Global Aircraft Engine MRO Market Size, Share, and COVID-19 Impact Analysis, By Engine Type (Turbine Engine and Piston Engine), By Aircraft Type (Fixed-Wing Aircraft and Rotary-Wing Aircraft), Application (Civil Aviation, and Military Aviation), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Aircraft Engine MRO Market Insights Forecasts to 2033

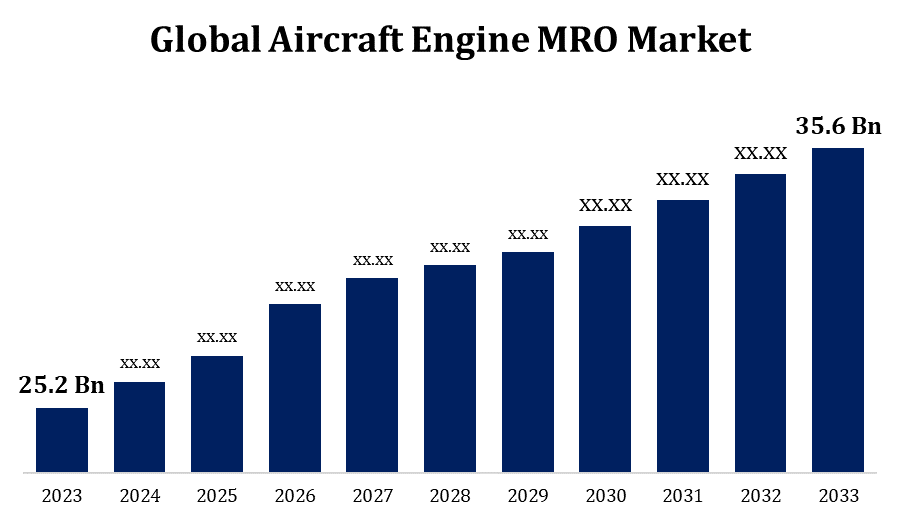

- The Global Aircraft Engine MRO Market Size was valued at USD 25.2 Billion in 2023.

- The Market Size is Growing at a CAGR of 3.52% from 2023 to 2033

- The Worldwide Aircraft Engine MRO Market Size is expected to reach USD 35.6 Billion by 2033

- Asia Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Aircraft Engine MRO Market is expected to reach USD 35.6 Billion by 2033, at a CAGR of 3.52% during the forecast period 2023 to 2033.

The Aircraft Engine Maintenance, Repair, and Overhaul (MRO) market is a vital segment of the aerospace industry, ensuring the safety and efficiency of aircraft operations. It encompasses services such as inspection, repair, and replacement of engine components, catering to both commercial and military sectors. The market is driven by factors like the aging aircraft fleet, technological advancements, and the growing demand for air travel. Key players include original equipment manufacturers (OEMs) and independent MRO service providers, who offer specialized services to enhance engine performance and lifecycle. The increasing adoption of predictive maintenance and digital solutions, such as artificial intelligence and data analytics, is further transforming the market, making operations more efficient and cost-effective.

Aircraft Engine MRO Market Value Chain Analysis

The Aircraft Engine MRO market value chain involves several key stages, from the initial design and manufacturing of engines to the delivery of maintenance, repair, and overhaul services. It starts with Original Equipment Manufacturers (OEMs), who provide engines and parts. The next stage involves specialized MRO service providers, who perform routine maintenance, repairs, and overhauls. These services are supported by a network of suppliers offering replacement parts and advanced technologies. Additionally, regulatory bodies ensure compliance with aviation safety standards. The final link includes the end-users—airlines and other aircraft operators—who rely on these services to maintain engine efficiency and safety. Technological advancements and strategic partnerships across the value chain are crucial for enhancing service quality and operational efficiency.

Aircraft Engine MRO Market Opportunity Analysis

The rising global air traffic and expansion of commercial airline fleets create a constant demand for MRO services. Additionally, the aging aircraft fleet in many regions necessitates more frequent maintenance and overhaul activities. Technological advancements, such as the integration of artificial intelligence and predictive analytics, enable more efficient and cost-effective maintenance solutions, attracting more airlines to adopt these services. Furthermore, the increasing focus on sustainability and fuel efficiency presents opportunities for MRO providers to offer eco-friendly solutions, such as engine retrofitting and upgrades. The growing demand in emerging markets, particularly in Asia-Pacific, also presents a substantial opportunity for market expansion.

Global Aircraft Engine MRO Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 25.2 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.52% |

| 2033 Value Projection: | USD 35.6 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 610 |

| Segments covered: | By Engine Type, By Aircraft Type, By Region |

| Companies covered:: | GE Aviation (U.S.), Pratt & Whitney (U.S.), Safran Aircraft Engines (Paris), Rolls-Royce (U.K.), ST Aerospace (Singapore), SIA Engineering Company (Singapore), Air France Industries KLM Engineering & Maintenance (France), Lufthansa Technik (Germany), MTU Aero Engines (Germany), Delta TechOps (U.S.), and other key companies. |

| Growth Drivers: | An increase in air travel drives market growth |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Market Dynamics

Aircraft Engine MRO Market Dynamics

An increase in air travel drives market growth

As passenger demand increases, airlines are expanding their fleets and increasing the frequency of flights, leading to higher utilization rates of aircraft. This rise in operational intensity accelerates the wear and tear of engines, necessitating more frequent maintenance, repair, and overhaul services to ensure safety and efficiency. Additionally, the expansion of low-cost carriers and the opening of new routes further boost the demand for MRO services. The need for regulatory compliance and adherence to stringent safety standards also contributes to market growth, as airlines seek reliable MRO providers to maintain their engines' performance and longevity.

Restraints & Challenges

One major issue is the high cost and complexity of maintaining advanced and next-generation aircraft engines, which require specialized skills and technology. The shortage of skilled technicians further exacerbates this problem, leading to potential delays and increased labor costs. Additionally, the market is highly regulated, necessitating strict compliance with aviation safety standards, which can increase operational costs. The volatility in the global economy and fluctuating fuel prices also pose risks, affecting airline profitability and, consequently, MRO spending. Furthermore, the rise of OEMs offering their own maintenance services intensifies competition, putting pressure on independent MRO providers to differentiate themselves and maintain market share.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Aircraft Engine MRO Market from 2023 to 2033. North America holds a significant share in the Aircraft Engine MRO market, driven by a mature aviation industry and a large fleet of commercial and military aircraft. The region is home to major airlines, extensive airline networks, and leading MRO service providers, which contribute to a robust demand for maintenance, repair, and overhaul services. The presence of Original Equipment Manufacturers (OEMs) and advanced technological infrastructure supports the development and adoption of innovative MRO solutions, such as predictive maintenance and digital twin technologies. Additionally, the aging aircraft fleet in North America increases the need for regular engine maintenance and upgrades. The regulatory environment, with stringent safety and compliance standards, further fuels demand for reliable MRO services in the region.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Emerging economies such as China, India, and Southeast Asian countries are seeing significant fleet expansions as airlines capitalize on growing middle-class populations and tourism. This results in a rising demand for engine maintenance, repair, and overhaul services. The region is also witnessing investments in MRO infrastructure, including new facilities and technological advancements, to cater to the growing market. Additionally, strategic partnerships between local airlines and global MRO providers are becoming more common, enhancing service capabilities and market reach. The increasing adoption of low-cost carriers and the development of regional aviation hubs further boost the demand for MRO services in Asia-Pacific.

Segmentation Analysis

Insights by Engine Type

The turbine engine segment accounted for the largest market share over the forecast period 2023 to 2033. Turbine engines, known for their high efficiency and power output, are essential for modern aircraft, leading to a constant demand for maintenance and repair services. The growth is further propelled by the aging fleet of turbine-powered aircraft, which necessitates regular MRO activities to ensure safety and performance. Technological advancements, such as more fuel-efficient and environmentally friendly engine designs, also contribute to increased maintenance complexity and frequency. Additionally, the introduction of new-generation turbine engines requires specialized MRO capabilities, creating opportunities for service providers to expand their expertise and offerings in this segment.

Insights by Aircraft Type

The fixed wing segment accounted for the largest market share over the forecast period 2023 to 2033. As the global fleet of fixed-wing aircraft continues to expand, particularly with the rise of commercial airlines and low-cost carriers, the demand for engine maintenance, repair, and overhaul services grows accordingly. This segment benefits from advancements in aircraft technology, including more efficient engines that require specialized maintenance. Additionally, the aging fleet of existing fixed-wing aircraft necessitates frequent MRO activities to ensure operational safety and efficiency. The growth of cargo and logistics sectors, which rely heavily on fixed-wing aircraft, also contributes to the increasing demand for MRO services in this segment.

Insights by Application

The civil aviation segment accounted for the largest market share over the forecast period 2023 to 2033. The surge in passenger traffic, particularly in emerging markets, has led airlines to increase the frequency of flights and routes, thereby escalating the need for regular engine maintenance and overhaul services. Additionally, the growing adoption of newer, more fuel-efficient aircraft by commercial airlines necessitates specialized MRO capabilities, contributing to market expansion. The aging fleet of civil aircraft also requires more frequent maintenance to ensure safety and compliance with regulatory standards. The proliferation of low-cost carriers and the increasing importance of sustainability are further driving demand for innovative and efficient MRO solutions within the civil aviation sector.

Recent Market Developments

- In December 2021, Korean Air demonstrated its technological breakthroughs by deploying drone swarms to inspect a full-body aeroplane with just four drones.

Competitive Landscape

Major players in the market

- GE Aviation (U.S.)

- Pratt & Whitney (U.S.)

- Safran Aircraft Engines (Paris)

- Rolls-Royce (U.K.)

- ST Aerospace (Singapore)

- SIA Engineering Company (Singapore)

- Air France Industries KLM Engineering & Maintenance (France)

- Lufthansa Technik (Germany)

- MTU Aero Engines (Germany)

- Delta TechOps (U.S.)

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aircraft Engine MRO Market, Engine Type Analysis

- Turbine Engine

- Piston Engine

Aircraft Engine MRO Market, Aircraft Type Analysis

- Fixed-Wing Aircraft

- Rotary-Wing Aircraft

Aircraft Engine MRO Market, Application Analysis

- Civil Aviation

- Military Aviation

Aircraft Engine MRO Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Aircraft Engine MRO?The global Aircraft Engine MRO Market is expected to grow from USD 25.2 billion in 2023 to USD 35.6 billion by 2033, at a CAGR of 3.52% during the forecast period 2023-2033.

-

2. Who are the key market players of the Aircraft Engine MRO Market?Some of the key market players of the market are GE Aviation (U.S.), Pratt & Whitney (U.S.), Safran Aircraft Engines (Paris), Rolls-Royce (U.K.), ST Aerospace (Singapore), SIA Engineering Company (Singapore), Air France Industries KLM Engineering & Maintenance (France), Lufthansa Technik (Germany), , MTU Aero Engines (Germany), , and Delta TechOps (U.S.).

-

3. Which segment holds the largest market share?The civil aviation segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Aircraft Engine MRO market?North America dominates the Aircraft Engine MRO market and has the highest market share.

Need help to buy this report?