Global Aircraft Insurance Market Size, Share, and COVID-19 Impact Analysis, By Type (Public Liability Insurance, Passenger Liability Insurance, Combined Single Limit (CSL), Ground Risk Hull (Motion) Insurance, Ground Risk Hull (Non-Motion) Insurance, Hangar & Ground Support Equipment Insurance, In-Flight Insurance, and Umbrella Insurance), By Application (Commercial Aviation, Business & General Aviation), By End-User (Airlines, Aircraft Product Manufacturers, Airports, Leasing Companies, and Other), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Aircraft Insurance Market Insights Forecasts to 2033

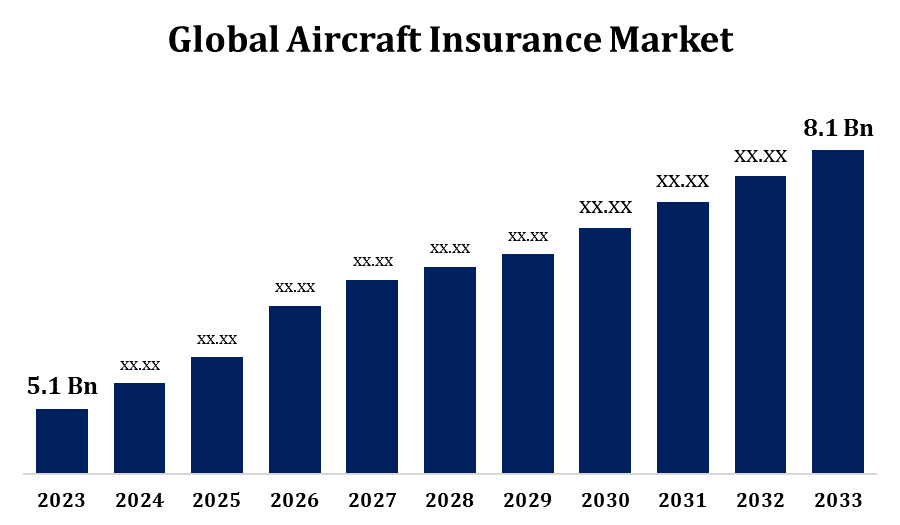

- The Aircraft Insurance Market Size was valued at USD 5.1 Billion in 2023.

- The Market Size is Growing at a CAGR of 4.73% from 2023 to 2033.

- The Worldwide Aircraft Insurance Market Size is Expected to reach USD 8.1 Billion by 2033.

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Aircraft Insurance Market Size is Expected to reach USD 8.1 Billion by 2033, at a CAGR of 4.73% during the forecast period 2023 to 2033.

The global aircraft insurance market is experiencing steady growth due to rising air traffic and an increasing number of commercial and private aircraft. This market includes insurance coverage for aviation liabilities, hull losses, and passenger liabilities, making it essential for mitigating financial risks in the aviation industry. Key drivers include the expansion of airline fleets, growth in general aviation, and advancements in aerospace technology. The market is also influenced by stringent regulations and the growing need for robust risk management strategies. However, the industry faces challenges like high premium costs and unpredictable losses due to natural disasters and accidents. North America and Europe dominate the market, while emerging regions like Asia-Pacific are expected to show significant growth due to increasing investments in air transportation infrastructure.

Aircraft Insurance Market Value Chain Analysis

The aircraft insurance market value chain involves multiple stakeholders, each playing a crucial role in the delivery and management of insurance products. It starts with aircraft owners and operators seeking coverage for liabilities, hull damage, and passenger claims. Insurers and underwriters assess risk profiles and provide tailored policies. Brokers act as intermediaries, negotiating terms and securing the best deals for clients. Reinsurers then help insurers manage risk by covering portions of the potential losses. Claims adjusters and legal experts step in during loss events to evaluate damages and ensure appropriate settlements. Supporting the chain are regulatory bodies that enforce compliance and industry standards. The integration of technology, such as digital platforms for risk assessment and claims processing, is further optimizing the value chain by enhancing efficiency and transparency.

Aircraft Insurance Market Opportunity Analysis

The aircraft insurance market offers significant opportunities driven by increasing global air travel, fleet expansions, and advancements in aerospace technology. Emerging markets in Asia-Pacific, Latin America, and the Middle East present lucrative growth prospects due to rising investments in aviation infrastructure and the expansion of commercial airlines. Additionally, the increasing popularity of private and business jets boosts demand for specialized insurance products. Innovations like unmanned aerial vehicles (UAVs) and electric aircraft open new avenues for tailored insurance solutions. With heightened focus on sustainability, insurers can leverage green technology initiatives for reduced premiums. Digital transformation, including AI-driven risk assessment and blockchain for claims management, further enhances operational efficiency and customer experience. Companies that proactively develop adaptable products and integrate technology will benefit from these evolving market dynamics.

Global Aircraft Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 5.1 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.73% |

| 2033 Value Projection: | USD 5.1 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 223 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, By End-User, By Region |

| Companies covered:: | USAA, American International Group, Inc., Global Aerospace, USAIG, Tokio Marine HCC, Travers & Associates Aviation Insurance Agency, LLC, AXA, BWI Aviation Insurance, STARR INTERNATIONAL COMPANY, INC., EAA Company Ltd, and Others |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Market Dynamics

Aircraft Insurance Market Dynamics

Rise in air passenger traffic to propel the market growth

The rise in global air passenger traffic is a key factor propelling the growth of the aircraft insurance market. As more people travel for business and leisure, airlines are expanding their fleets and adding new routes to meet the demand. This increase in flight operations heightens the need for comprehensive insurance coverage to mitigate potential risks associated with higher frequencies of takeoffs, landings, and maintenance. Additionally, increased passenger traffic amplifies liabilities, prompting operators to seek enhanced policies for passenger safety and compensation. The growth in commercial aviation is complemented by developments in low-cost carriers and regional air services, further boosting demand for tailored insurance products. Consequently, insurers are capitalizing on this trend by introducing innovative offerings and flexible coverage plans to cater to the expanding market.

Restraints & Challenges

The aircraft insurance market faces several challenges that impact its growth and profitability. High premium costs, driven by the complex risk environment and rising claims from natural disasters, accidents, and geopolitical events, pose a significant barrier for operators. The market is also highly cyclical, with fluctuating insurance rates due to economic conditions and changing demand for air travel. Increasing operational risks, such as cybersecurity threats to aviation systems and potential liabilities from newer technologies like drones and electric aircraft, add to the complexity. Regulatory changes and compliance requirements further burden insurers and operators. Moreover, the uncertainty from pandemics and fluctuating fuel prices creates additional unpredictability in fleet operations, impacting insurance costs. Addressing these challenges requires insurers to innovate with risk management solutions and explore new markets to maintain profitability and growth.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Aircraft Insurance Market from 2023 to 2033. The presence of major commercial airlines, general aviation operators, and business jet owners contributes to the high demand for comprehensive insurance solutions. The region is home to key industry players, such as AIG Aviation, Global Aerospace, and Allianz, who offer a wide range of products for hull, liability, and passenger coverage. Technological advancements in aviation, including new aircraft models and increased use of unmanned aerial vehicles (UAVs), have further fueled demand for specialized insurance offerings. Additionally, stringent regulatory standards by bodies like the Federal Aviation Administration (FAA) ensure adherence to safety and risk management practices, creating a stable market environment. Growth opportunities exist as insurers explore coverage for emerging sectors like UAVs and electric aircraft.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Countries like China, India, Japan, and Southeast Asia are seeing significant growth in fleet sizes and the launch of new airlines, which boosts the demand for aviation insurance. The expansion of low-cost carriers and regional connectivity initiatives has further propelled market development. Additionally, growing interest in business jets and general aviation is driving the need for specialized coverage. The market is characterized by the emergence of local insurers and increased participation from global companies seeking to capitalize on the region’s potential. Despite challenges such as regulatory complexities and fluctuating premiums, Asia-Pacific remains a key growth area, with insurers introducing innovative policies to meet evolving risks and compliance needs.

Segmentation Analysis

Insights by Type

The passenger liability insurance segment accounted for the largest market share over the forecast period 2023 to 2033. The passenger liability insurance segment is experiencing notable growth in the aircraft insurance market, driven by increasing global air traffic and heightened focus on passenger safety. As airlines expand their fleets and add new routes, they face greater exposure to passenger-related risks, including accidents, injuries, and compensation claims. This has led to a rising demand for robust liability coverage to protect against potential legal and financial repercussions. Stricter regulatory frameworks, such as the Montreal Convention, have mandated higher compensation limits, pushing airlines to opt for comprehensive policies. Additionally, the growth of low-cost carriers and regional airlines has further fueled demand for passenger liability insurance. Insurers are responding by offering tailored products with expanded coverage options, ensuring that operators can effectively manage the evolving risk landscape and safeguard their financial stability.

Insights by Application

The commercial aviation segment accounted for the largest market share over the forecast period 2023 to 2033. As the demand for air travel increases, especially in emerging markets like Asia-Pacific and the Middle East, airlines are adding new aircraft to their fleets, which boosts the need for comprehensive insurance solutions covering hull, liability, and passenger claims. Technological advancements in aircraft design, such as improved fuel efficiency and the adoption of electric and hybrid models, also influence insurance requirements and premiums. Additionally, the growth of low-cost carriers and cargo operations has heightened the demand for specialized policies. Insurers are capitalizing on this trend by offering flexible coverage plans, adapting to evolving risks, and providing comprehensive support to commercial airline operators.

Insights by End User

The airlines segment accounted for the largest market share over the forecast period 2023 to 2033. As global passenger traffic rebounds, airlines are investing in new aircraft and enhancing their existing fleets, necessitating comprehensive insurance coverage to mitigate various risks, including hull damage, passenger liabilities, and operational disruptions. The emergence of low-cost carriers has also diversified the market, creating demand for tailored insurance products that address unique operational needs. Additionally, regulatory requirements for safety and risk management are prompting airlines to secure higher coverage limits. Insurers are responding by offering customized policies that cater to the specific needs of airlines, including coverage for cyber risks and emerging technologies. This dynamic environment presents ample opportunities for insurers to innovate and expand their offerings within the airline segment.

Recent Market Developments

- In Novembe 2021, IQUW, the Lloyd's specialised reinsurer funded by ERS Group, announced the launch of a new aviation portfolio headed by a seasoned underwriter from Marsh and Cincinnati.

Competitive Landscape

Major players in the market

- USAA

- American International Group, Inc.

- Global Aerospace

- USAIG

- Tokio Marine HCC

- Travers & Associates Aviation Insurance Agency, LLC

- AXA

- BWI Aviation Insurance

- STARR INTERNATIONAL COMPANY, INC.

- EAA Company Ltd

- Others

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aircraft Insurance Market, Type Analysis

- Public Liability Insurance

- Passenger Liability Insurance

- Combined Single Limit (CSL)

- Ground Risk Hull (Motion) Insurance

- Ground Risk Hull (Non-Motion) Insurance

- Hangar & Ground Support Equipment Insurance

- In-Flight Insurance

- Umbrella Insurance

Aircraft Insurance Market, Application Analysis

- Commercial Aviation

- Business & General Aviation

Aircraft Insurance Market, End User Analysis

- Airlines

- Aircraft Product Manufacturers

- Airports

- Leasing Companies

- Other

Aircraft Insurance Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Aircraft Insurance Market?The global Aircraft Insurance Market is expected to grow from USD 5.1 billion in 2023 to USD 8.1 billion by 2033, at a CAGR of 4.73% during the forecast period 2023-2033.

-

2. Who are the key market players of the Aircraft Insurance Market?Some of the key market players of the market are USAA, American International Group, Inc., Global Aerospace, USAIG, Tokio Marine HCC, Travers & Associates Aviation Insurance Agency, LLC, AXA, BWI Aviation Insurance, STARR INTERNATIONAL COMPANY, INC., EAA Company Ltd.

-

3. Which segment holds the largest market share?The airlines segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Aircraft Insurance Market?North America dominates the Aircraft Insurance Market and has the highest market share.

Need help to buy this report?