Global Aircraft Galley Equipment Market Size, Share, and COVID-19 Impact Analysis, by Galley Type (Standard Galley, Modular Galley, and Customized Galley), Fit (Line Fit and Retro Fit), Inserts (Electric and Non-Electric Insert), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Aircraft Galley Equipment Market Insights Forecasts to 2033

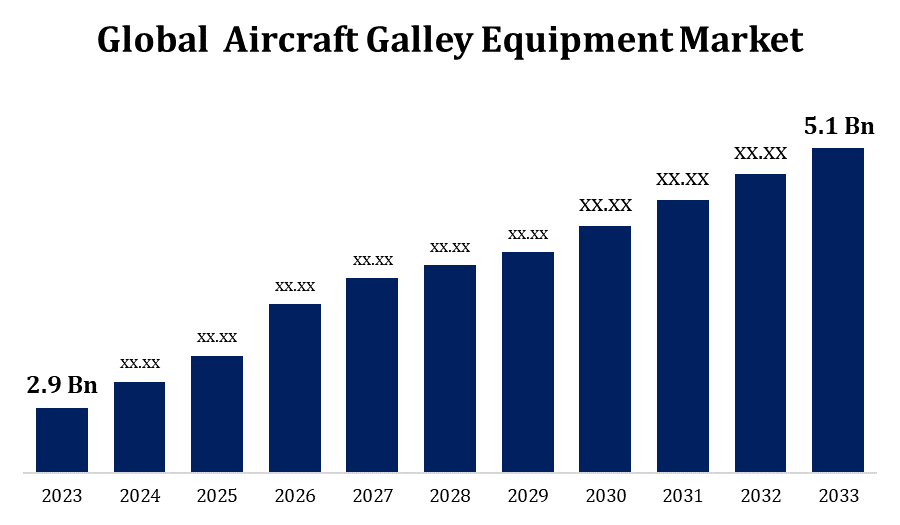

- The Aircraft Galley Equipment Market was valued at USD 2.9 billion in 2023.

- The market is growing at a CAGR of 5.81% from 2023 to 2033

- The global Aircraft Galley Equipment Market is expected to reach USD 5.1 billion by 2033

- Asia Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The global Aircraft Galley Equipment Market is expected to reach USD 5.1 billion by 2033, at a CAGR of 5.81% during the forecast period 2023 to 2033.

The Aircraft Galley Equipment Market encompasses a range of products and services essential for food and beverage preparation and storage on airplanes. This market includes ovens, coffee makers, refrigerators, food trolleys, and storage units, among other equipment. Growing passenger air travel, especially in emerging markets, is driving demand for advanced and efficient galley solutions. Airlines are increasingly focusing on enhancing passenger experience, which includes the quality and variety of in-flight services. Technological advancements, such as lightweight and energy-efficient materials, are also influencing market dynamics. Key players in this market are innovating to provide more compact, modular, and versatile equipment that meets stringent aviation safety standards. The market is highly competitive, with manufacturers striving to secure contracts with major airlines globally.

Aircraft Galley Equipment Market Value Chain Analysis

The Aircraft Galley Equipment Market value chain begins with raw material suppliers, providing essential components like aluminum, stainless steel, and composite materials. These materials are then transformed by manufacturers into galley equipment, including ovens, coffee makers, and trolleys. Design and engineering firms collaborate with manufacturers to create customized solutions that meet airline specifications. The equipment undergoes rigorous testing and certification to comply with aviation safety standards. Once produced, the equipment is distributed to airlines either directly or through specialized distributors. Airlines and aircraft manufacturers integrate these products into new aircraft or retrofit them into existing fleets. Maintenance and after-sales services form the final link in the chain, ensuring the longevity and optimal performance of the equipment throughout its lifecycle.

Aircraft Galley Equipment Market Opportunity Analysis

The Aircraft Galley Equipment Market presents significant opportunities driven by increasing air travel, especially in emerging markets. As airlines expand their fleets and upgrade existing aircraft, there is a growing demand for advanced galley equipment that enhances passenger comfort and in-flight service quality. Technological innovations, such as lightweight and energy-efficient materials, provide opportunities for manufacturers to offer more efficient and environmentally friendly products. The trend towards customized and modular galley solutions allows for tailored offerings that cater to specific airline needs. Additionally, the rise of premium travel classes and long-haul flights creates a demand for high-quality, multifunctional galley equipment. The market also offers growth potential in the retrofit segment, where older aircraft are being upgraded with modern galley systems.

Global Global Aircraft Galley Equipment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.9 billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.81% |

| 2033 Value Projection: | USD 5.1 billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Galley Type, By Region |

| Companies covered:: | Zodiac Aerospace, Rockwell Collins Inc., JAMCO Corporation, AIM Altitude, Diehl Stiftung & Co. KG, Bucher Group, Aerolux, Turkish Cabin Interior, Korita Aviation, and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Market Dynamics

Aircraft Galley Equipment Market Dynamics

High competition among airlines to deliver better services to flyers

With increasing customer expectations, carriers are investing in advanced and diverse galley equipment to enhance the onboard experience. This includes high-quality food and beverage preparation, improved storage solutions, and efficient service systems. The competition is particularly fierce among premium airlines and on long-haul routes, where the quality of onboard amenities significantly impacts customer satisfaction and loyalty. Airlines are also focusing on differentiated service offerings, such as gourmet meals and specialized beverages, necessitating sophisticated galley equipment. Consequently, manufacturers are innovating to provide versatile, space-saving, and energy-efficient solutions that cater to these demands, fostering market growth.

Restraints & Challenges

Compliance with these standards can be costly and time-consuming, potentially delaying product launches. Additionally, the market is impacted by fluctuations in raw material prices, particularly metals and composites, which can increase manufacturing costs. Airlines' constant pursuit of cost reduction pressures manufacturers to provide affordable yet high-quality equipment. The sector also faces challenges related to space and weight constraints, as airlines seek to maximize passenger capacity and fuel efficiency. Furthermore, the cyclical nature of the aviation industry, influenced by economic downturns and geopolitical factors, can lead to unpredictable demand, making it challenging for manufacturers to maintain steady production and growth.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Aircraft Galley Equipment Market from 2023 to 2033. The region's strong aviation industry, characterized by a high volume of both domestic and international flights, boosts demand for advanced galley equipment. North American airlines are at the forefront of enhancing passenger experience, leading to investments in modern, energy-efficient, and space-optimized galley solutions. The region also sees substantial retrofitting activity, as airlines update their fleets with state-of-the-art equipment to remain competitive. Additionally, stringent safety and environmental regulations in the U.S. and Canada require compliance with high standards, influencing product development and innovation.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. This growth is fueled by increasing disposable incomes, urbanization, and the emergence of budget airlines, making air travel more accessible. Major countries like China, India, and Japan are investing in modernizing their aviation infrastructure, leading to a surge in new aircraft orders and fleet expansions. This creates a significant demand for advanced galley equipment that enhances in-flight services and passenger comfort. Additionally, the region's airlines are focusing on offering high-quality services to differentiate themselves in a competitive market. The trend towards long-haul flights within and outside the region further drives the need for efficient and versatile galley equipment, making Asia Pacific a key market for growth.

Segmentation Analysis

Insights by Gallery Type

The modular gallery segment accounted for the largest market share over the forecast period 2023 to 2033. Modular galleys offer airlines the flexibility to customize layouts and configurations based on specific operational needs and aircraft types. This adaptability is particularly valuable as airlines seek to optimize space and improve service efficiency, especially on long-haul and premium routes. Additionally, modular systems facilitate easier maintenance and upgrades, allowing airlines to incorporate new technologies and equipment without extensive modifications. The growing trend of lightweight and energy-efficient materials in galley equipment also aligns with the modular approach, helping airlines reduce overall aircraft weight and improve fuel efficiency. As airlines continue to innovate and differentiate their in-flight offerings, the demand for modular galley solutions is expected to rise.

Insights by Fit

The retrofit segment accounted for the largest market share over the forecast period 2023 to 2033. With the high costs associated with purchasing new aircraft, many airlines opt for retrofitting to upgrade cabin interiors and enhance passenger experience. This includes installing advanced galley equipment that improves in-flight service efficiency and offers new features, such as high-quality coffee makers and advanced meal preparation systems. The retrofit market is also driven by regulatory requirements for updated safety and environmental standards, prompting airlines to replace outdated equipment. Additionally, as passenger expectations evolve, airlines invest in retrofitting to provide more modern and comfortable cabin environments.

Insights by Inserts

The electric inserts segment accounted for the largest market share over the forecast period 2023 to 2033. Electric inserts, such as compact ovens, coffee makers, and food warmers, offer airlines enhanced performance and reliability compared to traditional gas-powered equipment. These inserts are designed to be lightweight and space-saving, crucial for modern aircraft where optimizing cabin space is a priority. Additionally, the shift towards electric systems aligns with sustainability goals by reducing the carbon footprint associated with in-flight operations. Innovations in electric insert technology also contribute to faster heating times and better temperature control, improving overall service quality.

Recent Market Developments

- In June 2023, RTX (Raytheon Technologies), under its subsidiary Collins Aerospace, has produced a low-cost wireless networking solution for aeroplane galley inserts. It helps airlines achieve operational economies and cost reductions while simultaneously promoting greater passenger service.

Competitive Landscape

Major players in the market

- Zodiac Aerospace

- Rockwell Collins Inc.

- JAMCO Corporation

- AIM Altitude

- Diehl Stiftung & Co. KG

- Bucher Group

- Aerolux

- Turkish Cabin Interior

- Korita Aviation

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aircraft Galley Equipment Market, Galley Type Analysis

- Standard Galley

- Modular Galley

- Customized Galley

Aircraft Galley Equipment Market, Fit Analysis

- Line Fit

- Retro Fit

Aircraft Galley Equipment Market, Inserts Analysis

- Electric

- Non-Electric Insert

Aircraft Galley Equipment Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Aircraft Galley Equipment?The global Aircraft Galley Equipment Market is expected to grow from USD 2.9 billion in 2023 to USD 5.1 billion by 2033, at a CAGR of 5.81% during the forecast period 2023-2033.

-

2. Who are the key market players of the Aircraft Galley Equipment Market?Some of the key market players of the market are Zodiac Aerospace, Rockwell Collins Inc. , JAMCO Corporation , AIM Altitude, Diehl Stiftung & Co. KG, Bucher Group, Aerolux, Turkish Cabin Interior, Korita Aviation.

-

3. Which segment holds the largest market share?The electric inserts segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Aircraft Galley Equipment market?North America dominates the Aircraft Galley Equipment market and has the highest market share.

Need help to buy this report?