Global Aircraft Insulation Market Size, Share, and COVID-19 Impact Analysis, By Platform (Fixed Wing, Rotary Wing), By Type (Thermal, Acoustic & Vibration, Electric), By Material (Foamed Plastics, Fiberglass, Mineral Wool, Ceramic-based Materials), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Aircraft Insulation Market Insights Forecasts to 2033

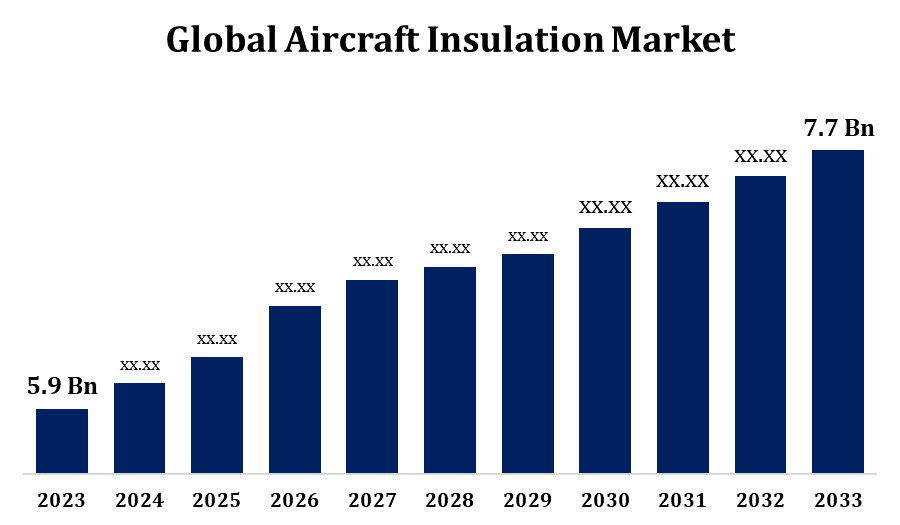

- The Global Aircraft Insulation Market Size was valued at USD 5.9 Billion in 2023.

- The Market is Growing at a CAGR of 2.70% from 2023 to 2033

- The Worldwide Aircraft Insulation Market Size is expected to reach USD 7.7 Billion By 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Aircraft Insulation Market Size is Expected to reach USD 7.7 Billion by 2033, at a CAGR of 2.70% during the forecast period 2023 to 2033.

The aircraft insulation market is experiencing significant growth, driven by the increasing demand for lightweight and efficient insulation materials in the aerospace industry. Insulation is crucial for thermal, acoustic, and fire protection in aircraft, enhancing passenger comfort and safety. Key players are focusing on developing advanced materials that offer superior performance while reducing weight, contributing to fuel efficiency. The rise in air travel, coupled with stringent regulatory requirements for noise reduction and energy efficiency, is further boosting market demand. Innovations in nanotechnology and the growing trend of using eco-friendly materials are also influencing the market. North America dominates the market due to its well-established aerospace sector, while Asia-Pacific is expected to witness rapid growth, driven by increasing aircraft production and modernization programs.

Aircraft Insulation Market Value Chain Analysis

The aircraft insulation market value chain involves multiple stages, beginning with raw material suppliers who provide essential components like fiberglass, foams, and composites. These materials are then processed by manufacturers into various insulation products, including thermal, acoustic, and fire-resistant materials. Next, insulation solution providers integrate these products into customized insulation systems tailored for specific aircraft models. The value chain continues with aircraft OEMs (Original Equipment Manufacturers), who install these systems during the assembly of aircraft. Distributors and suppliers play a critical role in ensuring the availability of these materials and systems to OEMs and aftermarket service providers. Regulatory bodies oversee compliance with safety and environmental standards throughout the process. Finally, end-users, including commercial and military aviation operators, benefit from enhanced safety, comfort, and efficiency.

Aircraft Insulation Market Opportunity Analysis

The push for lightweight, high-performance insulation materials that improve fuel efficiency creates a demand for innovative solutions. The increasing adoption of electric and hybrid-electric aircraft opens new avenues for specialized insulation to manage thermal and acoustic challenges. Emerging markets, particularly in Asia-Pacific, are expanding their aircraft fleets, leading to higher demand for insulation solutions. Additionally, the trend toward eco-friendly and recyclable materials provides opportunities for manufacturers to develop sustainable insulation products. The rise in retrofitting older aircraft with modern insulation systems also offers a lucrative aftermarket segment.

Global Aircraft Insulation Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 5.9 Billion |

| Forecast Period: | 2022 – 2032 |

| Forecast Period CAGR 2022 – 2032 : | 2.70% |

| 022 – 2032 Value Projection: | USD 7.7 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 248 |

| Tables, Charts & Figures: | 122 |

| Segments covered: | By Platform, By Type, By Material, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Esterline Technologies Corporation, DuPont, Johns Manville, Evonik Industries, Boyd Corporation, AVS Industries, Elmelin Ltd., BASF SE, Duracote Corporation, 3M, Hutchinson, Polymer Technologies Inc., Orcon Aerospace, Rogers Corporation, Promat, ThermoDyne, UPF Corporation, Triumph Group, Zotefoams, Zodiac Aerospace and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Aircraft Insulation Market Dynamics

Increase in demand for lightweight materials

As the aerospace industry focuses on enhancing fuel efficiency and reducing emissions, lightweight insulation materials are becoming essential. These materials, such as advanced composites and foams, offer high thermal and acoustic performance while significantly lowering the overall weight of the aircraft. Reduced weight leads to lower fuel consumption, contributing to cost savings and environmental sustainability. Additionally, the growing trend of electric and hybrid-electric aircraft amplifies the need for lightweight insulation solutions to optimize energy use. As airlines and aircraft manufacturers prioritize efficiency and sustainability, the demand for innovative, lightweight insulation materials is expected to continue rising, driving further market expansion.

Restraints & Challenges

One significant challenge is the stringent regulatory standards related to safety, fire resistance, and environmental impact, which require continuous innovation and compliance, driving up costs for manufacturers. The high cost of advanced, lightweight materials also presents a barrier, particularly for smaller manufacturers and aftermarket service providers. Additionally, the complexity of integrating new insulation materials into existing aircraft designs can lead to engineering challenges and increased time-to-market. Supply chain disruptions, exacerbated by geopolitical tensions and global economic uncertainties, can hinder the availability of raw materials and components. Furthermore, the market’s reliance on the aerospace sector makes it vulnerable to fluctuations in air travel demand, which can be affected by factors like economic downturns or pandemics.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Aircraft Insulation Market from 2023 to 2033. The region’s strong focus on innovation and the development of advanced insulation materials contribute to its market leadership. Regulatory bodies, such as the FAA, enforce stringent standards for safety, noise reduction, and energy efficiency, further propelling demand for high-performance insulation solutions. The growing emphasis on sustainable aviation practices and the adoption of lightweight, eco-friendly materials are also key trends in the region. Additionally, the rising demand for both commercial and military aircraft, coupled with significant investments in aircraft modernization and maintenance programs, supports the continuous growth of the aircraft insulation market in North America.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Countries are investing heavily in aircraft production and modernization, driving the need for advanced insulation materials. The rise of low-cost carriers and the expansion of airline fleets are further boosting market demand. Additionally, the region's growing focus on energy efficiency and environmental sustainability is leading to the adoption of lightweight, eco-friendly insulation solutions. Government initiatives to strengthen domestic aerospace capabilities and partnerships with international players are also contributing to market growth. Despite these opportunities, the market faces challenges such as regulatory complexities and the need for substantial investment in research and development to meet global standards.

Segmentation Analysis

Insights by Type

The Acoustic & Vibration segment accounted for the largest market share over the forecast period 2023 to 2033. The growth is driven by the increasing focus on passenger comfort and regulatory requirements for noise reduction. As air travel expands, airlines and manufacturers are prioritizing solutions that minimize cabin noise and vibration, enhancing the overall flight experience. Advanced materials such as acoustic foams, barriers, and damping systems are being developed to effectively reduce noise levels and vibration within the cabin and aircraft structure. This segment's growth is further supported by the rising demand for quieter, more efficient aircraft, particularly in regions with stringent noise pollution regulations.

Insights by Material

The foamed plastics segment accounted for the largest market share over the forecast period 2023 to 2033. Foamed plastics, such as polyurethane and polystyrene, offer excellent thermal and acoustic insulation properties while significantly reducing the overall weight of the aircraft. This weight reduction is critical for improving fuel efficiency and lowering operational costs, making these materials highly desirable in the aerospace industry. Additionally, advancements in manufacturing techniques have enabled the production of foamed plastics with enhanced fire resistance and environmental sustainability, meeting stringent industry regulations. The growing trend of retrofitting older aircraft with modern insulation solutions and the increasing adoption of electric and hybrid-electric aircraft further boost the demand for foamed plastics, solidifying their role in the market's expansion.

Insights by Platform

The fixed wing segment accounted for the largest market share over the forecast period 2023 to 2033. As air travel demand continues to rise, airlines are expanding their fleets, fueling the need for advanced insulation materials that enhance thermal, acoustic, and fire protection. In the military sector, ongoing investments in new aircraft and upgrades to existing fleets are further boosting demand. Fixed-wing aircraft, with their large surface areas and complex structures, require specialized insulation solutions to improve fuel efficiency, reduce cabin noise, and ensure passenger comfort. The growing focus on sustainability and the adoption of lightweight, eco-friendly insulation materials also contribute to the segment’s expansion, making it a critical component of the overall aircraft insulation market.

Recent Market Developments

- In September 2019, BASF SE created particle foam using polyethersulfone (PESU). The foam has several advantages, including flame retardancy, high-temperature resistance, and lightweight.

Competitive Landscape

Major players in the market

- Esterline Technologies Corporation

- DuPont

- Johns Manville

- Evonik Industries

- Boyd Corporation

- AVS Industries

- Elmelin Ltd.

- BASF SE

- Duracote Corporation

- 3M

- Hutchinson

- Polymer Technologies Inc.

- Orcon Aerospace

- Rogers Corporation

- Promat

- ThermoDyne

- UPF Corporation

- Triumph Group

- Zotefoams

- Zodiac Aerospace

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aircraft Insulation Market, Platform Analysis

- Fixed Wing

- Rotary Wing

Aircraft Insulation Market, Type Analysis

- Thermal

- Acoustic & Vibration

- Electric

Aircraft Insulation Market, Material Analysis

- Foamed Plastics

- Fiberglass

- Mineral Wool

- Ceramic-based Materials

Aircraft Insulation Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Aircraft Insulation?The global Aircraft Insulation Market is expected to grow from USD 5.9 billion in 2023 to USD 7.7 billion by 2033, at a CAGR of 2.70% during the forecast period 2023-2033.

-

2. Who are the key market players of the Aircraft Insulation Market?Some of the key market players of the market are Esterline Technologies Corporation, DuPont, Johns Manville, Evonik Industries, Boyd Corporation, AVS Industries, Elmelin Ltd., BASF SE, Duracote Corporation, 3M, Hutchinson, Polymer Technologies Inc., Orcon Aerospace, Rogers Corporation, Promat, ThermoDyne, UPF Corporation, Triumph Group, Zotefoams, Zodiac Aerospace and other key vendors.

-

3. Which segment holds the largest market share?The fixed wing segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Aircraft Insulation market?North America dominates the Aircraft Insulation market and has the highest market share.

Need help to buy this report?