Global Aircraft Braking System Market Size, Share, and COVID-19 Impact Analysis, Component (Wheels, Brake Discs, Brake Housing, Valves, Actuators, Accumulator, Electronics), By End Use (OEM, Aftermarket), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Aircraft Braking System Market Insights Forecasts to 2033

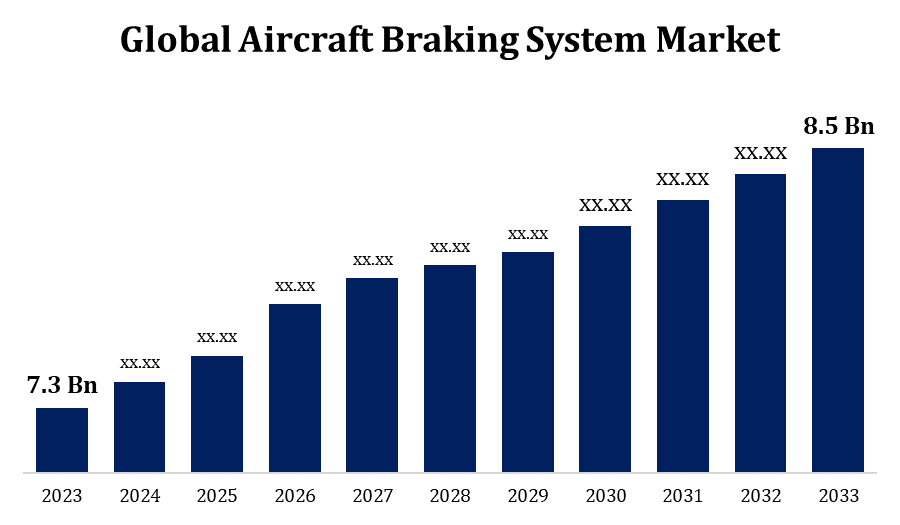

- The Aircraft Braking System Market Size was valued at USD 7.3 Billion in 2023.

- The Market is Growing at a CAGR of 1.53% from 2023 to 2033

- The Global Aircraft Braking System Market Size is expected to reach USD 8.5 Billion by 2033

- Asia Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Aircraft Braking System Market is expected to reach USD 8.5 billion by 2033, at a CAGR of 1.53% during the forecast period 2023 to 2033.

The aircraft braking system market is experiencing significant growth, driven by increasing air travel, advancements in aviation technology, and a rising demand for modern, efficient braking solutions. Key components of this market include wheels, brakes, and braking control systems, which are essential for safe aircraft operation. Innovations such as electric and carbon braking systems are gaining traction due to their enhanced performance and reduced weight. The market is further bolstered by the need for upgrades in existing aircraft and the expansion of the commercial and military aviation sectors. Major players are focusing on R&D to develop advanced braking technologies, aiming to improve safety, reliability, and cost-efficiency. This dynamic market is poised for continued expansion, propelled by the global increase in aircraft production and fleet modernization efforts.

Aircraft Braking System Market Value Chain Analysis

The aircraft braking system market value chain encompasses several critical stages, beginning with raw material suppliers who provide essential components such as metals, composites, and electronic parts. These materials are then utilized by manufacturers to produce braking system components, including wheels, brakes, and control systems. OEMs (Original Equipment Manufacturers) integrate these components into aircraft during assembly. The aftermarket segment plays a crucial role, involving maintenance, repair, and overhaul (MRO) services to ensure system reliability and safety throughout the aircraft's lifespan. Distribution channels, including direct sales and third-party distributors, facilitate the delivery of braking systems to various end-users, such as commercial airlines and military operators. This value chain is characterized by collaboration among suppliers, manufacturers, OEMs, and service providers to maintain high standards of quality and performance.

Aircraft Braking System Market Opportunity Analysis

The aircraft braking system market presents substantial growth opportunities driven by the expanding global aviation industry and increasing air traffic. The shift towards lightweight and fuel-efficient aircraft propels the demand for advanced braking systems like carbon and electric brakes, which offer enhanced performance and efficiency. Emerging markets in Asia-Pacific and the Middle East, with rising investments in aviation infrastructure and new airline establishments, provide lucrative prospects. Additionally, the growing focus on aircraft safety and stringent regulatory standards necessitate regular upgrades and maintenance, fostering a robust aftermarket segment. Technological advancements, such as automated braking systems and predictive maintenance, further open avenues for innovation. Collaborations between key industry players and continuous R&D efforts are crucial in capitalizing on these opportunities and addressing evolving market needs.

Global Aircraft Braking System Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 7.3 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 1.53% |

| 2033 Value Projection: | USD 8.5 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By End Use, By Region |

| Companies covered:: | AAR Corp, Beringer Aero, Collins Aerospace, Crane Co., Honeywell International Inc., Lufthansa Technik AG, Meggitt PLC, Parker-Hannifin Corporation, Parker Hannifin Corp, Safran, The Carlyle Johnson Machine Company, and other key companies. |

| Growth Drivers: | Technological advancements in brake components |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Market Dynamics

Aircraft Braking System Market Dynamics

Technological advancements in brake components

Technological advancements in the aircraft braking system market are revolutionizing brake components, enhancing performance, safety, and efficiency. Innovations include the development of carbon composite brakes, which offer superior heat dissipation, longer lifespan, and reduced weight compared to traditional steel brakes. Electric braking systems are gaining traction, providing more precise control and faster response times while eliminating the need for hydraulic fluid, thus reducing maintenance requirements. The integration of advanced materials and smart sensors enables real-time monitoring and predictive maintenance, improving reliability and reducing downtime. Additionally, advancements in anti-skid and automated braking systems enhance aircraft safety during landing and ground operations.

Restraints & Challenges

The aircraft braking system market faces several challenges, including the high cost of advanced braking technologies such as carbon composite and electric brakes, which can limit their adoption, especially among smaller airlines and emerging markets. Regulatory compliance and stringent safety standards necessitate rigorous testing and certification processes, which can be time-consuming and costly. The industry also grapples with the need for continuous innovation to keep pace with advancements in aircraft design and performance. Additionally, the market must address issues related to the maintenance and durability of braking systems, ensuring they can withstand extreme operating conditions and frequent use. Supply chain disruptions and fluctuations in raw material prices further complicate the market landscape, requiring manufacturers to develop resilient and adaptable strategies.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Aircraft Braking System Market from 2023 to 2033. The North American aircraft braking system market is a key region, driven by the presence of major aircraft manufacturers like Boeing and extensive airline networks. The region benefits from robust investments in aviation infrastructure and significant R&D activities aimed at developing advanced braking technologies. High air traffic volumes and the demand for efficient, lightweight, and reliable braking systems propel market growth. Additionally, stringent safety regulations and standards necessitate the continuous upgrade and maintenance of braking systems, fostering a strong aftermarket segment. The military aviation sector also contributes to market demand, with ongoing modernization programs and fleet expansions.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Emerging economies like China and India are investing heavily in aviation infrastructure, spurring the need for advanced braking systems. The region's burgeoning commercial aviation sector, along with significant growth in low-cost carriers, contributes to market expansion. Technological advancements and partnerships between local and global manufacturers enhance the development of innovative braking solutions, such as carbon and electric brakes. The growing military aviation segment, with numerous modernization programs, also fuels market demand. Despite challenges like regulatory compliance and high initial costs, the Asia-Pacific market presents substantial opportunities for growth, supported by continuous investments and an expanding aerospace industry.

Segmentation Analysis

Insights by Component

The actuators segment accounted for the largest market share over the forecast period 2023 to 2033. Electric actuators are increasingly preferred over traditional hydraulic ones for their superior control, faster response times, and reduced maintenance requirements. These actuators enhance the performance of modern braking systems, including carbon and electric brakes, by providing precise modulation and reliability. The rise in production of next-generation aircraft and the trend towards more electric aircraft (MEA) further drive this segment's growth. Additionally, the emphasis on reducing aircraft weight and improving fuel efficiency contributes to the increasing adoption of advanced actuators. Continuous R&D and technological innovation are essential to meeting the evolving needs of the aviation industry, thereby propelling the actuators segment forward.

Insights by End Use

The OEM segment accounted for the largest market share over the forecast period 2023 to 2033. The OEM segment in the aircraft brakes market is experiencing significant growth, driven by the rising production rates of commercial and military aircraft. Leading aircraft manufacturers are increasingly incorporating advanced braking systems, such as carbon composite and electric brakes, to enhance performance, safety, and efficiency. Technological innovations and a focus on lightweight, fuel-efficient aircraft further propel demand for sophisticated braking solutions from OEMs. The expansion of global air travel and the introduction of new aircraft models by key players like Boeing and Airbus contribute to this growth.

Recent Market Developments

- In August 2022, RUAG Australia has secured an agreement with Honeywell International Inc. to become an Authorised Service Centre for the F-35 Joint Strike Fighter Wheels and Brakes programme in Asia Pacific.

Competitive Landscape

Major players in the market

- AAR Corp

- Beringer Aero

- Collins Aerospace

- Crane Co.

- Honeywell International Inc.

- Lufthansa Technik AG

- Meggitt PLC

- Parker-Hannifin Corporation

- Parker Hannifin Corp

- Safran

- The Carlyle Johnson Machine Company

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aircraft Braking System Market, Component Analysis

- Wheels

- Brake Discs

- Brake Housing

- Valves

- Actuators

- Accumulator

- Electronics

Aircraft Braking System Market, End Use Analysis

- OEM

- Aftermarket

Aircraft Braking System Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Aircraft Braking System?The global Aircraft Braking System Market is expected to grow from USD 7.3 billion in 2023 to USD 8.5 billion by 2033, at a CAGR of 1.53% during the forecast period 2023-2033.

-

2. Who are the key market players of the Aircraft Braking System Market?Some of the key market players of the market are AAR Corp, Beringer Aero, Collins Aerospace, Crane Co., Honeywell International Inc., Lufthansa Technik AG, Meggitt PLC, Parker-Hannifin Corporation, Parker Hannifin Corp, Safran, and The Carlyle Johnson Machine Company.

-

3. Which segment holds the largest market share?The OEM segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Aircraft Braking System market?North America dominates the Aircraft Braking System market and has the highest market share.

Need help to buy this report?