Global Aircraft Component MRO Market Size, Share, and COVID-19 Impact Analysis, By Aircraft Type (Commercial Aircraft (Narrow Body, Wide Body, and Regional Aircraft), Business Jet, General Aviation Aircraft, and Helicopters), By Component (Engine, Wheel and Brakes, Landing Gear, Avionics, Fuel System, Hydraulic System, Cockpit System, Flight Control, Electrical Systems, Thrust Reverser, and Others), By Maintenance Service (Inspection, Overhaul, Repairs, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Aircraft Component MRO Market Insights Forecasts to 2033

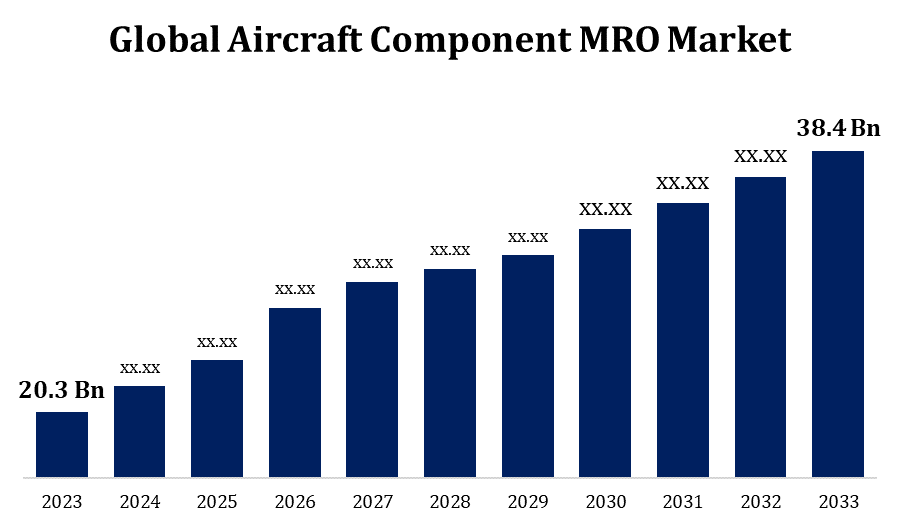

- The Global Aircraft Component MRO Market Size was valued at USD 20.3 Billion in 2023.

- The Market Size is Growing at a CAGR of 6.58% from 2023 to 2033

- The Worldwide Aircraft Component MRO Market Size is expected to reach USD 38.4 Billion by 2033

- Asia Pacific is expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Aircraft Component MRO Market Size is expected to reach USD 38.4 Billion by 2033, at a CAGR of 6.58% during the forecast period 2023 to 2033.

The Global Aircraft Component MRO (Maintenance, Repair, and Overhaul) Market is experiencing substantial growth, driven by increasing air travel, aging aircraft fleets, and the need for enhanced safety and performance. Key market players are investing in advanced technologies and innovative solutions to improve efficiency and reduce downtime. The market is segmented into airframe, engine, and component maintenance, with a significant demand for engine and component MRO services due to their critical role in aircraft operations. Regional markets in North America, Europe, and Asia-Pacific dominate, with Asia-Pacific showing the fastest growth due to expanding aviation infrastructure. Challenges include regulatory compliance, skilled labor shortages, and fluctuating raw material costs. However, technological advancements and strategic partnerships are expected to propel the market forward.

Aircraft Component MRO Market Value Chain Analysis

The Aircraft Component MRO Market value chain encompasses several critical stages, starting with the procurement of raw materials and components from suppliers, followed by the manufacturing and assembly of aircraft parts. Maintenance, repair, and overhaul services are provided by specialized MRO facilities, which inspect, repair, and refurbish components to ensure airworthiness and compliance with regulatory standards. Key players include OEMs (Original Equipment Manufacturers), independent MRO providers, and airline maintenance departments. Logistics and distribution networks play a crucial role in ensuring timely delivery of parts and components. The value chain is supported by advancements in technology, such as predictive maintenance and digital twins, which enhance efficiency and reduce downtime. Strategic collaborations and partnerships among stakeholders further streamline operations and improve service quality.

Aircraft Component MRO Market Opportunity Analysis

Aging aircraft fleets and the need for regular maintenance to ensure safety and compliance with stringent regulations create a steady demand for MRO services. Technological advancements, such as predictive maintenance and IoT integration, offer opportunities for enhanced efficiency and cost savings. Emerging markets in Asia-Pacific and the Middle East, with their growing aviation sectors, provide lucrative opportunities for MRO providers. Additionally, the rise of low-cost carriers and the focus on operational efficiency further drive the need for reliable MRO services.

Global Aircraft Component MRO Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 20.3 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 6.58% |

| 2033 Value Projection: | USD 38.4 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 212 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Aircraft Type, By Component, By Maintenance Service, By Region. |

| Companies covered:: | AAR Corp., Airbus SE, Delta Airlines, Inc. (Delta TechOps), Hong Kong Aircraft Engineering Company Limited, KLM U.K. Engineering Limited, Lufthansa Technik, MTU Aero Engines AG, Raytheon Technologies Corporation (Previously United Technologies Corporation), Singapore Technologies Engineering Ltd, TAP Maintenance & Engineering (TAP Air Portugal), and Others |

| Growth Drivers: | Aircraft deliveries and fleet expansion are expected to drive market growth |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Aircraft Component MRO Market Dynamics

Aircraft deliveries and fleet expansion are expected to drive market growth

Airlines are expanding their fleets to meet the rising demand for air travel, especially in emerging markets in Asia-Pacific and the Middle East. This expansion necessitates comprehensive MRO services to maintain aircraft performance and safety standards. Newer aircraft technologies require specialized MRO capabilities, driving investments in advanced maintenance solutions. Furthermore, as airlines modernize their fleets, the demand for efficient and cost-effective MRO services escalates. The continuous influx of new aircraft combined with the need to maintain aging fleets underscores the critical role of the MRO market in ensuring operational reliability and regulatory compliance, thereby fostering market growth.

Restraints & Challenges

One major challenge is the shortage of skilled labor, which affects the efficiency and quality of maintenance services. Regulatory compliance is another significant hurdle, as stringent aviation safety standards require continuous updates and adherence, increasing operational complexities. Fluctuations in raw material costs can lead to increased expenses and reduced profitability for MRO providers. Additionally, the rapid technological advancements in aircraft components necessitate constant upgrades in MRO capabilities, demanding substantial investment. The competitive landscape, with numerous players vying for market share, further pressures pricing strategies and margins.

Regional Forecasts

North America Market Statistics

Get more details on this report -

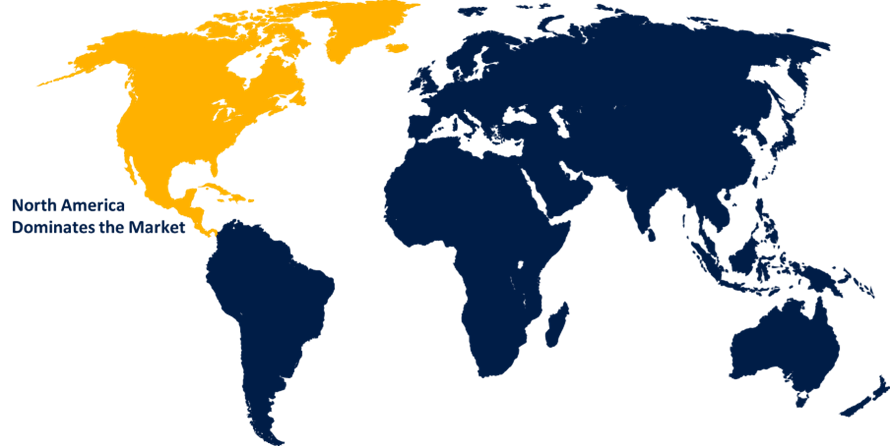

North America is anticipated to dominate the Aircraft Component MRO Market from 2023 to 2033. The presence of major airlines and OEMs (Original Equipment Manufacturers) boosts the demand for comprehensive MRO services. Technological advancements, including predictive maintenance and AI integration, are widely adopted, enhancing operational efficiency and reducing downtime. The region benefits from a skilled workforce and robust regulatory frameworks that ensure high safety and quality standards. However, challenges such as labor shortages and fluctuating raw material costs persist. Strategic partnerships and investments in advanced MRO facilities are key trends, enabling North America to maintain its dominant position and meet the growing demand for efficient and reliable aircraft maintenance solutions.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Emerging economies are at the forefront, with significant investments in new aircraft and aviation infrastructure. The rise of low-cost carriers and increased passenger traffic drive the need for extensive MRO services. The market is characterized by a growing presence of international MRO providers and local players, enhancing service capabilities and competitive pricing. Technological advancements, such as digitalization and predictive maintenance, are increasingly adopted to improve efficiency. Despite challenges like regulatory complexities and skilled labor shortages, the region's focus on developing robust MRO facilities and strategic partnerships positions it for substantial future growth.

Segmentation Analysis

Insights by Aircraft Type

The commercial aircraft segment accounted for the largest market share over the forecast period 2023 to 2033. Increasing global air travel, fleet expansions, and the introduction of new aircraft models fuel demand for maintenance services. Airlines are focusing on operational efficiency and cost-effectiveness, leading to a rise in outsourcing MRO activities to specialized providers. The aging fleet of commercial aircraft also necessitates regular maintenance, repair, and overhaul to ensure safety and performance. Technological advancements, such as predictive maintenance and AI-driven diagnostics, enhance MRO efficiency and reduce downtime. The market sees substantial investments in upgrading MRO capabilities to handle next-generation aircraft components.

Insights by Component

The flight control segment accounted for the largest market share over the forecast period 2023 to 2033. As aircraft become more advanced, the complexity of flight control systems increases, necessitating specialized maintenance and repair services. The aging fleet and increased aircraft utilization rates drive the demand for regular inspection and overhaul of flight control components. Technological advancements, such as fly-by-wire systems and digital control mechanisms, require sophisticated MRO capabilities, fostering investments in advanced diagnostic and repair technologies. Regulatory requirements for periodic maintenance of flight control systems ensure consistent demand. Additionally, the rise in global air traffic and the expansion of airline fleets further amplify the need for efficient and reliable flight control MRO services, propelling market growth.

Recent Market Developments

- In September 2023, ST Engineering announced the signing of a multi-year deal with Japan Airlines to deliver component Maintenance-By-the-Hour (MBHTM) solutions.

Competitive Landscape

Major players in the market

- AAR Corp.

- Airbus SE

- Delta Airlines, Inc. (Delta TechOps)

- Hong Kong Aircraft Engineering Company Limited

- KLM U.K. Engineering Limited

- Lufthansa Technik

- MTU Aero Engines AG

- Raytheon Technologies Corporation (Previously United Technologies Corporation)

- Singapore Technologies Engineering Ltd

- TAP Maintenance & Engineering (TAP Air Portugal)

- Others

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aircraft Component MRO Market, Aircraft Type Analysis

- Commercial Aircraft

- Narrow Body

- Wide Body

- Regional Aircraft

- Business Jet

- General Aviation Aircraft

- Helicopters

Aircraft Component MRO Market, Component Analysis

- Engine

- Wheel and Brakes

- Landing Gear

- Avionics

- Fuel System

- Hydraulic System

- Cockpit System

- Flight Control

- Electrical Systems

- Thrust Reverser

- Others

Aircraft Component MRO Market, Maintenance Service Analysis

- Inspection

- Overhaul

- Repairs

- Others

Aircraft Component MRO Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Aircraft Component MRO?The global Aircraft Component MRO Market is expected to grow from USD 20.3 billion in 2023 to USD 38.4 billion by 2033, at a CAGR of 6.58% during the forecast period 2023-2033.

-

2. Who are the key market players of the Aircraft Component MRO Market?Some of the key market players of the market are AAR Corp.; Airbus SE; Delta Airlines, Inc. (Delta TechOps); Hong Kong Aircraft Engineering Company Limited; KLM U.K. Engineering Limited; Lufthansa Technik; MTU Aero Engines AG; Raytheon Technologies Corporation (Previously United Technologies Corporation); Singapore Technologies Engineering Ltd; TAP Maintenance & Engineering (TAP Air Portugal).

-

3. Which segment holds the largest market share?The flight control segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Aircraft Component MRO market?North America dominates the Aircraft Component MRO market and has the highest market share.

-

1. What is the market size of the Aircraft Component MRO?The global Aircraft Component MRO Market is expected to grow from USD 20.3 billion in 2023 to USD 38.4 billion by 2033, at a CAGR of 6.58% during the forecast period 2023-2033.

-

2. Who are the key market players of the Aircraft Component MRO Market?Some of the key market players of the market are AAR Corp.; Airbus SE; Delta Airlines, Inc. (Delta TechOps); Hong Kong Aircraft Engineering Company Limited; KLM U.K. Engineering Limited; Lufthansa Technik; MTU Aero Engines AG; Raytheon Technologies Corporation (Previously United Technologies Corporation); Singapore Technologies Engineering Ltd; TAP Maintenance & Engineering (TAP Air Portugal).

-

3. Which segment holds the largest market share?The flight control segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Aircraft Component MRO market?North America dominates the Aircraft Component MRO market and has the highest market share.

Need help to buy this report?