sector is significantly driving the aircraft battery market growth. Electric propulsion systems require advanced, high-capacity batteries to power aircraft efficiently, leading to increased demand for cutting-edge battery technologies like lithium-ion and solid-state batteries. These systems offer benefits such as reduced fuel consumption, lower emissions, and quieter operations, aligning with global sustainability goals and stringent regulatory standards. Innovations in battery chemistry and design are enhancing energy density, safety, and lifecycle, making electric propulsion more viable for various aircraft types, including commercial planes, urban air mobility (UAM) vehicles, and unmanned aerial vehicles (UAVs). This trend is fostering strategic collaborations and investments in the aviation battery market, propelling its expansion and technological evolution.

Restraints & Challenges

High initial costs and complex manufacturing processes of advanced battery technologies like lithium-ion and solid-state batteries present significant barriers. Safety concerns, particularly related to thermal runaway and fire hazards, necessitate stringent regulatory compliance and robust safety testing, increasing development time and costs. Limited energy density and long charging times also restrict the widespread adoption of electric propulsion systems. Additionally, the need for infrastructure development for battery maintenance and charging in airports adds to the logistical hurdles. Supply chain constraints, particularly for critical raw materials like lithium and cobalt, further complicate production and scalability.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Aircraft Battery Market from 2023 to 2033. The growth is driven by the region's strong aerospace industry and substantial investments in advanced aviation technologies. The presence of key aircraft manufacturers and battery technology companies fosters innovation and development. Increasing adoption of electric and hybrid-electric aircraft, aimed at enhancing fuel efficiency and reducing emissions, propels market demand. The region benefits from supportive government policies and funding for sustainable aviation initiatives. Additionally, the rising use of unmanned aerial vehicles (UAVs) and urban air mobility (UAM) solutions expands market opportunities. However, challenges such as stringent safety regulations and high development costs remain. Continuous advancements in battery technology and strategic partnerships are essential for maintaining North America's leadership in the global aircraft battery market.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Rapid urbanization and rising air passenger traffic are driving the demand for more efficient and environmentally friendly aviation solutions. Countries like China, Japan, and India are leading the market with substantial R&D initiatives and government support for sustainable aviation technologies. The burgeoning unmanned aerial vehicle (UAV) and urban air mobility (UAM) sectors further stimulate market expansion. However, the region faces challenges such as supply chain constraints for critical raw materials and stringent regulatory requirements. Overcoming these hurdles through technological advancements and international collaborations is crucial for capitalizing on the market's growth potential in Asia-Pacific.

Segmentation Analysis

Insights by Battery Type

The lead acid battery segment accounted for the largest market share over the forecast period 2023 to 2033. These batteries are widely used for starting, lighting, and ignition (SLI) functions, as well as for backup power in commercial and military aircraft. Technological improvements have enhanced the lifespan and efficiency of lead-acid batteries, making them a viable option despite the emergence of advanced alternatives like lithium-ion batteries. Their relatively lower cost and well-understood technology continue to attract airlines and aircraft manufacturers looking for dependable energy solutions. However, the segment faces competition from newer battery technologies that offer higher energy density and lighter weight, which are critical for modern aviation demands.

Insights by Technology

The traditional aircraft segment accounted for the largest market share over the forecast period 2023 to 2033. This segment encompasses commercial airliners, cargo planes, and military aircraft that rely on batteries for critical functions such as starting engines, emergency power, and auxiliary power units (APUs). With a focus on maintaining and upgrading existing aircraft, the need for dependable and efficient batteries remains high. Advancements in battery technology, including improved energy density and longer life cycles, support the performance and safety requirements of traditional aircraft. Despite the rise of electric and hybrid-electric aviation, traditional aircraft persist as a significant market, ensuring sustained demand for high-quality battery systems.

Recent Market Developments

- In September 2022, Saft, a Total Energies subsidiary, created an innovative high-energy density storage system (ESS) designed for time-shifting applications, easing the wider adoption of renewable energy sources with a low carbon impact.

Competitive Landscape

Major players in the market

- Concorde Battery Corporation (US)

- Eaglepicher (US)

- Cella Engery (US)

- Enersys (US)

- Kokam (South Korea)

- Marvel Aero International (US)

- Mid-Continent Instruments and Avionics (US)

- GS Yuasa (Japan)

- Teledyne Battery Products (US)

- Saft Groupe SA (France)

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aircraft Battery Market, Aircraft Type Analysis

- Lead Acid Battery

- Lithium Ion Battery

- Nickel-Cadmium Battery

- Others

Aircraft Battery Market, Technology Analysis

- Traditional Aircraft

- More Electric Aircraft

- Hybrid Aircraft

- Electric Aircraft

Aircraft Battery Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Aircraft Battery?The global Aircraft Battery Market is expected to grow from USD 0.86 billion in 2023 to USD 1.73 billion by 2033, at a CAGR of 7.24% during the forecast period 2023-2033.

-

2. Who are the key market players of the Aircraft Battery Market?Some of the key market players of the market are Concorde Battery Corporation (US), Eaglepicher (US), Cella Engery (US), Enersys (US), Kokam (South Korea), Marvel Aero International (US), Mid-Continent Instruments and Avionics (US), GS Yuasa (Japan), Teledyne Battery Products (US), and Saft Groupe SA (France).

-

3. Which segment holds the largest market share?The traditional aircraft segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Aircraft Battery market?The traditional aircraft segment holds the largest market share and is going to continue its dominance.

Need help to buy this report?