Global Aircraft MRO Market Size, Share, and COVID-19 Impact Analysis, By MRO Type (Engine, Component, Line Maintenance, Airframe and Modifications), By Aircraft Type (Narrow-body, Wide-body and Others), By Application (Commercial Air Transport, Business and General Aviation and Military Aviation), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Aircraft MRO Market Insights Forecasts to 2033

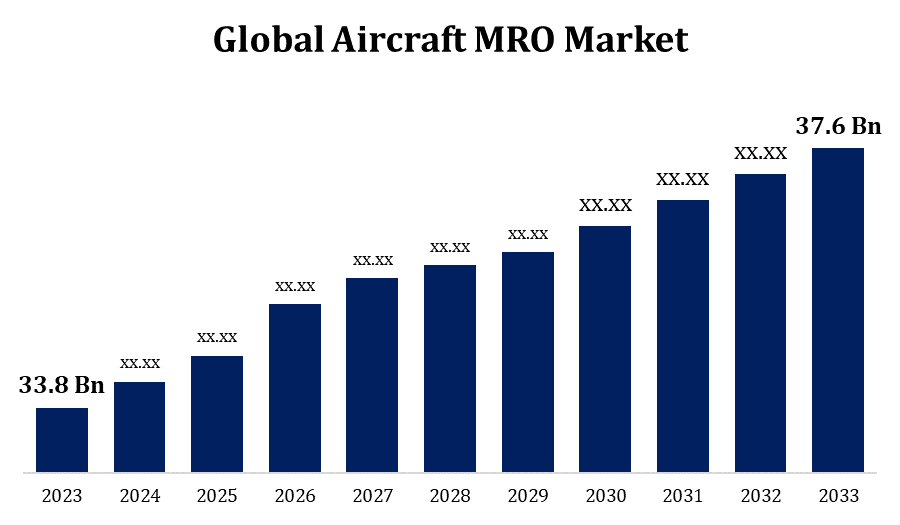

- The Global Aircraft MRO Market was valued at USD 33.8 Billion in 2023.

- The Market Size is Growing at a CAGR of 1.07% from 2023 to 2033

- The Worldwide Aircraft MRO Market Size is expected to reach USD 37.6 Billion by 2033

- Asia Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Aircraft MRO Market Size is expected to reach USD 37.6 Billion by 2033, at a CAGR of 1.07% during the forecast period 2023 to 2033.

The Aircraft Maintenance, Repair, and Overhaul (MRO) market is a critical sector ensuring the safety, efficiency, and longevity of aircraft. This market is driven by the increasing global air traffic, aging aircraft fleets, and stringent safety regulations. With the rise of low-cost carriers and expanding regional airlines, the demand for MRO services is growing steadily. Technological advancements, such as predictive maintenance and digital twins, are revolutionizing the industry, enabling more efficient and cost-effective operations. The market is also seeing a shift towards outsourcing MRO activities to specialized service providers, especially in emerging economies. Overall, the Aircraft MRO market is poised for significant growth, fueled by the aviation industry's recovery post-pandemic and the continued expansion of global air travel.

Aircraft MRO Market Value Chain Analysis

The Aircraft Maintenance, Repair, and Overhaul (MRO) market value chain is complex, involving multiple stakeholders to ensure seamless operations. It starts with OEMs (Original Equipment Manufacturers), who supply aircraft parts and components. These parts are then distributed by specialized suppliers and logistics providers. MRO service providers, including airlines' in-house teams and independent third-party companies, perform the actual maintenance, repair, and overhaul services. The process is supported by technology providers offering software solutions for inventory management, predictive maintenance, and compliance tracking. Regulatory bodies oversee the entire value chain to ensure adherence to safety standards. The integration of digital technologies and data analytics is enhancing collaboration across the value chain, leading to improved efficiency, cost savings, and reduced downtime in aircraft maintenance operations.

Aircraft MRO Market Opportunity Analysis

The rising global air traffic and the need for fleet modernization create a strong demand for MRO services. Emerging markets, particularly in Asia-Pacific, offer vast potential due to expanding airline operations and increasing aircraft deliveries. The growing trend of outsourcing MRO services to specialized third-party providers opens avenues for new entrants and partnerships. Additionally, advancements in predictive maintenance, fueled by big data and AI, are revolutionizing the industry, enabling more efficient operations and reducing costs. The shift towards sustainable aviation, with a focus on green technologies and environmentally friendly practices, also presents opportunities for innovation in MRO services tailored to meet these evolving needs.

Global Aircraft MRO Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 33.8 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 1.07% |

| 2033 Value Projection: | USD 37.6 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By MRO Type, By Aircraft Type, By Application, By Region |

| Companies covered:: | Airbus Group, Air France KLM Engineering & Maintenance, Air Works, Delta TechOps, HAECO, Honeywell International, GMF Aero Asia, Jet Maintenance Solutions, ST Aerospace Aviation, Rolls-Royce, Pratt & Whitney, Lufthansa Technik, Safran Aircraft Engines, and other key companies. |

| Growth Drivers: | Growing air travel will drive market growth |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges ,Growth, Analysis. |

Get more details on this report -

Market Dynamics

Aircraft MRO Market Dynamics

Growing air travel will drive market growth

As global air traffic continues to rise, fueled by increasing passenger demand, particularly in emerging markets, the need for regular maintenance and repair services intensifies. Airlines are expanding their fleets to accommodate this growth, leading to a higher volume of aircraft requiring MRO services. Additionally, as aircraft usage increases, the frequency of maintenance checks and repairs also escalates to ensure safety and operational efficiency. This trend is further amplified by the aging fleet of many airlines, necessitating more extensive overhauls. The expansion of low-cost carriers and regional airlines contributes to the steady demand for MRO services, positioning the market for robust growth in the coming years.

Restraints & Challenges

One major issue is the rising costs associated with labor and parts, which pressure MRO service providers to maintain profitability while offering competitive pricing. The shortage of skilled technicians, exacerbated by an aging workforce and insufficient training programs, poses a significant hurdle in meeting the growing demand for services. Additionally, the increasing complexity of modern aircraft, driven by rapid technological advancements, requires constant updates to MRO capabilities and tools, leading to higher operational costs. Regulatory compliance is another challenge, as stringent safety standards necessitate continuous investment in certifications and audits.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Aircraft MRO Market from 2023 to 2033. The U.S. is a key player, with a large fleet of both commercial and military aircraft requiring regular maintenance, repairs, and upgrades. North America's advanced infrastructure, coupled with a strong network of OEMs and specialized MRO providers, supports the sector's robust growth. The region is also a hub for technological innovation, with significant investments in digital maintenance solutions, predictive analytics, and sustainable practices. However, challenges such as labor shortages and the high cost of advanced technology adoption persist. Despite these, North America's MRO market is poised for steady growth, supported by continuous fleet modernization and increasing air travel demand.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. With a significant increase in air travel demand, particularly in countries like China, India, and Southeast Asia, airlines are expanding their fleets, leading to a higher demand for MRO services. Asia-Pacific is also witnessing a rise in low-cost carriers, further fueling the need for cost-effective maintenance solutions. The region is attracting significant investments in MRO infrastructure, with many global providers establishing or expanding their presence to cater to this growing market. However, challenges such as regulatory differences, skilled labor shortages, and high operational costs persist. Despite these, the Asia-Pacific MRO market is set for robust expansion, becoming a major hub for global aviation maintenance.

Segmentation Analysis

Insights by MRO Type

The airframe MRO segment accounted for the largest market share over the forecast period 2023 to 2033. As airframes endure wear and tear over time, regular maintenance, structural repairs, and upgrades become essential to ensure safety and compliance with stringent aviation standards. The shift towards lightweight materials like composites in modern aircraft also demands specialized MRO services, further boosting this segment. Additionally, advancements in predictive maintenance technologies are enabling more efficient and timely airframe inspections and repairs, reducing downtime and costs. With airlines focused on extending the lifespan of their fleets and optimizing operational efficiency, the airframe MRO segment is poised for continued growth.

Insights by Aircraft Type

The narrow body segment accounted for the largest market share over the forecast period 2023 to 2033. As airlines increasingly favor narrow-body jets for their operational efficiency and lower costs, the global fleet of these aircraft continues to expand. This growth directly boosts the need for MRO services, particularly in emerging markets where low-cost carriers are rapidly expanding their operations. Maintenance activities for narrow-body aircraft are further intensified by their high utilization rates, necessitating frequent inspections, repairs, and component overhauls. Additionally, technological advancements in narrow-body aircraft, such as next-generation engines and advanced avionics, require specialized MRO capabilities. As a result, the narrow-body segment remains a vital and growing component of the global aircraft MRO market.

Insights by Application

The commercial air transport segment accounted for the largest market share over the forecast period 2023 to 2033. Driven by the steady rise in global air travel, particularly in emerging economies, airlines are expanding their fleets, leading to increased demand for MRO services. The ongoing recovery of the aviation industry post-pandemic has further accelerated this growth, as airlines focus on maintaining and upgrading their aircraft to meet rising passenger demand. Technological advancements in aircraft systems, coupled with a shift towards more fuel-efficient models, are also driving the need for specialized MRO services. Additionally, the trend of outsourcing MRO activities to third-party providers is gaining traction, offering opportunities for market expansion.

Recent Market Developments

- In May 2023, SF Airlines (Shenzhen) and ST Engineering's commercial aerospace arm (Singapore) have formed a joint venture (JV) to provide commercial airframe maintenance, repair, and overhaul (MRO) services at China's Ezhou airport in eastern Hubei province.

Competitive Landscape

Major players in the market

- Airbus Group

- Air France KLM Engineering & Maintenance

- Air Works

- Delta TechOps

- HAECO

- Honeywell International

- GMF Aero Asia

- Jet Maintenance Solutions

- ST Aerospace Aviation

- Rolls-Royce

- Pratt & Whitney

- Lufthansa Technik

- Safran Aircraft Engines

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aircraft MRO Market, MRO Type Analysis

- Engine

- Component

- Line Maintenance

- Airframe

- Modifications

Aircraft MRO Market, Aircraft Type Analysis

- Narrow-body

- Wide-body

- Others

Aircraft MRO Market, Application Analysis

- Commercial Air Transport

- Business and General Aviation

- Military Aviation

Aircraft MRO Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Global Aircraft MRO Market?The Global Aircraft MRO Market is expected to grow from USD 33.8 billion in 2023 to USD 37.6 billion by 2033, at a CAGR of 1.07% during the forecast period 2023-2033.

-

2. Who are the key market players of the Aircraft MRO Market?Some of the key market players of the market are Airbus Group, Air France KLM Engineering & Maintenance, Air Works, Delta TechOps, HAECO, Honeywell International, GMF Aero Asia, Jet Maintenance Solutions, ST Aerospace Aviation, Rolls-Royce, Pratt & Whitney, Lufthansa Technik, Safran Aircraft Engines.

-

3. Which segment holds the largest market share?The narrow body segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Aircraft MRO Market?North America dominates the Aircraft MRO Market and has the highest market share.

Need help to buy this report?