Global Aircraft Engines Market Size, Share, and COVID-19 Impact Analysis, By Engine Type (Turboprop Engine, Turboshaft Engine, Turbofan Engine, and Piston Engine), By Technology (Conventional Engine, Electric/Hybrid Engine), By Component (Compressor, Turbine, Gear Box, Combustion Chamber, Fuel System, and Others), By End-Use (Commercial (Narrow Body, Wide Body, Business Jet, General Aviation, Helicopters) and Military (Fighter Aircraft, Military Transport Aircraft, Military Helicopters), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Aircraft Engines Market Insights Forecasts to 2033

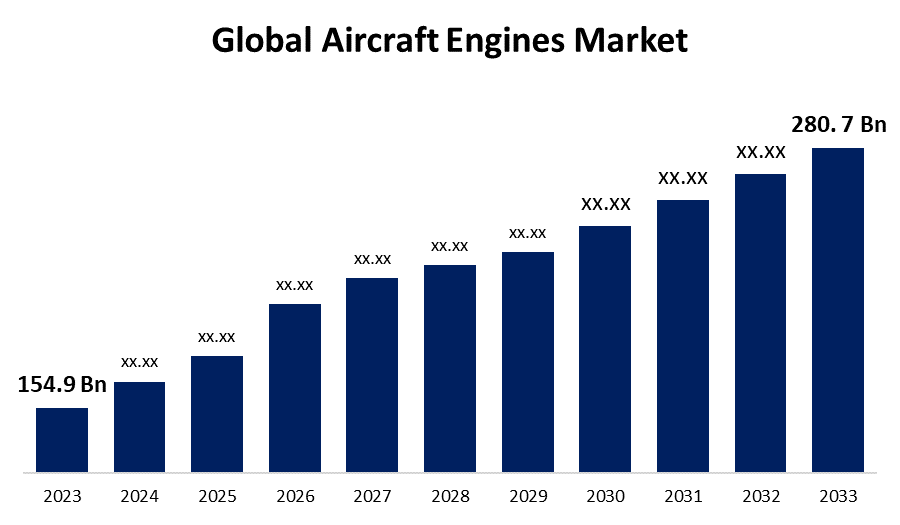

- The Global Aircraft Engines Market Size was valued at USD 154.9 Billion in 2023

- The Market Size is Growing at a CAGR of 6.13% from 2023 to 2033

- The Worldwide Aircraft Engines Market Size is expected to reach USD 280.7 Billion by 2033

- Asia Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Aircraft Engines Market is expected to reach USD 280.7 Billion by 2033, at a CAGR of 6.13% during the forecast period 2023 to 2033.

The aircraft engines market is a critical segment of the aerospace industry, driven by advancements in technology and increasing air travel demand. It includes a variety of engine types, such as turbofan, turboprop, and turboshaft, used in commercial, military, and general aviation. Key factors influencing the market include fuel efficiency, environmental regulations, and innovations in hybrid-electric propulsion. Major players, including GE Aviation, Rolls-Royce, and Pratt & Whitney, dominate the market, investing in research and development to enhance performance and reduce emissions. The Asia-Pacific region is experiencing significant growth, driven by rising air traffic and expanding aircraft fleets. The market's future is shaped by sustainability initiatives and the adoption of new technologies.

Aircraft Engines Market Value Chain Analysis

The aircraft engines market value chain encompasses several key stages, from raw material procurement to final engine delivery and aftermarket services. It begins with the sourcing of high-quality materials like titanium, nickel alloys, and composites, followed by the design and manufacturing of engine components, including compressors, turbines, and combustors. Leading engine manufacturers, such as GE Aviation and Rolls-Royce, oversee the integration and assembly of these components into complete engines. The engines then undergo rigorous testing and certification processes to meet regulatory and safety standards. Post-manufacture, the value chain extends to engine installation on aircraft, followed by maintenance, repair, and overhaul (MRO) services. This aftermarket segment is crucial for ensuring engine longevity and operational efficiency, providing ongoing revenue streams for manufacturers and service providers.

Aircraft Engines Market Opportunity Analysis

The aircraft engines market presents significant opportunities driven by advancements in technology, sustainability goals, and rising global air travel. The push for greener aviation solutions has spurred demand for fuel-efficient and low-emission engines, creating a market for innovative propulsion systems like hybrid-electric and hydrogen-powered engines. The growing fleet of commercial and regional aircraft, particularly in emerging markets such as Asia-Pacific and the Middle East, offers opportunities for new engine sales and retrofitting older fleets with more efficient models. Additionally, the expanding market for unmanned aerial vehicles (UAVs) and urban air mobility (UAM) solutions opens avenues for smaller, specialized engines. Investment in advanced materials and digital technologies, such as predictive maintenance, further enhances market potential, ensuring reliability and cost efficiency.

Global Aircraft Engines Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 154.9 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.13% |

| 2033 Value Projection: | USD 280.7 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Engine Type, By Technology, By Component, By End-Use, By Region |

| Companies covered:: | Honeywell International Inc., Safran, Rolls-Royce plc, Raytheon Technologies Corporation, Lycoming Engines, Engine Alliance, Textron Inc, MTU Aero Engines AG, Euravia Engineering & Supply Co. Ltd., General Electric, MITSUBISHI HEAVY INDUSTRIES, LTD, IHI Corporation, Barnes Group Inc, CFM International, and other key companies. |

| Growth Drivers: | Increased adoption of cost-effective and fuel-efficient aircraft is accelerating market growth |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Market Dynamics

Aircraft Engines Market Dynamics

Increased adoption of cost-effective and fuel-efficient aircraft is accelerating market growth

The aircraft engines market is experiencing accelerated growth due to the increased adoption of cost-effective and fuel-efficient aircraft. Airlines are prioritizing fleet modernization to reduce operational costs and meet stringent environmental regulations. New-generation engines, such as Pratt & Whitney's GTF and CFM International's LEAP, offer significant improvements in fuel efficiency and lower emissions, making them attractive to airlines aiming for cost savings and sustainability. Additionally, advancements in materials and aerodynamics contribute to lighter and more efficient engines. The trend is particularly strong in regions with rapidly growing air travel demand, like Asia-Pacific and the Middle East, where airlines are expanding their fleets with next-generation aircraft. This shift towards more efficient engines is driving demand and encouraging further innovation in the industry.

Restraints & Challenges

The aircraft engines market faces several challenges that impact its growth and development. Stringent environmental regulations necessitate significant investment in research and development to produce lower-emission and fuel-efficient engines, increasing costs for manufacturers. Technological complexities and the high precision required in manufacturing also pose barriers, with any faults potentially leading to costly delays and recalls. The market's cyclical nature, influenced by fluctuations in global air travel demand and economic conditions, adds another layer of unpredictability. Additionally, supply chain disruptions, such as shortages of critical raw materials or components, can hinder production schedules. The intense competition among major players further pressures companies to innovate continuously, while geopolitical tensions and trade restrictions can impact market access and operations, complicating global business strategies.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Aircraft Engines Market from 2023 to 2033. The region's demand is bolstered by the presence of major airlines modernizing their fleets with more fuel-efficient aircraft to reduce costs and comply with stringent environmental regulations. The U.S. government’s defense spending also contributes to the market, with ongoing investments in advanced military aircraft. Additionally, North America is a hub for research and development in next-generation propulsion technologies, including hybrid-electric and hydrogen-powered engines. The market benefits from a well-developed supply chain, advanced manufacturing capabilities, and a robust network of maintenance, repair, and overhaul (MRO) services, ensuring continued growth and innovation.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Major economies like China, India, and Southeast Asian countries are experiencing a surge in both commercial and regional aviation, leading airlines to invest in new, fuel-efficient aircraft to accommodate passenger growth and optimize operational costs. The region's market is also supported by the increasing presence of local aircraft and engine manufacturers, along with significant government investments in aerospace infrastructure. Asia-Pacific's focus on environmental sustainability drives demand for advanced, low-emission engines. Additionally, the growing interest in unmanned aerial vehicles (UAVs) and urban air mobility (UAM) solutions presents new opportunities.

Segmentation Analysis

Insights by Engine Type

The turbofan segment accounted for the largest market share over the forecast period 2023 to 2033. Turbofan engines, known for their high bypass ratios, offer a balance of fuel efficiency, noise reduction, and thrust, making them ideal for commercial aviation. The rise in air travel, fleet expansions, and the replacement of older, less efficient aircraft with modern models are key factors fueling this segment's growth. Innovations in materials, aerodynamics, and engine design, such as geared turbofans and ultra-high bypass ratios, are further enhancing efficiency and reducing emissions. The expansion of low-cost carriers and the increasing demand for long-haul flights in regions like Asia-Pacific and the Middle East also contribute to the growing adoption of advanced turbofan engines.

Insights by Technology

The conventional engine segment accounted for the largest market share over the forecast period 2023 to 2033. This growth is driven by ongoing demand for reliable and proven propulsion systems in commercial, military, and general aviation. Conventional engines remain the backbone for many aircraft, including narrow-body jets, regional aircraft, and helicopters. Fleet expansion and replacement cycles, especially in emerging markets, sustain the demand for these engines. Additionally, advancements in materials and design have improved the efficiency and performance of conventional engines, extending their relevance. While there's a push towards more sustainable propulsion systems, the conventional engine segment still holds a significant market share, supported by established infrastructure and extensive maintenance networks.

Insights by Component

The compressor segment accounted for the largest market share over the forecast period 2023 to 2033. Compressors play a crucial role in the engine's performance, as they compress incoming air before it enters the combustion chamber, directly impacting fuel efficiency and power output. The development of advanced materials and manufacturing technologies, such as additive manufacturing, has enabled the production of lighter, more durable, and highly efficient compressor components. This is particularly important for modern turbofan and turboprop engines, which require high-pressure ratios for optimal performance. The ongoing trend towards reducing engine emissions and improving fuel efficiency also drives innovation in compressor design.

Insights by End Use

The commercial segment accounted for the largest market share over the forecast period 2023 to 2033. Airlines are investing in new aircraft equipped with advanced engines to enhance fuel efficiency, reduce operating costs, and meet stringent environmental regulations. The rise of low-cost carriers and the need for long-haul and regional flights contribute to the demand for new, more efficient engines. Technological advancements, such as high-bypass turbofan engines and geared turbofan designs, are further propelling this segment's growth by offering significant improvements in fuel efficiency and reduced emissions. Additionally, the recovery of the aviation industry post-pandemic and expanding travel routes, particularly in emerging markets like Asia-Pacific, are key factors driving growth in the commercial engine segment.

Recent Market Developments

- In March 2024, the Ministry of Defence announced the signing of a contract with Hindustan Aeronautics Limited (HAL) to purchase MiG-29 aircraft engines for USD 5,249.72 billion.

Competitive Landscape

Major players in the market

- Honeywell International Inc.

- Safran

- Rolls-Royce plc

- Raytheon Technologies Corporation

- Lycoming Engines

- Engine Alliance

- Textron Inc

- MTU Aero Engines AG

- Euravia Engineering & Supply Co. Ltd.

- General Electric

- MITSUBISHI HEAVY INDUSTRIES, LTD

- IHI Corporation

- Barnes Group Inc

- CFM International

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aircraft Engines Market, Engine Type Analysis

- Turboprop Engine

- Turboshaft Engine

- Turbofan Engine

- Piston Engine

Aircraft Engines Market, Technology Analysis

- Conventional Engine

- Electric/Hybrid Engine

Aircraft Engines Market, Component Analysis

- Compressor

- Turbine

- Gear Box

- Combustion Chamber

- Fuel System

- Others

Aircraft Engines Market, End Use Analysis

- Commercial

- Narrow Body

- Wide Body

- Business Jet

- General Aviation

- Helicopters

- Military

- Fighter Aircraft

- Military Transport Aircraft

- Military Helicopters

Aircraft Engines Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Aircraft Engines?The global Aircraft Engines Market is expected to grow from USD 154.9 billion in 2023 to USD 280.7 billion by 2033, at a CAGR of 6.13% during the forecast period 2023-2033.

-

2. Who are the key market players of the Aircraft Engines Market?Some of the key market players of the market are Honeywell International Inc., Safran, Rolls-Royce plc, Raytheon Technologies Corporation, Lycoming Engines, Engine Alliance, Textron Inc, MTU Aero Engines AG, Euravia Engineering & Supply Co. Ltd., General Electric, MITSUBISHI HEAVY INDUSTRIES, LTD, IHI Corporation, Barnes Group Inc, CFM International.

-

3. Which segment holds the largest market share?The turbofans segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Aircraft Engines market?North America dominates the Aircraft Engines market and has the highest market share.

Need help to buy this report?