Global Aircraft Cabin Lighting Market Size, Share, and COVID-19 Impact Analysis, By Light Type (Reading Lights, Ceiling & Wall, Signage, Floor Path Lighting, and Lavatory Lights), Elements (Light Source, Electronics, Software Systems, Assembly, and Others), Aircraft Type (Narrow Body, Wide Body, and Very Large Aircraft), End User (OEM and Aftermarket), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Aircraft Cabin Lighting Market Insights Forecasts to 2033

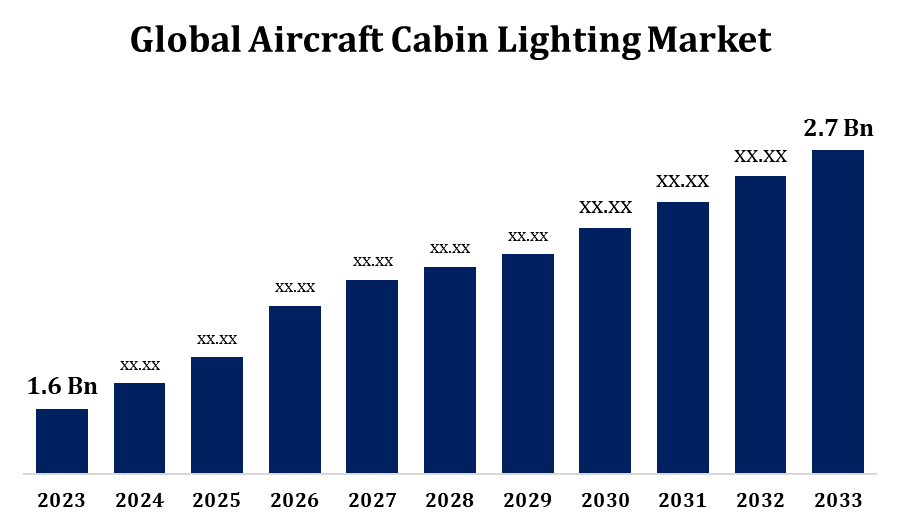

- The Global Aircraft Cabin Lighting Market Size was valued at USD 1.6 Billion in 2023.

- The Market Size is Growing at a CAGR of 5.37% from 2023 to 2033

- The Worldwide Aircraft Cabin Lighting Market Size is expected to reach USD 2.7 Billion by 2033

- Asia Pacific is expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Aircraft Cabin Lighting Market Size is expected to reach USD 2.7 Billion by 2033, at a CAGR of 5.37% during the forecast period 2023 to 2033.

The aircraft cabin lighting market is experiencing substantial growth, driven by advancements in LED and OLED technologies that enhance passenger experience through improved aesthetics and functionality. Airlines are increasingly investing in advanced lighting systems to create comfortable and visually appealing cabin environments, contributing to passenger well-being and satisfaction. The market is further propelled by the rising demand for energy-efficient solutions and the integration of smart lighting systems that offer customizable and adaptive lighting scenarios. Additionally, the expansion of the aviation industry, particularly in emerging markets, is boosting the demand for modern aircraft equipped with state-of-the-art cabin lighting. Key players are focusing on innovative product developments and strategic partnerships to gain a competitive edge in this dynamic market.

Aircraft Cabin Lighting Market Value Chain Analysis

The aircraft cabin lighting market value chain encompasses several key stages, starting with the sourcing of raw materials such as LEDs, OLEDs, and electronic components. These materials are then utilized by manufacturers to produce lighting systems tailored for various aircraft models. The production process involves design, engineering, and rigorous testing to ensure compliance with stringent aviation standards. Manufacturers often collaborate with suppliers, airlines, and aircraft OEMs to integrate lighting solutions seamlessly. Distributors and suppliers play a crucial role in delivering these systems to airlines and maintenance providers. Installation and after-sales services, including maintenance and upgrades, are critical to ensuring optimal performance and longevity of the lighting systems. This interconnected value chain underscores the importance of collaboration and innovation across all stages to meet the evolving needs of the aviation industry.

Aircraft Cabin Lighting Market Opportunity Analysis

The aircraft cabin lighting market presents significant opportunities driven by increasing passenger demand for enhanced in-flight experiences and the aviation industry's shift towards more sustainable solutions. Innovations in LED and OLED technologies offer airlines the chance to reduce energy consumption and maintenance costs while providing customizable lighting environments that enhance comfort and safety. The growing adoption of smart lighting systems, capable of adjusting to various flight phases and passenger activities, also presents lucrative prospects. Additionally, the expansion of the aviation sector in emerging markets is creating a substantial demand for modernized aircraft, further boosting the market. Collaborations between lighting manufacturers and airlines to develop tailored solutions and the rising trend of retrofitting existing fleets with advanced lighting systems offer considerable growth potential.

Global Aircraft Cabin Lighting Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.6 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 5.37% |

| 2033 Value Projection: | USD 2.7 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 234 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Light Type, Elements, Aircraft Type, End User, and By Region. |

| Companies covered:: | Astronics (US), Cobham (US), Honeywell (US), Luminator Technology Group (US), Collins Aerospace (US), Soderberg Manufacturing Company (US), Diehl Stiftung (Germany), Oxley Group (UK), STG Aerospace (UK), and Others |

| Growth Drivers: | Increased demand for aircraft cabin lighting in the aviation industry |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Aircraft Cabin Lighting Market Dynamics

Increased demand for aircraft cabin lighting in the aviation industry

Airlines are increasingly prioritizing passenger comfort and experience, leading to a surge in the adoption of advanced lighting solutions. Enhanced cabin lighting not only improves aesthetics but also contributes to passenger well-being by offering features like mood lighting, which can reduce jet lag and create a more relaxing environment. Additionally, advancements in energy-efficient LED and OLED technologies are appealing to airlines looking to reduce operational costs and environmental impact. The continuous expansion of both commercial and private aviation sectors, coupled with rising retrofitting activities for existing fleets, further propels the market. These factors collectively highlight the critical role of innovative cabin lighting in the evolving aviation landscape.

Restraints & Challenges

High initial costs associated with advanced lighting systems, such as LED and OLED technologies, can be a significant barrier for airlines, particularly smaller carriers with limited budgets. The stringent regulatory standards and certification requirements in the aviation industry add to the complexity and cost of developing and implementing new lighting solutions. Additionally, the integration of sophisticated lighting systems with existing aircraft infrastructure poses technical challenges and requires specialized skills. The market also contends with fluctuating raw material prices, which can affect manufacturing costs and profit margins.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Aircraft Cabin Lighting Market from 2023 to 2033. Major airlines in the United States and Canada are investing in innovative lighting technologies to enhance in-flight experience, focusing on energy-efficient LED and OLED systems. The presence of leading aircraft manufacturers and lighting solution providers in the region fosters continuous technological advancements and product developments. Additionally, North America's emphasis on upgrading existing fleets and the rising trend of premium air travel contribute to market growth. The region's well-established regulatory framework ensures high standards of safety and quality, further supporting the adoption of state-of-the-art cabin lighting systems. Overall, North America remains a key market for cabin lighting advancements and innovations.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Emerging economies are witnessing a surge in both domestic and international flights, leading airlines to invest in advanced cabin lighting to enhance passenger experience. The region's growing middle-class population and rising disposable incomes are also contributing to higher expectations for in-flight comfort and amenities. Additionally, numerous airlines in Asia Pacific are modernizing their fleets with energy-efficient LED and OLED lighting systems to reduce operational costs and environmental impact. Collaborations between local manufacturers and global technology providers are fostering innovation and tailored solutions. Overall, Asia Pacific presents significant opportunities for growth and development in the aircraft cabin lighting market.

Segmentation Analysis

Insights by Light Type

The reading lights segment accounted for the largest market share over the forecast period 2023 to 2033. Airlines are prioritizing the installation of advanced, adjustable reading lights to enhance passenger comfort and convenience, catering to individual preferences for activities like reading, working, or relaxing. Technological advancements in LED and OLED lighting enable energy-efficient solutions with better illumination and reduced glare, further enhancing user experience. Additionally, the integration of smart lighting systems that allow passengers to control their reading lights via personal devices is gaining traction. The rising trend of premium seating classes and enhanced cabin amenities also supports the growth of this segment. Overall, the focus on passenger-centric innovations is propelling the demand for sophisticated reading lights in aircraft cabins.

Insights by Element

The software systems segment accounted for the largest market share over the forecast period 2023 to 2033. Airlines are adopting advanced software solutions that enable dynamic control of cabin lighting, allowing for customizable lighting scenarios tailored to different flight phases and passenger activities. These systems offer features such as mood lighting, synchronized with in-flight entertainment, and personalized lighting settings, enhancing the overall passenger experience. The rise of the Internet of Things (IoT) and wireless connectivity in aircraft further supports this trend, enabling seamless interaction between lighting systems and passengers' personal devices. Additionally, the push for energy efficiency and sustainability in aviation drives the adoption of software-driven lighting management, optimizing energy use and reducing operational costs.

Insights by Aircraft Type

The narrow body segment accounted for the largest market share over the forecast period 2023 to 2033. The growth is driven by the increasing demand for fuel-efficient and cost-effective aircraft in both domestic and short-haul international routes. Airlines are prioritizing the enhancement of passenger experience in narrow-body aircraft, leading to greater investment in advanced cabin lighting solutions. The adoption of LED and OLED technologies in these aircraft provides energy efficiency, reduced maintenance costs, and improved lighting quality. Additionally, the trend towards high-density seating and maximizing cabin space necessitates innovative lighting designs that enhance comfort and aesthetics. The continuous expansion of low-cost carriers, particularly in emerging markets, further propels the demand for modern narrow-body aircraft equipped with state-of-the-art lighting systems. This focus on efficiency and passenger satisfaction drives significant growth in this market segment.

Insights by End User

The OEM segment accounted for the largest market share over the forecast period 2023 to 2033. Aircraft manufacturers are incorporating state-of-the-art lighting systems, including LED and OLED technologies, to enhance cabin aesthetics, comfort, and functionality right from the production stage. This trend is fueled by the demand for improved passenger experiences and energy-efficient solutions that reduce operational costs. The rise in new aircraft orders, especially from airlines seeking to modernize their fleets, is a key factor contributing to this growth. Additionally, collaborations between OEMs and lighting technology providers are fostering innovation and customization, ensuring that lighting systems meet the specific needs of different aircraft models and airline preferences.

Recent Market Developments

- In January 2022, Diehl Stiftung & Co. KG has signed an agreement with Boeing to supply interior components for Boeing aircraft. Diehl Aviation was contracted to perform cabin installation services on Boeing aircraft, including monuments and light bars.

Competitive Landscape

Major players in the market

- Astronics (US)

- Cobham (US)

- Honeywell (US)

- Luminator Technology Group (US)

- Collins Aerospace (US)

- Soderberg Manufacturing Company (US)

- Diehl Stiftung (Germany)

- Oxley Group (UK)

- STG Aerospace (UK)

- Others

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aircraft Cabin Lighting Market, Light Type Analysis

- Reading Lights

- Ceiling & Wall

- Signage

- Floor Path Lighting

- Lavatory Light

Aircraft Cabin Lighting Market, Elements Analysis

- Light Source

- Electronics

- Software Systems

- Assembly

- Others

Aircraft Cabin Lighting Market, Aircraft Type Analysis

- Narrow Body

- Wide Body

- Very Large Aircraft

Aircraft Cabin Lighting Market, End Use Analysis

- OEM

- Aftermarket

Aircraft Cabin Lighting Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Aircraft Cabin Lighting?The global Aircraft Cabin Lighting Market is expected to grow from USD 1.6 billion in 2023 to USD 2.7 billion by 2033, at a CAGR of 5.37% during the forecast period 2023-2033.

-

2. Who are the key market players of the Aircraft Cabin Lighting Market?Some of the key market players of the market are Astronics (US), Cobham (US), Honeywell (US), Luminator Technology Group (US), Collins Aerospace (US), Soderberg Manufacturing Company (US), Diehl Stiftung (Germany), Oxley Group (UK), and STG Aerospace (UK).

-

3. Which segment holds the largest market share?The OEM segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Aircraft Cabin Lighting market?North America dominates the Aircraft Cabin Lighting market and has the highest market share.

Need help to buy this report?