Global Aircraft Interface Devices Aid Market Size, Share, and COVID-19 Impact Analysis, By Connectivity (Wired And Wireless), By Aircraft Type (Civil And Military), By End-Use (Fixed Wing And Rotary Wing) and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Aircraft Interface Devices Aid Market Insights Forecasts to 2033

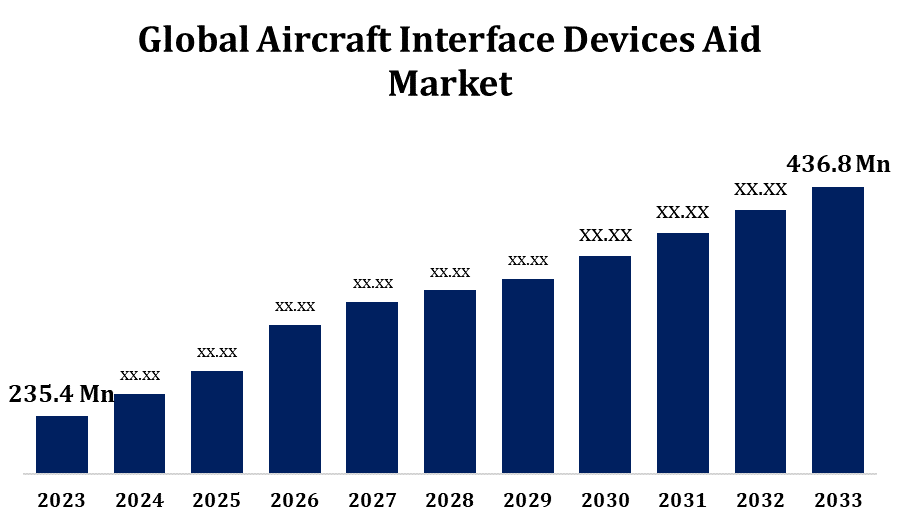

- The Aircraft Interface Devices Aid Market Size Was Valued at USD 235.4 Million in 2023.

- The Market Size is growing at a CAGR of 6.38% from 2023 to 2033.

- The Worldwide Aircraft Interface Devices Aid Market Size is expected to reach USD 436.8 million by 2033.

- Asia Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Aircraft Interface Devices Aid Market Size is expected to reach USD 436.8 Million by 2033, at a CAGR of 6.38% during the forecast period 2023 to 2033.

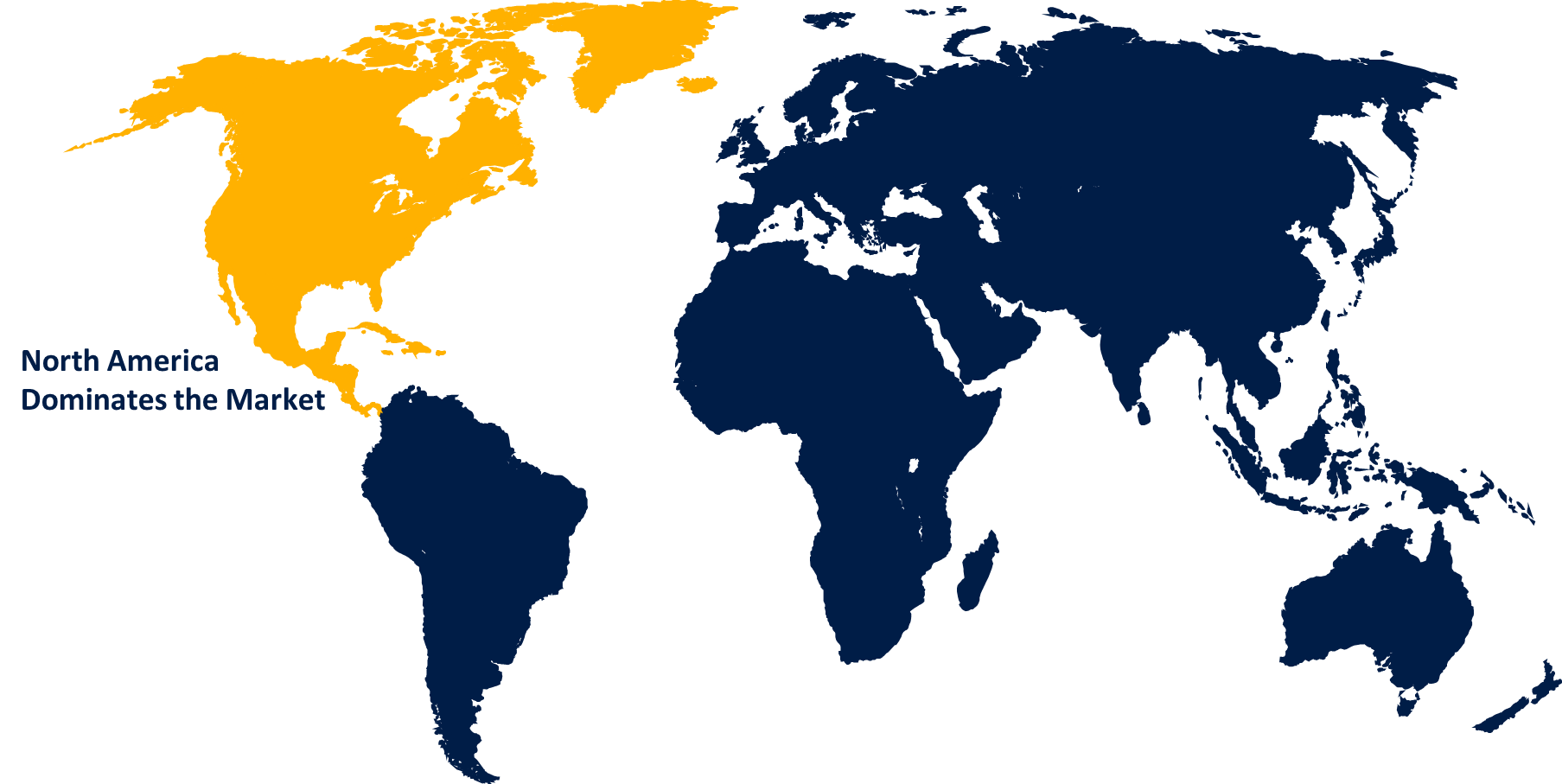

The Aircraft Interface Devices Aid market is experiencing significant growth due to the increasing demand for real-time data exchange and seamless communication between aircraft systems and avionics. AID serves as a crucial intermediary, connecting avionics systems with electronic flight bags (EFB) and other onboard technologies, enabling enhanced situational awareness, operational efficiency, and safety. The market is driven by rising air traffic, the adoption of advanced avionics, and the push for modernization of aircraft fleets across commercial, military, and business aviation sectors. Technological advancements, such as wireless connectivity and improved data security, are further fueling market expansion. Major players are focusing on developing versatile, lightweight, and efficient AID systems to meet industry needs. Geographically, North America and Europe dominate the market due to their mature aviation industries.

Aircraft Interface Devices Aid Market Value Chain Analysis

The value chain of the Aircraft Interface Devices Aid market involves several key stages, from component suppliers to end-users. It begins with raw material and component suppliers providing essential parts like sensors, processors, and communication modules. These are integrated by AID manufacturers who design and develop interface devices tailored to aviation industry standards. Original Equipment Manufacturers (OEMs) and avionics system integrators then incorporate these AIDs into aircraft systems, enabling data exchange between avionics and external devices like electronic flight bags (EFB). Regulatory bodies play a role in certifying AID systems for safety and compliance. Distributors and resellers deliver the final products to airlines, military aviation, and business jet operators. The end-users, including airlines and defense forces, benefit from improved operational efficiency, safety, and real-time data access through AID integration.

Aircraft Interface Devices Aid Market Opportunity Analysis

The Aircraft Interface Devices Aid market presents significant opportunities driven by the growing need for efficient, real-time data sharing and communication across aircraft systems. As airlines and military fleets increasingly adopt digital technologies like electronic flight bags (EFB) and connected avionics, the demand for advanced AID solutions is rising. The push for fleet modernization and the trend toward predictive maintenance provide further growth avenues. Emerging markets in Asia-Pacific and the Middle East, with expanding aviation sectors, offer opportunities for AID manufacturers to tap into untapped regions. Additionally, the integration of wireless technologies and cybersecurity advancements within AID systems enhances their appeal, creating potential for innovation and differentiation. Overall, the need for enhanced operational efficiency and safety in aviation drives robust market potential for AID solutions.

Global Aircraft Interface Devices Aid Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 235.4 Million |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 6.38% |

| 2033 Value Projection: | USD 436.8 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Connectivity, By Aircraft Type, By Region |

| Companies covered:: | Astronics Corporation, Esterline Technologies Corporation, Collins Aerospace, Global Eagle, Teledyne Technologies Incorporated, Avionica Inc., Collins Aerospace, Thales Group, The Boeing Company, and Skytrac System Ltd. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Aircraft Interface Devices Aid Market Dynamics

Introduction of Regulatory Mandates to use AID to Drive Market Growth

The introduction of regulatory mandates requiring Aircraft Interface Devices Aids is poised to drive substantial growth in the market. Aviation authorities, such as the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA), are increasingly enforcing regulations aimed at improving operational efficiency, safety, and real-time data exchange. These mandates compel airlines and aircraft operators to integrate advanced avionics systems, including AIDs, to comply with modern safety and data-sharing requirements. AIDs enable seamless communication between onboard systems and electronic flight bags (EFB), enhancing flight crew awareness and reducing the risk of errors. As governments push for fleet modernization and stricter compliance with safety standards, the demand for certified, compliant AID solutions will accelerate, encouraging manufacturers to innovate and meet evolving industry regulations.

Restraints & Challenges

One significant challenge is the high cost associated with developing, certifying, and integrating AID systems, which may deter smaller airlines and operators from adopting the technology. Additionally, the stringent regulatory approval processes for aviation components require time-consuming and expensive testing to ensure compliance with safety standards. Another challenge is the complexity of integrating AID with diverse avionics systems, as older aircraft may need extensive modifications to support modern technologies. Cybersecurity concerns also pose a threat, as AID systems are increasingly connected, making them vulnerable to hacking or data breaches. Finally, market players must continuously innovate to keep pace with rapid technological advancements, further adding pressure to stay competitive.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Aircraft Interface Devices Aid Market from 2023 to 2033. The U.S., in particular, drives growth with major aerospace companies, military fleets, and commercial airlines seeking to modernize their aircraft systems. The Federal Aviation Administration (FAA) plays a crucial role in mandating compliance with safety and operational standards, further boosting demand for AIDs. Additionally, the region's focus on upgrading legacy aircraft with real-time data-sharing capabilities and integrating electronic flight bags (EFBs) fuels market expansion. With growing emphasis on cybersecurity and wireless technologies, North American AID manufacturers are investing in innovative solutions to meet evolving regulatory and operational requirements, ensuring continued market leadership.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Developing nations are experiencing a surge in air travel, prompting airlines to invest in advanced avionics and data-sharing technologies, including AIDs. Fleet modernization initiatives and the adoption of electronic flight bags (EFBs) are further accelerating market demand. However, challenges such as regulatory differences and the high cost of implementation may slow adoption in some areas. Despite this, the rising focus on improving operational efficiency, safety, and connectivity is fueling interest in AID solutions. The region's growing defense and business jet sectors also contribute to market expansion, offering significant opportunities for manufacturers and suppliers.

Segmentation Analysis

Insights by Aircraft Type

The military aircraft segment accounted for the largest market share over the forecast period 2023 to 2033. Military organizations are prioritizing the integration of AIDs to improve communication, data sharing, and situational awareness in complex mission environments. AIDs facilitate real-time monitoring and diagnostics, enabling predictive maintenance that enhances aircraft readiness and minimizes downtime. Furthermore, the growing emphasis on modernization programs and the incorporation of advanced avionics in military fleets are driving demand for AID solutions. As militaries worldwide adopt next-generation aircraft and upgrade existing platforms, the need for reliable and efficient AIDs will continue to rise, making the military segment a key growth area within the overall AID market.

Insights by End Use

The fixed wing aircraft segment accounted for the largest market share over the forecast period 2023 to 2033. Fixed-wing aircraft, which make up a large portion of the global fleet, increasingly rely on AID solutions to support advanced avionics, electronic flight bags (EFB), and condition monitoring systems. Airlines are investing in fleet modernization and adopting AIDs to improve flight operations, reduce downtime, and optimize maintenance. The military sector also contributes to growth, as AIDs enable seamless integration of mission-critical systems. Additionally, the ongoing development of lightweight, wireless AID technologies further enhances adoption across both new and retrofitted fixed-wing aircraft, making this segment a key contributor to overall market expansion.

Insights by Connectivity

The wireless segment accounted for the largest market share over the forecast period 2023 to 2033. Wireless AIDs enable seamless communication between aircraft systems, ground control, and electronic flight bags (EFBs), enhancing situational awareness and operational efficiency. The shift toward digitalization in aviation, along with advancements in wireless technologies like Wi-Fi and Bluetooth, is facilitating the integration of AIDs into both new and existing aircraft. Airlines are prioritizing wireless solutions to reduce wiring complexity, improve data transfer speeds, and enhance overall system reliability. Additionally, regulatory support for innovative technologies and the need for enhanced cybersecurity measures are further boosting the adoption of wireless AIDs. This trend is expected to continue as the aviation industry embraces smarter, more connected aircraft systems.

Recent Market Developments

- In August 2023, FLYHT Aerospace Solutions LLC has announced a five-year contract extension with a long-term aircraft leasing client, ensuring continued software services for its entire fleet of Boeing 777 and 767 aircraft.

Competitive Landscape

Major players in the market

- Astronics Corporation

- Esterline Technologies Corporation

- Collins Aerospace

- Global Eagle

- Teledyne Technologies Incorporated

- Avionica Inc.

- Collins Aerospace

- Thales Group

- The Boeing Company

- Skytrac System Ltd.

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aircraft Interface Devices Aid Market, Aircraft Type Analysis

- Civil

- Military

Aircraft Interface Devices Aid Market, End Use Analysis

- Fixed Wing

- Rotary Wing

Aircraft Interface Devices Aid Market, Connectivity Analysis

- Wired

- Wireless

Aircraft Interface Devices Aid Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the market size of the Aircraft Interface Devices Aid Market?The global Aircraft Interface Devices Aid Market is expected to grow from USD 235.4 million in 2023 to USD 436.8 million by 2033, at a CAGR of 6.38% during the forecast period 2023-2033.

-

2.Who are the key market players of the Aircraft Interface Devices Aid Market?Some of the key market players of the market are Astronics Corporation, Esterline Technologies Corporation, Collins Aerospace, Global Eagle, Teledyne Technologies Incorporated, Avionica Inc., Collins Aerospace, Thales Group, The Boeing Company, Skytrac System Ltd.

-

3.Which segment holds the largest market share?The fixed wing segment holds the largest market share and is going to continue its dominance.

-

4.Which region dominates the Aircraft Interface Devices Aid Market?North America dominates the Aircraft Interface Devices Aid Market and has the highest market share.

Need help to buy this report?