Global Aircraft Nacelle Systems Market Size, Share, and COVID-19 Impact Analysis, by Application (Commercial Aviation, Military Aviation, Business Jets), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Aircraft Nacelle Systems Market Insights Forecasts to 2033

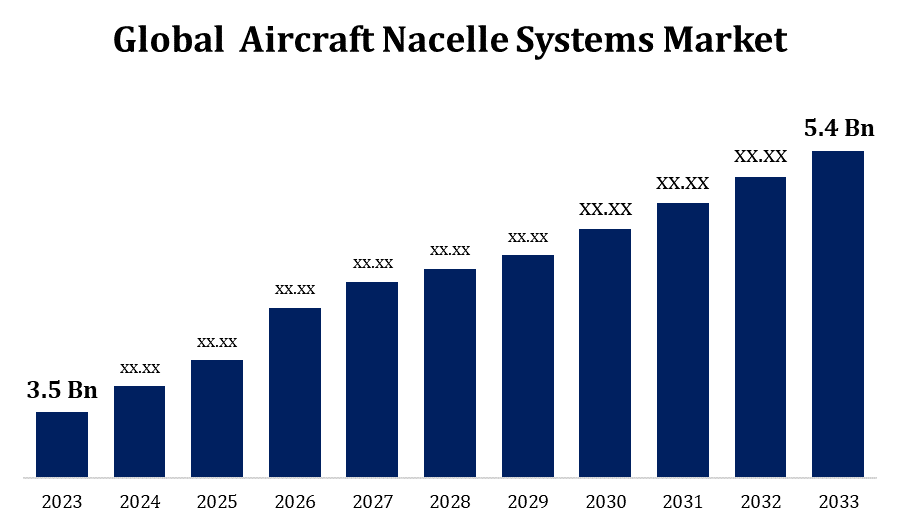

- The Aircraft Nacelle Systems Market Size was valued at USD 3.5 Billion in 2023.

- The Market Size is Growing at a CAGR of 4.43% from 2023 to 2033.

- The Global Aircraft Nacelle Systems Market is expected to reach USD 5.4 Billion by 2033.

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The global Aircraft Nacelle Systems Market is expected to reach USD 5.4 billion by 2033, at a CAGR of 4.43% during the forecast period 2023 to 2033.

The Aircraft Nacelle Systems Market is experiencing significant growth, driven by advancements in aerospace technology and the increasing demand for fuel-efficient aircraft. Nacelle systems, which house engines and optimize aerodynamics, are crucial for reducing drag and improving overall aircraft performance. Market expansion is propelled by the rising production of commercial and military aircraft, coupled with a focus on reducing emissions and enhancing operational efficiency. Additionally, the integration of advanced materials like composites and alloys has led to lighter, more durable nacelle systems. Key players are investing in R&D to develop innovative designs that meet stringent regulatory standards. The growing emphasis on aftermarket services and maintenance is also boosting the market, making nacelle systems a pivotal component in the aviation industry’s evolution.

Aircraft Nacelle Systems Market Value Chain Analysis

The Aircraft Nacelle Systems Market value chain comprises multiple stages, beginning with raw material suppliers and extending through design, manufacturing, assembly, and aftermarket services. Raw material suppliers provide essential inputs like composites, alloys, and titanium, which are crucial for lightweight and durable nacelle structures. Manufacturers and Original Equipment Manufacturers (OEMs) design and fabricate nacelle systems, integrating advanced technologies to enhance performance and comply with safety regulations. Assembly involves combining various components, such as engine mounts, thrust reversers, and noise-reduction features. Post-manufacturing, the nacelle systems are supplied to aircraft producers for installation. The final stage includes aftermarket services like maintenance, repair, and overhaul (MRO), ensuring longevity and reliability. This value chain is marked by strong collaboration among suppliers, OEMs, and service providers to meet evolving industry demands and standards.

Aircraft Nacelle Systems Market Opportunity Analysis

The Aircraft Nacelle Systems Market offers numerous opportunities driven by the growing demand for lightweight, fuel-efficient aircraft and the increasing focus on sustainable aviation solutions. Rising air travel and the need for fleet modernization are prompting airlines to invest in advanced nacelle systems that reduce noise and emissions. Technological advancements, such as the integration of smart sensors and predictive maintenance, present opportunities for enhanced performance and reliability. Moreover, the expansion of the aerospace sector in emerging markets, particularly in Asia-Pacific and the Middle East, is expected to drive nacelle system demand. OEMs and suppliers can capitalize on these trends by developing innovative, cost-effective solutions and providing comprehensive aftermarket services. Strategic collaborations and investments in research and development will be crucial to capturing these emerging opportunities.

Aircraft Nacelle Systems Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 3.5 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 4.43% |

| 2033 Value Projection: | USD 5.4 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 276 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | by Application, By Region |

| Companies covered:: | Safran (France), United Technologies Corporation (US), Leonardo SpA (Italy), Bombardier (Canada), ST Engineering (Singapore), Nexcelle (US), GKN Aerospace Services Limited (UK), Triumph Group (US), Aernnova Aerospace S.A. (Spain), and Barnes Group Inc. (US) |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Market Dynamics

Aircraft Nacelle Systems Market Dynamics

Growing demand for business jets and military aircraft

Business jets are increasingly sought after due to rising corporate travel, the need for on-demand mobility, and a preference for personalized aviation experiences. This trend drives demand for advanced nacelle systems that offer improved performance, reduced noise, and enhanced fuel efficiency. Similarly, military aircraft procurement is accelerating globally as nations modernize their defense capabilities and expand aerial fleets. Nacelle systems for military jets require robust designs that can withstand extreme conditions while ensuring optimal aerodynamic performance. Manufacturers are focusing on developing lightweight, durable nacelle systems to meet these needs, creating opportunities for innovation and growth. Strategic collaborations between nacelle system suppliers and aircraft manufacturers are expected to strengthen in response to this rising demand.

Restraints & Challenges

One key challenge is the high cost and complexity of manufacturing advanced nacelle systems, which incorporate lightweight materials like composites and alloys. The stringent regulatory standards for safety, noise reduction, and emissions further complicate design and development processes, increasing compliance costs for manufacturers. Additionally, supply chain disruptions, exacerbated by geopolitical tensions and global economic instability, have led to delays in raw material procurement and production schedules. The integration of new technologies, such as smart sensors and real-time monitoring, requires substantial investments in R&D, making it challenging for smaller players to compete. Furthermore, fluctuations in aircraft production rates, especially during economic downturns or crises like the COVID-19 pandemic, pose significant risks to market stability and growth.

Regional Forecasts

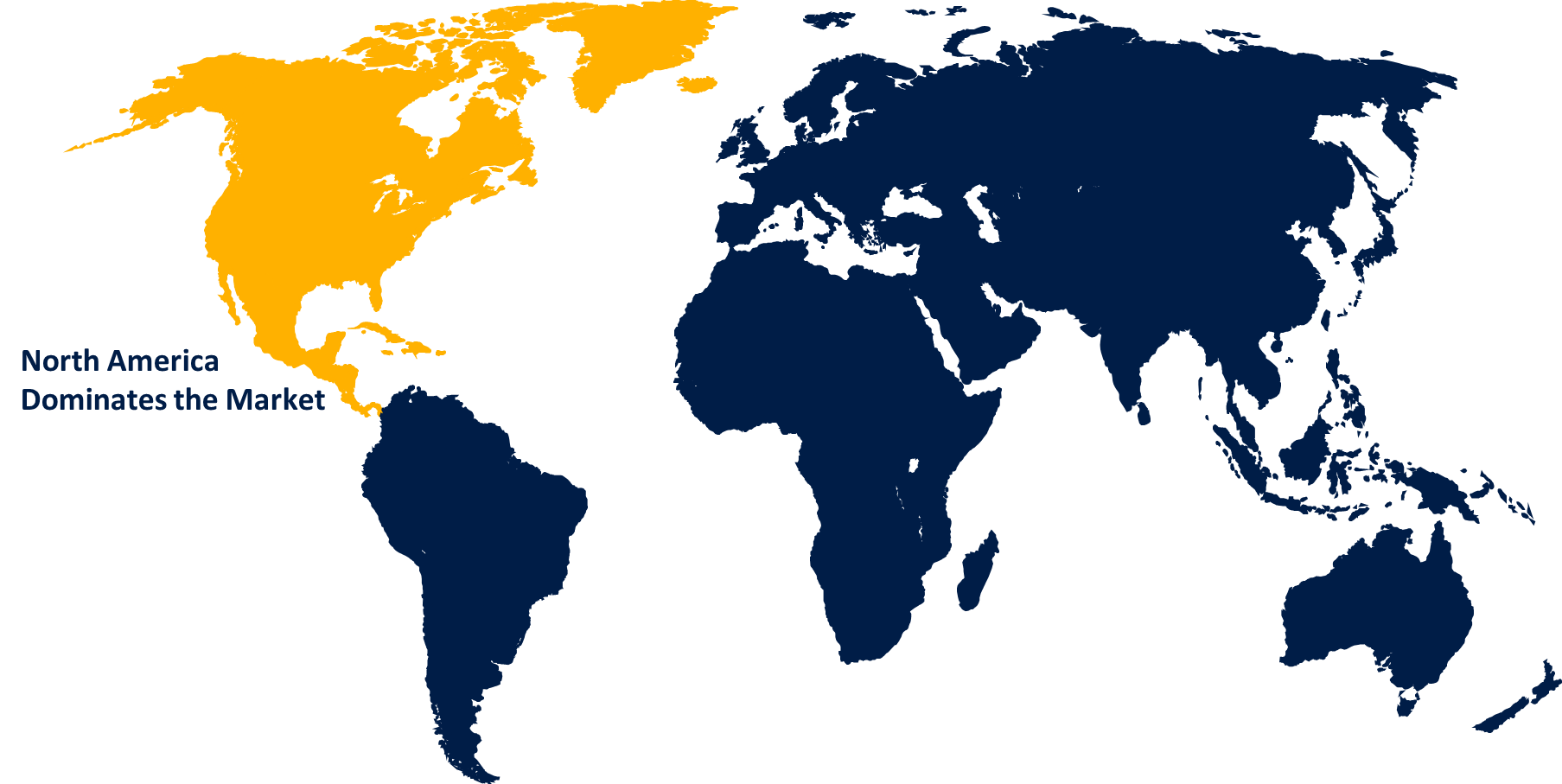

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Aircraft Nacelle Systems Market from 2023 to 2033. The region’s demand is fueled by increased production of commercial, business, and military aircraft, supported by investments in new technologies and fleet modernization. The United States, being a hub for major OEMs like Boeing and prominent nacelle suppliers such as Collins Aerospace and GE Aviation, plays a pivotal role in market growth. Additionally, the rising adoption of lightweight, fuel-efficient nacelle systems aligns with the region's focus on reducing emissions and operational costs. The robust aftermarket services, including maintenance, repair, and overhaul (MRO) facilities, further bolster North America's market presence, making it a key contributor to the global aircraft nacelle systems industry.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Countries like China, India, and Japan are investing heavily in their aerospace sectors, with China leading in both aircraft production and the establishment of new MRO facilities. The rise of low-cost carriers and regional airlines, along with fleet modernization initiatives, is boosting demand for advanced nacelle systems that offer improved fuel efficiency and reduced noise. Moreover, regional collaborations and joint ventures between local firms and global players are fostering technology transfer and innovation. As governments in Asia-Pacific emphasize the development of indigenous aerospace capabilities, the demand for high-performance nacelle systems is set to increase, presenting lucrative opportunities for market expansion.

Segmentation Analysis

Insights by Application

The commercial aviation segment accounted for the largest market share over the forecast period 2023 to 2033. As passenger demand recovers post-pandemic, airlines are focusing on modernizing their fleets with newer, fuel-efficient aircraft to optimize operating costs and reduce emissions. This trend is spurring demand for advanced nacelle systems that enhance aerodynamics, minimize noise, and support sustainable aviation. Additionally, the introduction of next-generation aircraft models, such as the Airbus A320neo and Boeing 737 MAX, which are equipped with innovative nacelle designs, is further propelling market growth. OEMs and nacelle manufacturers are investing in lightweight materials like composites and incorporating noise-reduction technologies to meet stringent regulatory standards, positioning the commercial aviation segment as a key driver of the nacelle systems market.

Recent Market Developments

- In August 2021, Boeing revealed its intention to improve the 737NG nacelles structurally in order to guarantee that the nacelles will remain intact in the case that a fan blade fails.

Competitive Landscape

Major players in the market

- Safran (France)

- United Technologies Corporation (US)

- Leonardo SpA (Italy)

- Bombardier (Canada)

- ST Engineering (Singapore)

- Nexcelle (US)

- GKN Aerospace Services Limited (UK)

- Triumph Group (US)

- Aernnova Aerospace S.A. (Spain)

- Barnes Group Inc. (US)

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aircraft Nacelle Systems Market, Application Analysis

- Commercial Aviation

- Military Aviation

- Business Jets

Aircraft Nacelle Systems Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Aircraft Nacelle Systems Market?The global Aircraft Nacelle Systems Market is expected to grow from USD 3.5 billion in 2023 to USD 5.4 billion by 2033, at a CAGR of 4.43% during the forecast period 2023-2033.

-

2. Who are the key market players of the Aircraft Nacelle Systems Market?Some of the key market players of the market are Safran (France), United Technologies Corporation (US), Leonardo SpA (Italy), Bombardier (Canada), ST Engineering (Singapore), Nexcelle (US), GKN Aerospace Services Limited (UK), Triumph Group (US), Aernnova Aerospace S.A. (Spain), and Barnes Group Inc. (US).

-

3. Which segment holds the largest market share?The commercial aviation segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Aircraft Nacelle Systems Market?North America dominates the Aircraft Nacelle Systems Market and has the highest market share.

Need help to buy this report?