Global Aircraft Exhaust System Market Size, Share, and COVID-19 Impact Analysis, By Engine Type (Turbine Engine System, Piston Engine System and APU System), By Application (Civil Aviation and Military Aviation), By End-User (OEM and Aftermarket), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Aircraft Exhaust System Market Insights Forecasts to 2033

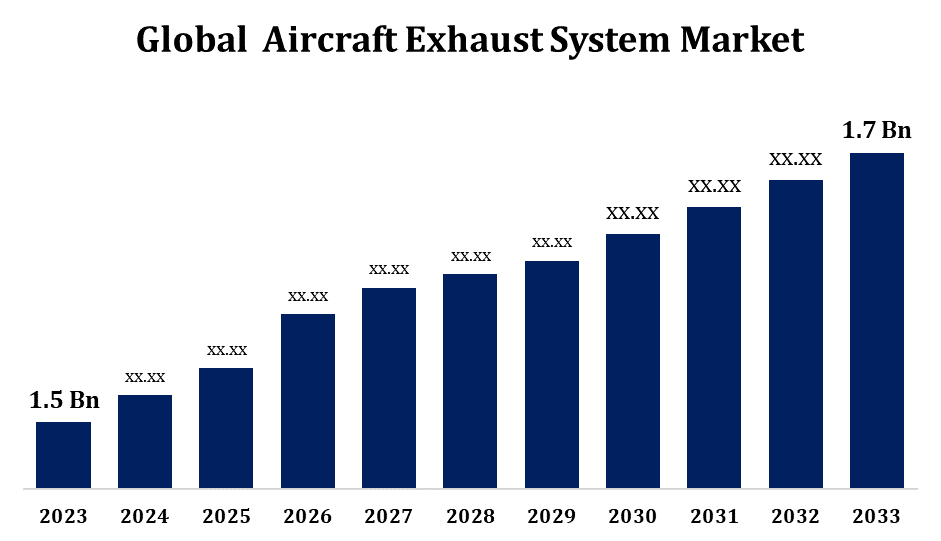

- The Aircraft Exhaust System Market Size was valued at USD 1.5 Billion in 2023.

- The market Size is Growing at a CAGR of 1.26% from 2023 to 2033

- The Worldwide Aircraft Exhaust System Market Size is Expected to reach USD 1.7 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Aircraft Exhaust System Market Size is Expected to reach USD 1.7 Billion by 2033, at a CAGR of 1.26% during the forecast period 2023 to 2033.

The aircraft exhaust system market is experiencing steady growth due to increasing air traffic, stringent emission regulations, and the rising demand for fuel-efficient aircraft. These systems are crucial for managing the expulsion of exhaust gases, reducing noise, and minimizing environmental impact. Technological advancements, such as the integration of lightweight materials and advanced heat-resistant coatings, are enhancing system efficiency and durability. Key players in the industry are investing in research and development to innovate and meet evolving regulatory standards. Additionally, the expansion of the aerospace sector in emerging economies is contributing to market growth.

Aircraft Exhaust System Market Value Chain Analysis

The aircraft exhaust system market's value chain begins with raw material suppliers providing essential components like high-temperature alloys and composites. Manufacturers then design and fabricate exhaust systems, incorporating advanced technologies for noise reduction and emission control. These systems are integrated by aircraft original equipment manufacturers (OEMs) during the assembly of aircraft. Aftermarket services, including maintenance, repair, and overhaul (MRO), play a crucial role in ensuring system longevity and compliance with safety standards. Regulatory bodies set emission and noise standards that influence system design and material selection. Additionally, research and development by key industry players drive innovation and efficiency improvements. The value chain is completed by end-users, including commercial airlines and military operators, who rely on these systems for safe and efficient operations.

Aircraft Exhaust System Market Opportunity Analysis

The aircraft exhaust system market presents significant opportunities driven by increasing air travel and the aviation industry's focus on sustainability. The growing demand for fuel-efficient and low-emission aircraft is spurring the development of advanced exhaust systems with lightweight materials and innovative technologies. Stringent environmental regulations are pushing manufacturers to design systems that minimize noise and reduce harmful emissions. Additionally, the expanding aerospace sector in emerging markets offers new avenues for market growth. The rising popularity of electric and hybrid aircraft also presents opportunities for specialized exhaust systems. Furthermore, the aftermarket segment, particularly for maintenance and upgrades, offers lucrative prospects as airlines seek to extend the lifespan of their fleets and comply with evolving regulatory standards.

Global Aircraft Exhaust System Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.5 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 1.26% |

| 2033 Value Projection: | USD 1.7 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 260 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Engine Type, By Application, By End-User, By Region |

| Companies covered:: | CKT Aero & Automotive Engineering Ltd., Knisley Welding, Inc., Doncasters Group Ltd., United Technologies Corporation, Magellen Aerospace Corporation, Senior plc, Acorn Welding Ltd., Sky Dynamics Corporation, Power Flow Systems, Inc., SAFRAN Nacelles and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, and Analysis |

Get more details on this report -

Market Dynamics

Aircraft Exhaust System Market Dynamics

Increasing need for new commercial aircraft

As global air travel demand rises, airlines are expanding their fleets to accommodate more passengers and cargo. This surge in new aircraft orders, particularly for fuel-efficient models, is boosting the demand for advanced exhaust systems that can meet stringent emission and noise regulations. Additionally, the replacement of aging aircraft with newer, more environmentally friendly models contributes to the market's expansion. Manufacturers are focusing on developing lightweight and durable exhaust systems that enhance fuel efficiency and reduce environmental impact. The continuous innovation and technological advancements in exhaust systems are critical in supporting the aviation industry's commitment to sustainability and operational efficiency.

Restraints & Challenges

The high cost of advanced materials and technologies needed to develop efficient systems poses financial constraints for manufacturers. Additionally, the complexity of integrating new systems into existing aircraft designs can lead to technical difficulties and increased development time. The market is also impacted by economic fluctuations and geopolitical tensions, which can affect airline profitability and, consequently, the demand for new aircraft and exhaust systems. Furthermore, the push for sustainable aviation solutions, such as electric and hybrid aircraft, presents a challenge as it requires the industry to adapt to new propulsion technologies that may not require traditional exhaust systems, potentially reducing market demand in the long term.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Aircraft Exhaust System Market from 2023 to 2033. The region is home to major aircraft manufacturers and a robust supply chain, fostering innovation and development in exhaust system technologies. The United States, in particular, has a strong defense sector, contributing to the demand for advanced exhaust systems for military aircraft. Additionally, stringent environmental regulations in North America are pushing for the adoption of systems that reduce emissions and noise pollution. The region's focus on modernizing aging fleets with more fuel-efficient and environmentally friendly aircraft further supports market growth.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The rise of low-cost carriers and the burgeoning middle-class population contribute to the increasing demand for new aircraft, boosting the market for advanced exhaust systems. Additionally, regional governments are implementing stricter environmental regulations, prompting airlines to adopt exhaust systems that reduce emissions and noise. The region's focus on developing domestic aerospace capabilities and infrastructure, along with significant investments in research and development, further supports market growth. The expanding aftermarket services sector also plays a crucial role in the maintenance and upgrading of aircraft exhaust systems.

Segmentation Analysis

Insights by Engine Type

The turbine engine system segment accounted for the largest market share over the forecast period 2023 to 2033. The turbine engine system segment is experiencing notable growth in the aircraft exhaust systems market, driven by the increasing demand for fuel-efficient and low-emission aircraft. As airlines seek to reduce operational costs and comply with stringent environmental regulations, there is a heightened focus on advanced turbine engines that offer improved efficiency and reduced emissions. This growth is further supported by the development of new materials and technologies, such as lightweight composites and advanced coatings, that enhance the performance and durability of turbine exhaust systems. Additionally, the proliferation of both commercial and military aircraft equipped with turbine engines, along with the expansion of the aviation sector in emerging markets, is fueling demand.

Insights by Application

The civil aviation segment accounted for the largest market share over the forecast period 2023 to 2033. The demand for new, fuel-efficient, and environmentally friendly aircraft is rising as airlines aim to reduce operational costs and comply with stricter emission and noise regulations. This has led to the adoption of advanced exhaust systems that offer better performance and lower environmental impact. The proliferation of low-cost carriers and regional airlines, especially in emerging markets, further bolsters demand for commercial aircraft. Additionally, the push for sustainability and innovation in the aviation industry is prompting the development of next-generation exhaust systems, which contribute to the overall growth of the civil aviation segment.

Insights by End User

The OEM segment accounted for the largest market share over the forecast period 2023 to 2033. As airlines expand their fleets to meet rising passenger demand, the demand for exhaust systems integrated during aircraft manufacturing has surged. OEMs are focusing on developing advanced exhaust systems that enhance fuel efficiency, reduce emissions, and comply with stringent environmental regulations. Innovations in materials and design, such as lightweight composites and noise-reducing technologies, are also key factors contributing to this segment's growth. The OEM segment benefits from the ongoing modernization of fleets, particularly as older aircraft are replaced with newer, more efficient models.

Recent Market Developments

- Recently, VMX-1 tested the viper attack helicopter with the JAGM weapon, improving the marine corps' capabilities to support maritime or littoral missions.

Competitive Landscape

Major players in the market

- CKT Aero & Automotive Engineering Ltd.

- Knisley Welding, Inc.

- Doncasters Group Ltd.

- United Technologies Corporation

- Magellen Aerospace Corporation

- Senior plc

- Acorn Welding Ltd.

- Sky Dynamics Corporation

- Power Flow Systems, Inc.

- SAFRAN Nacelles

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aircraft Exhaust System Market, Engine Analysis

- Turbine Engine System

- Piston Engine System

- APU System

Aircraft Exhaust System Market, Application Analysis

- Civil Aviation

- Military Aviation

Aircraft Exhaust System Market, End User Analysis

- OEM

- Aftermarket

Aircraft Exhaust System Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the market size of the Aircraft Exhaust System?The global Aircraft Exhaust System Market is expected to grow from USD 1.5 billion in 2023 to USD 1.7 billion by 2033, at a CAGR of 1.26% during the forecast period 2023-2033.

-

2.Who are the key market players of the Aircraft Exhaust System Market?Some of the key market players of the market are CKT Aero & Automotive Engineering Ltd., Knisley Welding, Inc., Doncasters Group Ltd., United Technologies Corporation, Magellen Aerospace Corporation, Senior plc, Acorn Welding Ltd., Sky Dynamics Corporation, Power Flow Systems, Inc., SAFRAN Nacelles.

-

3.Which segment holds the largest market share?The OEM segment holds the largest market share and is going to continue its dominance.

-

4.Which region dominates the Aircraft Exhaust System market?North America dominates the Aircraft Exhaust System market and has the highest market share.

Need help to buy this report?