Global Aircraft Lavatory System Market Size, Share, and COVID-19 Impact Analysis, By Aircraft Type (Commercial Aircraft, Business Jet, Regional Aircraft), By Technology (Vacuum Technology, Recirculating Technology), By Component (Toilet Assembly, Waste & Water Tank Assembly, Plumbing System, Lavatory Cabin, Electric & Electronic Components, and Others), By End-User (OEM and Aftermarket), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032.

Industry: Aerospace & DefenseGlobal Aircraft Lavatory System Market Insights Forecasts to 2032

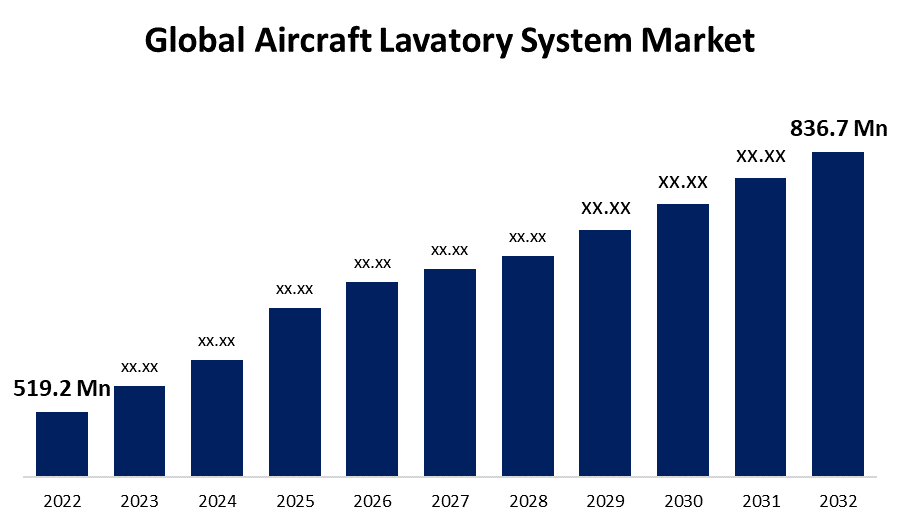

- The Global Aircraft Lavatory System Market Size was valued at USD 519.2 Million in 2022.

- The Market is growing at a CAGR of 4.9% from 2022 to 2032.

- The Worldwide Aircraft Lavatory System Market Size is expected to reach USD 836.7 Million by 2032.

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Aircraft Lavatory System Market size is anticipated to exceed USD 836.7 Million by 2032, growing at a CAGR of 4.9% from 2022 to 2032. Airlines are placing orders for newer generation fuel-efficient aircraft to expand their fleet size in response to rising air passenger traffic. This will create demand for a lavatory system, which is one of the most important systems in an airplane cabin interior and is used by all airlines.

Market Overview

The toilet assembly, actuators, valves, pipes, tanks, doors and panels, sensors, and other components comprise the aircraft lavatory system. Lavatory systems differ depending on the class and size of the aircraft. Aircraft lavatories are constantly being improved to reduce weight and maintenance costs. Furthermore, rising passenger demand for opulent restrooms is expected to drive market growth. Several factors, including increased air travel and technological advancements that improve product performance, are driving up demand for lavatory systems. During their travel time, most customers prefer to use clean and comfortable restrooms. The main advantages of such a system are its modern and lightweight design, which provides significant cost savings over a traditional system. The advanced system provides benefits such as increased reliability, ease of maintenance, and a lightweight design. Toilets, sensors, tanks, and vacuum generators are all available in these systems.

Manufacturers have gradually improved their designs by using new advanced materials to make them lighter. They have also reduced the size of the restrooms without affecting passenger comfort. Some key aircraft interior players are establishing manufacturing facilities to produce some of their components and parts, while many others are acquiring and merging. Boeing provides lavatory and stowage facilities for some of its programs. Companies are increasingly interested in expanding their supply chain networks and concentrating on in-house supply.

Report Coverage

This research report categorizes the market for the global aircraft lavatory system market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the aircraft lavatory system market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the aircraft lavatory system market.

Global Aircraft Lavatory System Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 519.2 Million |

| Forecast Period: | 2022 – 2032 |

| Forecast Period CAGR 2022 – 2032 : | 4.9% |

| 022 – 2032 Value Projection: | USD 836.7 Million |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 140 |

| Segments covered: | By Aircraft Type, By Technology, By Component, By End-User and By Region. |

| Companies covered:: | JAMCO Corporation, Safran Group, Collins Aerospace, Diehl Aerosystems, Yokohama Aerospace America, Inc., CIRCOR Aerospace and Defense, Inc., AIM Altitude, The Nordam Group LLC, Aero Aid Ltd and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Increasing innovations in lavatories aimed at reducing weight are contributing to the market's growth. Furthermore, the installation of advanced toilets to reduce downtime and increase revenue is propelling the international aircraft toilet systems market forward. Modern aircraft toilets are designed to provide a more luxurious and comfortable experience, which is expected to drive the international aircraft toilet systems market forward. Consumers prefer sanitary and comfortable travel, prompting airline operators to install more modern systems and propelling the international aircraft cleaning systems market forward.

Restraining Factors

Some airlines are discontinuing the two commercial jumbo-jets, the Boeing 747 and the Airbus A380, because the coronavirus outbreak has reduced demand for the four-engine planes. These aircraft were twice the size of a standard jetliner, with more seats and lavatories for a more comfortable flight. Because these flights will not carry passengers, they will have an impact on the market's revenue and growth.

Market Segmentation

The Global Aircraft Lavatory System Market share is classified into aircraft type, technology, and component

- The commercial aircraft segment is expected to grow at the highest rate in the global aircraft lavatory system market during the forecast period.

The global aircraft lavatory system market is categorized by aircraft type into commercial aircraft, business jet, and regional aircraft. Among these, the commercial aircraft segment is expected to grow at the highest rate in the global aircraft lavatory system market during the forecast period. Rising demand for commercial aircraft due to increased air passenger traffic is expected to drive market expansion. Narrow body aircrafts dominated the commercial segment. Narrow body aircrafts are becoming more capable as their operating efficiency and fuel mileage improve. Domestic travel is also increasing, which increases the demand for lavatory systems in narrow bodies. However, wide-body aircrafts are gradually gaining popularity among international airline operators. Lavatory systems have a high potential in wide body aircrafts due to the fact that there are roughly more lavatory systems incorporated due to two aisle configurations.

- The vacuum technology segment is expected to grow at the highest CAGR in the global aircraft lavatory system market during the forecast period.

Based on the technology, the global aircraft lavatory system market is divided into vacuum technology and recirculating technology. Among these, the vacuum technology segment is expected to grow at the highest CAGR in the global aircraft lavatory system market during the forecast period. The segmental expansion can be attributed to the widespread use of vacuum systems, which include vacuum toilets, valves, tanks, vacuum generators, and sensors. Furthermore, vacuum lavatories have the added benefit of reducing overall aircraft weight and increasing hygiene, which is expected to fuel segmental growth.

Regional Segment Analysis of the Global Aircraft Lavatory System Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

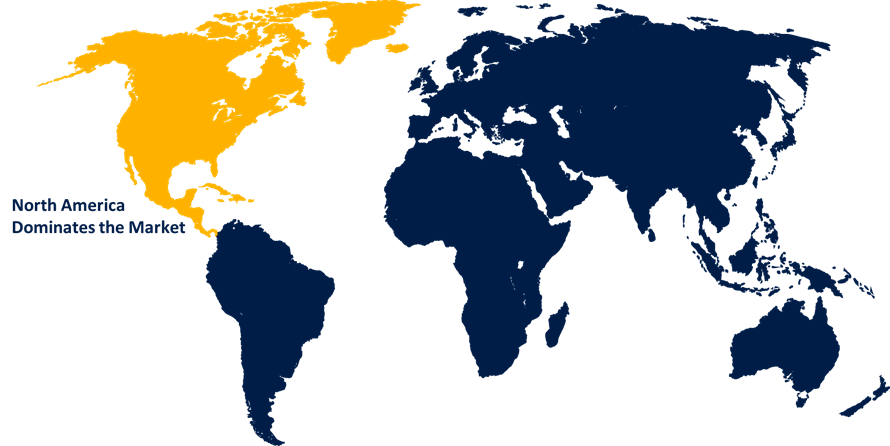

North America is anticipated to hold the largest share of the global aircraft lavatory system market over the predicted timeframe.

Get more details on this report -

North America is projected to hold the largest share of the global aircraft lavatory system market over the predicted years. The expansion is attributed to the region's large commercial and business jet fleets. Furthermore, the United States is home to major aircraft and aircraft lavatories manufacturers, as well as a large number of assembly lines and component assembly shops. Increased passenger air traffic and the development of advanced aircraft lavatories components, as well as the presence of major players in the region, are some of the factors driving market growth in North America.

Asia Pacific is expected to grow at the fastest pace in the global aircraft lavatory system market during the forecast period. The improvement in the economies of emerging countries such as India and China can be attributed to growth. The rising demand for new aircraft in China and India will likely drive the growth of the aircraft lavatory system market. Furthermore, the growing commercial aircraft fleet in India as a result of the entry of new market players such as Vistaara and Air India's expansion plans in the coming years is projected to propel the aircraft lavatory systems market growth throughout the forecast period.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global aircraft lavatory system along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- JAMCO Corporation

- Safran Group

- Collins Aerospace

- Diehl Aerosystems

- Yokohama Aerospace America, Inc.

- CIRCOR Aerospace and Defense, Inc.

- AIM Altitude

- The Nordam Group LLC

- AeroAid Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2022, The Boeing Company has signed a long-term agreement with Collins Aerospace to supply next-generation lavatories for the 737 family of aircraft. The new lavatory system enhances the passenger experience, increases airline operational efficiency, and paves the way for future technology integration.

- In February 2023, ST Engineering disclosed that its commercial aerospace division has signed a Letter of Intent (LOI) to supply its Access expandable cabin lavatory to Vaayu Group (Vaayu), an aircraft leasing and MRO company. According to the terms of the agreement, ST Engineering will supply 20 Access lavatory units for installation on Airbus A320 and Boeing 737 aircraft, making Vaayu the unit's launch customer.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Aircraft Lavatory System Market based on the below-mentioned segments:

Global Aircraft Lavatory System Market, By Aircraft Type

- Commercial Aircraft

- Business Jet

- Regional Aircraft

Global Aircraft Lavatory System Market, By Technology

- Vacuum Technology

- Recirculating Technology

Global Aircraft Lavatory System Market, By Component

- Toilet Assembly

- Waste & Water Tank Assembly

- Plumbing System

- Lavatory Cabin

- Electric & Electronic Components

- Others

Global Aircraft Lavatory System Market, By End-User

- OEM

- Aftermarket

Global Aircraft Lavatory System Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?