Global Aircraft Hangar Market Size, Share, and COVID-19 Impact Analysis, By Type (MRO, Assembly, Storage), By Construction (Fixed, Portable), By Aircraft (Wide Body, Narrow Body, Helicopters, General Aviation), By Platform (Commercial, Military), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Aircraft Hangar Market Insights Forecasts to 2033

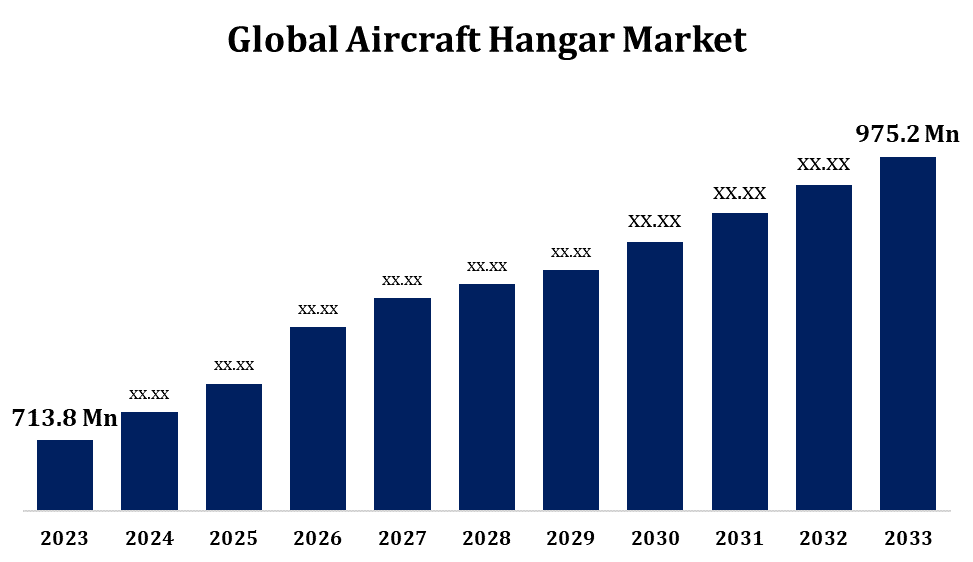

- The Aircraft Hangar Market Size was valued at USD 713.8 Million in 2023.

- The Market Size is Growing at a CAGR of 3.17% from 2023 to 2033

- The Worldwide Aircraft Hangar Market Size is Expected to reach USD 975.2 Million by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Aircraft Hangar Market Size is Expected to reach USD 975.2 Million by 2033, at a CAGR of 3.17% during the forecast period 2023 to 2033.

The aircraft hangar market is experiencing significant growth, driven by the increasing demand for aviation services and the expansion of airports worldwide. Rising air traffic, coupled with the need for maintenance, repair, and overhaul (MRO) services, is propelling the market forward. Technological advancements in hangar design, such as energy-efficient structures and automation, are enhancing operational efficiency. Additionally, the growing trend of private aviation and the surge in defense expenditures for military aircraft storage contribute to market expansion. Key regions witnessing substantial growth include North America, Europe, and Asia-Pacific, with major investments in airport infrastructure development. The market is competitive, with prominent players focusing on innovation and strategic partnerships to gain a foothold in this dynamic landscape.

Aircraft Hangar Market Value Chain Analysis

The aircraft hangar market value chain comprises several interconnected stages, starting with raw material suppliers who provide essential components like steel, aluminum, and advanced composites. Design and engineering firms then develop hangar blueprints and structural plans, focusing on efficiency and customization. Construction companies play a crucial role in building hangars, adhering to strict aviation standards. Next, maintenance and repair service providers ensure the hangars remain operationally efficient and safe. Facility management firms oversee daily operations, including security, utilities, and logistical support. End-users include commercial airlines, private aviation companies, and military organizations. Additionally, technological firms contribute with automation and smart hangar solutions, enhancing functionality. This collaborative chain ensures the seamless creation and maintenance of aircraft hangars, meeting the demands of a growing aviation industry.

Aircraft Hangar Market Opportunity Analysis

The aircraft hangar market offers significant opportunities driven by the global expansion of aviation infrastructure and rising air traffic. Increasing demand for advanced maintenance, repair, and overhaul (MRO) facilities creates a lucrative market for modern, efficient hangars. The surge in private aviation and corporate jets further fuels the need for customized hangar solutions. Additionally, the defense sector's ongoing investments in aircraft storage and maintenance facilities present substantial growth prospects. Technological advancements, such as smart hangars with automated systems and energy-efficient designs, open avenues for innovation and enhanced operational efficiency. Emerging markets in Asia-Pacific and the Middle East, with their rapid airport infrastructure development, provide fertile ground for market expansion, attracting investments from global players seeking to capitalize on these opportunities.

Global Aircraft Hangar Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 713.8 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.17% |

| 2033 Value Projection: | USD 975.2 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 213 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Construction, By Aircraft, By Platform, By Region |

| Companies covered:: | AECOM, PFEIFER GROUP, FulFab Inc., BlueScope Building Inc., The Korte Company, HTS TENTIQ GmbH, Rubb Buildings Ltd, Banyan Air Service, ALASKA STRUCTURES, Sunbelt Temporary Structure, Nucor Building Systems, JOHN REID AND SONS STRUCSTEEL LTD., Allied builders, LEGACY BUILDING SOLUTIONS, ERECT-A-TUBE, INC, Premier Building Systems, Inc, ClearSpan Fabric Structures, Inc., SML Group, Diuk Arches, and Others |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Market Dynamics

Aircraft Hangar Market Dynamics

Increasing demand for modernising airport infrastructure around the world to propel market growth.

The increasing demand for modernizing airport infrastructure worldwide is set to propel aircraft hangar market growth. Airports are upgrading facilities to accommodate rising air traffic, enhance safety, and improve operational efficiency. This modernization includes the construction of advanced, energy-efficient hangars designed to meet contemporary standards for commercial, private, and military aviation. Key factors driving this trend include the need for state-of-the-art maintenance, repair, and overhaul (MRO) services, and the expansion of airline fleets. Governments and private investors are pouring funds into airport development projects, particularly in emerging markets like Asia-Pacific and the Middle East. These investments not only bolster the aviation sector but also stimulate demand for innovative hangar solutions, ensuring robust market growth in the coming years.

Restraints & Challenges

High initial investment costs for constructing modern, technologically advanced hangars are a significant barrier, especially for smaller aviation companies and airports with limited budgets. Stringent regulatory requirements related to safety, environmental impact, and zoning add complexity and delay project timelines. Additionally, the market is sensitive to fluctuations in the global economy, which can lead to reduced spending on aviation infrastructure during downturns. The ongoing shortage of skilled labor in construction and maintenance also poses a challenge, affecting the timely delivery and upkeep of hangar facilities. Furthermore, the rapid pace of technological advancements necessitates continuous upgrades, which can strain resources and lead to obsolescence if not managed effectively.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Aircraft Hangar Market from 2023 to 2033. The U.S. leads the market, with numerous commercial, private, and military aviation projects fueling demand for modern hangar facilities. The region’s emphasis on technological innovation, including smart hangars equipped with automation and energy-efficient systems, enhances operational efficiency and safety, making it a key market driver. Additionally, the growing demand for maintenance, repair, and overhaul (MRO) services, spurred by an aging fleet and increased air traffic, further propels market growth. Canada’s expanding aviation sector also contributes, with major airport development projects and investments in advanced hangar solutions reinforcing North America’s dominant position in the global market.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The region's booming aviation sector, coupled with significant investments in new airport construction and modernization, is fueling demand for advanced hangar facilities. Governments and private entities are prioritizing the development of state-of-the-art hangars to support growing fleets, particularly in commercial aviation. Additionally, the increasing focus on maintenance, repair, and overhaul (MRO) services in the region, driven by the expanding aircraft fleet and aging planes, further boosts the market. Asia-Pacific’s dynamic economic growth, along with its strategic initiatives to enhance aviation infrastructure, positions the region as a major contributor to the global aircraft hangar market.

Segmentation Analysis

Insights by Type

The MRO segment accounted for the largest market share over the forecast period 2023 to 2033. As global air traffic continues to rise, airlines are investing heavily in MRO facilities to ensure safety, efficiency, and regulatory compliance. The expansion of hangar space dedicated to MRO services is essential, particularly for large commercial airlines and military aviation, where regular maintenance is critical. The trend toward outsourcing MRO activities to specialized providers also fuels demand for modern, well-equipped hangars. Technological advancements, such as predictive maintenance and automation, are enhancing the efficiency of MRO operations, further accelerating the growth of this segment and solidifying its importance in the overall aircraft hangar market.

Insights by Construction

The fixed segment accounted for the largest market share over the forecast period 2023 to 2033. As airports and aviation companies seek long-term solutions for aircraft storage, maintenance, and operations, the need for fixed hangars has surged. These structures offer superior protection against harsh weather conditions and provide the stability required for housing large commercial aircraft and military fleets. The trend toward airport modernization, especially in regions like North America, Europe, and Asia-Pacific, is boosting investments in fixed construction hangars. Additionally, advancements in construction materials and techniques are enabling the development of energy-efficient and sustainable hangars, further propelling the growth of this segment as aviation infrastructure expands globally.

Insights by Aircraft

The narrow body segment accounted for the largest market share over the forecast period 2023 to 2033. As these airlines increase their fleets to meet rising passenger demand, there is a corresponding need for specialized hangar facilities to accommodate and maintain these aircraft. The growing preference for narrow-body jets for short to medium-haul routes is fueling demand for efficient hangar solutions tailored to these aircraft’s specific requirements. Additionally, the rise in regional aviation and increased focus on cost-effective operations contribute to the segment’s growth. Investments in modern, scalable hangars that can efficiently handle narrow-body aircraft are crucial for supporting the expanding global fleet and ensuring operational readiness.

Insights by Platform

The commercial segment accounted for the largest market share over the forecast period 2023 to 2033. As airlines seek to enhance operational efficiency and safety, there is a growing need for state-of-the-art hangar facilities to support the maintenance, storage, and servicing of commercial aircraft. The rise of low-cost carriers and the recovery of the aviation industry post-pandemic have further boosted demand for modern hangars. Investments in advanced hangar infrastructure, equipped with automation and energy-efficient systems, are becoming crucial to accommodate larger fleets and optimize operational capabilities. Additionally, the expansion of airports and new airline routes globally contribute to the commercial segment’s growth, reinforcing its pivotal role in the aircraft hangar market.

Recent Market Developments

- In September 2022, McLaughlin and Harvey got a contract to design and construct a new aircraft hangar in Farnborough. The development will make more hangar space available to clients.

Competitive Landscape

Major players in the market

- AECOM, PFEIFER GROUP

- FulFab Inc.

- BlueScope Building Inc.

- The Korte Company

- HTS TENTIQ GmbH

- Rubb Buildings Ltd

- Banyan Air Service

- ALASKA STRUCTURES

- Sunbelt Temporary Structure

- Nucor Building Systems

- JOHN REID AND SONS STRUCSTEEL LTD.

- Allied builders

- LEGACY BUILDING SOLUTIONS

- ERECT-A-TUBE, INC

- Premier Building Systems, Inc

- ClearSpan Fabric Structures, Inc.

- SML Group

- Diuk Arches

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aircraft Hangar Market, Type Analysis

- MRO

- Assembly

- Storage

Aircraft Hangar Market, Construction Analysis

- Fixed

- Portable

Aircraft Hangar Market, Aircraft Analysis

- Wide Body

- Narrow Body

- Helicopters

- General Aviation

Aircraft Hangar Market, Platform Analysis

- Commercial

- Military

Aircraft Hangar Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Aircraft Hangar?The global Aircraft Hangar Market is expected to grow from USD 713.8 million in 2023 to USD 975.2 million by 2033, at a CAGR of 3.17% during the forecast period 2023-2033.

-

2. Who are the key market players of the Aircraft Hangar Market?Some of the key market players of the market are AECOM, PFEIFER GROUP, FulFab Inc., BlueScope Building Inc., The Korte Company, HTS TENTIQ GmbH, Rubb Buildings Ltd, Banyan Air Service, ALASKA STRUCTURES, Sunbelt Temporary Structure, Nucor Building Systems, JOHN REID AND SONS STRUCSTEEL LTD., Allied builders, LEGACY BUILDING SOLUTIONS, ERECT-A-TUBE, INC, Premier Building Systems, Inc, ClearSpan Fabric Structures, Inc., SML Group, Diuk Arches.

-

3. Which segment holds the largest market share?The fixed segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Aircraft Hangar market?North America dominates the Aircraft Hangar market and has the highest market share.

Need help to buy this report?