Global Aircraft Cameras Market Size, Share, and COVID-19 Impact Analysis, by Application (Commercial Aircraft and Military Aircraft), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Aircraft Cameras Market Insights Forecasts to 2033

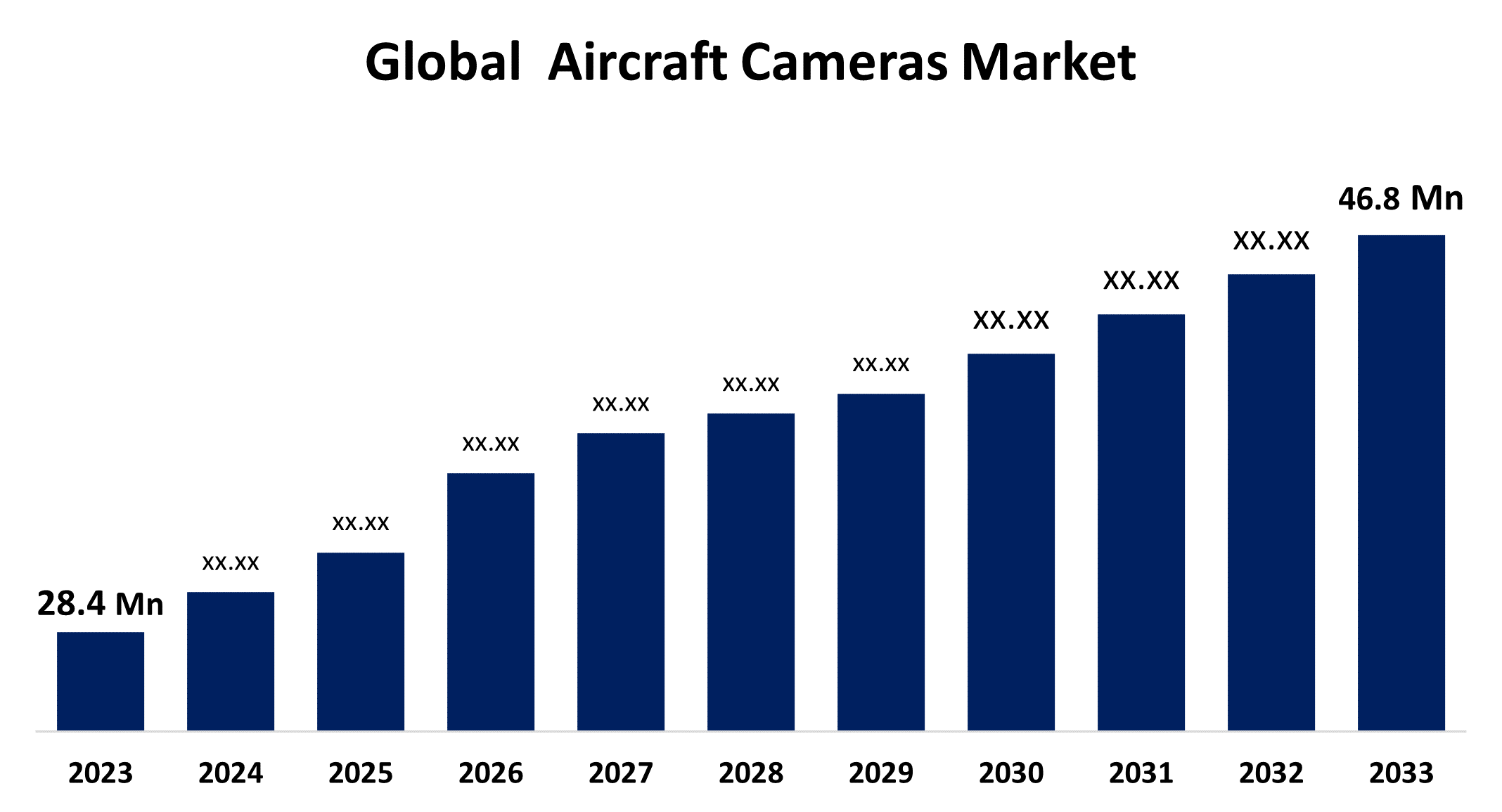

- The Aircraft Cameras Market Size was valued at USD 28.4 million in 2023.

- The Market Size is Growing at a CAGR of 5.12% from 2023 to 2033.

- The Worldwide Aircraft Cameras Market is expected to reach USD 46.8 million by 2033.

- Asia Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Aircraft Cameras Market is expected to reach USD 46.8 million by 2033, at a CAGR of 5.12% during the forecast period 2023 to 2033.

The aircraft cameras market is experiencing steady growth due to increasing demand for enhanced in-flight safety, monitoring, and entertainment systems. These cameras are widely integrated into commercial, military, and business aircraft for surveillance, security, and passenger experience improvement. Advanced technologies, such as HD and 4K cameras, are being adopted to provide real-time monitoring and data collection for maintenance and safety purposes. Moreover, growing air travel and the rising focus on aircraft modernization are key factors driving market expansion. The surge in demand for unmanned aerial vehicles (UAVs) equipped with high-tech cameras further fuels this growth. Leading manufacturers are focusing on innovation and developing compact, lightweight camera systems to meet industry demands. North America and Europe are dominant regions, while Asia-Pacific shows significant growth potential.

Aircraft Cameras Market Value Chain Analysis

The aircraft cameras market value chain involves several key stages, from raw material suppliers to end users. It begins with the supply of materials like lenses, sensors, and electronic components by specialized manufacturers. These materials are then used by camera system manufacturers who design, develop, and assemble advanced camera systems for aircraft. The next stage includes the integration of these systems by aircraft manufacturers and system integrators, ensuring that the cameras meet regulatory standards and functional requirements. These integrated camera systems are supplied to airlines, defense agencies, and private aircraft owners for purposes like surveillance, monitoring, and navigation. Finally, after-sales services, including maintenance, upgrades, and technical support, are offered by service providers to ensure long-term functionality. This value chain supports continuous innovation and regulatory compliance across the industry.

Aircraft Cameras Market Opportunity Analysis

The aircraft cameras market presents significant growth opportunities driven by advancements in aviation technology, safety requirements, and demand for enhanced passenger experiences. Increasing adoption of next-generation aircraft and unmanned aerial vehicles (UAVs) in both commercial and defense sectors boosts the need for high-definition cameras for navigation, surveillance, and monitoring. Growing safety regulations, such as cockpit and cabin monitoring systems, also contribute to the market expansion. Furthermore, innovations in artificial intelligence and data analytics create new possibilities for real-time monitoring and predictive maintenance using aircraft cameras. The rise of smart airports and the integration of cameras in air traffic control and ground handling systems further expand the market. Emerging markets, particularly in Asia-Pacific, are expected to provide significant growth potential as air travel increases.

Global Aircraft Cameras Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 28.4 million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.12% |

| 2033 Value Projection: | USD 46.8 million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 223 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Application, By Region |

| Companies covered:: | A.S. Avionics Services S/A, AD Aerospace Ltd., Cabin Avionics Ltd., Collins Aerospace (Raytheon Technologies Corporation), Eirtech Aviation Services, Global ePoint Inc., Groupe Latécoère, Kappa Optronics Gmbh, KID-Systeme GmbH, Meggitt Plc, Otonomy Aviation, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Aircraft Cameras Market Dynamics

Rising passenger traffic is driving the demand for commercial aircraft

Rising passenger traffic globally is fueling the demand for commercial aircraft, which in turn drives the growth of the aircraft cameras market. As airlines expand their fleets to accommodate increasing travel demand, they are incorporating advanced camera systems to enhance safety, security, and passenger experience. These cameras are used for cockpit monitoring, cabin surveillance, external views during taxiing, and navigation assistance. Additionally, the push for improved operational efficiency and real-time monitoring in commercial aviation is boosting the adoption of high-definition cameras. Emerging economies, particularly in Asia-Pacific and the Middle East, are experiencing rapid air traffic growth, leading to more orders for commercial aircraft and, subsequently, aircraft camera systems. This trend is expected to accelerate as global air travel continues to recover and expand post-pandemic.

Restraints & Challenges

High development and installation costs of advanced camera systems, coupled with the complex integration processes in aircraft, can limit widespread adoption, especially among cost-sensitive airlines. Stringent regulatory standards in aviation, including safety certifications, add to the complexities and time required to bring new technologies to market. Additionally, the industry must address cybersecurity concerns, as connected camera systems may be vulnerable to hacking, posing risks to aircraft security. The reliance on advanced sensors and electronics also exposes the market to supply chain disruptions, such as component shortages, which can affect production timelines. Furthermore, fluctuating fuel prices and economic uncertainties in global aviation may slow down aircraft procurement, reducing the demand for new camera systems.

Regional Forecasts

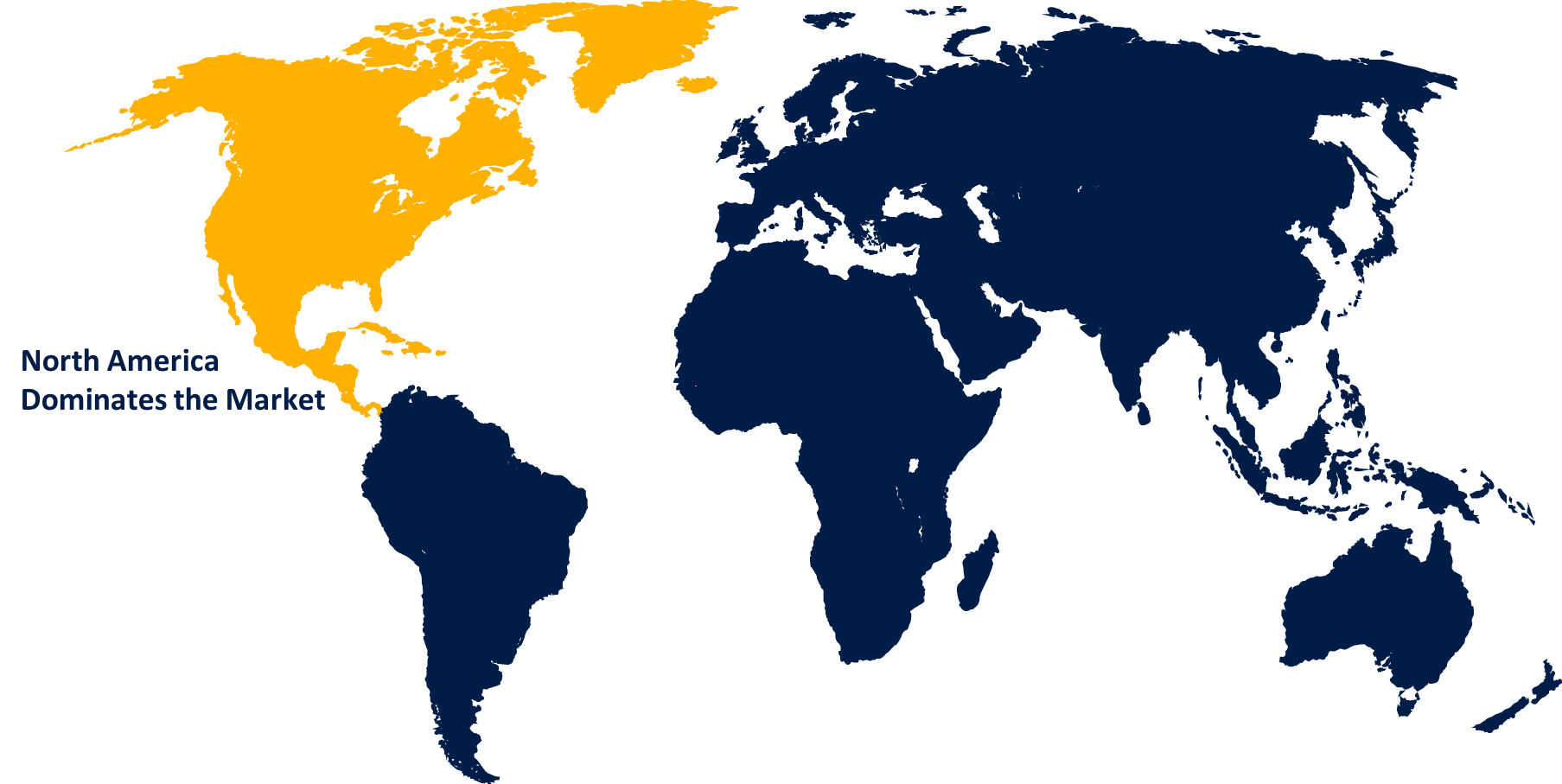

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Aircraft Cameras Market from 2023 to 2033. The region’s demand for advanced camera systems is fueled by high investments in next-generation aircraft, particularly for commercial, defense, and private aviation. The U.S. military’s focus on surveillance and reconnaissance aircraft also boosts the adoption of high-performance camera systems. Additionally, the Federal Aviation Administration (FAA) mandates stringent safety and security regulations, prompting airlines and aircraft manufacturers to integrate sophisticated cockpit and external monitoring cameras. Growing passenger traffic and the need for enhanced in-flight experiences further contribute to market growth. North America’s strong research and development capabilities drive continuous innovation in aircraft camera technologies, ensuring the region’s market leadership.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Developing countries are investing heavily in both commercial and defense aviation, leading to a rising demand for advanced camera systems for surveillance, navigation, and safety. As major airlines expand their fleets, they are adopting state-of-the-art aircraft cameras to enhance operational efficiency, improve passenger experience, and comply with strict safety regulations. Additionally, the growth of low-cost carriers and regional airlines in Southeast Asia is contributing to increased aircraft orders, further driving demand for camera systems. Government initiatives and infrastructure developments, such as smart airports and modernized air traffic control, also support the aircraft cameras market in this region.

Segmentation Analysis

Insights by Application

The military aircraft segment accounted for the largest market share over the forecast period 2023 to 2033. Military forces worldwide are adopting advanced camera systems for various applications, including surveillance, reconnaissance, intelligence gathering, and targeting. These high-performance cameras, integrated into unmanned aerial vehicles (UAVs), fighter jets, and transport aircraft, provide real-time situational awareness, enhancing mission effectiveness. Rising geopolitical tensions and the need for modernized defense capabilities are prompting investments in cutting-edge camera technologies. Additionally, the development of next-generation aircraft with stealth capabilities and improved avionics is fueling demand for sophisticated camera systems. The U.S., China, and Russia are leading the charge in adopting these systems, driving growth in the military aircraft segment of the global aircraft cameras market.

Recent Market Developments

- In September 2023, the UK Ministry of Defence (MoD) has awarded BAE Systems PLC a contract to further develop the Striker II helmet-mounted display (HMD) for the Eurofighter Typhoon FGR4 combat aircraft. The Striker II HMD includes an outer assembly equipped with a day/night camera.

Competitive Landscape

Major players in the market

- A.S. Avionics Services S/A

- AD Aerospace Ltd.

- Cabin Avionics Ltd.

- Collins Aerospace (Raytheon Technologies Corporation)

- Eirtech Aviation Services

- Global ePoint Inc.

- Groupe Latécoère

- Kappa Optronics Gmbh

- KID-Systeme GmbH

- Meggitt Plc

- Otonomy Aviation

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aircraft Cameras Market, Application Analysis

- Commercial Aircraft

- Military Aircraft

Aircraft Cameras Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the market size of the Aircraft Cameras Market?The global Aircraft Cameras Market is expected to grow from USD 28.4 million in 2023 to USD 46.8 million by 2033, at a CAGR of 5.12% during the forecast period 2023-2033.

-

2. Who are the key market players of the Aircraft Cameras Market?Some of the key market players of the market are A.S. Avionics Services S/A, AD Aerospace Ltd., Cabin Avionics Ltd., Collins Aerospace (Raytheon Technologies Corporation), Eirtech Aviation Services, Global ePoint Inc., Groupe Latécoère, Kappa Optronics Gmbh, KID-Systeme GmbH, Meggitt Plc. and Otonomy Aviation.

-

3. Which segment holds the largest market share?The military aircraft segment holds the largest market share and is going to continue its dominance.

-

4.Which region dominates the Aircraft Cameras Market?North America dominates the Aircraft Cameras Market and has the highest market share.

Need help to buy this report?