Global Aircraft Hydraulic Systems Market Size, Share, and COVID-19 Impact Analysis, By Type (Closed-center, Open-center), By End-user (Line-fit, Retrofit), By Platform (Fixed Wing, Rotary Wing, Unmanned Aerial Vehicles), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Aircraft Hydraulic Systems Market Insights Forecasts to 2033

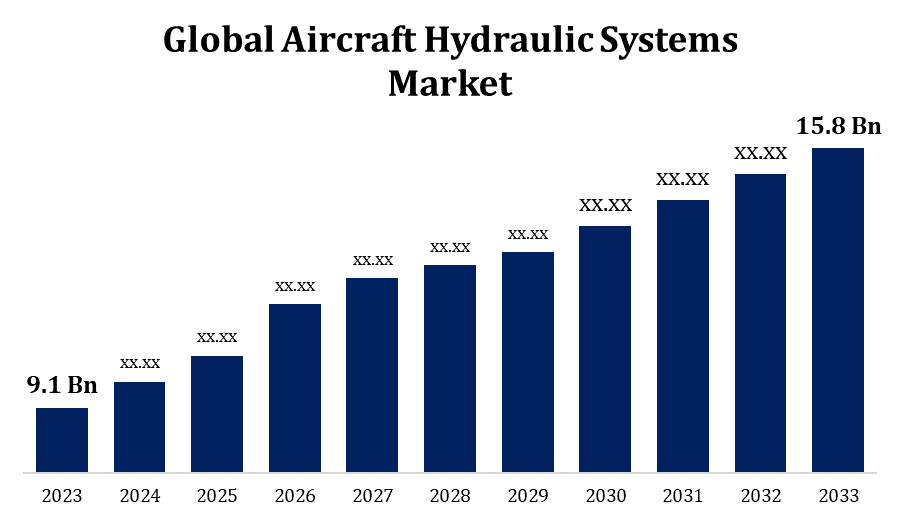

- The Global Aircraft Hydraulic Systems Market Size was valued at USD 9.1 Billion in 2023.

- The Market Size is Growing at a CAGR of 5.67% from 2023 to 2033

- The Worldwide Aircraft Hydraulic Systems Market Size is expected to reach USD 15.8 Billion by 2033

- Asia Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Aircraft Hydraulic Systems Market Size is expected to reach USD 15.8 Billion by 2033, at a CAGR of 5.67% during the forecast period 2023 to 2033.

The Aircraft Hydraulic Systems Market is experiencing significant growth, driven by the increasing demand for advanced aircraft systems and the rising global air traffic. Hydraulic systems in aircraft are essential for various operations, including landing gear, flight control surfaces, and braking systems. The market is propelled by the expansion of commercial aviation, the modernization of military fleets, and the development of new aircraft models. Additionally, the trend towards more fuel-efficient and lightweight aircraft is pushing manufacturers to innovate in hydraulic technology.

Aircraft Hydraulic Systems Market Value Chain Analysis

The Aircraft Hydraulic Systems Market value chain encompasses several critical stages, starting with raw material suppliers who provide essential components like hydraulic fluids, pumps, valves, and actuators. These materials are then manufactured into hydraulic systems by specialized companies that design and produce systems tailored for various aircraft applications. Original Equipment Manufacturers (OEMs) integrate these systems into aircraft during assembly, ensuring compatibility and performance. The value chain also includes distributors and suppliers who manage the logistics and delivery of these systems to OEMs and maintenance facilities. Aftermarket services, including maintenance, repair, and overhaul (MRO), play a vital role in the value chain, ensuring the longevity and reliability of hydraulic systems throughout an aircraft's operational life. Continuous innovation and collaboration across the value chain drive efficiency and technological advancements.

Aircraft Hydraulic Systems Market Opportunity Analysis

The Aircraft Hydraulic Systems Market presents significant growth opportunities driven by the rising demand for new, fuel-efficient aircraft and the modernization of aging fleets. As airlines strive for improved performance and reduced environmental impact, there is a growing need for advanced hydraulic systems that are lighter, more efficient, and capable of supporting the latest aircraft technologies. The expansion of the global aviation industry, particularly in emerging markets like Asia-Pacific and the Middle East, further enhances market potential. Additionally, the increasing focus on electric and hybrid-electric aircraft offers opportunities for innovative hydraulic solutions tailored to these new platforms. The aftermarket segment, including maintenance, repair, and overhaul (MRO) services, also offers lucrative prospects as airlines seek to extend the lifespan of existing aircraft.

Global Aircraft Hydraulic Systems Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 9.1 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.67% |

| 2033 Value Projection: | USD 15.8 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By End-user, By Platform, By Region |

| Companies covered:: | Raytheon Technologies Corporation (U.S.), Parker-Hannifin Corporation (U.S.), Safran S.A. (France), Eaton Corporation Plc (Ireland), Liebherr-International Deutschland GmbH (Switzerland), Woodward, Inc. (U.S.), Triumph Group, Inc. (U.S.), Moog Inc. (U.S.), Arkwin Industries Inc. (U.S.), Beaver Aerospace & Defense, Inc. (U.S.), and other key companies. |

| Growth Drivers: | Enhanced The inherent benefits of combining hydraulic systems |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Market Dynamics

Aircraft Hydraulic Systems Market Dynamics

Enhanced The inherent benefits of combining hydraulic systems

Hydraulic systems are known for their high power-to-weight ratio, reliability, and efficiency in transmitting power, which are crucial for critical aircraft operations like landing gear, flight control, and braking. By integrating hydraulic systems, aircraft achieve improved performance, responsiveness, and safety, essential for both commercial and military aviation. The adaptability of hydraulic systems to varying aircraft sizes and types further enhances their appeal, making them indispensable in modern and next-generation aircraft. Additionally, hydraulic systems are relatively easy to maintain and repair, reducing downtime and operational costs.

Restraints & Challenges

One significant challenge is the high maintenance and operational costs associated with hydraulic systems, which require regular inspections, fluid replacements, and potential overhauls to ensure reliability and safety. Additionally, hydraulic systems are prone to leaks and contamination, leading to performance degradation and increased maintenance needs. The market also contends with the rising trend toward electric aircraft, which could reduce reliance on traditional hydraulic systems as manufacturers explore alternative technologies like electro-hydrostatic actuators (EHAs). Furthermore, the industry faces a shortage of skilled labor, essential for maintaining and repairing these complex systems.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Aircraft Hydraulic Systems Market from 2023 to 2033. The demand for advanced hydraulic systems is fueled by the ongoing production of commercial, military, and business aircraft, alongside a strong focus on aircraft modernization and fleet expansion. The region's robust defense spending and continuous investments in next-generation military aircraft further boost market growth. Additionally, the extensive aftermarket services network in North America supports the maintenance, repair, and overhaul (MRO) of hydraulic systems, ensuring the longevity and reliability of aircraft operations. Technological advancements and R&D initiatives in hydraulic systems also contribute to North America's leadership in the global market.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The region's expanding middle class and increasing air travel demand have led to significant investments in new aircraft, boosting the need for advanced hydraulic systems. Additionally, Asia-Pacific is witnessing robust military modernization programs, with countries upgrading their defense capabilities, further driving demand for hydraulic systems in military aircraft. The region's focus on establishing local manufacturing capabilities and partnerships with global aerospace giants is enhancing its market presence. However, challenges such as regulatory compliance, skilled labor shortages, and infrastructure constraints exist. Despite these hurdles, Asia-Pacific is poised for substantial market growth due to its dynamic aviation industry.

Segmentation Analysis

Insights by Type

The closed center segment accounted for the largest market share over the forecast period 2023 to 2033. In a closed center system, hydraulic fluid is directed only when needed, which reduces energy consumption and heat generation, leading to improved system efficiency and longevity. This segment is increasingly favored in modern aircraft designs, particularly in larger commercial and military aircraft that require more complex and reliable hydraulic operations. The trend towards more energy-efficient and responsive aircraft systems further drives the adoption of closed center configurations. Additionally, advancements in hydraulic technology, including better sealing and pressure control, enhance the performance and reliability of closed center systems, making them an attractive choice for new and retrofitted aircraft, contributing to their market growth.

Insights by Platform

The fixed wing segment accounted for the largest market share over the forecast period 2023 to 2033. Fixed-wing aircraft, including commercial airliners, business jets, and military fighters, rely heavily on hydraulic systems for critical operations such as landing gear deployment, flight control, and braking. The expansion of the global aviation sector, especially the increasing number of commercial flights and the replacement of aging fleets, has significantly boosted the demand for advanced hydraulic systems in fixed-wing aircraft. Additionally, the modernization of military fleets with next-generation fighters and transport aircraft is contributing to the segment's growth.

Insights by End User

The line fit segment accounted for the largest market share over the forecast period 2023 to 2033. Line fit, which involves integrating hydraulic systems during the initial assembly of an aircraft, is favored by manufacturers due to the efficiency and cost-effectiveness of installing systems directly at the production stage. The demand for new, more efficient aircraft, spurred by rising air travel and fleet modernization efforts, is propelling this segment's growth. Additionally, advances in hydraulic technology, such as lighter, more efficient systems, are being incorporated into new aircraft designs to meet regulatory and performance standards.

Recent Market Developments

- In June 2021, Eaton, a power management corporation based in the United States, bought Cobham Mission Systems with the goal of using power management technology and services to improve quality of life and environmental sustainability.

Competitive Landscape

Major players in the market

- Raytheon Technologies Corporation (U.S.)

- Parker-Hannifin Corporation (U.S.)

- Safran S.A. (France)

- Eaton Corporation Plc (Ireland)

- Liebherr-International Deutschland GmbH (Switzerland)

- Woodward, Inc. (U.S.)

- Triumph Group, Inc. (U.S.)

- Moog Inc. (U.S.)

- Arkwin Industries Inc. (U.S.)

- Beaver Aerospace & Defense, Inc. (U.S.)

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aircraft Hydraulic Systems Market, Type Analysis

- Closed-center

- Open-center

Aircraft Hydraulic Systems Market, Platform Analysis

- Fixed Wing

- Rotary Wing

- Unmanned Aerial Vehicles

Aircraft Hydraulic Systems Market, End User Analysis

- Line-fit

- Retrofit

Aircraft Hydraulic Systems Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Aircraft Hydraulic Systems?The global Aircraft Hydraulic Systems Market is expected to grow from USD 9.1 billion in 2023 to USD 15.8 billion by 2033, at a CAGR of 5.67% during the forecast period 2023-2033.

-

2. Who are the key market players of the Aircraft Hydraulic Systems Market?Some of the key market players of the market are Raytheon Technologies Corporation (U.S.), Parker-Hannifin Corporation (U.S.), Safran S.A. (France), Eaton Corporation Plc (Ireland), Liebherr-International Deutschland GmbH (Switzerland), Woodward, Inc. (U.S.), Triumph Group, Inc. (U.S.), Moog Inc. (U.S.), Arkwin Industries Inc. (U.S.), and Beaver Aerospace & Defense, Inc. (U.S.).

-

3. Which segment holds the largest market share?Some of the key market players of the market are Raytheon Technologies Corporation (U.S.), Parker-Hannifin Corporation (U.S.), Safran S.A. (France), Eaton Corporation Plc (Ireland), Liebherr-International Deutschland GmbH (Switzerland), Woodward, Inc. (U.S.), Triumph Group, Inc. (U.S.), Moog Inc. (U.S.), Arkwin Industries Inc. (U.S.), and Beaver Aerospace & Defense, Inc. (U.S.).

-

4. Which region dominates the Aircraft Hydraulic Systems market?North America dominates the Aircraft Hydraulic Systems market and has the highest market share.

Need help to buy this report?