Global Aircraft Engine Test Cells Market Size, Share, and COVID-19 Impact Analysis, by Engine Test (Turbofan, Turbojet, Turboshaft, Piston Engine, APU), by End User (OEMs, MROs, Airlines & Operators), by Point of Sale (New Installation, Retrofit & Upgrades, Maintenance & Services), by Solution Type (Test Cells, Component Test Benches, Software, Ancillary Systems, Data Acquisition & Control systems, Test Cells), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Aircraft Engine Test Cells Market Insights Forecasts to 2033

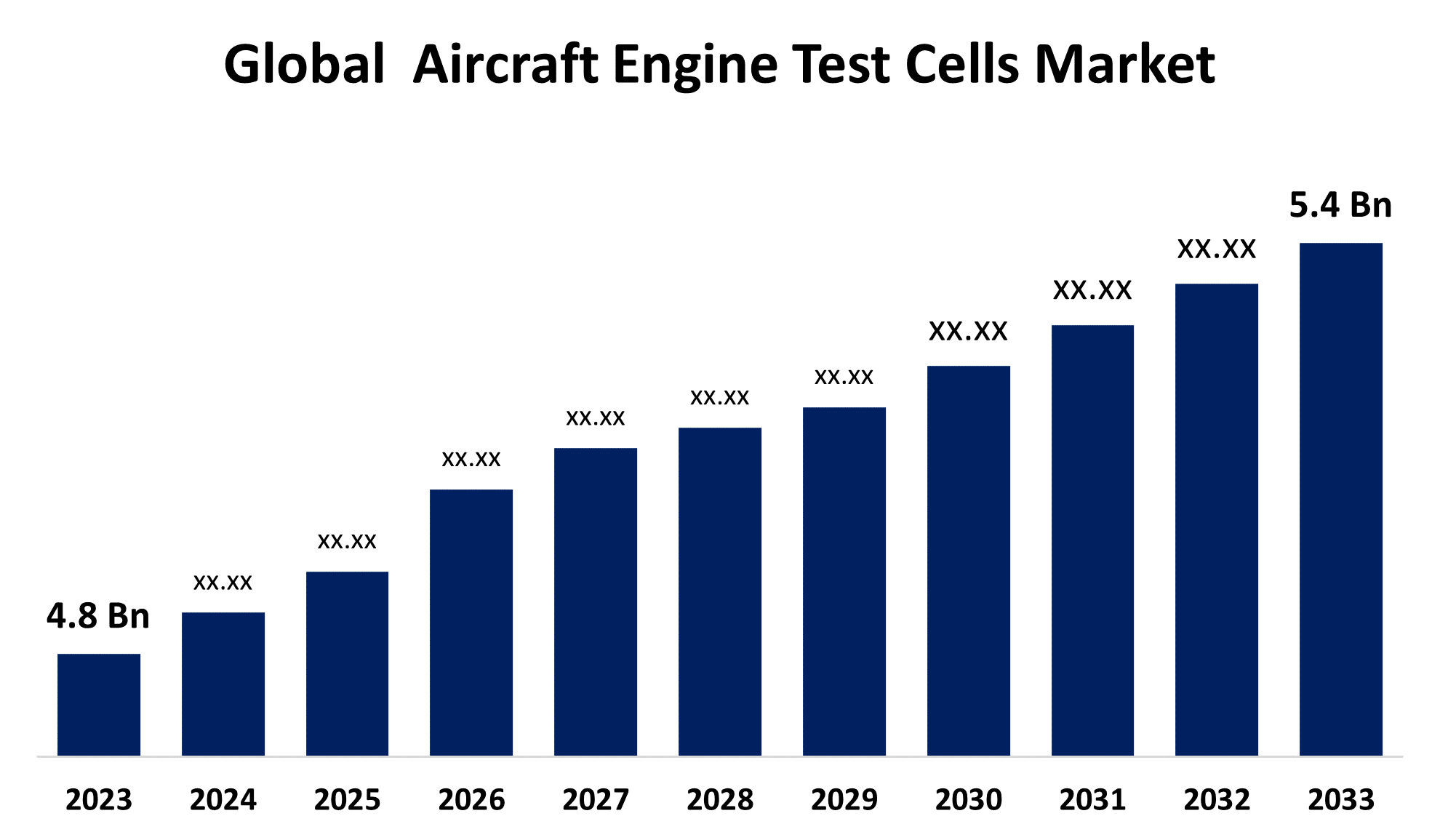

- The Aircraft Engine Test Cells Market Size was valued at USD 4.8 billion in 2023.

- The Market Size is Growing at a CAGR of 1.18% from 2023 to 2033

- The Worldwide Aircraft Engine Test Cells Market Size is Expected to reach USD 5.4 billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period

Get more details on this report -

The global Aircraft Engine Test Cells Market is expected to reach USD 5.4 billion by 2033, at a CAGR of 1.18% during the forecast period 2023 to 2033.

The Aircraft Engine Test Cells market is a critical segment of the aerospace industry, focusing on the development and operation of facilities designed for testing aircraft engines. These test cells are essential for ensuring the performance, reliability, and safety of engines under various conditions. The market is driven by increasing air travel, the need for engine efficiency, and stringent safety regulations. Technological advancements, such as automation and data analytics, are enhancing testing capabilities. Key players in this market include OEMs, MRO service providers, and specialized test cell manufacturers. The market is experiencing growth due to rising demand for new aircraft and the need for regular maintenance of existing fleets. Geographically, North America and Europe are the leading regions, with significant contributions from Asia-Pacific.

Global Aircraft Engine Test Cells Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 4.8 billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 1.18% |

| 2033 Value Projection: | USD 5.4 billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Engine Test, By Point of Sale, By Solution Type, By Region |

| Companies covered:: | Safran (France), MDS Aero Support Corporation (US), Calspan Corporation (US), Atec, Inc. (US), CEL (Canada), General Electric (US), RTX Corporation (US), Rolls-Royce plc (UK), Honeywell International Inc. (US), and Others key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Aircraft Engine Test Cells Market Value Chain Analysis

The value chain of the Aircraft Engine Test Cells market involves several key stages, from raw material supply to end-user application. It begins with the procurement of specialized materials and components necessary for constructing test cells, including advanced sensors, control systems, and data acquisition equipment. Next, engineering and design firms create customized solutions tailored to specific engine types and testing requirements. Manufacturers then produce and assemble these systems, incorporating the latest technologies for accurate performance evaluation. After installation, service providers offer calibration, maintenance, and support services to ensure the test cells operate optimally. Finally, end-users, such as OEMs, airlines, and MROs, utilize these facilities to test new engines, conduct routine checks, and certify repairs, ensuring safety and regulatory compliance.

Aircraft Engine Test Cells Market Opportunity Analysis

The Aircraft Engine Test Cells market presents significant growth opportunities driven by the increasing demand for new aircraft, stringent regulatory requirements, and the growing focus on fuel efficiency and emissions reduction. The rise in air travel, particularly in emerging markets, necessitates the expansion of fleets, thereby boosting the need for advanced engine testing facilities. Innovations in engine technology, including hybrid and electric propulsion, also require specialized test cells, creating new avenues for market expansion. Additionally, the trend towards digitalization and automation in testing processes offers opportunities for integrating advanced analytics and real-time monitoring, enhancing operational efficiency and accuracy. The aftermarket services segment, including maintenance and upgrades, presents further opportunities as airlines and MRO providers seek to extend the lifespan and performance of existing test cells.

Market Dynamics

Aircraft Engine Test Cells Market Dynamics

Increasing spending to establish new testing facilities for aviation engines to promote market expansion

The Aircraft Engine Test Cells market is poised for expansion due to increased spending on establishing new testing facilities for aviation engines. As airlines and aircraft manufacturers invest in expanding their fleets and upgrading to more fuel-efficient and environmentally friendly engines, the demand for state-of-the-art test cells grows. These facilities are essential for ensuring engines meet stringent regulatory standards and perform optimally. Additionally, the shift towards hybrid and electric propulsion systems necessitates specialized testing environments, prompting further investments. Governments and private sector players are allocating funds to develop advanced testing infrastructures, incorporating the latest technologies such as automation and data analytics. This trend not only supports the development of new engine types but also enhances the maintenance and performance optimization of existing engines, driving market growth.

Restraints & Challenges

One significant challenge is the high cost of developing and maintaining advanced test cell facilities, which requires substantial investment in technology and infrastructure. The complexity of integrating new technologies, such as automation and digital analytics, can also pose difficulties, particularly for smaller players lacking technical expertise and financial resources. Additionally, stringent regulatory standards and certification processes can create barriers, as compliance requires rigorous testing and documentation. The market is further challenged by the cyclical nature of the aviation industry, which can lead to fluctuating demand for test cell services. Moreover, the shift towards new propulsion technologies, such as electric and hybrid engines, necessitates specialized testing capabilities, adding another layer of complexity and cost.

Regional Forecasts

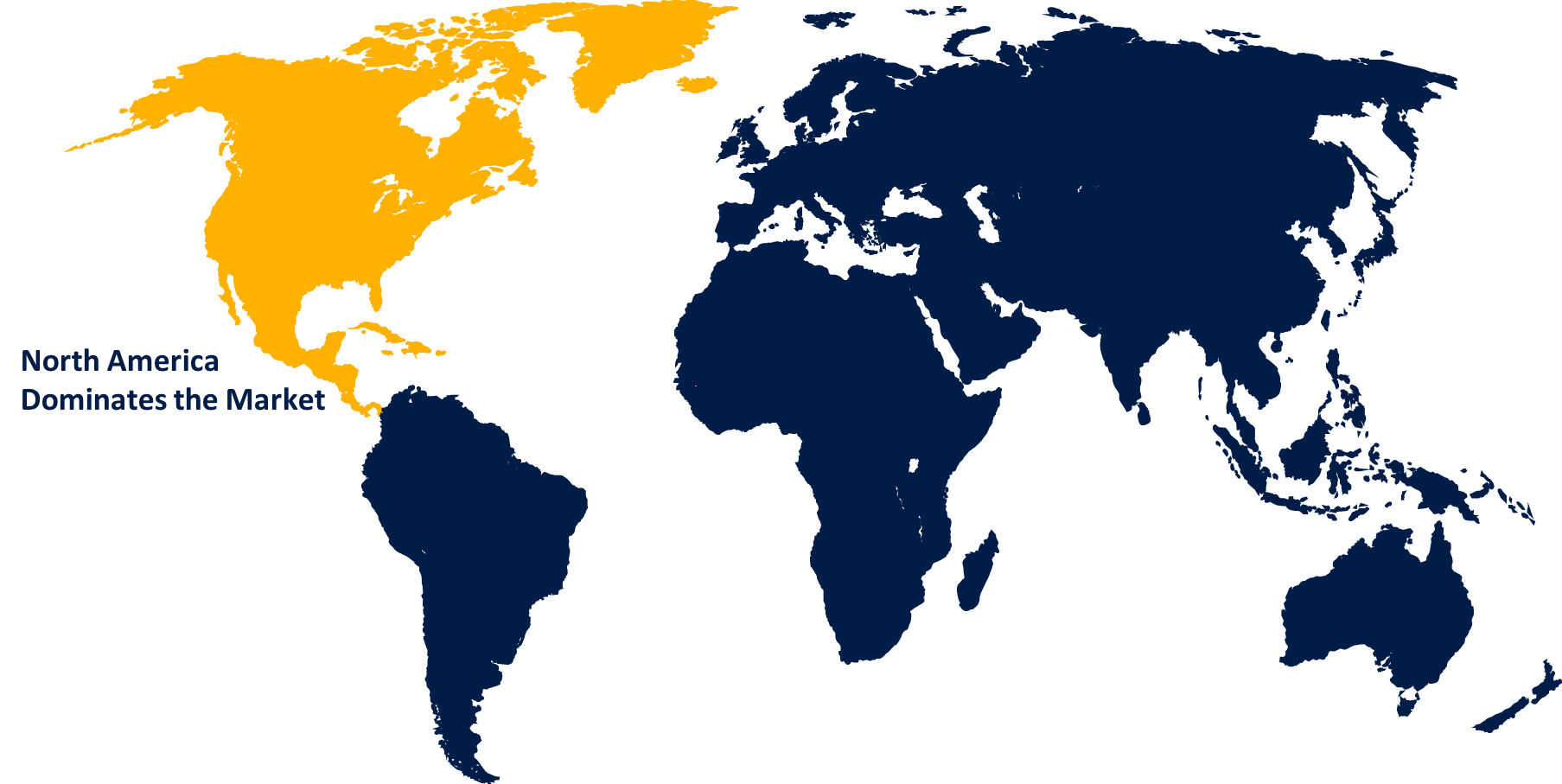

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Aircraft Engine Test Cells Market from 2023 to 2033. The region is characterized by a high concentration of test facilities and a strong focus on research and development, supported by substantial investments in the aerospace sector. The demand for new aircraft and the continuous upgrade of existing fleets contribute to the need for advanced testing capabilities. Additionally, stringent regulatory standards in the U.S. and Canada necessitate rigorous testing and certification processes, further boosting market demand. The growth of innovative engine technologies, such as fuel-efficient and hybrid engines, also drives the need for specialized test cells, fostering market expansion in North America.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Key factors include the rising need for new aircraft, driven by economic growth and a burgeoning middle class, which in turn boosts the demand for engine testing facilities. The region is also witnessing significant investments in the development of indigenous aircraft and engine manufacturing capabilities, particularly in countries like China and India. Additionally, the increasing focus on maintenance, repair, and overhaul (MRO) services necessitates advanced test cells to ensure engine reliability and compliance with international standards. The shift towards more fuel-efficient and environmentally friendly engines further drives the market, as these technologies require specialized testing environments.

Segmentation Analysis

Insights by Engine Test

The turbofan segment accounted for the largest market share over the forecast period 2023 to 2033. These engines are favored for their efficiency, reliability, and lower noise emissions, making them a preferred choice for both narrow-body and wide-body aircraft. The increasing production of commercial jets, coupled with the continuous development of new, more fuel-efficient turbofan models, necessitates advanced test cells for performance evaluation and certification. Furthermore, the stringent environmental regulations pushing for reduced carbon emissions are prompting innovations in turbofan technology, such as geared and ultra-high bypass ratio designs. These advancements require sophisticated testing environments to validate performance under various operational conditions, thus driving demand in this segment of the market.

Insights by End User

The OEM segment accounted for the largest market share over the forecast period 2023 to 2033. As leading engine manufacturers develop new and more efficient engine models, there is a corresponding need for specialized test cells to ensure these engines meet stringent performance, safety, and regulatory standards. The increasing production of aircraft to meet global travel demand, coupled with advancements in engine technology such as high-bypass turbofans and hybrid propulsion systems, fuels the need for advanced testing facilities. OEMs are investing in state-of-the-art test cells equipped with the latest technologies, including automation, data analytics, and simulation capabilities. This investment supports the validation, certification, and optimization of new engines, ensuring they operate efficiently and reliably across various conditions, thereby driving market growth in the OEM segment.

Insights by Point of Sale

The retrofit and upgrades segment accounted for the largest market share over the forecast period 2023 to 2033. As engine technologies evolve, older test cells require upgrades to accommodate new testing requirements, such as those for fuel-efficient and hybrid engines. This includes integrating advanced systems for data acquisition, automation, and emissions monitoring. Airlines and MRO (Maintenance, Repair, and Overhaul) providers are increasingly investing in retrofitting test cells to enhance their capabilities, ensure regulatory compliance, and optimize testing accuracy. The demand for these upgrades is also fueled by cost-saving considerations, as updating existing facilities is often more economical than building new ones.

Insights by Solution Type

The test cells segment accounted for the largest market share over the forecast period 2023 to 2033. As aviation technology advances, the need for specialized test cells that can accommodate new engine types and configurations, such as high-bypass turbofans and hybrid engines, is rising. Test cells equipped with advanced instrumentation, automation, and data analytics are essential for accurate performance evaluation and certification. The growth is further supported by the expansion of global aircraft fleets and the need for regular maintenance and upgrades of existing engines.

Recent Market Developments

- In February 2024, Safran and its associate Turbotech revealed progress in their project to develop hydrogen-powered turboprop engines for general aviation.

Competitive Landscape

Major players in the market

- Safran (France)

- MDS Aero Support Corporation (US)

- Calspan Corporation (US)

- Atec, Inc. (US)

- CEL (Canada)

- General Electric (US)

- RTX Corporation (US)

- Rolls-Royce plc (UK)

- Honeywell International Inc. (US)

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aircraft Engine Test Cells Market, Engine Test Analysis

- Turbofan

- Turbojet

- Turboshaft

- Piston Engine

- APU

Aircraft Engine Test Cells Market, End User Analysis

- OEMs

- MROs

- Airlines & Operators

Aircraft Engine Test Cells Market, Point of Sale Analysis

- New Installation

- Retrofit & Upgrades

- Maintenance & Services

Aircraft Engine Test Cells Market, Solution Analysis

- Test Cells

- Component Test Benches

- Software

- Ancillary Systems

- Data Acquisition & Control systems

Aircraft Engine Test Cells Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the market size of the Aircraft Engine Test Cells?The global Aircraft Engine Test Cells Market is expected to grow from USD 4.8 billion in 2023 to USD 5.4 billion by 2033, at a CAGR of 1.18% during the forecast period 2023-2033.

-

2.Who are the key market players of the Aircraft Engine Test Cells Market?Some of the key market players of the market are Safran (France), MDS Aero Support Corporation (US), Calspan Corporation (US), Atec, Inc. (US), CEL (Canada), General Electric (US), RTX Corporation (US), Rolls-Royce plc (UK), and Honeywell International Inc. (US).

-

3. Which segment holds the largest market share?The turbofans segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Aircraft Engine Test Cells market?North America dominates the Aircraft Engine Test Cells market and has the highest market share.

Need help to buy this report?