Global Aircraft Doors Market Size, Share, and COVID-19 Impact Analysis, By End User (OEM and Aftermarket), Application (Commercial and Military) and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Aircraft Doors Market Insights Forecasts to 2033

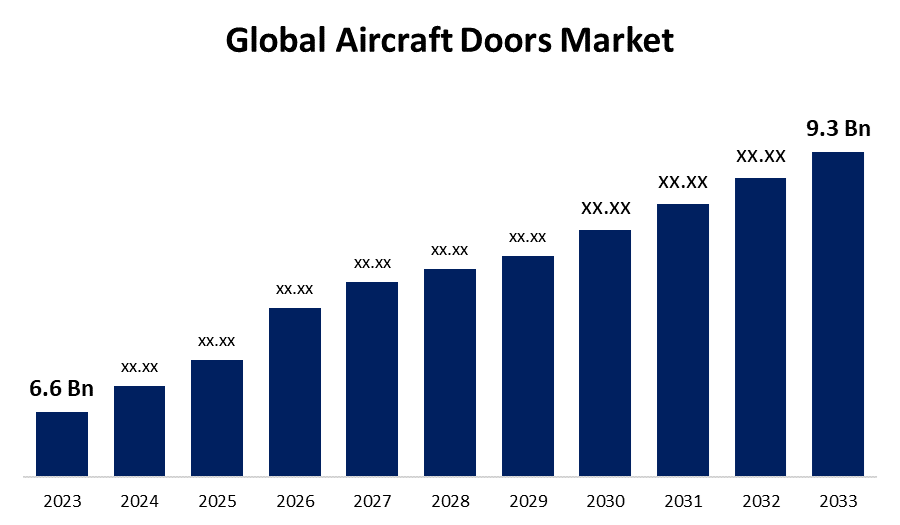

- The Aircraft Doors Market Size was valued at USD 6.6 Billion in 2023.

- The market Size is Growing at a CAGR of 3.49% from 2023 to 2033

- The Worldwide Aircraft Doors Market Size is Expected to reach USD 9.3 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Aircraft Doors Market Size is Expected to reach USD 9.3 Billion by 2033, at a CAGR of 3.49% during the forecast period 2023 to 2033.

The Aircraft Doors Market is experiencing significant growth, driven by increasing demand for commercial and military aircraft. Advancements in technology, such as the integration of lightweight composite materials, are enhancing the efficiency and durability of aircraft doors. The market is also benefiting from the rise in air travel and the subsequent need for fleet expansion and replacement. Key players are focusing on innovation, offering advanced safety features and automated systems. Regulatory requirements for safety and security are further propelling market expansion. However, challenges such as high manufacturing costs and stringent certification processes pose constraints. Overall, the market is poised for steady growth, supported by continuous advancements in aerospace technology and increasing investments in the aviation sector.

Aircraft Doors Market Value Chain Analysis

The Aircraft Doors Market value chain involves several key stages, from raw material procurement to end-user delivery. Initially, raw materials like aluminum, composites, and titanium are sourced from suppliers. These materials are then processed by manufacturers who design and produce various aircraft doors, including passenger, cargo, and emergency exits. Advanced manufacturing techniques and precision engineering are critical at this stage. The doors undergo rigorous testing and certification to meet stringent aerospace standards. OEMs (Original Equipment Manufacturers) integrate these doors into aircraft during assembly. Distribution channels include direct sales to airlines, MRO (Maintenance, Repair, and Overhaul) services, and aftermarket sales. The final stage involves installation, maintenance, and regular inspections to ensure safety and performance, closing the loop in the value chain.

Aircraft Doors Market Opportunity Analysis

The Aircraft Doors Market presents significant opportunities driven by several factors. The surge in global air travel and expansion of airline fleets create a growing demand for new aircraft doors. Technological advancements in materials, such as lightweight composites and smart materials, offer opportunities for innovation, improving fuel efficiency and reducing maintenance costs. Emerging markets in Asia-Pacific and the Middle East, with increasing air traffic and aircraft procurement, present lucrative prospects for market players. Additionally, the push towards sustainable aviation solutions drives the need for doors that contribute to overall aircraft efficiency. There is also a growing demand for retrofitting older aircraft with modern, advanced doors. Collaborations and partnerships for R&D in new technologies further enhance market opportunities, promising robust growth in the coming years.

Global Aircraft Doors Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 6.6 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.49% |

| 2033 Value Projection: | USD 9.3 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 264 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By End User, By Application, By Region |

| Companies covered:: | Safran (France), Hindustan Aeronautics Limited (India), Bombardier (Canada), Boeing (US), American Airlines Group Inc. (US), Aernnova Aerospace S.A. (Spain), Airbus S.A.S. (France), Latécoère (France), Saab AB (Sweden), Elbit Systems Ltd. (Israel), Triumph Group (US), Esterline Technologies (US), Barnes Group Inc. (US), HONEYCOMB (US), DAHER (France), MITSUBISHI HEAVY INDUSTRIES, LTD. (Japan), Delastek Inc. (Canada), and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, and Analysis |

Get more details on this report -

Market Dynamics

Aircraft Doors Market Dynamics

Increased need for lightweight aircraft doors

The increased need for lightweight aircraft doors is a significant driver of growth in the aircraft door market. Lightweight doors, primarily made from advanced composites and high-strength alloys, are essential for enhancing fuel efficiency and overall aircraft performance. These materials reduce the aircraft's weight, leading to lower fuel consumption and operating costs, which is crucial for airlines facing rising fuel prices. Additionally, lightweight doors contribute to improved payload capacity and longer flight ranges. The demand for such doors is further propelled by stringent environmental regulations and the aviation industry's push for sustainability. As airlines and manufacturers prioritize reducing carbon emissions, the integration of lightweight doors becomes a critical component in achieving these goals, thereby fostering market expansion and technological advancements.

Restraints & Challenges

High manufacturing costs, driven by the use of advanced materials and precision engineering, pose significant financial constraints for producers. Stringent certification processes and regulatory compliance add complexity and time to product development, creating barriers to market entry and slowing innovation. Additionally, supply chain disruptions, particularly in sourcing specialized materials, can lead to production delays and increased costs. The need for continuous technological upgrades and maintenance increases operational expenses for airlines. Moreover, the market is highly competitive, with major players investing heavily in R&D, putting pressure on smaller companies.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Aircraft Doors Market from 2023 to 2033. The presence of leading aircraft manufacturers like Boeing and Lockheed Martin fosters a dynamic market environment. Increasing investments in research and development for advanced door technologies, including lightweight materials and automated systems, are propelling market expansion. Regulatory emphasis on safety and environmental standards further boosts the demand for innovative door solutions. Additionally, the rise in air travel and the need for fleet modernization and maintenance support market growth. However, challenges such as stringent certification requirements and supply chain constraints can impact the market. Overall, North America remains a key player in the global aircraft doors market, leveraging technological advancements and strong industry infrastructure.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The region's burgeoning aviation sector, with significant orders for new aircraft and expanding airline fleets, fuels demand for advanced aircraft doors. Government initiatives to develop aerospace infrastructure and domestic manufacturing capabilities further support market growth. Key players are investing in the region, establishing manufacturing plants and R&D centers to tap into local markets.

Segmentation Analysis

Insights by Application

The commercial segment accounted for the largest market share over the forecast period 2023 to 2033. Increasing demand for new aircraft, especially from low-cost carriers and emerging markets, boosts the need for advanced, reliable doors. Innovations in lightweight materials and enhanced safety features are key factors propelling this growth, as airlines seek to improve fuel efficiency and passenger safety. Additionally, the trend towards larger aircraft with greater passenger capacity requires robust and efficient door systems. Regulatory compliance and stringent safety standards further necessitate continuous upgrades and replacements of aircraft doors.

Insights by End User

The OEM segment accounted for the largest market share over the forecast period 2023 to 2033. Technological advancements in materials, such as lightweight composites and high-strength alloys, are enhancing door performance and efficiency, making them attractive to OEMs. Additionally, stringent safety regulations and the need for compliance with international standards drive OEMs to innovate continuously. Collaborations between OEMs and door manufacturers for integrated and customized solutions further bolster this segment's growth. The push for fuel efficiency and sustainability in aviation also propels the demand for advanced, lightweight OEM aircraft doors, contributing to the segment's expansion.

Recent Market Developments

- In March 2023, Airbus SE has awarded a contract to Tata Advanced Systems Ltd. (TASL) to produce cargo and bulk cargo doors for the Airbus A320neo family.

Competitive Landscape

Major players in the market

- Safran (France)

- Hindustan Aeronautics Limited (India)

- Bombardier (Canada)

- Boeing (US)

- American Airlines Group Inc. (US)

- Aernnova Aerospace S.A. (Spain)

- Airbus S.A.S. (France)

- Latécoère (France)

- Saab AB (Sweden)

- Elbit Systems Ltd. (Israel)

- Triumph Group (US)

- Esterline Technologies (US)

- Barnes Group Inc. (US)

- HONEYCOMB (US)

- DAHER (France)

- MITSUBISHI HEAVY INDUSTRIES, LTD. (Japan)

- Delastek Inc. (Canada)

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aircraft Doors Market, End User Analysis

- OEM

- Aftermarket

Aircraft Doors Market, Application Analysis

- Commercial

- Military

Aircraft Doors Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the market size of the Aircraft Doors?The global Aircraft Doors Market is expected to grow from USD 6.6 billion in 2023 to USD 9.3 billion by 2033, at a CAGR of 3.49% during the forecast period 2023-2033.

-

2.Who are the key market players of the Aircraft Doors Market?Some of the key market players of the market are Safran (France), Hindustan Aeronautics Limited (India), Bombardier (Canada), Boeing (US), American Airlines Group Inc. (US), Aernnova Aerospace S.A. (Spain), Airbus S.A.S. (France), Latécoère (France), Saab AB (Sweden), Elbit Systems Ltd. (Israel), Triumph Group (US), Esterline Technologies (US), Barnes Group Inc. (US), HONEYCOMB (US), DAHER (France), MITSUBISHI HEAVY INDUSTRIES, LTD. (Japan) and Delastek Inc. (Canada).

-

3.Which segment holds the largest market share?The OEM segment holds the largest market share and is going to continue its dominance.

-

4.Which region dominates the Aircraft Doors market?North America dominates the Aircraft Doors market and has the highest market share.

Need help to buy this report?