Global Aircraft Engine Market Size, Share, and COVID-19 Impact Analysis, By Engine (Turboprop, Turbofan, Turboshaft, Piston Engine), By Aircraft (Commercial, Military, Business & General Aviation), By Point Of Sale (OEM, Aftermarket), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Aircraft Engine Market Insights Forecasts to 2033

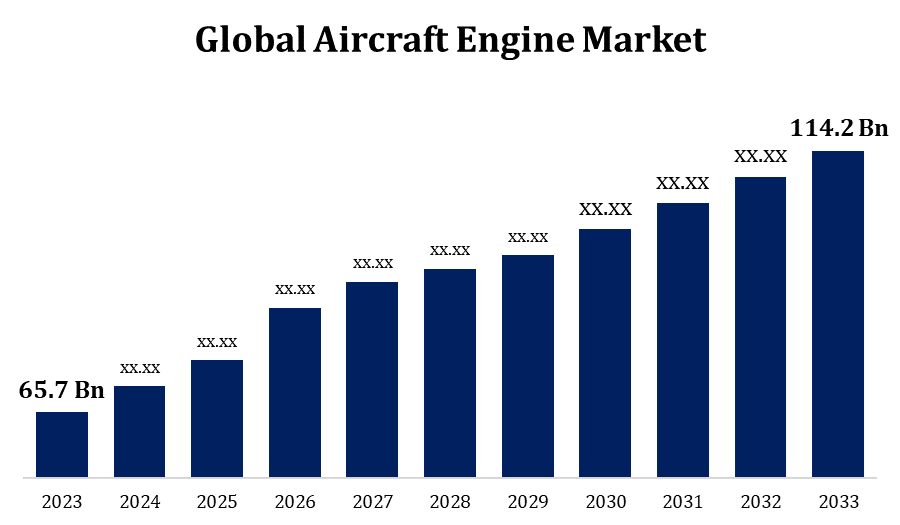

- The Aircraft Engine Market Size was valued at USD 65.7 Billion in 2023.

- The Market Size is Growing at a CAGR of 5.68% from 2023 to 2033.

- The Worldwide Aircraft Engine Market Size is Expected to reach USD 114.2 Billion by 2033.

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Aircraft Engine Market Size is Expected to reach USD 114.2 Billion by 2033, at a CAGR of 5.68% during the forecast period 2023 to 2033.

The aircraft engine market is experiencing robust growth, driven by increasing global air travel, demand for fuel-efficient engines, and the rise of low-cost carriers. Technological advancements, such as the development of lightweight materials and more efficient engines, are reshaping the industry. The push for sustainability and reduced emissions is also prompting investment in next-generation engines, including hybrid-electric and hydrogen-powered designs. Major players like General Electric, Rolls-Royce, and Pratt & Whitney dominate the market, with innovations focused on reducing operational costs and improving performance. However, challenges such as high R&D costs and stringent regulatory standards can restrain market growth. The market is expected to expand further, fueled by the rising demand for both commercial and military aircraft across the globe.

Aircraft Engine Market Value Chain Analysis

The aircraft engine market value chain involves several key stages, from raw material suppliers to end users. It begins with raw material suppliers providing essential components like titanium, aluminum, and composite materials. These materials are then passed to manufacturers who design and produce engine components, such as turbines, compressors, and combustion chambers. Key engine manufacturers like GE Aviation, Rolls-Royce, and Pratt & Whitney assemble these components into complete engine systems. Distribution involves partnerships with aircraft manufacturers such as Boeing and Airbus, which integrate the engines into their aircraft. Aftermarket services, including maintenance, repair, and overhaul (MRO), play a crucial role, ensuring long-term engine performance and generating significant revenue. The value chain is tightly regulated, with stringent quality and safety standards at every stage to ensure reliability and efficiency.

Aircraft Engine Market Opportunity Analysis

The aircraft engine market presents significant opportunities driven by the growing demand for fuel-efficient and environmentally friendly engines. The increasing global air passenger traffic, particularly in emerging markets like Asia-Pacific and the Middle East, offers potential for engine manufacturers. Advancements in engine technology, such as hybrid-electric and hydrogen-powered engines, are creating new avenues for innovation, catering to the industry's push for sustainability and reduced carbon emissions. The rise in defense spending and the need for advanced military aircraft engines also provide a lucrative segment. Additionally, the aftermarket services sector, including engine maintenance, repair, and overhaul (MRO), offers substantial revenue opportunities, as airlines prioritize extending engine lifecycles and reducing operational costs. These factors collectively make the aircraft engine market ripe for innovation and expansion.

Global Aircraft Engine Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 65.7 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 5.68% |

| 2033 Value Projection: | USD 114.2 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 264 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Engine, By Aircraft, By Point Of Sale, By Region |

| Companies covered:: | Advanced Atomization Technologies Inc., Enjet Aero, Engine Alliance, Safran Group, Pratt & Whitney, Rolls-Royce Holdings plc, MTU Aero Engines AG, CFM International, General Electric Company, ITP Aero, New Hampshire Ball Bearing (MinebeaMitsumi Aerospace), IAE International Aero Engines AG, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, and Analysis |

Get more details on this report -

Market Dynamics

Aircraft Engine Market Dynamics

Growth in the number of aircraft delivered and passengers travelling by air worldwide

The growth in aircraft deliveries and air passenger traffic is a key driver of the aircraft engine market. With global air travel increasing, particularly in regions like Asia-Pacific, the Middle East, and Latin America, airlines are expanding their fleets to meet demand. Major aircraft manufacturers such as Boeing and Airbus are ramping up production, leading to increased orders for fuel-efficient and advanced engines. Rising disposable incomes and the expansion of low-cost carriers are boosting passenger numbers, further fueling the need for new aircraft. This trend is expected to continue as air travel becomes more accessible, especially in emerging markets. As a result, engine manufacturers are witnessing growing demand for next-generation, environmentally friendly engines, which enhance fuel efficiency and reduce emissions, contributing significantly to market growth.

Restraints & Challenges

One of the primary hurdles is the high cost of research and development (R&D) required for advanced engine technologies, such as fuel-efficient and low-emission engines. These investments are crucial but can strain profitability, particularly for smaller manufacturers. Stringent regulatory standards on safety, emissions, and noise levels also add pressure, requiring continuous innovation and compliance. Supply chain disruptions, such as shortages of critical raw materials like titanium and composite materials, further complicate production timelines and costs. Additionally, the rising demand for sustainable aviation is pushing engine manufacturers to accelerate the transition to hybrid-electric and hydrogen-powered engines, posing technological and infrastructure challenges. These factors collectively impact the pace of innovation and market expansion in the aircraft engine sector.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Aircraft Engine Market from 2023 to 2033. The region benefits from strong demand in both commercial and military aviation, supported by high air passenger traffic, fleet expansions, and defense spending. The push for sustainability and fuel efficiency has accelerated innovation, with North American companies leading in the development of next-generation engines, including hybrid-electric and hydrogen-powered models. Additionally, the region has a well-established ecosystem for aircraft maintenance, repair, and overhaul (MRO) services, further driving market growth.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. This region is seeing a surge in commercial aircraft deliveries, driving demand for new and more fuel-efficient engines. Additionally, growing defense budgets in countries such as China, Japan, and India are boosting the market for military aircraft engines. Asia-Pacific is also emerging as a hub for aircraft maintenance, repair, and overhaul (MRO) services, attracting investments and partnerships from global engine manufacturers. However, challenges like fluctuating fuel prices, supply chain constraints, and the need to meet strict environmental regulations could impact growth. Overall, the region presents substantial opportunities for engine innovation and expansion in both commercial and defense sectors.

Segmentation Analysis

Insights by Engine

The turbofan engine segment accounted for the largest market share over the forecast period 2023 to 2033. Turbofan engines are favored for their fuel efficiency, reduced noise, and ability to support long-haul flights, making them the preferred choice for modern commercial aircraft like Boeing 737s and Airbus A320s. The increasing demand for fuel-efficient and environmentally friendly aircraft is pushing manufacturers to innovate, developing advanced turbofan engines with higher bypass ratios and better performance. Additionally, the rise of low-cost carriers and the expansion of air travel in emerging markets are further propelling this segment. With continuous technological advancements, such as geared turbofan engines that offer even greater efficiency, the turbofan segment is expected to maintain its dominance and contribute significantly to the overall growth of the aircraft engine market.

Insights by Aircraft

The commercial aircraft segment accounted for the largest market share over the forecast period 2023 to 2033. Airlines are investing in new-generation aircraft to reduce operational costs and meet rising passenger demand, particularly in emerging markets like Asia-Pacific and the Middle East. This is boosting demand for advanced engines that offer lower fuel consumption and emissions. The development of lightweight materials and hybrid-electric engine technology is also contributing to growth in this segment. Additionally, the expansion of low-cost carriers and regional airlines is accelerating aircraft deliveries, further driving engine demand. Despite challenges like regulatory pressures and supply chain disruptions, the commercial aircraft segment is poised for steady growth, supported by the global aviation industry’s recovery post-pandemic.

Insights by Point Of Sale

The aftermarket segment accounted for the largest market share over the forecast period 2023 to 2033. As airlines aim to extend the lifespan of their existing fleets and optimize operational costs, demand for engine servicing has surged. The growing number of aircraft in service, particularly aging fleets, creates substantial opportunities for aftermarket providers. Engine manufacturers are capitalizing on this by offering comprehensive maintenance contracts and advanced digital tools for predictive maintenance, improving efficiency and reducing downtime. Additionally, the aftermarket segment benefits from technological advancements in engine components, requiring periodic upgrades and replacements. The rise in air travel, combined with the focus on operational reliability, ensures that the aftermarket sector will continue to play a critical role in the aircraft engine market’s growth.

Recent Market Developments

- In March 2024, the Ministry of Defence declared that it has signed a contract worth USD 5,249.72 billion with Hindustan Aeronautics Limited (HAL) to buy aircraft engines for MiG-29 aircraft.

Competitive Landscape

Major players in the market

- Advanced Atomization Technologies Inc.

- Enjet Aero

- Engine Alliance

- Safran Group

- Pratt & Whitney

- Rolls-Royce Holdings plc

- MTU Aero Engines AG

- CFM International

- General Electric Company

- ITP Aero

- New Hampshire Ball Bearing (MinebeaMitsumi Aerospace)

- IAE International Aero Engines AG

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aircraft Engine Market, Engine Analysis

- Turboprop

- Turbofan

- Turboshaft

- Piston Engine

Aircraft Engine Market, Aircraft Analysis

- Commercial

- Military

- Business & General Aviation

Aircraft Engine Market, Point Of Sale Analysis

- OEM

- Aftermarket

Aircraft Engine Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the market size of the Aircraft Engine Market?The global Aircraft Engine Market is expected to grow from USD 65.7 billion in 2023 to USD 114.2 billion by 2033, at a CAGR of 5.68% during the forecast period 2023-2033.

-

2.Who are the key market players of the Aircraft Engine Market?Some of the key market players of the market are Advanced Atomization Technologies Inc.; Enjet Aero; Engine Alliance; Safran Group; Pratt & Whitney; Rolls-Royce Holdings plc; MTU Aero Engines AG; CFM International; General Electric Company; ITP Aero; New Hampshire Ball Bearing (MinebeaMitsumi Aerospace); IAE International Aero Engines AG.

-

3.Which segment holds the largest market share?The aftermarket segment holds the largest market share and is going to continue its dominance.

-

4.Which region dominates the Aircraft Engine Market?North America dominates the Aircraft Engine Market and has the highest market share.

Need help to buy this report?