Global Aircraft Interface Device Market Size, Share, and COVID-19 Impact Analysis, By Application (Flight tracking, Quick Access Recording, Aircraft Condition Monitoring System (ACMS), DVR and Video Streaming, and Others), By Aircraft Type (Fixed Wing and Rotary Wing), By Connectivity (Wired and Wireless), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Aircraft Interface Device Market Insights Forecasts to 2033

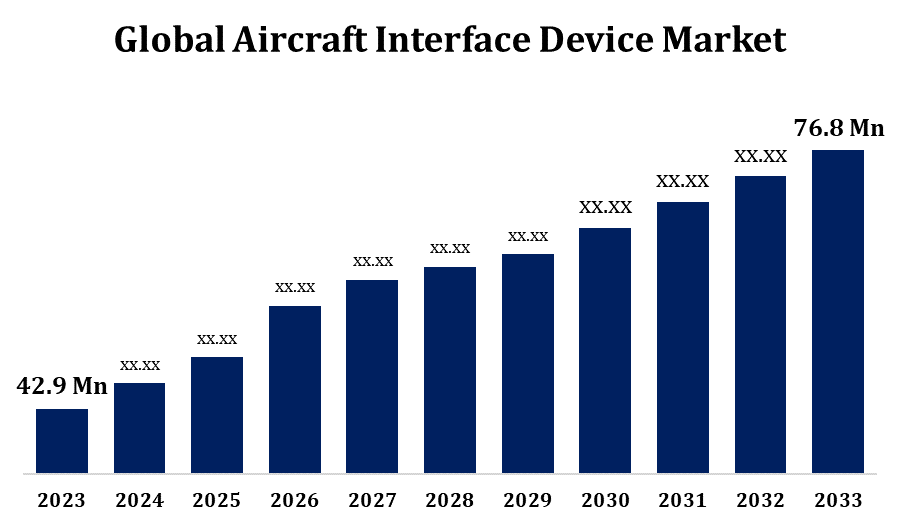

- The Global Aircraft Interface Device Market Size was valued at USD 42.9 Million in 2023.

- The Market is Growing at a CAGR of 6.00% from 2023 to 2033

- The Worldwide Aircraft Interface Device Market Size is Expected to reach USD 76.8 Million by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Aircraft Interface Device Market Size is Expected to reach USD 76.8 Million by 2033, at a CAGR of 6.00% during the forecast period 2023 to 2033.

The Aircraft Interface Device (AID) market is experiencing significant growth, driven by increasing demand for advanced avionics systems and improved in-flight connectivity. AID systems serve as critical components, linking various avionics systems with Electronic Flight Bags (EFBs) to enhance operational efficiency, safety, and real-time data communication. Key factors propelling market expansion include advancements in technology, rising adoption of wireless communication systems, and stringent regulatory requirements for enhanced safety measures. Major players in the market are focusing on innovation, partnerships, and acquisitions to strengthen their portfolios.

Aircraft Interface Device Market Value Chain Analysis

The Aircraft Interface Device (AID) market value chain encompasses multiple stages, from component manufacturing to end-user deployment. Initially, raw materials and electronic components are sourced and assembled into AID systems by specialized manufacturers. These manufacturers often collaborate with avionics and software developers to ensure seamless integration with existing aircraft systems. Following production, the devices are distributed to Original Equipment Manufacturers (OEMs) and airlines through various channels, including direct sales and specialized distributors. Implementation involves installation and rigorous testing to comply with aviation standards. After deployment, ongoing support and maintenance are critical, provided by service providers and in-house airline teams to ensure optimal performance and regulatory compliance. The value chain is enhanced by continuous feedback loops, fostering innovation and improvements in AID technology.

Aircraft Interface Device Market Opportunity Analysis

The Aircraft Interface Device (AID) market presents substantial opportunities driven by the growing emphasis on enhancing aviation safety and operational efficiency. Increasing adoption of Electronic Flight Bags (EFBs) and advanced avionics systems fuels demand for AIDs, which act as essential connectors. The trend towards digital transformation and data-driven decision-making in aviation offers a lucrative growth avenue. Opportunities are particularly robust in emerging markets, where expanding airline fleets and modernization efforts are prevalent. Additionally, the rise of wireless communication technologies and Internet of Things (IoT) integration opens new prospects for innovative AID solutions. Strategic partnerships, technological advancements, and regulatory mandates for improved safety standards further bolster market potential, encouraging investment in research and development to meet evolving industry needs.

Global Aircraft Interface Device Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 42.9 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.00% |

| 2033 Value Projection: | USD 76.8 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 214 |

| Tables, Charts & Figures: | 109 |

| Segments covered: | By Application, By Aircraft Type, By Connectivity, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Astronics Corporation, Esterline Technologies Corporation, Collins Aerospace, Global Eagle, Teledyne Technologies Incorporated, Avionica Inc., Thales Group, The Boeing Company, Skytrac System Ltd., and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Aircraft Interface Device Market Dynamics

Increased In-Flight Connectivity in Aircraft to Drive Market Growth

The surge in demand for in-flight connectivity is a major driver for the growth of the Aircraft Interface Device (AID) market. As airlines strive to enhance passenger experience through seamless internet access and real-time data services, the need for advanced AID systems has intensified. These devices are pivotal in integrating and managing connectivity solutions, ensuring efficient communication between onboard systems and ground operations. The proliferation of smart devices among passengers and crew further amplifies this demand. Additionally, regulatory mandates for improved communication and safety systems onboard are accelerating the adoption of AIDs.

Restraints & Challenges

One significant hurdle is the high cost associated with the development and implementation of advanced AID systems, which can strain airline budgets, especially for smaller carriers. Additionally, ensuring compatibility and seamless integration with diverse avionics systems and Electronic Flight Bags (EFBs) across different aircraft models can be complex and time-consuming. Regulatory compliance and certification processes are stringent and can delay product deployment. Cybersecurity threats pose another critical challenge, as increasing connectivity heightens the risk of data breaches and system vulnerabilities. Moreover, the market's dependency on the overall health of the aviation industry makes it susceptible to economic downturns and fluctuations in air travel demand, potentially impacting investment and adoption rates.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Aircraft Interface Device Market from 2023 to 2033. The presence of major aircraft manufacturers, such as Boeing, and leading avionics companies fosters innovation and demand for AIDs. Regulatory bodies like the FAA enforce stringent safety and connectivity standards, propelling the adoption of AIDs to enhance operational efficiency and compliance. Additionally, the region's robust air traffic and high passenger demand for in-flight connectivity and entertainment services further stimulate market growth. The ongoing modernization of commercial and military fleets, coupled with substantial investments in research and development, positions North America as a critical hub for the expansion and advancement of the AID market.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The region's burgeoning low-cost carrier sector is also contributing to market growth, as these airlines seek cost-effective solutions to improve operational efficiency. Furthermore, supportive government policies and investments in aviation infrastructure development boost the adoption of advanced avionics systems, including AIDs. Collaborations with global avionics manufacturers and technology providers are enhancing the region's market potential, making Asia Pacific a dynamic and promising landscape for AID advancements.

Segmentation Analysis

Insights by Application

The Aircraft Condition Monitoring System (ACMS) segment accounted for the largest market share over the forecast period 2023 to 2033. ACMS facilitates real-time monitoring and analysis of critical aircraft systems, enabling timely detection of potential issues and reducing maintenance costs. The integration of ACMS with AIDs enhances data acquisition and communication, supporting comprehensive diagnostics and operational insights. Airlines are increasingly adopting ACMS to optimize fleet performance, improve reliability, and comply with stringent regulatory standards. Technological advancements, such as the incorporation of advanced sensors and IoT capabilities, further propel the segment's expansion. As airlines focus on minimizing downtime and enhancing safety protocols, the demand for ACMS-integrated AIDs continues to rise, driving market growth.

Insights by Aircraft Type

The fixed wing segment dominates the market and has the largest market share over the forecast period 2023 to 2033. The increasing demand for improved in-flight connectivity, operational efficiency, and real-time data monitoring in commercial aviation significantly boosts this segment. Airlines are investing in advanced AID systems to enhance Electronic Flight Bag (EFB) functionalities, optimize flight operations, and ensure compliance with evolving safety regulations. In the military sector, the need for robust and secure communication systems for mission-critical operations drives AID adoption. Technological advancements, such as wireless integration and IoT applications, further augment the functionality and appeal of AIDs in fixed-wing aircraft. Consequently, the fixed-wing segment is experiencing substantial growth, reflecting the broader expansion of the aviation industry.

Insights by Connectivity

The wireless segment accounted for the largest market share over the forecast period 2023 to 2033. Wireless technologies enable seamless communication between onboard systems, Electronic Flight Bags (EFBs), and ground operations, thereby improving operational efficiency and passenger experience. The adoption of wireless AID systems is driven by their ability to support real-time data transfer, remote diagnostics, and software updates, crucial for maintaining aircraft performance and compliance with regulatory standards. Moreover, the integration of wireless capabilities facilitates flexible installation options and reduces wiring complexity, lowering installation and maintenance costs for airlines.

Recent Market Developments

- In August 2023, FLYHT Aerospace Solutions LLC reported that it had extended a five-year contract with a long-term aircraft lease customer to offer ongoing software services for its complete Boeing 777 and 767 fleet.

Competitive Landscape

Major players in the market

- Astronics Corporation

- Esterline Technologies Corporation

- Collins Aerospace

- Global Eagle

- Teledyne Technologies Incorporated

- Avionica Inc.

- Thales Group

- The Boeing Company

- Skytrac System Ltd.

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aircraft Interface Device Market, Application Analysis

- Flight tracking

- Quick Access Recording

- Aircraft Condition Monitoring System (ACMS)

- DVR and Video Streaming

- Others

Aircraft Interface Device Market, Aircraft Type Analysis

- Fixed Wing

- Rotary Wing

Aircraft Interface Device Market, Connectivity Analysis

- Wired

- Wireless

Aircraft Interface Device Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Aircraft Interface Device?The global Aircraft Interface Device Market is expected to grow from USD 42.9 million in 2023 to USD 76.8 million by 2033, at a CAGR of 6.00% during the forecast period 2023-2033.

-

2. Who are the key market players of the Aircraft Interface Device Market?Some of the key market players of the market are Astronics Corporation, Esterline Technologies Corporation, Collins Aerospace, Global Eagle, Teledyne Technologies Incorporated, Avionica Inc., Collins Aerospace, Thales Group, The Boeing Company, Skytrac System Ltd. And other key vendors.

-

3. Which segment holds the largest market share?The wireless segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Aircraft Interface Device market?North America dominates the Aircraft Interface Device market and has the highest market share.

Need help to buy this report?