Global Aircraft Filters Market Size, Share, and COVID-19 Impact Analysis, By Aircraft Type (Narrow-body, Wide-body, Regional, General Aviation, Helicopter, Military), by Application (Cabin, Engine, Hydraulics, Avionics, Others), By End-Use (OEM, Aftermarket), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Aircraft Filters Market Insights Forecasts to 2033

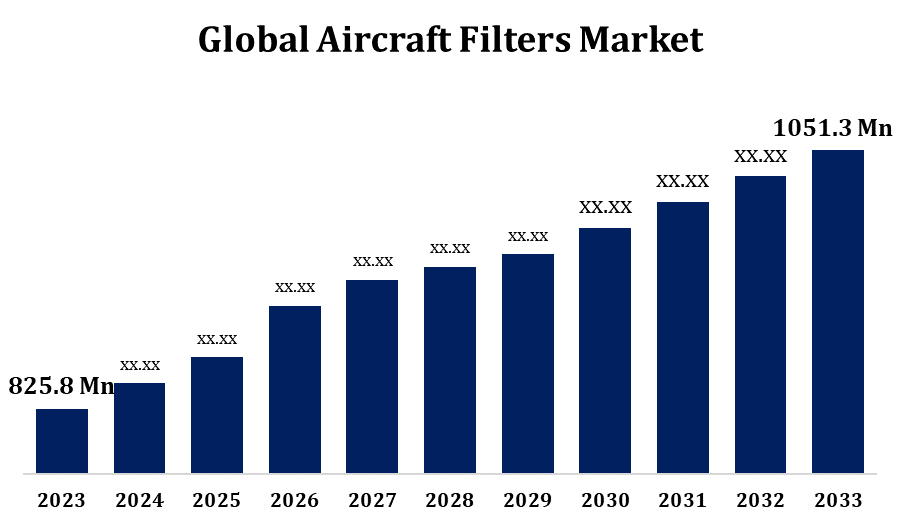

- The Aircraft Filters Market Size was valued at USD 825.8 Million in 2023.

- The Market is Growing at a CAGR of 2.44% from 2023 to 2033.

- The Global Aircraft Filters Market Size is Expected to reach USD 1051.3 Million By 2033.

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Aircraft Filters Market is Size Expected to reach USD 1051.3 Million By 2033, at a CAGR of 2.44% during the forecast period 2023 to 2033.

The aircraft filters market is experiencing steady growth due to increasing air travel, rising aircraft production, and stringent regulations on aviation safety and emissions. These filters play a crucial role in maintaining air quality, fluid purity, and engine efficiency in both commercial and military aircraft. Factors such as technological advancements in filtration materials, the growing demand for fuel-efficient aircraft, and the expansion of the aviation industry in emerging economies are driving market growth. Key segments include air filters, fuel filters, oil filters, and hydraulic filters, with major players focusing on innovation and lightweight solutions. The aftermarket sector is also expanding due to frequent maintenance requirements. North America and Europe dominate the market, while Asia-Pacific is witnessing rapid growth due to rising aircraft fleets. Sustainability trends are further influencing filter design and materials.

Aircraft Filters Market Value Chain Analysis

The aircraft filters market value chain consists of several key stages, from raw material suppliers to end-users. It begins with suppliers providing materials such as metal alloys, synthetic fibers, and advanced filtration media. Manufacturers then design and produce various filters, including air, fuel, oil, and hydraulic filters, ensuring compliance with aviation standards. These products are distributed through OEMs (original equipment manufacturers) that integrate them into new aircraft or supply them to airlines and defense agencies. The aftermarket segment, including MRO (maintenance, repair, and overhaul) services, plays a critical role in replacing and upgrading filters to ensure optimal aircraft performance. Regulatory bodies such as the FAA and EASA oversee quality and safety compliance. Technological advancements and sustainability trends are driving innovations in filter efficiency and durability.

Aircraft Filters Market Opportunity Analysis

The aircraft filters market presents significant opportunities driven by rising air travel, expanding aircraft fleets, and stringent aviation regulations. The growing demand for fuel-efficient and low-emission aircraft is pushing manufacturers to develop advanced filtration solutions. Emerging markets in Asia-Pacific and the Middle East offer lucrative growth prospects due to increasing air passenger traffic and military aviation investments. The aftermarket segment is also expanding, with airlines prioritizing maintenance and retrofitting older aircraft with high-performance filters. Innovations in nanofiber filtration, lightweight materials, and smart monitoring technologies further enhance market potential. Additionally, the push for sustainable aviation solutions, such as eco-friendly filters and improved air purification systems, creates new avenues for growth. Partnerships between OEMs and MRO service providers will be key in capturing these opportunities.

Global Aircraft Filters Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 825.8 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 2.44% |

| 2033 Value Projection: | USD 1051.3 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Aircraft Type, By Application, By End-Use, By Region |

| Companies covered:: | Aerospace Systems & Components, Arrowprop Co Inc, Camfil, Donaldson Inc., Eaton Corporation Plc, Filtration Group, Fluid Conditioning Products, Inc., Freudenberg & Co. KG, HFE International, LLC, Hollingsworth & Vose, Honeywell International Inc., Pall Corporation, Parker Hannifin Corporation, Porvair plc, PTI Technologies, Rapco Inc., Recco Products, Safran Group, Sky Power Gmbh, Swift Filters Inc., Tempest Plus, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Aircraft Filters Market Dynamics

Frequent replacement requirements for aircraft filters

The aircraft filters market is witnessing steady growth, driven by increasing air travel, stringent aviation regulations, and the need for enhanced aircraft performance. One key factor contributing to market expansion is the frequent replacement requirements for aircraft filters. These filters play a crucial role in maintaining air quality, fuel efficiency, and overall system performance, necessitating regular maintenance and replacements. The rise in global aircraft fleets, coupled with growing MRO (maintenance, repair, and overhaul) activities, is further boosting demand. Additionally, advancements in filtration technologies, such as nanofiber and high-efficiency particulate filters, are driving innovation in the sector. The aftermarket segment is experiencing significant growth as airlines prioritize fleet maintenance. Emerging economies, particularly in Asia-Pacific, present lucrative opportunities, making the market highly dynamic and competitive.

Restraints & Challenges

The aircraft filters market faces several challenges despite its growth potential. High manufacturing and maintenance costs pose a significant barrier, especially for smaller airlines and MRO providers. Frequent replacement requirements for aircraft filters increase operational expenses, impacting airline profitability. Stringent aviation regulations demand strict compliance with safety and quality standards, leading to lengthy certification processes that can delay product launches. Supply chain disruptions, including raw material shortages and geopolitical tensions, further hinder market stability. Additionally, the increasing adoption of next-generation aircraft with advanced, longer-lasting filtration systems may reduce replacement frequency, affecting aftermarket sales. Environmental concerns and the push for sustainable materials add complexity to manufacturing processes. To overcome these challenges, companies must focus on innovation, cost efficiency, and strategic partnerships with OEMs and MRO providers.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Aircraft Filters Market from 2023 to 2033. North America dominates the aircraft filters market, driven by a strong aviation industry, high air traffic, and a well-established defense sector. The presence of leading aircraft manufacturers like Boeing, as well as major airline operators, boosts demand for advanced filtration systems. Stringent regulations by the FAA and EPA regarding air quality, emissions, and fuel efficiency further propel market growth. Additionally, the region has a well-developed MRO industry, ensuring consistent demand for replacement filters. Technological advancements, such as high-efficiency particulate air (HEPA) filters and eco-friendly filtration solutions, are shaping the market. The rising focus on next-generation aircraft and sustainable aviation practices is driving innovation. Overall, North America remains a key player, with continuous investments in both commercial and military aviation fueling market expansion.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Government initiatives to boost domestic aircraft manufacturing, such as China’s COMAC and India’s Make in India programs, are further fueling market expansion. The region’s growing MRO sector is also contributing to demand for replacement filters, particularly for air, fuel, oil, and hydraulic systems. Additionally, rising concerns over air quality and emissions are prompting airlines to adopt advanced filtration technologies. With strong economic growth and continued infrastructure development, Asia-Pacific presents significant opportunities for aircraft filter manufacturers and suppliers.

Segmentation Analysis

Insights by Aircraft Type

The narrow body segment accounted for the largest market share over the forecast period 2023 to 2033. Airlines are expanding their narrow-body fleets, particularly in emerging markets, to cater to rising passenger traffic and improve operational efficiency. Aircraft such as the Boeing 737 and Airbus A320 families are in high demand, boosting the need for efficient filtration systems, including air, fuel, oil, and hydraulic filters. Additionally, frequent flight cycles of narrow-body aircraft lead to higher maintenance and replacement rates, driving aftermarket sales. Technological advancements in lightweight and high-efficiency filters further enhance market potential. As fuel efficiency and emission regulations become stricter, airlines are adopting advanced filtration solutions, ensuring continued growth in this segment.

Insights by Application

The cabin segment accounted for the largest market share over the forecast period 2023 to 2033. Airlines are investing in advanced cabin air filtration systems, including HEPA (High-Efficiency Particulate Air) filters, to remove airborne contaminants, bacteria, and viruses, enhancing passenger safety and comfort. The COVID-19 pandemic further accelerated the adoption of high-performance cabin air filters to improve inflight air circulation. With rising air travel, especially in long-haul flights, the need for efficient air purification systems is growing. Additionally, sustainability trends are pushing manufacturers to develop eco-friendly, longer-lasting filtration solutions. The expansion of commercial and business aviation, particularly in Asia-Pacific and the Middle East, is further driving demand, making the cabin segment a key growth area.

Insights by End Use

The OEM segment accounted for the largest market share over the forecast period 2023 to 2033. Leading aircraft manufacturers like Boeing, Airbus, and regional jet producers are increasing production to meet growing air travel demand, directly boosting the need for advanced filtration solutions. OEMs are focusing on integrating high-efficiency air, fuel, oil, and hydraulic filters into new-generation aircraft to enhance performance, fuel efficiency, and environmental compliance. Additionally, strict aviation regulations mandate high-quality filtration systems, further propelling demand. The shift toward lightweight, durable, and sustainable materials in aircraft filters is another key trend.

Recent Market Developments

- In January 2021, Filtration Group has announced the acquisition of AFPRO Filters, a leading air filter manufacturer based in the Netherlands.

Competitive Landscape

Major players in the market

- Aerospace Systems & Components

- Arrowprop Co Inc

- Camfil

- Donaldson Inc.

- Eaton Corporation Plc

- Filtration Group

- Fluid Conditioning Products, Inc.

- Freudenberg & Co. KG

- HFE International, LLC

- Hollingsworth & Vose

- Honeywell International Inc.

- Pall Corporation

- Parker Hannifin Corporation

- Porvair plc

- PTI Technologies

- Rapco Inc.

- Recco Products

- Safran Group

- Sky Power Gmbh

- Swift Filters Inc.

- Tempest Plus

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aircraft Filters Market, Aircraft Type Analysis

- Narrow-body

- Wide-body

- Regional

- General Aviation

- Helicopter

- Military

Aircraft Filters Market, Application Analysis

- Cabin

- Engine

- Hydraulics

- Avionics

- Others

Aircraft Filters Market, End Use Analysis

- OEM

- Aftermarket

Aircraft Filters Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Aircraft Filters Market?The global Aircraft Filters Market is expected to grow from USD 825.8 million in 2023 to USD 1051.3 million by 2033, at a CAGR of 2.44% during the forecast period 2023-2033.

-

2. Who are the key market players of the Aircraft Filters Market?Some of the key market players of the market are the Aerospace Systems & Components, Arrowprop Co Inc, Camfil, Donaldson Inc., Eaton Corporation Plc, Filtration Group, Fluid Conditioning Products, Inc., Freudenberg & Co. KG, HFE International, LLC, Hollingsworth & Vose, Honeywell International Inc., Pall Corporation, Parker Hannifin Corporation, Porvair plc, PTI Technologies, Rapco Inc., Recco Products, Safran Group, Sky Power Gmbh, Swift Filters Inc., and Tempest Plus.

-

3. Which segment holds the largest market share?The OEM segment holds the largest market share and is going to continue its dominance.

Need help to buy this report?