Global Aircraft Cabin Comfort System Market Size, Share, and COVID-19 Impact Analysis, By Component (Seats, Cabin Lighting, Windows & Windshield, Galley & Lavatory, In-Flight Entertainment & Connectivity, Stowage Bins, and Interior Panels), By End-user (OEM and After Market), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Aircraft Cabin Comfort System Market Insights Forecasts to 2033

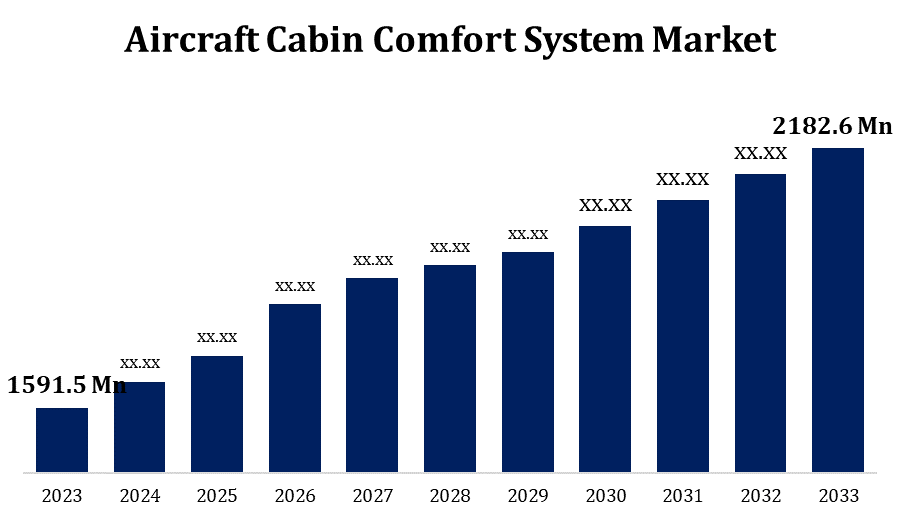

- The Global Aircraft Cabin Comfort System Market Size was valued at USD 1591.5 Million in 2023

- The Market Size is Growing at a CAGR of 3.21% from 2023 to 2033

- The Worldwide Aircraft Cabin Comfort System Market is expected to reach USD 2182.6 Million by 2033

- Asia Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Aircraft Cabin Comfort System Market is expected to reach USD 2182.6 Million by 2033, at a CAGR of 3.21% during the forecast period 2023 to 2033.

The Aircraft Cabin Comfort System Market is experiencing robust growth, driven by increasing air passenger traffic, demand for enhanced passenger comfort, and technological advancements in cabin components. Airlines are investing heavily in upgrading cabin interiors to improve customer satisfaction and loyalty. Key trends include the adoption of lightweight materials, innovative seating solutions, and advanced in-flight entertainment systems. The market is also witnessing a surge in demand for premium economy and business class segments, reflecting changing passenger preferences. Major players are focusing on sustainability, integrating eco-friendly materials and energy-efficient systems. Regional growth is notable in Asia-Pacific due to rising disposable incomes and expanding airline fleets. Overall, the market is poised for sustained expansion, supported by continuous innovation and evolving consumer expectations.

Aircraft Cabin Comfort System Market Value Chain Analysis

The Aircraft Cabin Comfort System market value chain encompasses several key stages, starting with raw material suppliers who provide essential inputs like composites, fabrics, and metals. These materials are then procured by component manufacturers who produce items such as seats, galleys, lavatories, and in-flight entertainment systems. Subsequently, these components are assembled by original equipment manufacturers (OEMs) or specialized interior integrators. The assembled interiors are installed in aircraft during manufacturing or retrofitting processes. Airlines, as end-users, play a crucial role in specifying design and comfort requirements to cater to passenger needs. Throughout this chain, collaboration and coordination are vital to ensure compliance with stringent safety and quality standards. Additionally, aftermarket services, including maintenance and upgrades, further extend the value chain, emphasizing the importance of continuous improvement and innovation.

Aircraft Cabin Comfort System Market Opportunity Analysis

The Aircraft Cabin Comfort System market presents significant opportunities driven by evolving passenger expectations for comfort, connectivity, and personalization. Airlines are increasingly seeking to differentiate themselves through premium cabin designs and enhanced in-flight experiences. The rise in global air travel, particularly in emerging markets, amplifies the demand for new and retrofitted aircraft interiors. Advancements in technology, such as smart seats and immersive entertainment systems, offer opportunities for innovation. Additionally, the push towards sustainability opens avenues for eco-friendly materials and energy-efficient solutions. The growth of budget airlines and the expanding middle class further boost demand for cost-effective yet comfortable interiors. Overall, the market is ripe for companies that can deliver cutting-edge, customizable, and sustainable cabin solutions to meet the diverse needs of modern air travelers.

Global Aircraft Cabin Comfort System Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1591.5 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.21% |

| 2033 Value Projection: | USD 2182.6 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Component, By End-user, By Region |

| Companies covered:: | Safran S.A., Acro Aircraft Seating Ltd., Raytheon Technologies Corporation, Aviointeriors S.p.A., Thales Group, Hong Kong Aircraft Engineering Company Limited, GAL Aerospace, Diehl Stiftung & Co. KG, Astronics Corporation, Jamco Corporation, and other key companies. |

| Growth Drivers: | Rising demand for long-distance flights and regional aviation transport will support market growth |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Market Dynamics

Aircraft Cabin Comfort System Market Dynamics

Rising demand for long-distance flights and regional aviation transport will support market growth

The rising demand for long-distance flights and regional aviation transport is a key driver of growth in the Aircraft Cabin Comfort System market. As global travel increases, particularly for international business and leisure, airlines are focusing on enhancing passenger comfort and experience on long-haul flights. This includes investing in advanced seating, improved in-flight entertainment, and more spacious cabin layouts. Additionally, the expansion of regional aviation networks in emerging markets drives demand for modern, efficient, and comfortable interiors in smaller aircraft. Airlines are seeking to provide a consistent and high-quality passenger experience across both long-haul and regional routes. Consequently, the market for Aircraft Cabin Comfort Systems is set to grow, driven by these dual trends of long-distance and regional travel expansion.

Restraints & Challenges

High costs associated with advanced materials and technologies can deter airlines from frequent upgrades, especially in a cost-sensitive industry. Stringent safety and regulatory requirements necessitate extensive testing and certification, prolonging development timelines and increasing expenses. Additionally, the need for lightweight yet durable materials to enhance fuel efficiency presents technical challenges. Rapid technological advancements can also lead to obsolescence, pressuring manufacturers to continuously innovate. The market's dependency on the overall health of the aviation industry makes it vulnerable to economic downturns and fluctuations in passenger demand.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Aircraft Cabin Comfort System Market from 2023 to 2033. The United States, being home to leading companies like Boeing, plays a pivotal role in market development. Airlines in North America are heavily investing in upgrading cabin interiors to enhance passenger comfort and stay competitive. This includes innovations in seating, in-flight entertainment, and connectivity solutions. Additionally, there is a growing focus on sustainability, with airlines adopting eco-friendly materials and energy-efficient technologies. The region's mature aviation infrastructure, high passenger expectations, and strong economic conditions further support market growth, making North America a key player in the global Aircraft Cabin Comfort System industry.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Airlines in the region are investing heavily in modernizing their fleets with advanced cabin interiors to enhance passenger comfort and differentiate themselves in a competitive market. Innovations in seating, in-flight entertainment, and connectivity are particularly in demand. The regional focus on both premium and budget travel segments further stimulates market growth. Additionally, Asia-Pacific's strategic importance in global aviation and the presence of major aircraft manufacturers and suppliers make it a vital and dynamic market for Aircraft Cabin Comfort Systems.

Segmentation Analysis

Insights by Component

The seats segment accounted for the largest market share over the forecast period 2023 to 2033. Airlines are investing in advanced seating solutions that offer enhanced ergonomics, more legroom, and improved reclining features, catering to passenger demands for greater comfort, especially on long-haul flights. Innovations such as lightweight materials, modular designs, and smart seat technologies that offer personalized in-flight entertainment and connectivity options are also driving this growth. Additionally, the rise in premium economy and business class travel is fueling demand for luxurious and customizable seating options.

Insights by End Use

The OEM segment accounted for the largest market share over the forecast period 2023 to 2033. OEMs are focusing on integrating lightweight, durable materials and cutting-edge technologies to enhance passenger comfort and operational efficiency. Collaboration with suppliers and interior specialists allows OEMs to offer innovative and tailor-made interior solutions. Additionally, the growing emphasis on sustainability and regulatory compliance propels OEMs to adopt eco-friendly materials and energy-efficient designs. This dynamic environment fosters continuous innovation and strengthens the growth of the OEM segment in the Aircraft Cabin Comfort Systems market.

Recent Market Developments

- In October 2022, Singapore Airlines has unveiled its next-generation cabin interiors for first, business, and economy classes. To ensure optimal comfort, airlines now offer entirely flat beds, fine food, and luxury in-flight shower suites. Airlines have recently added the largest full-flat seat while also improving storage, functionality, and features.

Competitive Landscape

Major players in the market

- Safran S.A.

- Acro Aircraft Seating Ltd.

- Raytheon Technologies Corporation

- Aviointeriors S.p.A.

- Thales Group

- Hong Kong Aircraft Engineering Company Limited

- GAL Aerospace

- Diehl Stiftung & Co. KG

- Astronics Corporation

- Jamco Corporation

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aircraft Cabin Comfort System Market, Component Analysis

- Seats

- Cabin Lighting

- Windows & Windshield

- Galley & Lavatory

- In-Flight Entertainment & Connectivity

- Stowage Bins

- Interior Panels

Aircraft Cabin Comfort System Market, End Use Analysis

- OEM

- Aftermarket

Aircraft Cabin Comfort System Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Aircraft Cabin Comfort System?The global Aircraft Cabin Comfort System Market is expected to grow from USD 1591.5 million in 2023 to USD 2182.6 million by 2033, at a CAGR of 3.21% during the forecast period 2023-2033.

-

2. Who are the key market players of the Aircraft Cabin Comfort System Market?Some of the key market players of the market are Safran S.A., Acro Aircraft Seating Ltd., Raytheon Technologies Corporation, Aviointeriors S.p.A., Thales Group, Hong Kong Aircraft Engineering Company Limited, GAL Aerospace, Diehl Stiftung & Co. KG, Astronics Corporation, Jamco Corporation.

-

3. Which segment holds the largest market share?The OEM segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Aircraft Cabin Comfort System market?North America dominates the Aircraft Cabin Comfort System market and has the highest market share.

Need help to buy this report?