Global Aircraft Maintenance Market Size, Share, and COVID-19 Impact Analysis, By Maintenance Type (Airframe, Engine, Line Maintenance, Components, Others), By End-Use (Military, Commercial, Others), By Aircraft Type (Wide-body Aircrafts, Narrow-body Aircrafts, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Aircraft Maintenance Market Insights Forecasts to 2033

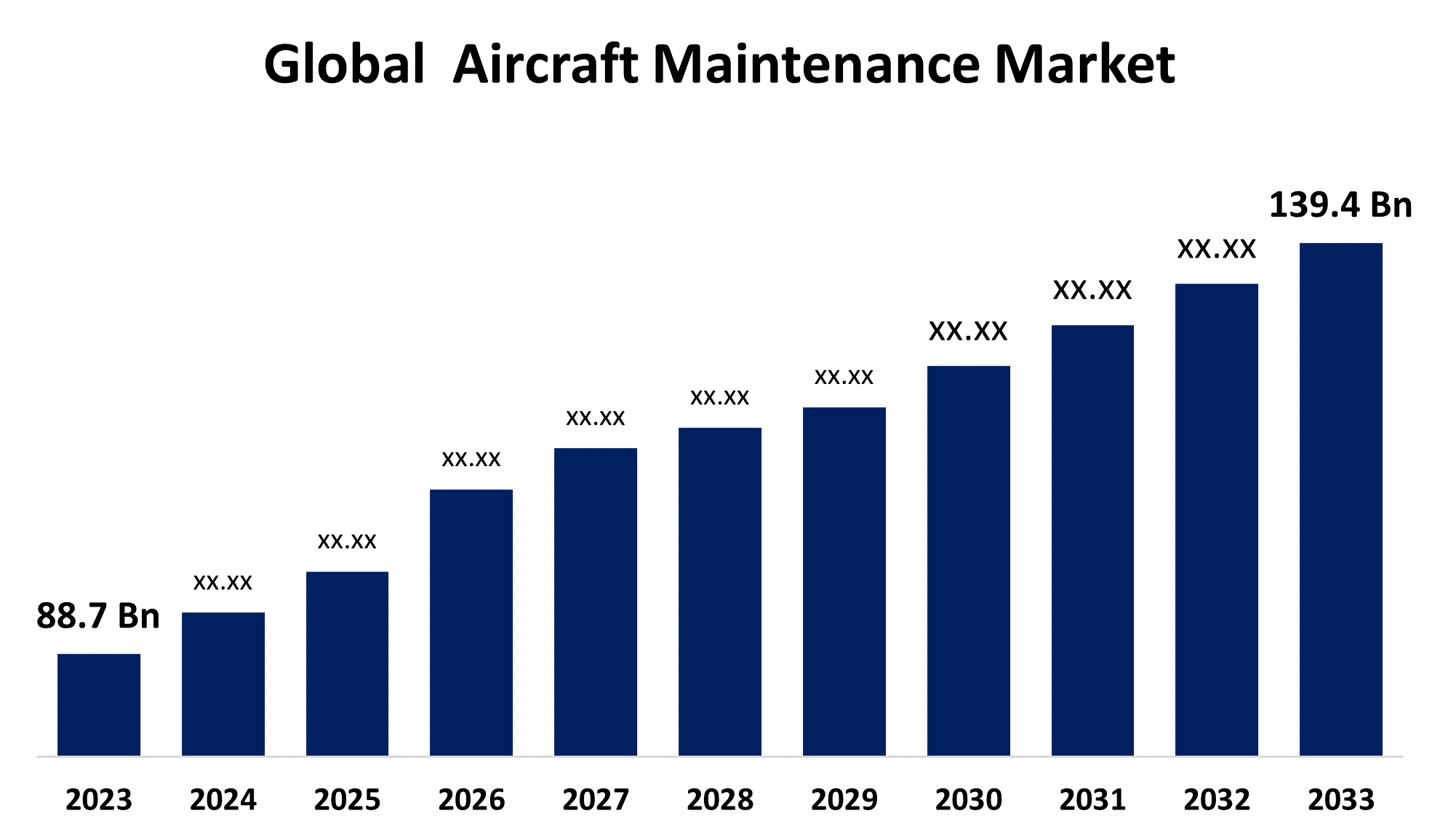

- The Global Aircraft Maintenance Market Size was valued at USD 88.7 Billion in 2023.

- The Market Size is Growing at a CAGR of 4.62% from 2023 to 2033

- The Worldwide Aircraft Maintenance Market Size is Expected to reach USD 139.4 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Aircraft Maintenance Market size is expected to reach USD 139.4 billion by 2033, at a CAGR of 4.62% during the forecast period 2023 to 2033.

The global aircraft maintenance market is experiencing robust growth, driven by the increasing demand for air travel, fleet expansion, and stringent safety regulations. Airlines and aviation companies are investing heavily in maintaining and upgrading aircraft to ensure operational efficiency and compliance with international standards. The market encompasses various segments, including line maintenance, heavy maintenance, engine overhaul, and component maintenance. Technological advancements, such as predictive maintenance and the integration of AI and IoT, are enhancing the efficiency and accuracy of maintenance operations. Additionally, the growth of low-cost carriers and the rise in air cargo demand are contributing to the market's expansion.

Aircraft Maintenance Market Value Chain Analysis

The aircraft maintenance market value chain is a complex network involving multiple stakeholders that ensure the safe and efficient operation of aircraft. It begins with Original Equipment Manufacturers (OEMs) who supply aircraft parts and components. Maintenance, Repair, and Overhaul (MRO) providers perform inspections, repairs, and upgrades, ensuring compliance with safety standards. Airlines and fleet operators are key players, overseeing routine maintenance and coordinating with MROs for more extensive work. Regulatory bodies set and enforce safety standards, while technology providers offer software and tools to enhance maintenance processes. Additionally, logistics and supply chain partners ensure the timely availability of spare parts. This interconnected chain is critical in minimizing aircraft downtime, ensuring safety, and optimizing operational efficiency across the aviation industry.

Aircraft Maintenance Market Opportunity Analysis

The aircraft maintenance market presents significant opportunities driven by increasing global air travel, fleet expansion, and evolving regulatory requirements. With the rise in low-cost carriers and the growing demand for air cargo, there is a heightened need for efficient and cost-effective maintenance solutions. Technological advancements, such as predictive maintenance, AI, and IoT integration, offer opportunities for enhanced operational efficiency and reduced downtime. The shift towards more sustainable aviation, including the adoption of greener technologies and materials, creates avenues for specialized maintenance services. Additionally, the expansion of the aircraft fleet in emerging markets, particularly in Asia-Pacific and the Middle East, opens up new growth opportunities for MRO providers. Companies that can innovate and adapt to these evolving demands are well-positioned to capture significant market share.

Global Aircraft Maintenance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 88.7 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.62% |

| 2033 Value Projection: | USD 139.4 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 203 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Maintenance Type, By End-Use, By Aircraft Type, By Region |

| Companies covered:: | Honeywell International, Safran Aircraft Engines, ST Aerospace, Air France KLM Engineering & Maintenance, GE Aviation, Pratt & Whitney, GMF AeroAsia, Lufthansa Technik, Airbus Group, Delta TechOps, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Aircraft Maintenance Market Dynamics

Increase in global air passenger traffic

The increase in global air passenger traffic is a major driver of growth in the aircraft maintenance market. As more people travel by air, airlines are expanding their fleets and increasing flight frequencies, leading to higher wear and tear on aircraft. This surge in demand necessitates more frequent and comprehensive maintenance to ensure safety, reliability, and regulatory compliance. Additionally, the expansion of low-cost carriers and the emergence of new routes, particularly in developing regions, are fueling the need for maintenance services. The rise in passenger traffic also accelerates the adoption of advanced maintenance technologies, such as predictive analytics and digital twin simulations, to minimize downtime and optimize operations. This growing demand for air travel is thus directly contributing to the robust expansion of the aircraft maintenance market.

Restraints & Challenges

One of the primary challenges is the shortage of skilled labor, as the demand for qualified technicians often outpaces supply. This talent gap can lead to delays in maintenance schedules and increased operational costs. Additionally, the high cost of maintenance, repair, and overhaul (MRO) services, particularly for newer, more technologically advanced aircraft, poses a challenge for airlines operating on tight budgets. The complexity of regulatory compliance across different regions adds another layer of difficulty, as companies must navigate varying standards and procedures. Moreover, the volatility of fuel prices and the economic impact of global events, such as pandemics or geopolitical tensions, can disrupt airline operations, thereby affecting demand for maintenance services.

Regional Forecasts

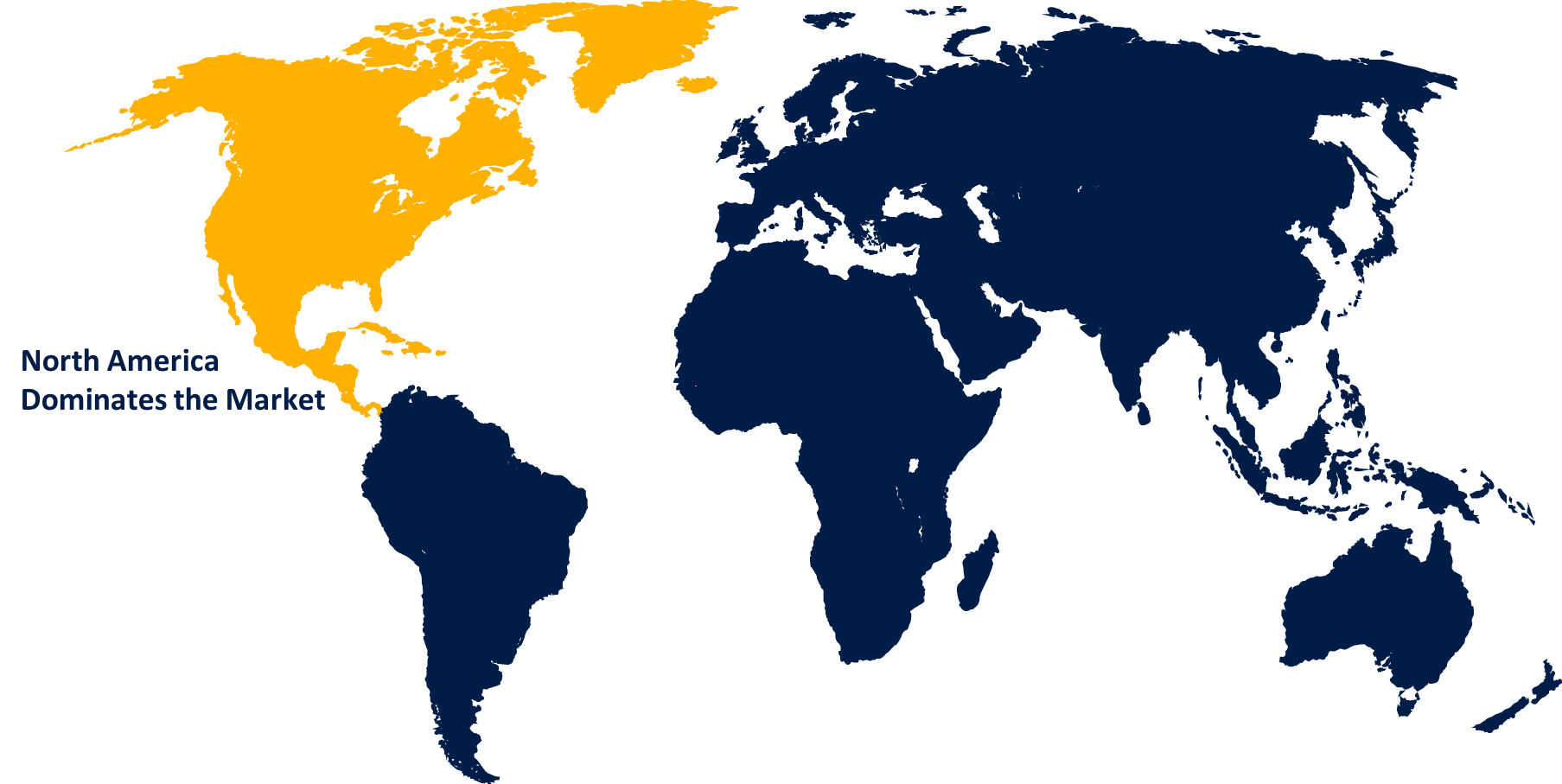

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Aircraft Maintenance Market from 2023 to 2033. The market is bolstered by the region's focus on technological innovation, including the adoption of predictive maintenance and advanced digital tools to enhance efficiency and reduce downtime. Regulatory compliance, enforced by authorities like the Federal Aviation Administration (FAA), ensures stringent maintenance standards, further fueling demand for high-quality MRO services. Additionally, the aging aircraft fleet in North America, particularly among legacy carriers, presents ongoing opportunities for maintenance, upgrades, and retrofitting, sustaining the market's growth trajectory.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Asia-Pacific is witnessing significant fleet expansion, particularly among low-cost carriers and emerging airlines. This growth fuels the demand for Maintenance, Repair, and Overhaul (MRO) services, making the region a key hub for aircraft maintenance. Additionally, the rise of air cargo traffic and the need for fleet modernization further boost the market. Governments in the region are investing in infrastructure and regulatory frameworks to support the aviation industry, enhancing the capabilities of local MRO providers. The adoption of advanced technologies, such as predictive maintenance and digital platforms, is also accelerating, positioning Asia-Pacific as a major player in the global aircraft maintenance market.

Segmentation Analysis

Insights by Maintenance Type

The engine segment accounted for the largest market share over the forecast period 2023 to 2033. As airlines expand their fleets and flight operations increase, the demand for engine maintenance, repair, and overhaul (MRO) services rises correspondingly. Technological advancements in modern engines, such as the use of composite materials and higher efficiency designs, require specialized maintenance skills and tools, driving growth in this segment. Additionally, the shift towards more fuel-efficient engines and the increased focus on sustainability have led to more frequent upgrades and retrofitting of existing engines. Engine maintenance also involves high costs and complex procedures, making it a significant revenue stream for MRO providers.

Insights by Aircraft Type

The narrow body segment accounted for the largest market share over the forecast period 2023 to 2033. As airlines increasingly opt for narrow-body aircraft due to their fuel efficiency and versatility, the maintenance requirements for this segment are expanding. Fleet expansion and frequent utilization of these aircraft intensify the need for regular maintenance, repair, and overhaul (MRO) services. Additionally, the introduction of next-generation narrow-body models with advanced technology and materials necessitates specialized maintenance expertise. MRO providers are capitalizing on this trend by enhancing their capabilities to support the evolving needs of this high-demand segment.

Insights by End Use

The commercial segment accounted for the largest market share over the forecast period 2023 to 2033. Airlines are continually expanding their fleets to meet rising passenger demand, particularly in emerging markets, leading to increased requirements for maintenance, repair, and overhaul (MRO) services. The introduction of fuel-efficient and technologically advanced commercial aircraft, such as the Boeing 787 and Airbus A350, necessitates specialized maintenance capabilities, further driving market growth. Additionally, the aging fleet of legacy carriers requires ongoing maintenance and upgrades to ensure safety and regulatory compliance. The shift towards predictive maintenance and the integration of digital technologies in MRO operations are also enhancing efficiency and reducing downtime, making the commercial segment a key focus area for MRO providers globally.

Recent Market Developments

- In October 2023, Amazon has teamed with a newly established Part 147 school in Lakeland, Florida, to develop the Aviation Maintenance Training Program, which will provide a career training program for individuals interested in following a new career path in MRO and contribute to the growth of the aviation maintenance workforce pipeline.

Competitive Landscape

Major players in the market

- Honeywell International

- Safran Aircraft Engines

- ST Aerospace

- Air France KLM Engineering & Maintenance

- GE Aviation

- Pratt & Whitney

- GMF AeroAsia

- Lufthansa Technik

- Airbus Group

- Delta TechOps

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aircraft Maintenance Market, Maintenance Type Analysis

- Airframe

- Engine

- Line Maintenance

- Components

- Others

Aircraft Maintenance Market, Aircraft Type Analysis

- Wide-body Aircrafts

- Narrow-body Aircrafts

- Others

Aircraft Maintenance Market, End Use Analysis

- Military

- Commercial

- Others

Aircraft Maintenance Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the market size of the Aircraft Landing Gears?The Global Aircraft Maintenance Market is expected to grow from USD 88.7 billion in 2023 to USD 139.4 billion by 2033, at a CAGR of 4.62% during the forecast period 2023-2033.

-

2. Who are the key market players of the Aircraft Maintenance Market?Some of the key market players of the market are Honeywell International, Safran Aircraft Engines, ST Aerospace, Air France KLM Engineering & Maintenance, GE Aviation, Pratt & Whitney, GMF AeroAsia, Lufthansa Technik, Airbus Group, Delta TechOps.

-

3. Which segment holds the largest market share?The narrow body segment holds the largest market share and is going to continue its dominance.

-

4.Which region dominates the Aircraft Maintenance Market?North America dominates the Aircraft Maintenance Market and has the highest market share.

Need help to buy this report?