Global Aircraft Landing Gears Market Size, Share, and COVID-19 Impact Analysis, By Type (Nose Landing Gear and Main Landing Gear), By Platform (Fixed-Wing and Rotary Wing), By Component (Retraction System, Brakes & Wheels, Steering, and Others), By End-User (OEM and Aftermarket), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Aircraft Landing Gears Market Insights Forecasts to 2033

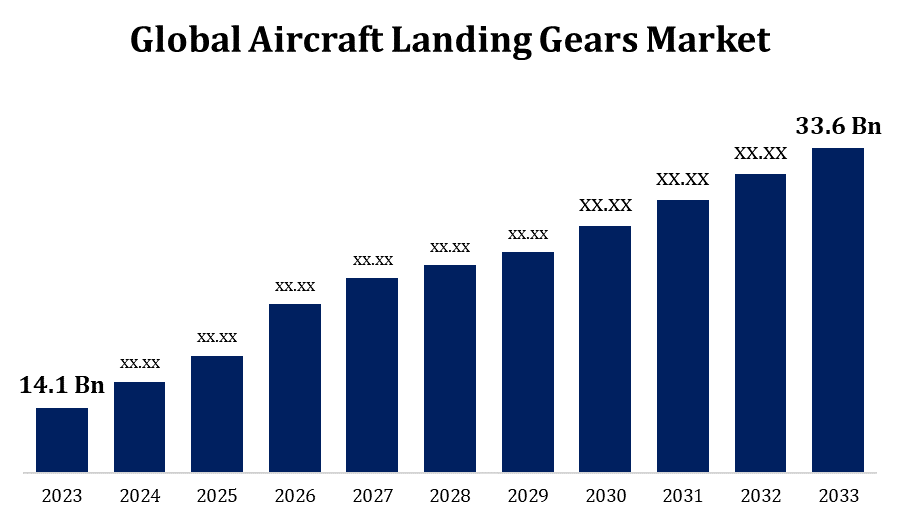

- The Global Aircraft Landing Gears Market Size was valued at USD 14.1 Billion in 2023.

- The Market Size is Growing at a CAGR of 9.07% from 2023 to 2033

- The Worldwide Aircraft Landing Gears Market Size is expected to reach USD 33.6 Billion by 2033

- Asia Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Aircraft Landing Gears Market Size is expected to reach USD 33.6 Billion by 2033, at a CAGR of 9.07% during the forecast period 2023 to 2033.

The aircraft landing gears market is projected to grow significantly, driven by increased demand for air travel and the expansion of the aviation sector. Key trends include advancements in technology for enhanced safety and efficiency, such as the integration of smart sensors and lightweight materials like carbon composites. The market is also influenced by the rising adoption of commercial and military aircraft, coupled with the need for regular maintenance and upgrades of existing fleets. Major players are focusing on innovation to meet stringent safety regulations and improve performance. Additionally, the shift towards electric and hybrid aircraft is expected to introduce new dynamics and opportunities in the landing gear sector.

Aircraft Landing Gears Market Value Chain Analysis

The aircraft landing gears market value chain begins with the procurement of raw materials such as steel, titanium, and composites. These materials are then processed and manufactured into individual components by suppliers. Original equipment manufacturers (OEMs) assemble these components into complete landing gear systems. These systems are integrated into aircraft by aircraft manufacturers. Once in service, the landing gears undergo maintenance, repair, and overhaul (MRO) by specialized service providers to ensure continued safety and performance. The value chain is completed with end-users, including airlines and military operators, who use the aircraft. Each stage involves key activities that contribute to the overall efficiency, safety, and cost-effectiveness of landing gear systems.

Aircraft Landing Gears Market Opportunity Analysis

The aircraft landing gears market presents significant opportunities driven by growing global air travel and advancements in aviation technology. Key opportunities include the adoption of lightweight materials and advanced composites, which enhance performance and fuel efficiency. The rise of electric and hybrid aircraft offers new avenues for innovation in landing gear design. Additionally, increasing investments in aircraft maintenance, repair, and overhaul (MRO) services create growth potential in the aftermarket segment. Expanding defense budgets and rising military aircraft procurement also drive demand. Emerging markets in Asia-Pacific and the Middle East present further opportunities due to rapid economic growth and expanding aviation infrastructure.

Global Aircraft Landing Gears Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 14.1 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 9.07% |

| 2033 Value Projection: | USD 33.6 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By Platform, By Component, By End-User, By Region |

| Companies covered:: | AAR, Circor International, Eaton Corporation, GKN Aerospace, Hawker Pacific Aerospace, Heroux-Devtek, Inc., Honeywell International, Liebherr Group, Magellan Aerospace, Safran, SPP Canada Aircraft, Triumph Group, United Technologies, UTC Aerospace Systems, and other key companies. |

| Growth Drivers: | Increased Procurement of Modern Generation Aircraft to Drive Market Growth |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Market Dynamics

Aircraft Landing Gears Market Dynamics

Increased Procurement of Modern Generation Aircraft to Drive Market Growth

The increased procurement of modern generation aircraft is poised to significantly drive the growth of the aircraft landing gear market. Modern aircraft, which emphasize fuel efficiency, advanced aerodynamics, and enhanced safety, require state-of-the-art landing gear systems designed to meet their stringent performance and reliability standards. These next-generation aircraft often incorporate lightweight materials and advanced technology, pushing demand for innovative landing gear solutions. Additionally, the global expansion of airlines and defense fleets further fuels the need for updated landing gear systems. As airlines and military operators upgrade their fleets to improve operational efficiency and meet environmental regulations, the demand for advanced landing gear systems will continue to rise, propelling market growth.

Restraints & Challenges

The complexity of designing landing gear systems that meet rigorous safety and performance standards can lead to lengthy and costly certification processes. Additionally, fluctuating raw material prices and supply chain disruptions can impact production costs and timelines. The need for regular maintenance, repair, and overhaul (MRO) also adds to the overall lifecycle costs of landing gear systems. Furthermore, the industry must navigate evolving regulatory requirements and environmental standards, which can affect design and manufacturing practices. Companies must address these challenges through innovation, efficient supply chain management, and strategic planning to remain competitive in the market.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Aircraft Landing Gears Market from 2023 to 2033. The region is home to major aircraft manufacturers like Boeing and numerous aerospace suppliers, contributing to significant market activity. North America’s focus on technological advancements, such as lightweight materials and smart landing gear systems, supports growth. The presence of a well-established maintenance, repair, and overhaul (MRO) industry further boosts the market. Additionally, increased defense spending and the modernization of military fleets drive demand for advanced landing gear systems.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Emerging economies like China and India are increasing their investment in new aircraft and fleet modernization, driving demand for advanced landing gear systems. The region’s burgeoning commercial and military aviation sectors, coupled with rising disposable incomes and urbanization, contribute to this growth. Additionally, the Asia-Pacific market benefits from expanding aerospace manufacturing capabilities and the presence of key suppliers.

Segmentation Analysis

Insights by Type

The main landing gear segment accounted for the largest market share over the forecast period 2023 to 2033. As the demand for new commercial and military aircraft rises, the need for advanced main landing gear systems that support heavier and more technologically sophisticated aircraft increases. Innovations in materials and design, such as lightweight composites and advanced hydraulics, are enhancing the performance and durability of main landing gears. Additionally, the expansion of global airlines and defense fleets fuels the demand for reliable and efficient landing gear systems. The segment’s growth is further supported by the need for regular maintenance, repair, and overhaul (MRO) services, ensuring continuous demand throughout the lifecycle of aircraft.

Insights by Platform

The rotary wing segment accounted for the largest market share over the forecast period 2023 to 2033. Rising defense budgets and the expansion of search and rescue, medical evacuation, and offshore operations are fueling demand for advanced landing gear systems in helicopters. Innovations in materials and design are enhancing the performance and durability of rotary wing landing gears, which must support various types of missions and environments. Additionally, the growing adoption of lightweight materials and integrated systems is improving efficiency and safety. The market is also supported by the need for specialized maintenance, repair, and overhaul (MRO) services tailored to rotary wing aircraft.

Insights by Component

The retraction systems segment accounted for the largest market share over the forecast period 2023 to 2033. Retractable landing gear systems are crucial for reducing drag and improving aerodynamic performance, which is essential for modern, fuel-efficient aircraft. Innovations in automation and lightweight materials are enhancing the reliability and functionality of these systems. The growing trend toward high-performance commercial and military aircraft, which require sophisticated retraction mechanisms, further drives demand. Additionally, the need for more streamlined and space-efficient designs in aircraft is boosting the adoption of advanced retraction systems. As airlines and defense operators seek to optimize operational efficiency and performance, the retraction systems segment is poised for continued expansion.

Insights by End User

The OEM segment accounted for the largest market share over the forecast period 2023 to 2033. The growth is driven by the increasing production of new aircraft and technological advancements. As airlines and military forces expand and modernize their fleets, demand for high-performance, reliable landing gear systems from OEMs rises. Innovations such as lightweight materials, advanced hydraulics, and smart systems are becoming integral to new aircraft designs, pushing OEMs to deliver cutting-edge solutions. Additionally, the growth of the aerospace industry in emerging markets and the rise in aircraft orders are bolstering the OEM segment. The focus on integrating advanced landing gear systems into new aircraft models, coupled with stringent safety and performance standards, ensures robust growth and competitive opportunities for OEMs in the market.

Recent Market Developments

- In March 2023, Lufthansa Technik was awarded an MRO service contract from Emirates to repair and maintain the operating aircraft fleet's landing gear.

Competitive Landscape

Major players in the market

- AAR

- Circor International

- Eaton Corporation

- GKN Aerospace

- Hawker Pacific Aerospace

- Heroux-Devtek, Inc.

- Honeywell International

- Liebherr Group

- Magellan Aerospace

- Safran

- SPP Canada Aircraft

- Triumph Group

- United Technologies

- UTC Aerospace Systems

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aircraft Landing Gears Market, Type Analysis

- Nose Landing Gear

- Main Landing Gear

Aircraft Landing Gears Market, Platform Analysis

- Fixed-Wing

- Rotary Wing

Aircraft Landing Gears Market, Component Analysis

- Retraction System

- Brakes & Wheels

- Steering

- Others

Aircraft Landing Gears Market, End User Analysis

- OEM

- Aftermarket

Aircraft Landing Gears Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Aircraft Landing Gears?The global Aircraft Landing Gears Market is expected to grow from USD 14.1 billion in 2023 to USD 33.6 billion by 2033, at a CAGR of 9.07% during the forecast period 2023-2033.

-

2. Who are the key market players of the Aircraft Landing Gears Market?Some of the key market players of the market are AAR, Circor International, Eaton Corporation, GKN Aerospace, Hawker Pacific Aerospace, Heroux-Devtek, Inc., Honeywell International, Liebherr Group, Magellan Aerospace, Safran, SPP Canada Aircraft, Triumph Group, United Technologies, and UTC Aerospace Systems.

-

3. Which segment holds the largest market share?The rotary wing segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Aircraft Landing Gears market?North America dominates the Aircraft Landing Gears market and has the highest market share.

Need help to buy this report?