Global Aircraft Fuel Cells Market Size, Share, and COVID-19 Impact Analysis, by Fuel Type (Hydrogen, Hydrocarbon, Others), Power Output (0-100kW, 100 kW- 1MW, 1MW & Above), Aircraft Type (Fixed-Wing, Rotary Wing, UAVs, AAMs), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Aircraft Fuel Cells Market Insights Forecasts to 2033

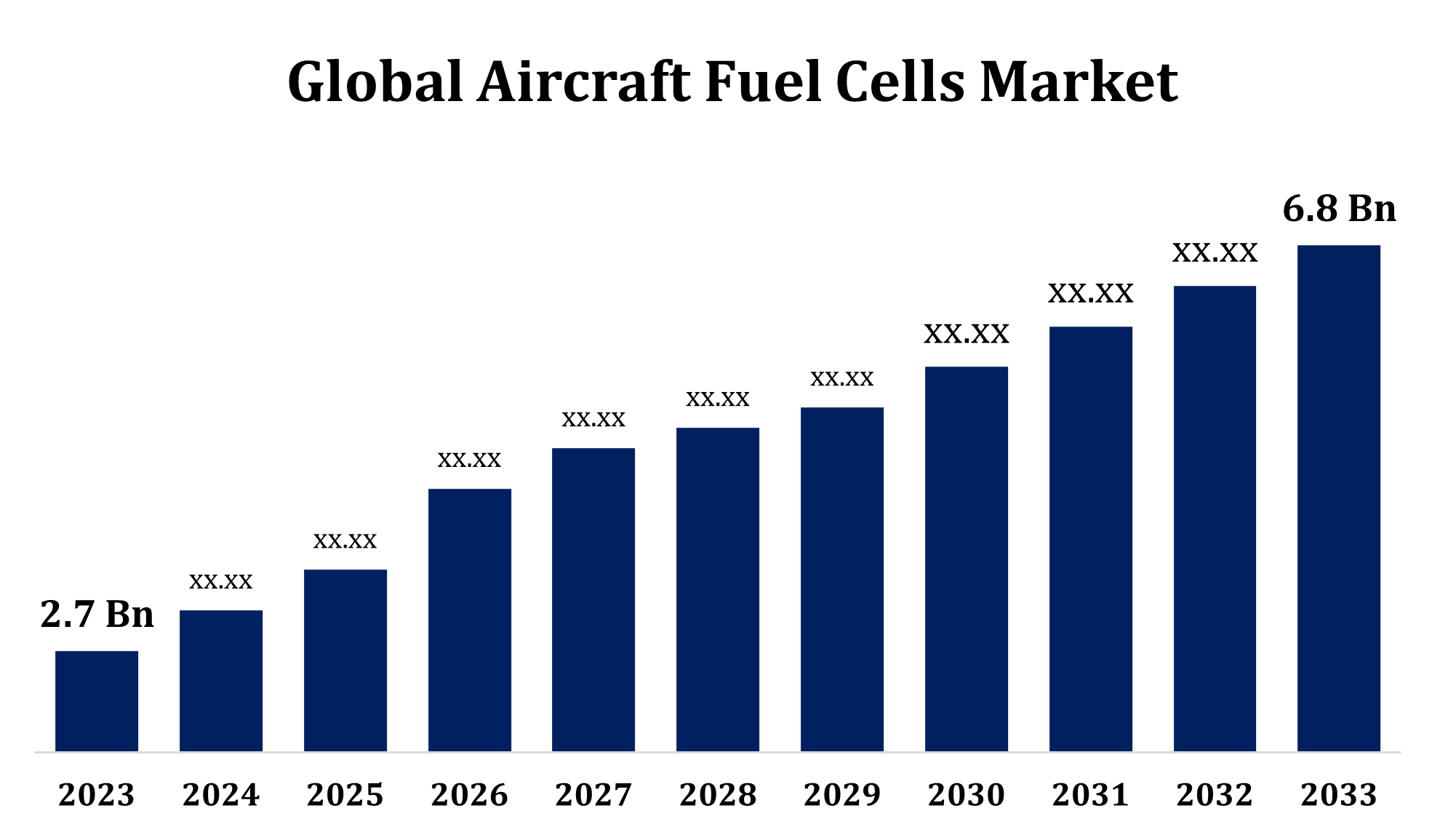

- The Global Aircraft Fuel Cells Market Size was valued at USD 2.7 Billion in 2023.

- The Market is Growing at a CAGR of 9.68% from 2023 to 2033.

- The Worldwide Aircraft Fuel Cells Market Size is expected to reach USD 6.8 Billion by 2033.

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Aircraft Fuel Cells Market Size is expected to reach USD 6.8 Billion by 2033, at a CAGR of 9.68% during the forecast period 2023 to 2033.

The aircraft fuel cells market is experiencing significant growth due to rising demand for sustainable and energy-efficient aviation technologies. Fuel cells, which convert chemical energy into electrical energy, are emerging as a viable alternative to conventional aviation fuel systems, offering lower emissions and higher efficiency. Key drivers include advancements in fuel cell technology, increased focus on reducing the carbon footprint of aviation, and supportive government policies. Hydrogen fuel cells are particularly gaining traction for their potential to enable zero-emission flights. Market growth is further supported by increasing investments in research and development, collaborations between aviation and energy companies, and the expansion of green hydrogen infrastructure. Challenges such as high initial costs and infrastructure development remain, but innovation is driving market potential.

Aircraft Fuel Cells Market Value Chain Analysis

The aircraft fuel cells market value chain involves multiple stages, starting with raw material suppliers who provide critical components such as membranes, catalysts, and hydrogen storage materials. These components are then manufactured into fuel cell systems by specialized producers, focusing on proton exchange membrane (PEM) and solid oxide fuel cell (SOFC) technologies. System integrators customize these fuel cells for aviation applications, ensuring compatibility with aircraft designs. Aircraft manufacturers and operators form the end-users, deploying fuel cells to enhance energy efficiency and reduce emissions. Supporting the value chain are hydrogen production and distribution networks, essential for fueling operations. Additionally, research institutions, technology developers, and regulatory bodies play pivotal roles in advancing innovations, establishing standards, and addressing challenges like cost, weight, and infrastructure for broader adoption.

Aircraft Fuel Cells Market Opportunity Analysis

The aircraft fuel cells market presents significant opportunities driven by the global push for sustainable aviation and stringent emission reduction targets. Hydrogen fuel cells, in particular, are gaining momentum as a zero-emission alternative to traditional fuel systems, creating potential for new aircraft designs and retrofitting existing fleets. Advances in lightweight materials and efficient fuel cell technologies are expanding their feasibility for commercial, regional, and unmanned aircraft. Emerging markets in Asia-Pacific and the Middle East, with growing air traffic and government support for green energy, offer lucrative growth prospects. Additionally, collaborations between aerospace companies and hydrogen suppliers are fostering the development of robust hydrogen production and distribution infrastructures. While challenges like high costs and scalability exist, ongoing innovation and funding create pathways for widespread adoption and long-term market expansion.

Global Aircraft Fuel Cells Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.7 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 9.68% |

| 023 – 2033 Value Projection: | USD 6.8 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 257 |

| Tables, Charts & Figures: | 117 |

| Segments covered: | By Fuel Type, Power Output, Aircraft Type, By Regional Analysis |

| Companies covered:: | Ballard Power Systems, Air Products, Iwatani, Showa Denko, Plug Power, Doosan Fuel Cell, Linde, Nuvera Fuel Cells, Ceres Power, Hydrogenics, Cummins, Bloom Energy, SAFT, SFC Energy, Praxair, and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Aircraft Fuel Cells Market Dynamics

Advancements in fuel cell technology and improvements in cost efficiency are driving growth

Advancements in fuel cell technology and improved cost efficiency are key drivers of growth in the aircraft fuel cells market. Innovations in hydrogen fuel cells, including lightweight designs and enhanced efficiency, are making them increasingly viable for aviation applications. These advancements address critical challenges such as energy density and operational durability, enabling fuel cells to power various aircraft types, from unmanned aerial vehicles to commercial planes. Simultaneously, declining costs in fuel cell production and the development of scalable manufacturing processes are accelerating adoption. Supportive government policies, investments in green hydrogen infrastructure, and a growing focus on decarbonizing aviation further boost market potential. Despite challenges like infrastructure limitations and high initial investments, continuous innovation is unlocking new opportunities for sustainable aviation solutions using fuel cells.

Restraints & Challenges

High initial costs for fuel cell development and integration remain a significant barrier, particularly for commercial scalability. Infrastructure limitations, such as inadequate hydrogen production, storage, and refueling networks, further complicate market expansion. Technical challenges, including achieving lightweight designs, ensuring durability under extreme operating conditions, and maintaining high energy density, also persist. Additionally, the limited availability of green hydrogen and its production costs can impact the feasibility of fuel cell-powered aviation. Regulatory hurdles and the need for standardization in fuel cell technology add complexity. Furthermore, competition from alternative sustainable aviation solutions, such as battery-electric and hybrid propulsion systems, poses challenges for market penetration.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Aircraft Fuel Cells Market from 2023 to 2033. The United States and Canada, home to leading aerospace companies and research institutions, are investing heavily in hydrogen fuel cell development to meet emission reduction goals. Government initiatives, such as subsidies for clean energy projects and funding for hydrogen infrastructure, further support market growth. The region's established aviation industry, coupled with a growing demand for eco-friendly solutions, is fostering the adoption of fuel cells in commercial, military, and unmanned aircraft. Additionally, collaborations between aerospace manufacturers and hydrogen suppliers are accelerating advancements in fuel cell technology.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Japan and South Korea are leading in hydrogen infrastructure development, while China focuses on scaling fuel cell production and adoption across industries. Government initiatives, including subsidies and strategic policies, are fostering advancements in aviation fuel cell technology. Additionally, collaborations between aerospace companies and renewable energy firms are driving innovation in the region. However, challenges such as limited infrastructure and high costs persist, but ongoing investments and regional partnerships are positioning Asia-Pacific as a key market for aircraft fuel cells.

Segmentation Analysis

Insights by Aircraft Type

The UAVs segment accounted for the largest market share over the forecast period 2023 to 2033. Fuel cells offer advantages over conventional batteries, such as higher energy density, lightweight design, and extended operational range, making them ideal for UAV applications in military, commercial, and research sectors. Key drivers include the rising use of UAVs for surveillance, delivery services, disaster management, and environmental monitoring. Governments and private organizations are investing in hydrogen fuel cell technology to enhance UAV performance while reducing carbon emissions. Additionally, advancements in miniaturized fuel cell systems and hydrogen storage solutions are boosting adoption in this segment. Despite challenges like cost and refueling infrastructure, innovation and growing application diversity are propelling the UAV segment’s expansion.

Insights by Power Output

The 0-100 kW segment accounted for the largest market share over the forecast period 2023 to 2033. This power range aligns with the energy requirements of lightweight applications, offering an efficient, eco-friendly alternative to conventional fuel systems. The growing demand for clean propulsion technologies in unmanned aerial systems, regional aircraft, and hybrid-electric propulsion systems is fueling the adoption of 0-100 kW fuel cells. Additionally, advancements in compact fuel cell designs, improved energy densities, and reduced production costs are making these systems more accessible. The segment also benefits from increasing government funding for sustainable aviation and the expansion of hydrogen infrastructure. Despite challenges in scaling production, the 0-100 kW segment holds significant potential as the industry prioritizes lightweight, efficient energy solutions.

Insights by Fuel Type

The hydrogen segment accounted for the largest market share over the forecast period 2023 to 2033. Hydrogen fuel cells offer a promising solution to reduce carbon emissions and meet the aviation industry’s sustainability goals. As governments and aviation companies intensify efforts to reduce their environmental impact, hydrogen fuel cells are gaining traction, particularly for commercial and regional aircraft, as well as UAVs. Advances in hydrogen production, storage, and refueling infrastructure are helping overcome challenges related to hydrogen adoption. The development of green hydrogen, produced from renewable energy sources, further enhances the environmental appeal of this segment. As hydrogen-powered aircraft gain attention from industry leaders, the segment is poised for robust growth, supported by collaborations, investments, and regulatory initiatives focused on decarbonizing aviation.

Recent Market Developments

- In September 2021, SFC Energy AG has teamed up with Bharat Electronics and FC TecNrgy to explore energy generation solutions using hydrogen fuel cells for off-grid power supply. This collaboration focuses on applications in homeland security, civil protection, and defense.

Competitive Landscape

Major players in the market

- Ballard Power Systems

- Air Products

- Iwatani

- Showa Denko

- Plug Power

- Doosan Fuel Cell

- Linde

- Nuvera Fuel Cells

- Ceres Power

- Hydrogenics

- Cummins

- Bloom Energy

- SAFT

- SFC Energy

- Praxair

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aircraft Fuel Cells Market, Fuel Type Analysis

- Hydrogen

- Hydrocarbon

- Others

Aircraft Fuel Cells Market, Power Output Analysis

- 0-100kW

- 100 kW- 1MW

- 1MW & Above

Aircraft Fuel Cells Market, Aircraft Type Analysis

- Fixed-Wing

- Rotary Wing

- UAVs

- AAMs

Aircraft Fuel Cells Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?