Global Aircraft Communication System Market Size By System (Audio Integrating Systems, Communication Radios, Radio Tuning Systems), By Connectivity (SATCOM, High Frequency, Very High Frequency), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033

Industry: Aerospace & DefenseGlobal Aircraft Communication System Market Insights Forecasts to 2033

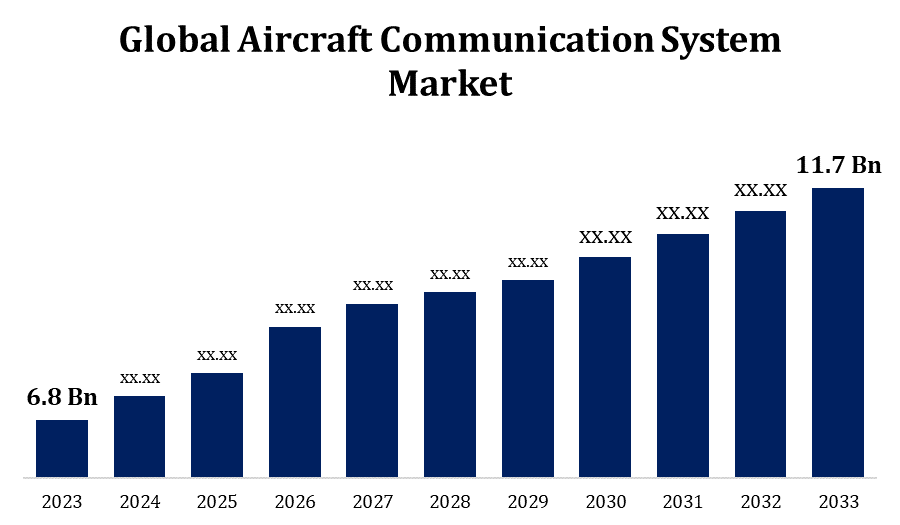

- The Global Aircraft Communication System Market Size was valued at USD 6.8 Billion in 2023.

- The Market Size is Growing at a CAGR of 5.58% from 2023 to 2033.

- The Worldwide Aircraft Communication System Market Size is expected to reach USD 11.7 Billion by 2033.

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Aircraft Communication System Market Size is expected to reach USD 11.7 Billion by 2033, at a CAGR of 5.58% during the forecast period 2023 to 2033.

The primary driver of demand for aircraft communication systems is the requirement for safe, dependable communication between aircraft and both ground stations and other aircraft. This is essential to guaranteeing effective and safe operations, particularly in congested skies. Adoption of cutting-edge communication technologies, such as software-defined radios, digital data linkages, and satellite-based communication, is one of the emerging trends in the aeroplane communication system market. Compared to conventional communication networks, these technologies provide increased bandwidth, enhanced cybersecurity, and increased reliability. Furthermore, the market environment is being shaped by the growing integration of communication systems with other aircraft systems, like navigation and surveillance. Enhancing situational awareness and operational efficiency, this interface facilitates smooth data interchange and interoperability.

Aircraft Communication System Market Value Chain Analysis

A vital role in the value chain is played by businesses that specialise in producing and providing parts like radios, antennas, transceivers, modems, and other electronic equipment. System integrators assemble communication systems using these components. Complete aircraft communication systems are put together by system integrators from disparate parts and subsystems. Additionally, they might create solutions specifically designed to meet the needs of airlines, military clients, and manufacturers of aircraft. In the market for aviation communication systems, big defence and aerospace firms frequently act as system integrators. During the manufacturing process, aeroplane manufacturers incorporate communication systems into their creations. To make sure that communication systems abide by legal standards and are compatible with other onboard systems, they collaborate closely with system integrators. For current aircraft fleets, aftermarket service companies provide installation, integration, and retrofitting services for communication systems. MRO companies provide communication system maintenance, repair, and overhaul services to guarantee their dependability and efficiency during the course of an aircraft's life. The final consumers of aircraft communication systems are airlines, armed forces, and other operators of both military and commercial aircraft.

Aircraft Communication System Market Opportunity Analysis

The market for aircraft communication systems is poised for substantial growth due to the consistent rise in air travel, particularly in developing nations. Increasing demand for air travel necessitates improved communication skills in order to safely and effectively handle the growing number of flights. The requirement to update and modernise current aircraft fleets offers aftermarket communication system providers a significant opportunity. Refitting older aircraft with updated communication systems is becoming more and more expensive for airlines and military operators as a way to comply with regulations, increase operational effectiveness, and improve passenger experience. Growing defence spending across the globe present opportunities for companies who provide communication systems for military use. For tactical communication, command and control, and data exchange, military aircraft require sophisticated communication systems, which presents profitable potential for businesses in the defence sector.

Global Aircraft Communication System Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 6.8 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.58% |

| 2033 Value Projection: | USD 11.7 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By System, By Connectivity, By Region, By Geographic Scope |

| Companies covered:: | Raytheon Company, Northrop Grumman Systems Corporation, Lockheed Martin Corporation, Rohde & Schwarz GmbH & Co KG, General Dynamics Corporation, Viasat, Inc., United Technologies Company, L3 Technologies, Inc., and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact,Challenges,Growth, Analysis. |

Get more details on this report -

Market Dynamics

Aircraft Communication System Market Dynamics

Increasing air passenger traffic to propel the market growth

Robust and effective communication systems are more important than ever to maintain safe and efficient air traffic management as more planes and passengers commute. Aircraft communication systems improve airspace capacity and safety by enabling smooth communication between aircraft, air traffic control (ATC), and ground stations. In order to control traffic and preserve a safe distance between planes, increasing air traveller traffic demands sophisticated navigation and surveillance systems. For effective air traffic flow management, precise location reporting, the sharing of surveillance data, and cooperative decision-making are critical functions of aircraft communication systems. The demand for broadband-capable aircraft communication systems is driven by passengers' growing reliance on in-flight connectivity services for internet access, entertainment streaming, and real-time communication.

Restraints & Challenges

The process of creating and incorporating cutting-edge communication technologies into aviation systems can be difficult and expensive in terms of research and development. Communication system vendors face technical problems in ensuring interoperability, dependability, and compatibility with current aircraft systems while adhering to strict regulatory standards. The aviation sector is increasingly concerned about cybersecurity due to the growing digitization and interconnection of aircraft equipment. Flight safety and passenger privacy are at danger due to cyber threats like malware, hacking, and data leaks that can affect aircraft communication systems. For industrial stakeholders, ensuring strong cybersecurity safeguards to safeguard communication networks and data integrity is a major concern. Ensuring dependable and interference-free communication between aircraft and ground stations is challenging due to the restricted radio frequency spectrum available for aviation communication.

Regional Forecasts

North America Market Statistics

North America is anticipated to dominate the Aircraft Communication System Market from 2023 to 2033. With a large amount of general aviation, military operations, and commercial aircraft, North America has some of the busiest airspace in the world. There is a constant need for aircraft communication solutions since the region's expanding aviation traffic demands sophisticated communication systems to maintain safe and effective airspace management. Major business aviation operators, cargo carriers, and commercial airlines are based in North America, and they depend on dependable communication networks to support their operations. Modern communication technologies are added to airline fleets as an investment to increase operational efficiency, improve passenger experience, and adhere to regulatory standards. Companies in North America spend money on R&D to create cutting-edge communication technology for next aircraft systems.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Due to growing middle-class populations, urbanisation, and increased disposable incomes, the Asia Pacific area is seeing a sharp increase in air passenger traffic. In order to facilitate safe and effective air travel, this growth is driving up demand for new planes outfitted with cutting-edge communication technologies. Governments in the Asia-Pacific region are making significant investments in the development and modernization of airports, communication networks, and ATC systems. Aviation communication system suppliers now have the chance to offer cutting-edge communication solutions for newly constructed and renovated facilities thanks to these investments. A number of Asia-Pacific nations are investing in modernising their fleets of military aircraft and raising their defence budgets. For tactical and strategic operations, this involves acquiring modern fighter jets, spy aircraft, and unmanned aerial vehicles (UAVs) outfitted with cutting-edge communication technologies.

Segmentation Analysis

Insights by System

The communication radios segment accounted for the largest market share over the forecast period 2023 to 2033. To update its communication equipment and infrastructure, government bodies and military groups around the world are investing in modernization programmes. The acquisition of novel communication radios featuring improved functionalities like encrypted voice and data transfer, platform interoperability, and alignment with developing communication protocols is encompassed in this. A growing number of communication radios with strong encryption and authentication features are needed to safeguard confidential voice and data transmissions in light of the aviation industry's expanding cybersecurity risks. Secure communication protocols and advanced encryption standards have been adopted because military and government users, in particular, place a high priority on secure communication capabilities in their radio systems.

Insights by Connectivity

The SATCOM segment accounted for the largest market share over the forecast period 2023 to 2033. The need for SATCOM systems is driven by the expansion of in-flight connection services and the growing desire of passengers for high-speed internet access. By providing passengers with broadband access, SATCOM systems allow airlines to improve the in-flight experience and create new income streams through onboard Wi-Fi services. Worldwide coverage offered by SATCOM systems makes it possible for aeroplanes and ground-based networks to be in constant communication, no matter where they are in the world. In situations when terrestrial-based communication infrastructure is scarce or nonexistent, long-haul flights, rural locations, and oceanic routes can all benefit from this global connectivity, which guarantees dependable communication. In order to facilitate secure communication, command and control, intelligence collection, and surveillance operations, SATCOM systems are extensively utilised in military and government aircraft.

Recent Market Developments

- In November 2021, Lockheed Martin has been awarded a potential eight-year contract worth USD 250 million by the United States Special Operations Command to develop computer technology for aircraft that can support communications interfaces between different systems.

Competitive Landscape

Major players in the market

- Raytheon Company

- Northrop Grumman Systems Corporation

- Lockheed Martin Corporation

- Rohde & Schwarz GmbH & Co KG

- General Dynamics Corporation

- Viasat, Inc.

- United Technologies Company

- L3 Technologies, Inc.

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aircraft Communication System Market, System Analysis

- Audio Integrating Systems

- Communication Radios

- Radio Tuning Systems

Aircraft Communication System Market, Connectivity Analysis

- SATCOM

- High Frequency

- Very High Frequency

Aircraft Communication System Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Aircraft Communication System Market?The global Aircraft Communication System Market is expected to grow from USD 6.8 billion in 2023 to USD 11.7 billion by 2033, at a CAGR of 5.58% during the forecast period 2023-2033.

-

2. Who are the key market players of the Aircraft Communication System Market?Some of the key market players of the market are Raytheon Company, Northrop Grumman Systems Corporation, Lockheed Martin Corporation, Rohde & Schwarz GmbH & Co KG, General Dynamics Corporation, Viasat, Inc., United Technologies Company, L3 Technologies, Inc..

-

3. Which segment holds the largest market share?The SATCOM segment holds the largest market share and is going to continue its dominance.

-

4. Which region is dominating the Aircraft Communication System Market?North America is dominating the Aircraft Communication System Market with the highest market share.

Need help to buy this report?