Global Aircraft Oxygen System Market Size, Share, and COVID-19 Impact Analysis, By Aircraft Type (Narrow Body Aircraft, Wide Body Aircraft, Very Large Body Aircraft, Regional Aircraft), By Component (Oxygen Storage, Oxygen Delivery, Oxygen Mask), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Aircraft Oxygen System Market Insights Forecasts to 2033

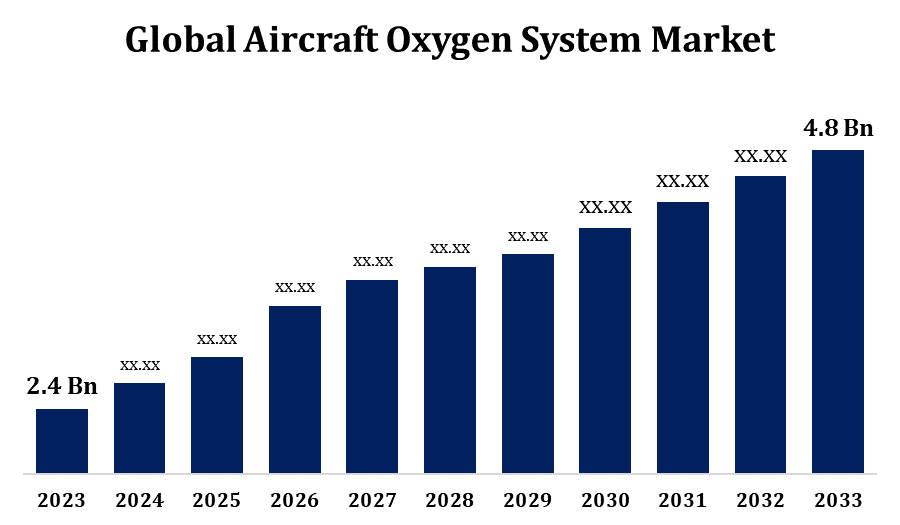

- The Aircraft Oxygen System Market Size Was Valued at USD 2.4 Billion in 2023.

- The Market Size is Growing at a CAGR of 7.18% from 2023 to 2033

- The Worldwide Aircraft Oxygen System Market Size is expected to reach USD 4.8 Billion by 2033

- Asia Pacific is expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Aircraft Oxygen System Market Size is expected to reach USD 4.8 billion by 2033, at a CAGR of 7.18% during the forecast period 2023 to 2033.

The aircraft oxygen system market is experiencing steady growth due to increasing air travel and the rising need for safety and emergency preparedness. These systems are essential for ensuring passenger and crew safety at high altitudes, providing oxygen in cases of cabin depressurization or during emergency situations. The market is driven by advancements in technology, leading to more efficient and lightweight oxygen systems. Regulatory mandates and the growing demand for both commercial and military aircraft further fuel this market. Additionally, the trend towards more sustainable and energy-efficient aviation solutions contributes to innovations in oxygen system design. Key players are focusing on expanding their product portfolios and enhancing system reliability, creating a competitive landscape. The market is expected to continue growing as air travel demand rises globally.

Aircraft Oxygen System Market Value Chain Analysis

The aircraft oxygen system market value chain encompasses several key stages, from raw material procurement to end-user application. It begins with the sourcing of essential materials such as metals, composites, and specialized components like oxygen masks and cylinders. These materials are then supplied to manufacturers who design and produce oxygen systems, ensuring compliance with stringent aviation safety standards. The systems are tested rigorously before being integrated into aircraft by original equipment manufacturers (OEMs). Distributors and suppliers play a critical role in delivering these systems to airlines and maintenance, repair, and overhaul (MRO) providers. Finally, end-users, including commercial airlines and military operators, utilize these systems to ensure passenger and crew safety. The value chain is characterized by strong collaborations among suppliers, manufacturers, and service providers, driving innovation and reliability.

Aircraft Oxygen System Market Opportunity Analysis

Rising air travel demands and the need for enhanced safety protocols are primary growth drivers. Technological advancements, such as the development of lightweight and more efficient oxygen systems, offer opportunities for innovation and improved performance. The increasing focus on aviation safety regulations and compliance creates a demand for advanced oxygen systems. Additionally, the growing trend towards the modernization of existing aircraft fleets and the expansion of air travel in emerging markets contribute to market potential. There are also opportunities in the military sector, where advanced oxygen systems are required for diverse aircraft applications.

Global Aircraft Oxygen System Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.4 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 7.18% |

| 2033 Value Projection: | USD 4.8 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 226 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Aircraft Type, By Component, By Region |

| Companies covered:: | Collins Aerospace (U.S.), Zodiac Aerospace (France), ATR (France), KONGSBERG (Norway), Technodinamika (Russia), Cobham Limited (U.K.), Adams Rite Aerospace Inc. (U.S.), East/West Industries, Inc. (U.S.), Essex Industries, Inc. (U.S.), BAE Systems. (U.K.), NetAcquire Corporation (U.S.), Aerox Aviation Oxygen Systems (U.S.), Diehl Stiftung & Co. K.G. (Germany), Precise Flight, Inc (U.S.), Aeromedix, Inc. (U.S.) |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Aircraft Oxygen System Market Dynamics

Stringent regulations laid down by civil aviation industry

Stringent regulations imposed by the civil aviation industry significantly influence the growth of the aircraft oxygen systems market. Regulatory bodies, such as the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA), mandate rigorous standards for oxygen systems to ensure passenger and crew safety at high altitudes. These regulations require systems to be reliable, durable, and capable of providing adequate oxygen in emergencies. Compliance with these standards drives manufacturers to innovate and enhance system performance, contributing to market growth. Additionally, regular updates to safety regulations prompt continuous improvements and adaptations in oxygen system technology, creating ongoing demand for advanced solutions. The need to meet these regulatory requirements fuels market expansion and drives investment in safety-focused innovations.

Restraints & Challenges

High costs associated with advanced oxygen systems and their integration into aircraft can be a barrier, particularly for smaller airlines and operators. The complexity of complying with stringent regulatory requirements requires significant investment in testing and certification processes, which can be costly and time-consuming. Additionally, the need for continuous technological advancements to meet evolving safety standards can strain resources and limit market entry for new players. Supply chain disruptions and fluctuations in the cost of raw materials also pose challenges. Moreover, the market must address the integration of new technologies with existing systems and ensure compatibility across various aircraft types.

Regional Forecasts

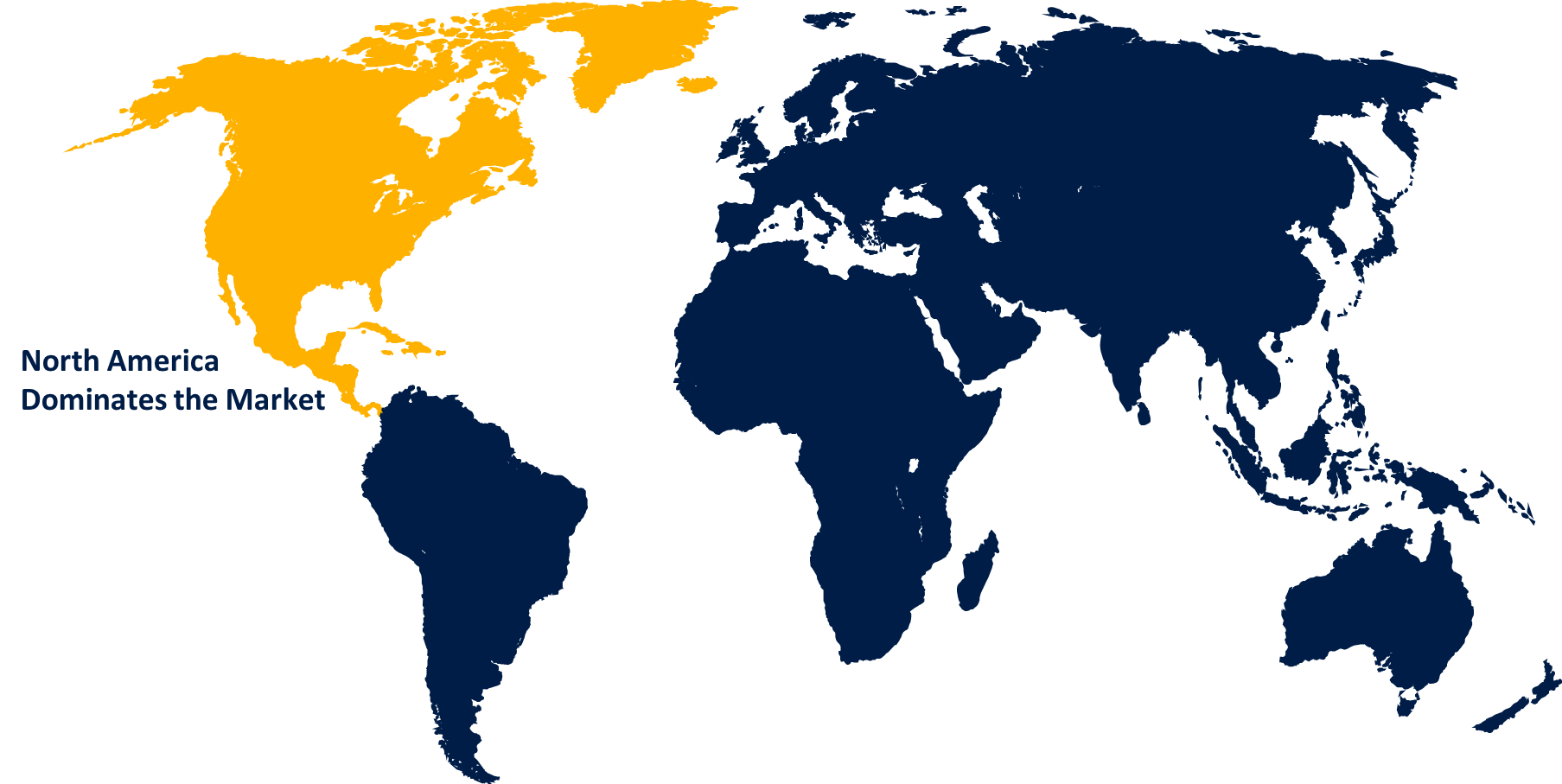

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Aircraft Oxygen System Market from 2023 to 2033. The region's advanced aviation infrastructure and significant investments in both commercial and military aircraft drive demand for reliable oxygen systems. Regulatory bodies like the FAA enforce strict standards, prompting ongoing innovations and upgrades in oxygen system technology. The presence of major aerospace manufacturers and suppliers in North America further fuels market expansion. Additionally, the modernization of existing aircraft fleets and the introduction of new aircraft models contribute to increased demand. The market also benefits from a strong focus on passenger safety and technological advancements, positioning North America as a key player in the global aircraft oxygen systems market.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The region's burgeoning middle class and growing urbanization drive higher demand for air travel, prompting investments in both commercial and regional aircraft. Regulatory agencies are also enhancing safety standards, which boosts the need for advanced oxygen systems. Emerging economies are modernizing their fleets and investing in new technologies, creating opportunities for market expansion. Additionally, the growth of low-cost carriers and increased defense spending further contribute to market dynamics.

Segmentation Analysis

Insights by Aircraft Type

The narrow body aircraft segment accounted for the largest market share over the forecast period 2023 to 2033. These aircraft, which are commonly used by low-cost carriers and regional airlines, require efficient and cost-effective oxygen systems to meet safety regulations and enhance passenger comfort. The growth of budget airlines and expanding connectivity in both developed and emerging markets contribute to the demand for narrow-body aircraft. Technological advancements in oxygen systems, such as lighter and more compact designs, align with the needs of these aircraft. Additionally, the replacement and upgrading of older narrow-body fleets further drive market expansion. As air travel continues to rise, the narrow-body segment remains a key focus for oxygen system manufacturers and suppliers.

Insights by Component

The oxygen storage system segment accounted for the largest market share over the forecast period 2023 to 2033. Advancements in storage technology, including lighter and more compact cylinders and innovative storage solutions, are driving this growth. The rising number of aircraft globally and the need for reliable oxygen supplies in emergency situations fuel demand for advanced storage systems. Regulatory requirements for higher safety standards also push for improved storage solutions. Additionally, the modernization of aircraft fleets and the integration of next-generation storage technologies contribute to market expansion. As airlines and manufacturers seek to enhance the performance and reliability of oxygen systems, the oxygen storage system segment is poised for continued growth and development.

Recent Market Developments

- In March 2021, Cobham Mission Systems, a renowned US maker of military aviation oxygen systems, has announced a new contract to supply oxygen concentrator systems for the full fleet of US Navy T-45 Goshawk jet trainers.

Competitive Landscape

Major players in the market

- Collins Aerospace (U.S.)

- Zodiac Aerospace (France)

- ATR (France)

- KONGSBERG (Norway)

- Technodinamika (Russia)

- Cobham Limited (U.K.)

- Adams Rite Aerospace Inc. (U.S.)

- East/West Industries, Inc. (U.S.)

- Essex Industries, Inc. (U.S.)

- BAE Systems. (U.K.)

- NetAcquire Corporation (U.S.)

- Aerox Aviation Oxygen Systems (U.S.)

- Diehl Stiftung & Co. K.G. (Germany)

- Precise Flight, Inc (U.S.)

- Aeromedix, Inc. (U.S.)

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aircraft Oxygen System Market, Aircraft Type Analysis

- Narrow Body Aircraft

- Wide Body Aircraft

- Very Large Body Aircraft

- Regional Aircraft

Aircraft Oxygen System Market, Component Analysis

- Oxygen Storage

- Oxygen Delivery

- Oxygen Mask

Aircraft Oxygen System Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the market size of the Aircraft Oxygen System Market?The global Aircraft Oxygen System Market is expected to grow from USD 2.4 billion in 2023 to USD 4.8 billion by 2033, at a CAGR of 7.18% during the forecast period 2023-2033.

-

2 Who are the key market players of the Aircraft Oxygen System Market?Some of the key market players of the market are Collins Aerospace (U.S.), Zodiac Aerospace (France) ATR (France), KONGSBERG (Norway), Technodinamika (Russia), Cobham Limited (U.K.), Adams Rite Aerospace Inc. (U.S.), East/West Industries, Inc. (U.S.), Essex Industries, Inc. (U.S.), BAE Systems. (U.K.), NetAcquire Corporation (U.S.), Aerox Aviation Oxygen Systems (U.S.), Diehl Stiftung & Co. K.G. (Germany), Precise Flight, Inc (U.S.), Aeromedix, Inc. (U.S.).

-

3.Which segment holds the largest market share?The oxygen storage system segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Aircraft Oxygen System Market?North America dominates the Aircraft Oxygen System Market and has the highest market share.

Need help to buy this report?