Global Aircraft Propeller System Market Size, Share, and COVID-19 Impact Analysis, By Type (Fixed Pitch, Variable Pitch), By Component (Blade, Spinner, Hub), By Engine (Conventional, Hybrid & Electric), By Platform (Civil, Military), By End Use (OEM, Aftermarket), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Aircraft Propeller System Market Insights Forecasts to 2033

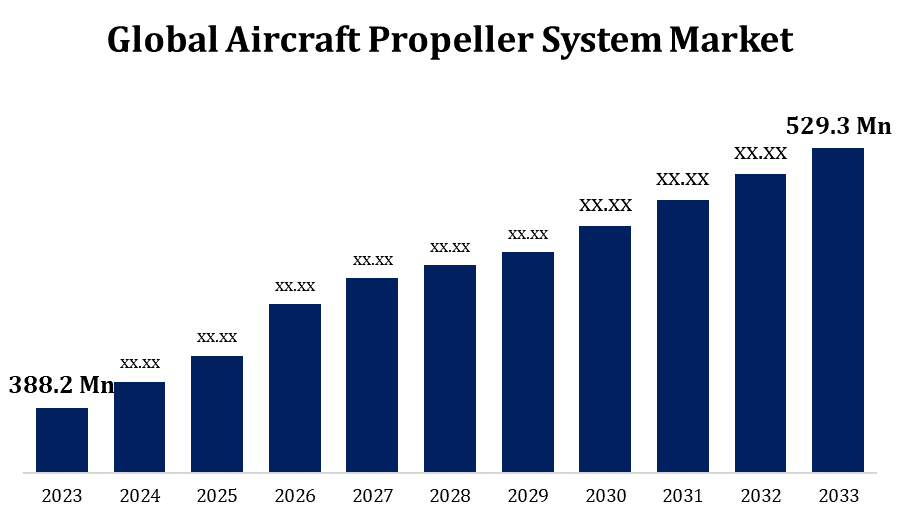

- The Global Aircraft Propeller System Market Size was valued at USD 388.2 Million in 2023

- The Market Size is Growing at a CAGR of 3.15% from 2023 to 2033

- The Worldwide Aircraft Propeller System Market Size is expected to reach USD 529.3 Million by 2033

- Asia Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Aircraft Propeller System Market Size is expected to reach USD 529.3 Million by 2033, at a CAGR of 3.15% during the forecast period 2023 to 2033.

The Aircraft Propeller System Market is poised for significant growth, driven by the increasing demand for lightweight, fuel-efficient, and environmentally friendly aircraft. Propeller systems are crucial for enhancing aircraft performance, particularly in regional, turboprop, and unmanned aerial vehicles. Technological advancements, such as the integration of composite materials and advanced blade designs, are improving propeller efficiency and reducing noise levels. The market is also benefiting from the rising popularity of electric and hybrid propulsion systems, which are reshaping the aviation industry. Key players are focusing on innovation and strategic partnerships to meet the evolving demands of the aerospace sector. However, challenges such as high manufacturing costs and stringent regulatory standards may hinder market expansion. Overall, the market is expected to experience steady growth in the coming years.

Aircraft Propeller System Market Value Chain Analysis

The Aircraft Propeller System Market value chain is a complex ecosystem involving multiple stages from raw material sourcing to end-user delivery. It begins with the procurement of raw materials like aluminum, composites, and other alloys, essential for manufacturing propeller components. Manufacturers then focus on designing, engineering, and producing propeller systems, integrating advanced technologies for improved performance. Suppliers play a crucial role in providing specialized components, including blades, hubs, and control systems. Original Equipment Manufacturers (OEMs) and Tier 1 suppliers are key players in assembling these systems into aircraft. The distribution network, including logistics providers and aftermarket service suppliers, ensures the propellers reach airlines and maintenance repair organizations (MROs). Finally, the end-users—commercial, military, and general aviation sectors—utilize these systems, with ongoing support from MRO services.

Aircraft Propeller System Market Opportunity Analysis

The Aircraft Propeller System Market presents significant growth opportunities, driven by the increasing demand for fuel-efficient, low-emission propulsion systems in aviation. The rise of regional air travel, especially in emerging markets, is boosting demand for turboprop aircraft, where propeller systems are essential. Additionally, advancements in electric and hybrid-electric propulsion are opening new avenues for propeller technology, with the potential to revolutionize urban air mobility (UAM) and unmanned aerial vehicles (UAVs). The military sector also offers opportunities for modernizing fleets with advanced propeller systems. Moreover, the ongoing focus on reducing aircraft noise and enhancing performance through innovative materials and designs provides a fertile ground for market players. Strategic investments in research and development, coupled with partnerships, are key to capitalizing on these opportunities.

Global Aircraft Propeller System Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 388.2 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.15% |

| 2033 Value Projection: | USD 529.3 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Component, By Engine, By Platform, By End Use, By Region |

| Companies covered:: | Hartzell Propeller, Inc. (Hartzell Propeller), MT-Propeller Entwicklung GmbH (MT-Propeller), Dowty Propellers, Hartzell Propeller, Hélices E-Props, Hercules Propellers Ltd., MT-Propeller Entwicklung GmbH, McCauley Propeller Systems, and other key companies. |

| Growth Drivers: | A growing number of special light-sport aircraft (SLSA) deliveries globally |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Market Dynamics

Aircraft Propeller System Market Dynamics

A growing number of special light-sport aircraft (SLSA) deliveries globally

The growing number of Special Light-Sport Aircraft (SLSA) deliveries globally is significantly impacting the Aircraft Propeller System Market. SLSAs, known for their affordability, fuel efficiency, and ease of use, are gaining popularity among recreational pilots and flight schools. This surge in demand is driving the need for advanced, lightweight propeller systems that enhance the performance and efficiency of these aircraft. Manufacturers are increasingly focusing on developing propeller systems that offer superior aerodynamics, noise reduction, and durability to meet the specific requirements of SLSAs. The trend is particularly strong in regions with expanding general aviation sectors, such as North America and Europe. As the SLSA market continues to grow, it presents substantial opportunities for propeller system manufacturers to innovate and capture a larger share of this expanding market segment.

Restraints & Challenges

High manufacturing and maintenance costs remain a significant barrier, particularly for advanced propeller systems that require specialized materials and precision engineering. Stringent regulatory standards for safety and environmental impact add further complexity, necessitating rigorous testing and certification processes that can delay product launches and increase costs. The market also contends with the shift toward jet engines in larger aircraft, which reduces the demand for propeller-driven models in commercial aviation. Additionally, technological advancements in alternative propulsion systems, such as electric and hybrid engines, could disrupt traditional propeller markets if they become more cost-effective and widely adopted.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Aircraft Propeller System Market from 2023 to 2033. The region is home to leading aircraft and propeller manufacturers who are at the forefront of technological innovation, focusing on lightweight materials, noise reduction, and fuel efficiency. The growing popularity of turboprop aircraft for regional and business travel further fuels demand for advanced propeller systems. Additionally, the rise in Special Light-Sport Aircraft (SLSA) deliveries and the expansion of unmanned aerial vehicles (UAVs) are contributing to market growth. The strong presence of military aviation and ongoing modernization programs also support the demand for high-performance propeller systems.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The growth is fueled by increasing air travel, economic expansion, and growing investment in aviation infrastructure. The demand for regional and turboprop aircraft is rising, particularly in countries like China, India, and Southeast Asia, where short-haul routes are expanding rapidly. This surge is driving the need for efficient and reliable propeller systems. Additionally, the growing adoption of Special Light-Sport Aircraft (SLSA) and unmanned aerial vehicles (UAVs) in this region is contributing to market expansion. The region's focus on modernizing military fleets and enhancing general aviation capabilities further boosts demand.

Segmentation Analysis

Insights by Type

The Fixed-pitch propellers segment accounted for the largest market share over the forecast period 2023 to 2033. Fixed-pitch propellers, with blades set at a fixed angle, require less maintenance and are easier to manufacture, making them a popular choice for private pilots, flight schools, and recreational aviation. The segment benefits from the growing demand for lightweight, fuel-efficient aircraft in emerging markets, where affordability and ease of use are key considerations. Additionally, advancements in materials and aerodynamic design are enhancing the performance of fixed-pitch propellers, further supporting their adoption. As the general aviation sector continues to expand globally, the fixed-pitch propellers segment is expected to witness sustained growth.

Insights by Component

The propeller blades segment accounted for the largest market share over the forecast period 2023 to 2033. Technological advancements, such as the use of composite materials and innovative aerodynamic designs, are enhancing the efficiency, durability, and noise reduction capabilities of propeller blades. These improvements are particularly important for modern turboprop aircraft, unmanned aerial vehicles (UAVs), and Special Light-Sport Aircraft (SLSA), where performance and fuel efficiency are critical. The rise in regional air travel and the push for more environmentally friendly aviation solutions are also fueling demand for advanced propeller blades. Manufacturers are focusing on research and development to produce lighter, stronger, and more efficient blades, positioning this segment for continued growth as the aviation industry evolves.

Insights by Engine

The conventional engine segment accounted for the largest market share over the forecast period 2023 to 2033. Conventional engines, typically paired with propeller systems, remain a preferred choice for smaller aircraft due to their proven performance, ease of maintenance, and cost-effectiveness. This segment benefits from the ongoing demand for turboprop aircraft, especially in emerging markets where short-haul routes are expanding. Additionally, the segment supports a broad range of applications, from recreational flying to military training, making it a versatile option. However, while the segment is growing, it faces challenges from the rising interest in electric and hybrid-electric propulsion systems, which offer potential long-term competition to conventional engines in the aviation industry.

Insights by Platform

The aircraft propeller system segment accounted for the largest market share over the forecast period 2023 to 2033. Enhanced performance and efficiency are key factors, with innovations in materials like composites and improvements in aerodynamic designs contributing to more fuel-efficient and quieter propeller systems. The rise of regional air travel, coupled with the growing popularity of Special Light-Sport Aircraft (SLSA) and unmanned aerial vehicles (UAVs), is boosting demand for advanced propeller systems. Additionally, the push for environmentally friendly aviation solutions is encouraging the development of more efficient and sustainable propeller technologies. As manufacturers continue to innovate and address specific needs for different aircraft types, the aircraft propeller system segment is poised for continued expansion and technological advancement in the market.

Insights by End Use

The OEM segment accounted for the largest market share over the forecast period 2023 to 2033. Original Equipment Manufacturers (OEMs) are focusing on integrating cutting-edge technologies, such as composite materials and advanced aerodynamic designs, to enhance the performance, fuel efficiency, and noise reduction of propeller systems. The expansion of regional and business aviation, as well as the rise of Special Light-Sport Aircraft (SLSA) and unmanned aerial vehicles (UAVs), is further propelling the demand for OEM-provided propeller systems. Additionally, the modernization of military and commercial fleets is creating opportunities for OEMs to supply state-of-the-art propeller systems. As the aviation industry continues to evolve, the OEM segment is well-positioned for growth and innovation.

Recent Market Developments

- In February 2023, Hamilton Sundstrand Corp., a company of Collins Aerospace, has received a USD 135 million contract to build the NP2000 eight-blade propeller and electronic propeller control system for the US Air Force's (USAF) C-130 Hercules aircraft.

Competitive Landscape

Major players in the market

- Hartzell Propeller, Inc. (Hartzell Propeller)

- MT-Propeller Entwicklung GmbH (MT-Propeller)

- Dowty Propellers

- Hartzell Propeller

- Hélices E-Props

- Hercules Propellers Ltd.

- MT-Propeller Entwicklung GmbH

- McCauley Propeller Systems

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aircraft Propeller System Market, Type Analysis

- Fixed Pitch

- Variable Pitch

Aircraft Propeller System Market, Component Analysis

- Blade

- Spinner

- Hub

Aircraft Propeller System Market, Engine Analysis

- Conventional

- Hybrid & Electric

Aircraft Propeller System Market, Platform Analysis

- Civil

- Military

Aircraft Propeller System Market, End Use Analysis

- OEM

- Aftermarket

Aircraft Propeller System Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Aircraft Paint?The Global Aircraft Propeller System Market is expected to grow from USD 388.2 million in 2023 to USD 529.3 million by 2033, at a CAGR of 3.15% during the forecast period 2023-2033.

-

2. Who are the key market players of the Aircraft Propeller System Market?Some of the key market players of the market are Hartzell Propeller, Inc. (Hartzell Propeller), MT-Propeller Entwicklung GmbH (MT-Propeller), and Dowty Propellers, Hartzell Propeller, Hélices E-Props, Hercules Propellers Ltd., MT-Propeller Entwicklung GmbH, McCauley Propeller Systems.

-

3. Which segment holds the largest market share?The OEM segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Aircraft Propeller System Market?North America dominates the Aircraft Propeller System Market and has the highest market share.

Need help to buy this report?