Global Aircraft Fasteners Market Size By Product Type (Screws, Rivets, Nuts & Bolts), By Material Based (Aluminum, Steel, Titanium, Superalloys), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033

Industry: Aerospace & DefenseGlobal Aircraft Fasteners Market Size Insights Forecasts to 2033

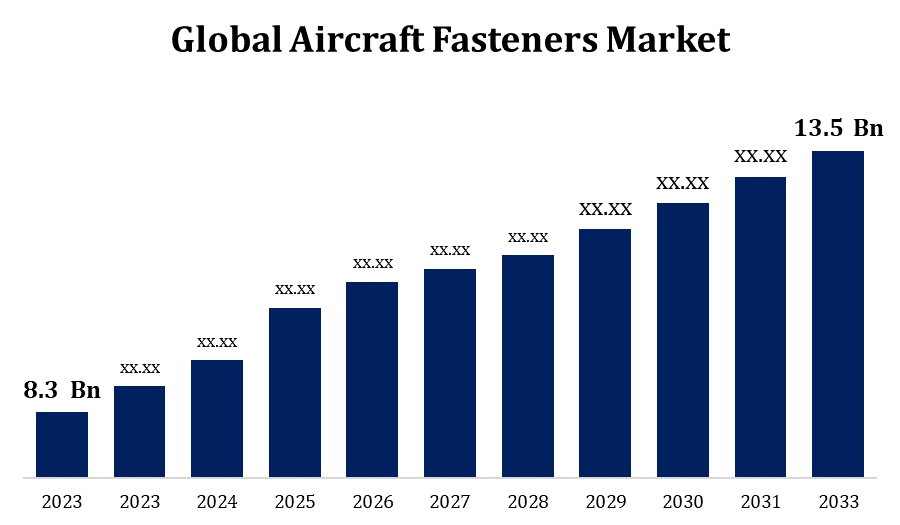

- The Global Aircraft Fasteners Market Size was valued at USD 8.3 Billion in 2023.

- The market is Growing at a CAGR of 4.98% from 2023 to 2033

- The Worldwide Aircraft Fasteners Market is Expected to reach USD 13.5 Billion by 2033

- Asia Pacific is Expected to Grow the Fastest during the Forecast period

Get more details on this report -

The Global Aircraft Fasteners Market is expected to reach USD 13.5 billion by 2033, at a CAGR of 4.98% during the forecast period 2023 to 2033.

The demand for aircraft fasteners is closely related to the manufacture of new aircraft. As airlines and military organisations throughout the world continue to modernise and expand their fleets, the demand for fasteners grows. Innovations in materials and manufacturing techniques help to generate more efficient and lightweight fasteners, which are critical for improving aircraft performance. Titanium and other lightweight metals have grown in popularity for fastener manufacturing due to their high strength-to-weight ratio and corrosion resistance. The aerospace industry's growing emphasis on sustainability has resulted in the development of environmentally friendly materials and manufacturing procedures for fasteners. The use of digital technology for supply chain management, quality control, and maintenance is becoming more common in the aerospace fasteners sector.

Aircraft Fasteners Market Value Chain Analysis

The process begins with the procurement of raw materials such as high-strength metals and alloys like titanium, aluminium, stainless steel, and nickel-based alloys. Raw materials are treated using a variety of processes, including forging, extrusion, and machining, to generate the basic shapes necessary for fasteners. Many fasteners are heat treated to improve their mechanical qualities, including strength and hardness. The treated materials are subsequently shaped into the exact forms needed for fasteners using techniques such as cold heading for bolts and threading for screws. To create entire fastening systems, fastener manufacturers may rely on specialised suppliers for additional components such as washers or nuts. Finished fasteners are provided via a network of suppliers, distributors, and, in some cases, directly to aircraft manufacturers. Aircraft builders use fasteners in a variety of components during the assembly process, including the airframe, wings, engines, and interior fittings. End users, including commercial airlines and defence forces, operate and maintain aircraft, necessitating a consistent supply of fasteners for continuing operations and prospective modifications.

Aircraft Fasteners Market Opportunity Analysis

With rising demand for air travel and the need for fleet modernization, fastener producers have a chance to capitalise on expanded aircraft production by offering a bigger number of high-quality, technologically sophisticated fasteners. The aircraft sector is constantly evolving, and fastener producers have an opportunity to engage in R&D to offer innovative fastening solutions. This might include lightweight materials, smart fasteners with sensors, and cutting-edge coating processes. As emerging economies' air travel demand grows, fastener makers have a chance to extend their market position in these markets. Integrating digital technologies for supply chain management, quality control, and predictive maintenance can increase efficiency while providing a competitive advantage.

Global Aircraft Fasteners Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 8.3 billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.98% |

| 2033 Value Projection: | USD 13.5 billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product Type, By Material, By Region, By Geographic |

| Companies covered:: | Bombardier, Embraer, Comac, Stanley Black & Decker Inc., LISI Aerospace, 3M Fasteners, Precision Castparts Corp, Alcoa Fastening Systems & Rings, B&B Specialities Inc, Bufab Group, Boeing, Airbus, Dassault System, Boeing Distribution Services Inc., Stanely Black & Decker Inc., and |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Aircraft Fasteners Market Dynamics

Surge in demand for commercial aircraft

As the world's economy rise and middle-class populations grow, so does demand for air travel. This results in increased orders for new commercial aircraft to fulfil expanding passenger demand. Airlines constantly replace their fleets with newer, more fuel-efficient, and technologically advanced aircraft. This is frequently motivated by a desire to lower operating expenses and increase overall efficiency. The expansion of low-cost carriers (LCCs) and regional airlines has been a major trend in the aviation sector. These airlines frequently concentrate on high-frequency, short-haul services. The demand for air travel has increased significantly in emerging areas, particularly Asia, the Middle East, and Latin America. These regions are investing in aviation infrastructure to accommodate an increasing number of passengers.

Restraints & Challenges

The aerospace business has undergone consolidation, with larger corporations acquiring smaller ones. This might provide difficulties for smaller fastener makers in terms of competition and market access. The aircraft business is cyclical and can be impacted by economic downturns, geopolitical crises, or external shocks (such as the COVID-19 pandemic). Fluctuations in new aircraft demand during economic downturns can have a direct impact on demand for aircraft fasteners. Companies must be resilient and adaptive to traverse industry cycles. The aircraft supply chain is complex and worldwide, making it susceptible to disruptions caused by geopolitical conflicts, natural disasters, or other unanticipated circumstances. Fasteners are frequently constructed from high-performance materials such as titanium and nickel-based alloys, and their prices might fluctuate.

Regional Forecasts

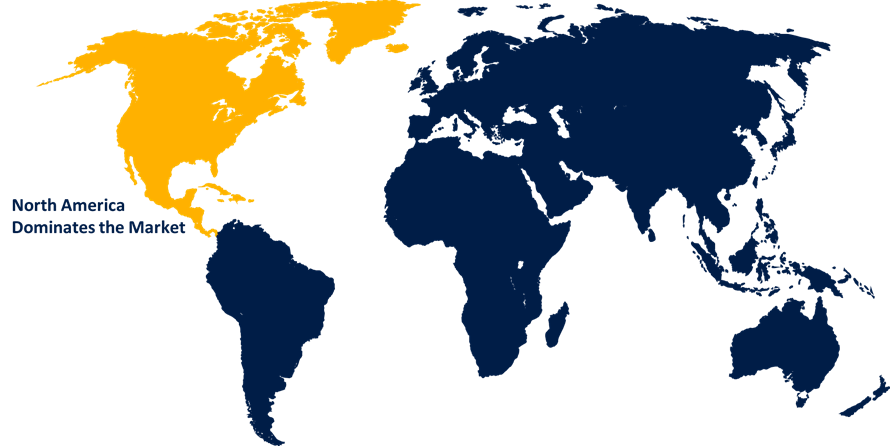

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Aircraft Fasteners Market from 2023 to 2033. North America, notably the United States, boasts a formidable defence sector. Military aircraft production and maintenance, driven by Department of Defence contracts, increase demand for specialised fasteners used in military aviation. North America boasts well-established and interconnected aerospace supply chains. Fastener makers in the region frequently collaborate with aircraft OEMs, Tier 1 suppliers, and other supply chain stakeholders. North America has a large aftermarket for aviation maintenance and repair. The demand for replacement fasteners in MRO activities influences the overall market dynamics. North American aerospace companies, especially fastener producers, frequently export their products worldwide. The region's impact goes beyond its home market, assisting worldwide trade in the aircraft industry.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Countries in the Asia-Pacific area, particularly China and India, have seen significant economic expansion, resulting in an increase in air travel demand. The rising demand for commercial aircraft in the region has aided the growth of the aircraft fasteners industry. Several Asia-Pacific countries, particularly China, have made considerable investments in expanding their aerospace manufacturing capabilities. China, in particular, has made efforts towards developing a competitive aircraft sector. Cities such as Chengdu and Shanghai have emerged as aerospace hubs, housing a variety of production facilities and research centres. Some Asia-Pacific countries are investing in defence modernization, which is driving up demand for military aircraft and related equipment.

Segmentation Analysis

Insights by Product Type

The rivets segment accounted for the largest market share over the forecast period 2023 to 2033. The aircraft sector has seen material advancements such as lightweight metals and composites. Rivets' versatility to many materials, such as aluminium, titanium, and composite materials, makes them crucial components in current aircraft construction. The growth in worldwide air travel has created demand for new commercial aircraft. The construction of new aircraft necessitates a large number of fasteners, including rivets, which contributes to the growth of the rivets market. The aftermarket segment, which includes MRO activities, requires an ongoing supply of replacement fasteners. Rivets are widely employed in MRO activities, which contributes to the ongoing demand for rivets for maintaining and repairing current aircraft. Aerospace manufacturers, particularly those that make rivets, frequently engage in international trade.

Insights by Material Based

The superalloys segment accounted for the largest market share over the forecast period 2023 to 2033. Superalloys have outstanding mechanical qualities at high temperatures, making them ideal for crucial applications in aircraft engines and other components subjected to great heat. The aerospace industry has a high demand for high-temperature-resistant materials, which is helping to drive the expansion of superalloys in the fasteners market. As the aviation industry continues to innovate and build more modern and fuel-efficient engines, there is an increasing demand for superalloy fasteners that can survive the extreme conditions found within engines. Global demand for air travel has resulted in increased aircraft production to suit the aviation industry's expanding needs. The increased production of aeroplanes creates a commensurate demand for sophisticated materials such as superalloys in fasteners used in various components.

Recent Market Developments

- In June 2019, Trimas Aerospace, based in the United States, stated that it has inked a long-term deal with Safran nacelles and Sonaca business.

Competitive Landscape

Major players in the market

- Bombardier

- Embraer

- Comac

- Stanley Black & Decker Inc.

- LISI Aerospace

- 3M Fasteners

- Precision Castparts Corp

- Alcoa Fastening Systems & Rings

- B&B Specialities Inc

- Bufab Group

- Boeing

- Airbus

- Dassault System

- Boeing Distribution Services Inc.

- Stanely Black & Decker Inc.

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aircraft Fasteners Market, Product Analysis

- Screws

- Rivets

- Nuts & Bolts

Aircraft Fasteners Market, Material Based Analysis

- Aluminum

- Steel

- Titanium

- Superalloys

Aircraft Fasteners Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Need help to buy this report?